1040nr Fillable 2018

What is the 1040NR Fillable?

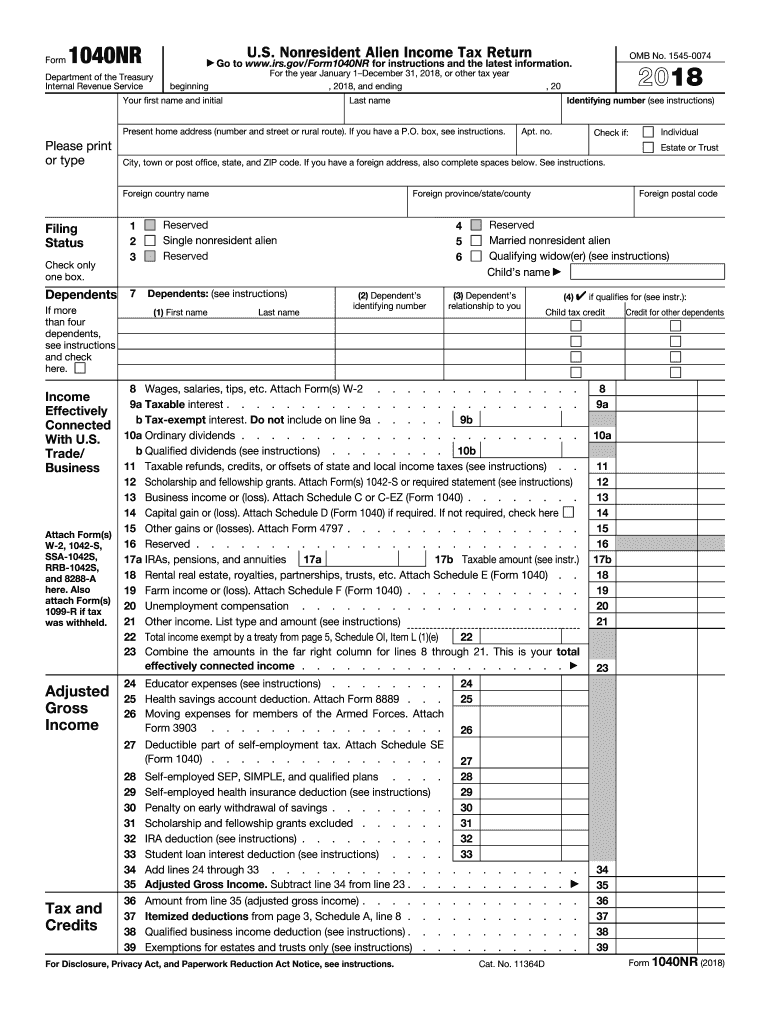

The 1040NR Fillable form is a specific version of the IRS Form 1040 designed for non-resident aliens who are required to file a U.S. tax return. This form allows individuals who do not meet the criteria for resident status to report their income effectively. The fillable version provides an interactive format that simplifies the completion process, ensuring that users can input their information directly into the form fields. This version is particularly useful for those who prefer to file their taxes electronically.

How to Use the 1040NR Fillable

Using the 1040NR Fillable form involves several straightforward steps. First, access the form through the IRS website or a trusted tax preparation platform. Once you have the form open, you can enter your personal information, such as your name, address, and taxpayer identification number. Next, input your income details, deductions, and any applicable credits. The interactive fields will help guide you through the process, making it easier to ensure all necessary information is included. After completing the form, review all entries for accuracy before submitting.

Steps to Complete the 1040NR Fillable

Completing the 1040NR Fillable form requires careful attention to detail. Follow these steps to ensure a successful filing:

- Download or access the 1040NR Fillable form from a reliable source.

- Fill in your personal information, including your residency status and contact details.

- Report your income, including wages, dividends, and any other sources.

- Claim any deductions or credits for which you are eligible.

- Double-check all entries for accuracy, ensuring no fields are left blank.

- Save your completed form and consider printing a copy for your records.

- Submit the form electronically or by mail, following the IRS submission guidelines.

IRS Guidelines

The IRS provides specific guidelines for completing and submitting the 1040NR Fillable form. It is essential to adhere to these guidelines to avoid penalties or delays in processing. Key points include understanding your filing status, accurately reporting all income, and ensuring that you meet the deadlines for submission. Additionally, familiarize yourself with any changes to tax laws that may affect your filing. The IRS website offers resources and publications that can help clarify these guidelines further.

Filing Deadlines / Important Dates

Filing deadlines for the 1040NR Fillable form are crucial to ensure compliance with IRS regulations. Typically, non-resident aliens must file their tax returns by April fifteenth of the following year. If you are unable to meet this deadline, you may apply for an extension, which usually grants an additional six months. However, it is important to note that any taxes owed must still be paid by the original deadline to avoid interest and penalties.

Required Documents

To successfully complete the 1040NR Fillable form, you will need several key documents. These typically include:

- Your passport or other identification documents.

- Form W-2 from employers, detailing your earnings.

- Form 1099 for any additional income sources.

- Documentation of any deductions or credits you intend to claim.

Gathering these documents in advance can streamline the filing process and help ensure accuracy in your tax return.

Quick guide on how to complete 1040nr 2018 2019 form

Uncover the most efficient method to complete and endorse your 1040nr Fillable

Are you still spending time preparing your official documents on paper instead of online? airSlate SignNow presents a superior approach to finish and endorse your 1040nr Fillable and related forms for public services. Our advanced electronic signature solution equips you with all the tools necessary to handle documentation swiftly and in line with official standards - comprehensive PDF editing, managing, securing, signing, and sharing functionalities readily available through an intuitive interface.

Only a few steps are needed to complete and endorse your 1040nr Fillable:

- Upload the editable template to the editor using the Get Form button.

- Review which information you must include in your 1040nr Fillable.

- Move between the fields using the Next option to ensure nothing is overlooked.

- Utilize Text, Check, and Cross tools to fill in the fields with your information.

- Revise the content with Text boxes or Images from the upper toolbar.

- Emphasize what is important or Conceal areas that are no longer relevant.

- Select Sign to create a legally valid electronic signature using your preferred method.

- Add the Date next to your signature and finalize your work with the Done button.

Store your completed 1040nr Fillable in the Documents folder of your profile, download it, or send it to your preferred cloud storage. Our solution also offers versatile form sharing. There’s no necessity to print your forms when submitting them to the appropriate public office - do it via email, fax, or by requesting a USPS "snail mail" delivery from your account. Give it a try now!

Create this form in 5 minutes or less

Find and fill out the correct 1040nr 2018 2019 form

FAQs

-

Which ITR form should an NRI fill out for AY 2018–2019 to claim the TDS deducted by banks only?

ITR form required to be submitted depends upon nature of income. As a NRI shall generally have income from other sources like interest, rental income therefore s/he should file ITR 2.

-

Am I supposed to report income which is earned outside of the US? I have to fill the 1040NR form.

If you are a US citizen, resident(?), or company based within the US or its territories, you are required by the IRS to give them a part of whatever you made. I'm not going to go into specifics, but as they say, "the only difference between a tax man and a taxidermist is that the taxidermist leaves the skin" -Mark Twain

-

Which ITR form should an NRI fill out for AY 2018–2019 for salary income?

File ITR 2 and for taking credit of foreign taxes fill form 67 before filling ITR.For specific clarifications / legal advice feel free to write to dsssvtax[at]gmail or call/WhatsApp: 9052535440.

-

Can I fill the form for the SSC CGL 2018 which will be held in June 2019 and when will the form for 2019 come out?

No, you can’t fill the form for SSC CGL 2018 as application process has been long over.SSC CGL 2019 : No concrete information at this time. Some update should come by August-September 2019.Like Exambay on facebook for all latest updates on SSC CGL 2018 , SSC CGL 2019 and other upcoming exams

-

How do I fill out the IIFT 2018 application form?

Hi!IIFT MBA (IB) Application Form 2018 – The last date to submit the Application Form of IIFT 2018 has been extended. As per the initial notice, the last date to submit the application form was September 08, 2017. However, now the candidates may submit it untill September 15, 2017. The exam date for IIFT 2018 has also been shifted to December 03, 2017. The candidates will only be issued the admit card, if they will submit IIFT application form and fee in the prescribed format. Before filling the IIFT application form, the candidates must check the eligibility criteria because ineligible candidates will not be granted admission. The application fee for candidates is Rs. 1550, however, the candidates belonging to SC/STPWD category only need to pay Rs. 775. Check procedure to submit IIFT Application Form 2018, fee details and more information from the article below.Latest – Last date to submit IIFT application form extended until September 15, 2017.IIFT 2018 Application FormThe application form of IIFT MBA 2018 has only be released online, on http://tedu.iift.ac.in. The candidates must submit it before the laps of the deadline, which can be checked from the table below.Application form released onJuly 25, 2017Last date to submit Application form(for national candidates)September 08, 2017 September 15, 2017Last date to submit the application form(by Foreign National and NRI)February 15, 2018IIFT MBA IB entrance exam will be held onNovember 26, 2017 December 03, 2017IIFT 2018 Application FeeThe candidates should take note of the application fee before submitting the application form. The fee amount is as given below and along with it, the medium to submit the fee are also mentioned.Fee amount for IIFT 2018 Application Form is as given below:General/OBC candidatesRs 1550SC/ST/PH candidatesRs 775Foreign National/NRI/Children of NRI candidatesUS$ 80 (INR Rs. 4500)The medium to submit the application fee of IIFT 2018 is as below:Credit CardsDebit Cards (VISA/Master)Demand Draft (DD)Candidates who will submit the application fee via Demand Draft will be required to submit a DD, in favour of Indian Institute of Foreign Trade, payable at New Delhi.Procedure to Submit IIFT MBA Application Form 2018Thank you & Have a nice day! :)

Create this form in 5 minutes!

How to create an eSignature for the 1040nr 2018 2019 form

How to make an eSignature for your 1040nr 2018 2019 Form in the online mode

How to create an eSignature for your 1040nr 2018 2019 Form in Chrome

How to make an electronic signature for signing the 1040nr 2018 2019 Form in Gmail

How to generate an eSignature for the 1040nr 2018 2019 Form from your smart phone

How to create an electronic signature for the 1040nr 2018 2019 Form on iOS devices

How to create an eSignature for the 1040nr 2018 2019 Form on Android devices

People also ask

-

What are IRS tax forms 2018 1040 instructions printable?

IRS tax forms 2018 1040 instructions printable provide detailed guidance on how to fill out your federal income tax return for the 2018 tax year. These instructions include information on deductions, credits, and how to properly report your income. Utilizing these forms helps ensure you comply with IRS requirements and potentially maximize your tax refund.

-

How can I obtain IRS tax forms 2018 1040 instructions printable?

You can easily access IRS tax forms 2018 1040 instructions printable by visiting the official IRS website or using electronic document services like airSlate SignNow. This allows you to download, print, and fill out the necessary forms conveniently, ensuring you have the most up-to-date and accurate information available.

-

Are there costs associated with downloading IRS tax forms 2018 1040 instructions printable from airSlate SignNow?

Downloading IRS tax forms 2018 1040 instructions printable from airSlate SignNow is completely free. Our platform provides easy access and support for all users, ensuring that you can obtain the necessary tax forms without any hidden fees or costs. Signing up may provide additional features for document management, but the forms are free to download.

-

What features does airSlate SignNow offer for managing IRS tax forms 2018 1040 instructions printable?

airSlate SignNow provides a user-friendly interface for managing your IRS tax forms 2018 1040 instructions printable. Key features include eSignature capabilities, document sharing, and cloud storage, which make filing your taxes easier and more efficient. Our platform is designed to streamline your document workflow and ensure that your tax documents are securely managed.

-

Can I eSign IRS tax forms 2018 1040 instructions printable using airSlate SignNow?

Yes, you can eSign IRS tax forms 2018 1040 instructions printable directly using airSlate SignNow. Our solution simplifies the signing process, allowing you to securely sign your tax documents electronically. This eliminates the need for printing and mailing, saving you time and ensuring your paperwork is processed quickly.

-

Does airSlate SignNow integrate with other tax preparation software for IRS tax forms 2018 1040 instructions printable?

Absolutely! airSlate SignNow integrates seamlessly with various tax preparation software, allowing you to manage your IRS tax forms 2018 1040 instructions printable more efficiently. This integration enhances your workflow by ensuring that all of your documents and information are accessible in one place, streamlining your tax preparation process.

-

What benefits can I expect from using airSlate SignNow for IRS tax forms 2018 1040 instructions printable?

By using airSlate SignNow for IRS tax forms 2018 1040 instructions printable, you gain a more organized approach to handling your tax documents. Our platform offers enhanced security, time-saving workflows, and convenience with eSigning capabilities. This ensures that your tax filing experience is straightforward and stress-free.

Get more for 1040nr Fillable

Find out other 1040nr Fillable

- Electronic signature Florida Amendment to an LLC Operating Agreement Secure

- Electronic signature Florida Amendment to an LLC Operating Agreement Fast

- Electronic signature Florida Amendment to an LLC Operating Agreement Simple

- Electronic signature Florida Amendment to an LLC Operating Agreement Safe

- How Can I eSignature South Carolina Exchange of Shares Agreement

- Electronic signature Michigan Amendment to an LLC Operating Agreement Computer

- Can I Electronic signature North Carolina Amendment to an LLC Operating Agreement

- Electronic signature South Carolina Amendment to an LLC Operating Agreement Safe

- Can I Electronic signature Delaware Stock Certificate

- Electronic signature Massachusetts Stock Certificate Simple

- eSignature West Virginia Sale of Shares Agreement Later

- Electronic signature Kentucky Affidavit of Service Mobile

- How To Electronic signature Connecticut Affidavit of Identity

- Can I Electronic signature Florida Affidavit of Title

- How Can I Electronic signature Ohio Affidavit of Service

- Can I Electronic signature New Jersey Affidavit of Identity

- How Can I Electronic signature Rhode Island Affidavit of Service

- Electronic signature Tennessee Affidavit of Service Myself

- Electronic signature Indiana Cease and Desist Letter Free

- Electronic signature Arkansas Hold Harmless (Indemnity) Agreement Fast