Irs Form 990 Ez 2018

Filing Deadlines / Important Dates

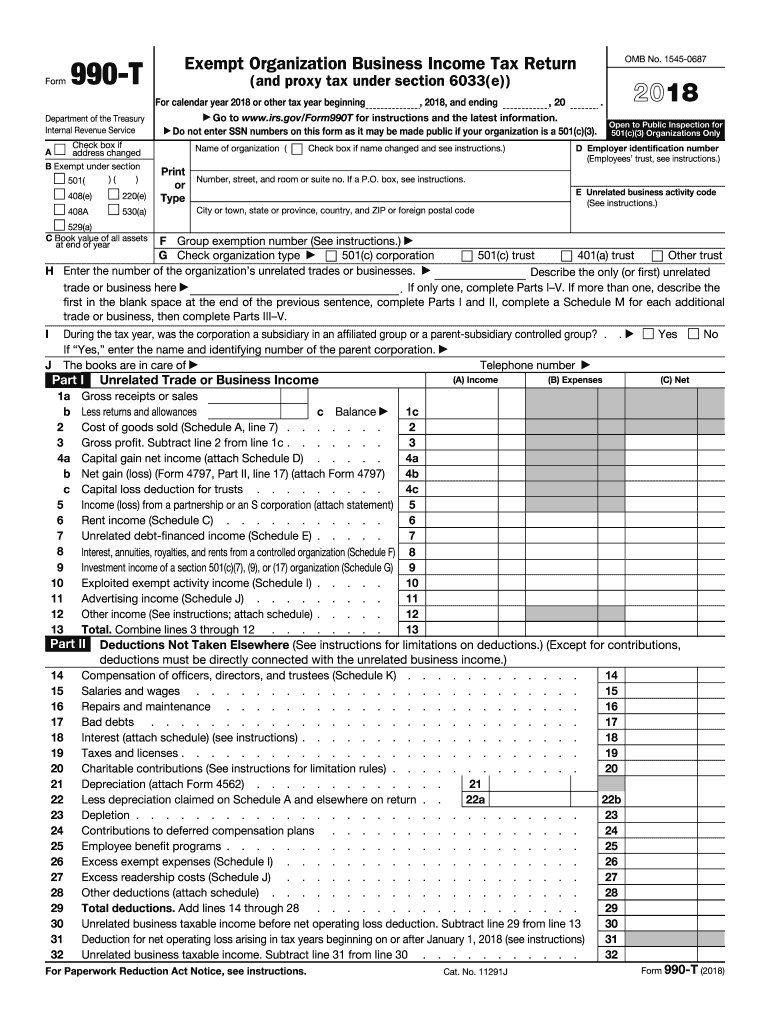

Understanding the filing deadlines for Form 990-T is crucial for compliance and avoiding penalties. Generally, the due date for filing is the fifteenth day of the fifth month after the end of the organization’s tax year. For organizations operating on a calendar year, this means the form is due by May 15. If additional time is needed, organizations can file for an automatic six-month extension, which extends the deadline to November 15. It is important to note that even with an extension, any taxes owed must be paid by the original due date to avoid interest and penalties.

Required Documents

When preparing to file Form 990-T, several documents are necessary to ensure accurate reporting. Organizations should gather the following:

- Financial statements, including income statements and balance sheets.

- Details of unrelated business income, including sources and amounts.

- Documentation of expenses related to the unrelated business activities.

- Any prior year Forms 990-T, if applicable, for reference.

Having these documents ready will streamline the filing process and help in accurately completing the form.

Form Submission Methods (Online / Mail / In-Person)

Organizations have multiple options for submitting Form 990-T. The form can be filed electronically using IRS-approved e-filing software, which is often the fastest and most efficient method. Alternatively, organizations can mail a paper copy of the form to the appropriate IRS address based on their location. It is important to ensure that the form is sent to the correct address to avoid processing delays. In-person submissions are not typically accepted for this form.

Penalties for Non-Compliance

Failure to file Form 990-T on time can result in significant penalties. The IRS imposes a penalty of $20 per day for each day the return is late, with a maximum penalty of $10,000 or five percent of the organization's gross receipts, whichever is less. Additionally, if the organization fails to pay any taxes owed by the due date, interest will accrue on the unpaid amount. Organizations should take compliance seriously to avoid these financial repercussions.

Eligibility Criteria

Form 990-T is specifically for tax-exempt organizations that generate unrelated business income. To be eligible to file, an organization must be recognized as tax-exempt under Internal Revenue Code Section 501(c)(3) or other relevant sections. It is important to assess whether the income is considered unrelated to the organization's exempt purpose, as only such income is subject to taxation. Organizations should review their activities closely to determine if they meet the eligibility criteria for filing.

Quick guide on how to complete for calendar year 2018 or other tax year beginning

Uncover the most efficient method to complete and authorize your Irs Form 990 Ez

Are you still spending time organizing your official paperwork on physical copies instead of handling it digitally? airSlate SignNow provides a superior way to finalize and endorse your Irs Form 990 Ez and associated forms for public services. Our advanced electronic signature solution offers you all the necessary tools to process documents swiftly and in compliance with regulatory standards - comprehensive PDF editing, managing, securing, signing, and sharing options all readily available within a user-friendly interface.

Only a few steps are required to finalize and authorize your Irs Form 990 Ez:

- Incorporate the editable template into the editor by clicking the Get Form button.

- Review the information you need to include in your Irs Form 990 Ez.

- Navigate through the fields utilizing the Next option to ensure nothing is overlooked.

- Employ Text, Check, and Cross tools to fill in the areas with your information.

- Update the content with Text boxes or Images from the upper toolbar.

- Emphasize what is essential or Blackout fields that are irrelevant.

- Select Sign to create a legally binding electronic signature using your preferred method.

- Insert the Date next to your signature and conclude your task with the Done button.

Store your finished Irs Form 990 Ez in the Documents directory within your profile, download it, or transfer it to your desired cloud storage. Our solution also offers versatile file sharing options. There’s no necessity to print your templates when you must submit them to the correct public office - accomplish it through email, fax, or by requesting a USPS “snail mail” delivery from your account. Give it a try now!

Create this form in 5 minutes or less

Find and fill out the correct for calendar year 2018 or other tax year beginning

FAQs

-

How can I fill out the income tax return of the year 2016-17 in 2018?

There is no option to file online return but you can prepare an offline return and went to the officer of your jurisdiction income tax commissioner and after his permission you can file the return with his office.

-

What tax form do I have to fill out for the money I made on Quora?

For 2018, there is only form 1040. Your income is too low to file. Quora will issue you a 1099 Misc only if you made over $600

-

Why don't schools teach children about taxes and bills and things that they will definitely need to know as adults to get by in life?

Departments of education and school districts always have to make decisions about what to include in their curriculum. There are a lot of life skills that people need that aren't taught in school. The question is should those skills be taught in schools?I teach high school, so I'll talk about that. The typical high school curriculum is supposed to give students a broad-based education that prepares them to be citizens in a democracy and to be able to think critically. For a democracy to work, we need educated, discerning citizens with the ability to make good decisions based on evidence and objective thought. In theory, people who are well informed about history, culture, science, mathematics, etc., and are capable of critical, unbiased thinking, will have the tools to participate in a democracy and make good decisions for themselves and for society at large. In addition to that, they should be learning how to be learners, how to do effective, basic research, and collaborate with other people. If that happens, figuring out how to do procedural tasks in real life should not provide much of a challenge. We can't possibly teach every necessary life skill people need, but we can help students become better at knowing how to acquire the skills they need. Should we teach them how to change a tire when they can easily consult a book or search the internet to find step by step instructions for that? Should we teach them how to balance a check book or teach them how to think mathematically and make sense of problems so that the simple task of balancing a check book (which requires simple arithmetic and the ability to enter numbers and words in columns and rows in obvious ways) is easy for them to figure out. If we teach them to be good at critical thinking and have some problem solving skills they will be able to apply those overarching skills to all sorts of every day tasks that shouldn't be difficult for someone with decent cognitive ability to figure out. It's analogous to asking why a culinary school didn't teach its students the steps and ingredients to a specific recipe. The school taught them about more general food preparation and food science skills so that they can figure out how to make a lot of specific recipes without much trouble. They're also able to create their own recipes.So, do we want citizens with very specific skill sets that they need to get through day to day life or do we want citizens with critical thinking, problem solving, and other overarching cognitive skills that will allow them to easily acquire ANY simple, procedural skill they may come to need at any point in their lives?

-

Income Tax: Which ITR form (ITR 1 or 2) should I fill for this financial year?

The answer to this question will keep changing year to year based on the ITR forms released by the income tax department every year.For the FY 2016–17 (AY 2017–18), ITR 1 is meant for individuals only whereas ITR 2 is for both individuals and HUFs. However, the usage of these forms are based on the categories of income that the individuals derive.For FY 2016–17:If you have income from capital gains then ITR 2 will be applicable;If you have income from business as an individual, ITR 3 will be applicable (unless you are adopting presumptive taxation - then it's ITR 4)If you have both of the above, please use ITR 3 only (or ITR 4 if adopting presumptive taxation).If none of the above, and earning income from salary/ interest/ house property then please use ITR 1.A snapshot from the income tax website for reference:Hope the above was useful.Best regards,Aditiaditi.bhardwaj@outlook.com

-

If a foreign citizen lives in the US on a working visa for more than a year, then what is his status? What tax form will such a person fill out when filing for taxes at the end of the tax year? Is the 1040NR the form to fill out?

In most situations, a person who is physically present in the United States for at least 183 days out of any calendar year is a US resident for tax purposes and must file Form 1040 as a tax resident. There are exceptions to this general rule, but none of them apply to people who are present in the United States in H-1B (guest worker) status. Furthermore, H-1B workers are categorically resident aliens for tax purposes and must pay taxes on the income they earn while in H-1B status as a resident alien in every year in which they earn more than the personal exemption limit. This includes both the first year and last year, even if the first or last year contains less than 183 days of residence in the United States. The short years may result in a filing as a “dual-status” alien.An H-1B worker will therefore only file Form 1040NR as his or her primary tax return in the tax year in which he or she leaves the United States permanently, and all US-connected income during that year will be taxed as if the taxpayer was a US resident, under the dual-status rules. All other tax returns during that person’s residence in the United States will be on Form 1040. The first year’s return may be under dual-status rules, with a Form 1040NR attached as a “dual status statement” as per the procedure in Chapter 6 of Publication 519 (2016), U.S. Tax Guide for Aliens. A person who resides the entire year in the United States in H-1B status may not use Form 1040NR, and is required to pay US income tax on his or her worldwide income, excepting only that income which is subject to protection under a tax treaty.See Publication 519 (2016), U.S. Tax Guide for Aliens for more information. The use of a tax professional, especially in the first and last year of H-1B status, is highly recommended as completing a dual-status return correctly is exceedingly challenging.

-

I do have a EIN number and LLC DE that sell online. People say that if you are incorporated in DE as a LLC than the only thing you pay is 300$ for a year and a fill out a form 1040NR. Do I have to get register to some other permits or do I have to pay any other tax?

For the sales tax issues here, check out www.taxjar.com. They’ve got this nailed.You do NOT need to file a 1040NR. You only need to file a 1040NR if you are subject to US federal income tax. That’s the case only where you have your own people on the ground in the US operating your business.Here’s more detail on how this works: Non-US Entrepreneurs: You Can Sell Products into the US without Paying US Tax - U.S Tax Services

Create this form in 5 minutes!

How to create an eSignature for the for calendar year 2018 or other tax year beginning

How to create an electronic signature for the For Calendar Year 2018 Or Other Tax Year Beginning in the online mode

How to create an electronic signature for the For Calendar Year 2018 Or Other Tax Year Beginning in Google Chrome

How to create an electronic signature for signing the For Calendar Year 2018 Or Other Tax Year Beginning in Gmail

How to create an electronic signature for the For Calendar Year 2018 Or Other Tax Year Beginning from your smartphone

How to make an eSignature for the For Calendar Year 2018 Or Other Tax Year Beginning on iOS devices

How to create an eSignature for the For Calendar Year 2018 Or Other Tax Year Beginning on Android

People also ask

-

What are the form 990 T filing requirements for organizations?

The form 990 T filing requirements apply to tax-exempt organizations. They must file this form if they have gross income of $1,000 or more from unrelated business activities. Understanding these requirements is crucial for compliance and avoiding penalties.

-

How does airSlate SignNow help with form 990 T filing requirements?

airSlate SignNow streamlines the process of preparing documents related to form 990 T filing requirements. Our solution allows you to easily create, share, and eSign the necessary forms, ensuring you meet all compliance deadlines efficiently. This can save your organization valuable time and resources.

-

What features does airSlate SignNow offer for managing form 990 T filing?

AirSlate SignNow offers features such as customizable templates, document tracking, and electronic signatures, which are essential for managing form 990 T filing requirements. These features ensure that all necessary documents are completed accurately and promptly while maintaining legal compliance.

-

Are there any pricing plans available for using airSlate SignNow for form 990 T filings?

Yes, airSlate SignNow provides several pricing plans designed to fit various organizational needs. Each plan includes features that assist with form 990 T filing requirements. You can choose a plan based on the number of users and the level of functionality needed for your organization.

-

Can I integrate airSlate SignNow with other accounting software for form 990 T filings?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and tax software, allowing you to manage your form 990 T filing requirements more effectively. These integrations help you sync data, making it easier to prepare and submit your filings accurately.

-

How secure are the documents signed through airSlate SignNow related to form 990 T filings?

Security is a top priority for airSlate SignNow. All documents signed through our platform related to form 990 T filing requirements are encrypted and stored securely. This ensures the privacy and integrity of your sensitive financial information.

-

What benefits can I expect from using airSlate SignNow for form 990 T documentation?

Using airSlate SignNow for your form 990 T documentation offers numerous benefits, such as improved efficiency and reduced turnaround times for document processing. With our easy-to-use interface, your team can focus more on their core responsibilities while ensuring compliance with form 990 T filing requirements.

Get more for Irs Form 990 Ez

- Recipient designation 1098605 form

- Dentaquest orthoselect form

- Waldpachtvertrag form

- Summer school registration archbishop rummel high school form

- Cannabist manifest sheet oklahoma form

- St 28f agricultural exemption certificate rev 8 22 farmers ranchers feedlots fisheries grass farms nurseries christmas tree form

- When to use tax form 4137 tax on unreported tip income

- Form 200 local intangibles tax return rev 7 22 the intangibles tax is a local tax levied on gross earnings received from

Find out other Irs Form 990 Ez

- Sign Arkansas Application for University Free

- Sign Arkansas Nanny Contract Template Fast

- How To Sign California Nanny Contract Template

- How Do I Sign Colorado Medical Power of Attorney Template

- How To Sign Louisiana Medical Power of Attorney Template

- How Do I Sign Louisiana Medical Power of Attorney Template

- Can I Sign Florida Memorandum of Agreement Template

- How Do I Sign Hawaii Memorandum of Agreement Template

- Sign Kentucky Accident Medical Claim Form Fast

- Sign Texas Memorandum of Agreement Template Computer

- How Do I Sign Utah Deed of Trust Template

- Sign Minnesota Declaration of Trust Template Simple

- Sign Texas Shareholder Agreement Template Now

- Sign Wisconsin Shareholder Agreement Template Simple

- Sign Nebraska Strategic Alliance Agreement Easy

- Sign Nevada Strategic Alliance Agreement Online

- How To Sign Alabama Home Repair Contract

- Sign Delaware Equipment Rental Agreement Template Fast

- Sign Nevada Home Repair Contract Easy

- Sign Oregon Construction Contract Template Online