Form 1040 Schedule D 2014

What is the Form 1040 Schedule D

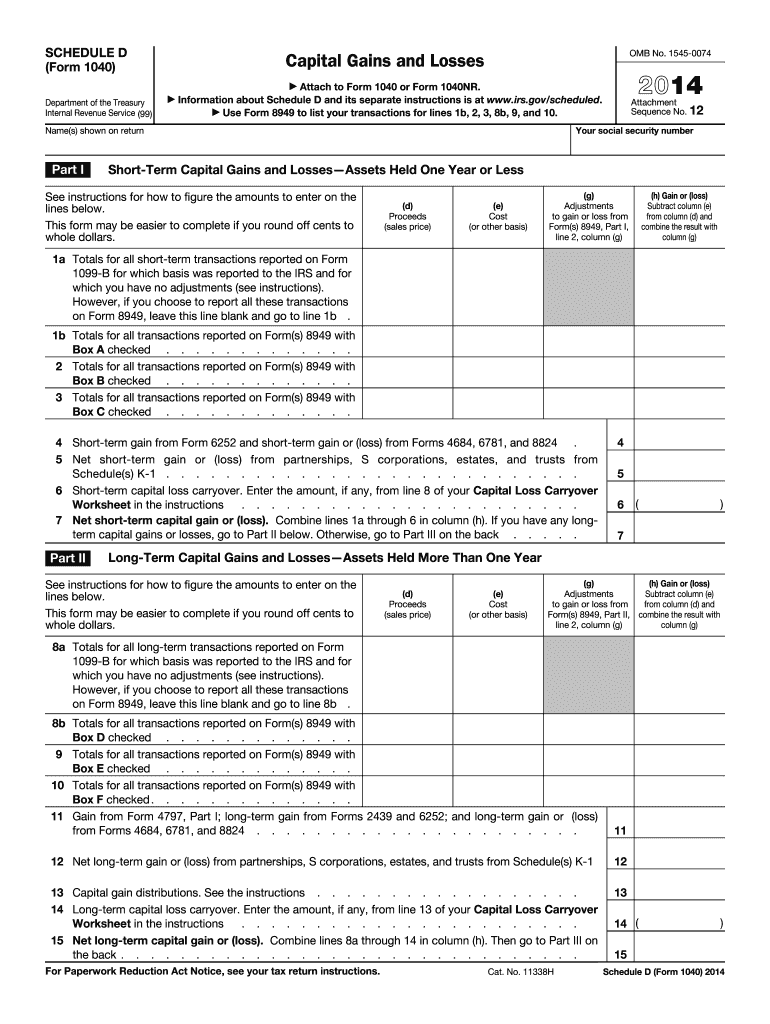

The Form 1040 Schedule D is a tax form used by U.S. taxpayers to report capital gains and losses from the sale of assets. This form is essential for individuals who have sold stocks, bonds, real estate, or other investments during the tax year. By detailing these transactions, taxpayers can calculate their overall capital gain or loss, which ultimately affects their taxable income. Understanding the Schedule D is crucial for accurate tax reporting and compliance with IRS regulations.

How to use the Form 1040 Schedule D

To effectively use the Form 1040 Schedule D, taxpayers must first gather all relevant documents related to their capital transactions. This includes purchase and sale records, brokerage statements, and any other documentation that reflects gains or losses. Once the necessary information is compiled, taxpayers can fill out the form by entering details about each transaction, including the date acquired, date sold, sales price, and cost basis. After completing the form, it should be attached to the main Form 1040 when filing taxes.

Steps to complete the Form 1040 Schedule D

Completing the Form 1040 Schedule D involves several key steps:

- Gather all documents related to your capital gains and losses.

- Fill out Part I for short-term capital gains and losses, detailing each transaction.

- Complete Part II for long-term capital gains and losses, following the same process.

- Calculate the total gains and losses from both parts to determine your net capital gain or loss.

- Transfer the net amount to the appropriate line on your Form 1040.

IRS Guidelines

The IRS provides specific guidelines for filling out the Form 1040 Schedule D, including instructions on what constitutes a capital asset and how to report different types of transactions. Taxpayers should refer to the IRS instructions for Schedule D for detailed information on reporting requirements, allowable deductions, and calculations for capital gains tax rates. Staying informed about these guidelines is essential for accurate tax filings and avoiding potential penalties.

Filing Deadlines / Important Dates

Filing deadlines for the Form 1040 Schedule D align with the general tax filing deadlines in the United States. Typically, individual taxpayers must submit their tax returns, including Schedule D, by April 15 of the following year. However, if this date falls on a weekend or holiday, the deadline may be extended. It is important to keep track of any changes in deadlines, especially for those who may need to file for extensions.

Penalties for Non-Compliance

Failing to accurately report capital gains and losses on the Form 1040 Schedule D can result in significant penalties imposed by the IRS. These penalties may include fines for underreporting income, interest on unpaid taxes, and potential audits. To avoid these consequences, it is crucial for taxpayers to ensure all information is complete and accurate when filing. Consulting with a tax professional can provide additional assurance of compliance.

Quick guide on how to complete 2014 form 1040 schedule d

Complete Form 1040 Schedule D seamlessly on any device

Web-based document management has gained traction with companies and individuals alike. It offers an ideal eco-conscious alternative to conventional printed and signed files, as you can acquire the necessary form and securely keep it online. airSlate SignNow provides you with all the tools you need to create, modify, and eSign your documents quickly and efficiently. Handle Form 1040 Schedule D on any platform with airSlate SignNow Android or iOS applications and simplify any document-related process today.

The easiest way to modify and eSign Form 1040 Schedule D effortlessly

- Obtain Form 1040 Schedule D and click Get Form to begin.

- Use the tools we provide to complete your form.

- Emphasize pertinent sections of your documents or obscure sensitive data with tools that airSlate SignNow specifically provides for this purpose.

- Create your eSignature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Verify the details and click on the Done button to finalize your changes.

- Choose how you want to send your form, via email, text (SMS), or an invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, arduous form searching, or mistakes that require printing new document versions. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and eSign Form 1040 Schedule D and ensure outstanding communication at any phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2014 form 1040 schedule d

Create this form in 5 minutes!

How to create an eSignature for the 2014 form 1040 schedule d

The way to generate an electronic signature for a PDF file online

The way to generate an electronic signature for a PDF file in Google Chrome

The way to create an electronic signature for signing PDFs in Gmail

The best way to create an eSignature straight from your mobile device

The best way to make an eSignature for a PDF file on iOS

The best way to create an eSignature for a PDF document on Android devices

People also ask

-

What is Form 1040 Schedule D?

Form 1040 Schedule D is used to report capital gains and losses for individual taxpayers. It helps calculate the taxable income from the sale of assets, such as stocks or property. Understanding this form is crucial for accurate tax reporting and maximizing potential deductions.

-

How can airSlate SignNow assist with Form 1040 Schedule D?

airSlate SignNow offers an easy eSigning solution that streamlines the process of submitting your Form 1040 Schedule D. By using our service, users can securely send, sign, and store their financial documents digitally. This helps ensure compliance and simplifies the overall tax filing experience.

-

Is airSlate SignNow affordable for small businesses needing to file Form 1040 Schedule D?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses of all sizes, including small businesses. Our pricing plans are transparent and flexible, allowing businesses to choose the level of service that meets their needs for filing documents like Form 1040 Schedule D without overspending.

-

What features does airSlate SignNow provide for handling documents like Form 1040 Schedule D?

airSlate SignNow offers a range of features that enhance document management, including templates, secure eSignatures, and cloud storage. These features simplify the preparation and signing of important tax documents such as Form 1040 Schedule D. This ensures that all essential information is easily accessible and editable.

-

Does airSlate SignNow integrate with accounting software for Form 1040 Schedule D?

Yes, airSlate SignNow integrates seamlessly with various accounting software, allowing users to access and sign documents like Form 1040 Schedule D effortlessly. These integrations streamline workflows and reduce the time spent on tax preparation, ensuring a more efficient process for users.

-

Can I securely share Form 1040 Schedule D using airSlate SignNow?

Absolutely! airSlate SignNow provides secure sharing options that allow users to send their Form 1040 Schedule D and other sensitive documents safely. Our platform uses advanced encryption methods, protecting your information and ensuring that only authorized individuals can access the documents.

-

What are the benefits of using airSlate SignNow for submitting Form 1040 Schedule D?

Using airSlate SignNow for submitting your Form 1040 Schedule D offers several benefits, including time savings, reduced paperwork, and enhanced document security. Our user-friendly interface makes the tax filing process straightforward, allowing you to complete essential forms efficiently without hassle.

Get more for Form 1040 Schedule D

- Town no i i i 59 south prospect street hartford form

- Dl 31cd 7 19 form

- Illinois acceptable and unacceptable identification documents chart for drivers licensestate id form

- Beginning driver experience log nrs 483 form

- Temporary visitor drivers license tvdl quick guide form

- Illinois secretary of state polish edition form

- Vehicle inspection form houston county probate court

- Form trs78 direct deposit request form trs78 direct deposit request

Find out other Form 1040 Schedule D

- How To eSignature Maryland Doctors Word

- Help Me With eSignature South Dakota Education Form

- How Can I eSignature Virginia Education PDF

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form