Form 990 Schedule G 2013

What is the Form 990 Schedule G

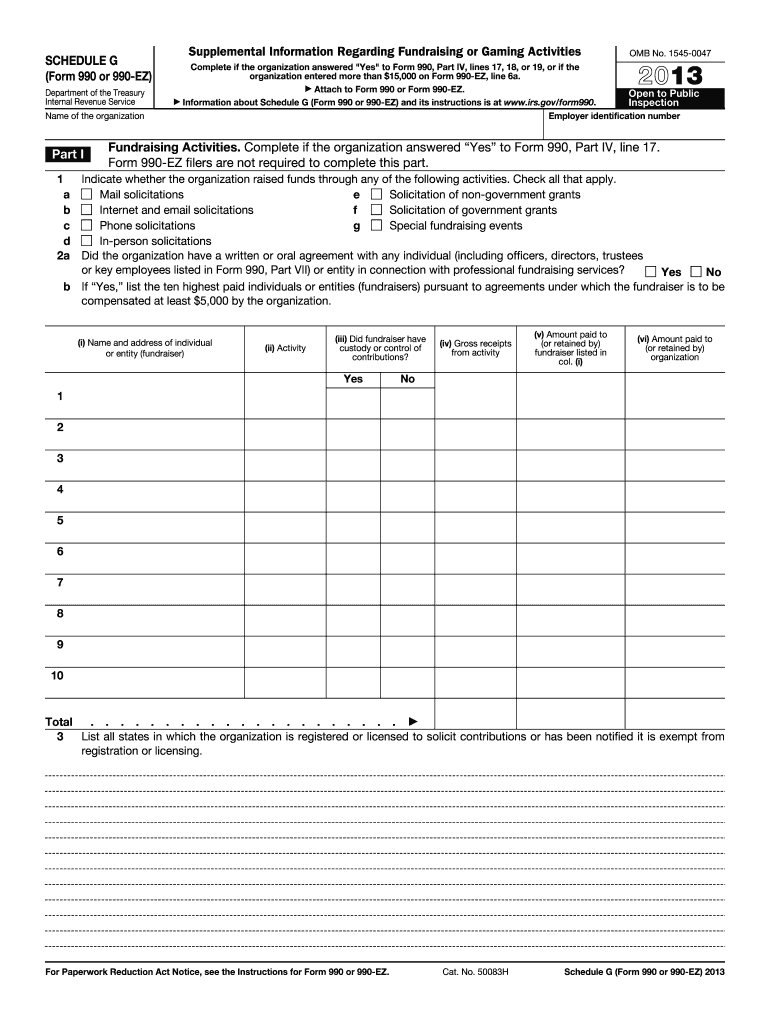

The Form 990 Schedule G is a supplementary form required by the Internal Revenue Service (IRS) for certain tax-exempt organizations. It provides detailed information about the organization's professional fundraising services, including the fees paid to professional fundraisers and the total contributions received. This form is essential for ensuring transparency and accountability in fundraising activities, helping to maintain public trust in nonprofit organizations.

How to use the Form 990 Schedule G

To use the Form 990 Schedule G, organizations must first determine if they are required to file it based on their fundraising activities. If applicable, the organization should gather all necessary financial information related to fundraising efforts, including contracts with professional fundraisers and records of donations. The completed form is then attached to the main Form 990 when filing with the IRS.

Steps to complete the Form 990 Schedule G

Completing the Form 990 Schedule G involves several key steps:

- Identify whether your organization is required to file the form based on its fundraising activities.

- Collect relevant financial data, including total contributions and details of any professional fundraising contracts.

- Fill out the form accurately, ensuring all sections are completed as required by the IRS.

- Review the completed form for accuracy and compliance with IRS guidelines.

- Attach the Schedule G to the main Form 990 and submit it to the IRS by the designated deadline.

Legal use of the Form 990 Schedule G

The legal use of the Form 990 Schedule G is governed by IRS regulations. Organizations must ensure that the information provided is truthful and complete, as inaccuracies can lead to penalties or loss of tax-exempt status. Additionally, the form must be filed in accordance with the applicable deadlines to maintain compliance with federal laws.

Key elements of the Form 990 Schedule G

Key elements of the Form 990 Schedule G include:

- Identification of the organization and its fundraising activities.

- Details of any professional fundraising services used, including compensation and fees.

- Summary of contributions received and the methods used to solicit donations.

- Disclosure of any relationships with professional fundraisers and the nature of those relationships.

Filing Deadlines / Important Dates

Filing deadlines for the Form 990 Schedule G align with the main Form 990 submission dates. Generally, organizations must file their Form 990 by the fifteenth day of the fifth month after the end of their fiscal year. Extensions may be available, but organizations should ensure they comply with all deadlines to avoid penalties.

Form Submission Methods (Online / Mail / In-Person)

The Form 990 Schedule G can be submitted in several ways. Organizations can file it electronically using approved e-filing software, which is often the preferred method for efficiency and accuracy. Alternatively, organizations may choose to mail a paper copy of the form to the IRS. In-person submissions are generally not accepted for this form.

Quick guide on how to complete 2013 form 990 schedule g

Easily Prepare Form 990 Schedule G on Any Device

Managing documents online has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the correct form and securely store it on the web. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly and without delays. Handle Form 990 Schedule G on any device with the airSlate SignNow apps for Android or iOS and enhance any document-related process today.

How to Edit and Electronically Sign Form 990 Schedule G Effortlessly

- Locate Form 990 Schedule G and click on Get Form to begin.

- Use the tools we provide to fill out your document.

- Emphasize relevant sections of your documents or obscure sensitive information with the specific tools that airSlate SignNow provides for this purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to save your changes.

- Choose how you wish to deliver your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns over lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Form 990 Schedule G to maintain excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2013 form 990 schedule g

Create this form in 5 minutes!

How to create an eSignature for the 2013 form 990 schedule g

The way to generate an electronic signature for your PDF in the online mode

The way to generate an electronic signature for your PDF in Chrome

The way to generate an electronic signature for putting it on PDFs in Gmail

The best way to create an electronic signature from your smart phone

The best way to make an electronic signature for a PDF on iOS devices

The best way to create an electronic signature for a PDF file on Android OS

People also ask

-

What is Form 990 Schedule G and why is it important?

Form 990 Schedule G is used by tax-exempt organizations to report compensation paid to certain individuals, including the organization's highest-paid employees and contractors. This form is important for transparency and compliance, helping organizations maintain their nonprofit status and avoid penalties.

-

How can airSlate SignNow assist with Form 990 Schedule G?

airSlate SignNow provides a streamlined process for eSigning and sending documents related to Form 990 Schedule G. With our platform, you can ensure that your organization’s forms are completed efficiently and securely, allowing for timely submissions to the IRS.

-

What features does airSlate SignNow offer for managing Form 990 Schedule G documents?

airSlate SignNow offers robust features such as customizable templates, real-time tracking, and secure cloud storage, specifically designed to simplify the management of Form 990 Schedule G documents. These features enable you to access forms anytime, ensuring compliance and minimizing delays.

-

Is airSlate SignNow cost-effective for organizations managing Form 990 Schedule G?

Yes, airSlate SignNow is a cost-effective solution for organizations that need to manage and submit Form 990 Schedule G. Our pricing plans are designed to suit organizations of all sizes, providing access to essential features without breaking the bank.

-

Can airSlate SignNow integrate with accounting software for Form 990 Schedule G?

Yes, airSlate SignNow seamlessly integrates with popular accounting software, making it easy to transfer your data for Form 990 Schedule G. This integration helps maintain accurate records and streamlines the preparation process, ensuring compliance with federal regulations.

-

What are the benefits of using airSlate SignNow for nonprofit organizations?

Using airSlate SignNow, nonprofit organizations can benefit from increased efficiency, enhanced security, and reduced paper usage when managing Form 990 Schedule G. Our platform empowers teams to focus on their mission while ensuring compliance and timely submissions.

-

Is the airSlate SignNow platform easy to use for submitting Form 990 Schedule G?

Absolutely! The airSlate SignNow platform is designed with user-friendliness in mind, enabling anyone to navigate easily while submitting Form 990 Schedule G. With intuitive features and guided workflows, you'll be able to complete tasks quickly and efficiently.

Get more for Form 990 Schedule G

Find out other Form 990 Schedule G

- Sign Police Word Missouri Computer

- Sign Missouri Police Resignation Letter Fast

- Sign Ohio Police Promissory Note Template Easy

- Sign Alabama Courts Affidavit Of Heirship Simple

- How To Sign Arizona Courts Residential Lease Agreement

- How Do I Sign Arizona Courts Residential Lease Agreement

- Help Me With Sign Arizona Courts Residential Lease Agreement

- How Can I Sign Arizona Courts Residential Lease Agreement

- Sign Colorado Courts LLC Operating Agreement Mobile

- Sign Connecticut Courts Living Will Computer

- How Do I Sign Connecticut Courts Quitclaim Deed

- eSign Colorado Banking Rental Application Online

- Can I eSign Colorado Banking Medical History

- eSign Connecticut Banking Quitclaim Deed Free

- eSign Connecticut Banking Business Associate Agreement Secure

- Sign Georgia Courts Moving Checklist Simple

- Sign Georgia Courts IOU Mobile

- How Can I Sign Georgia Courts Lease Termination Letter

- eSign Hawaii Banking Agreement Simple

- eSign Hawaii Banking Rental Application Computer