Irs 4562 Form 2014

What is the Irs 4562 Form

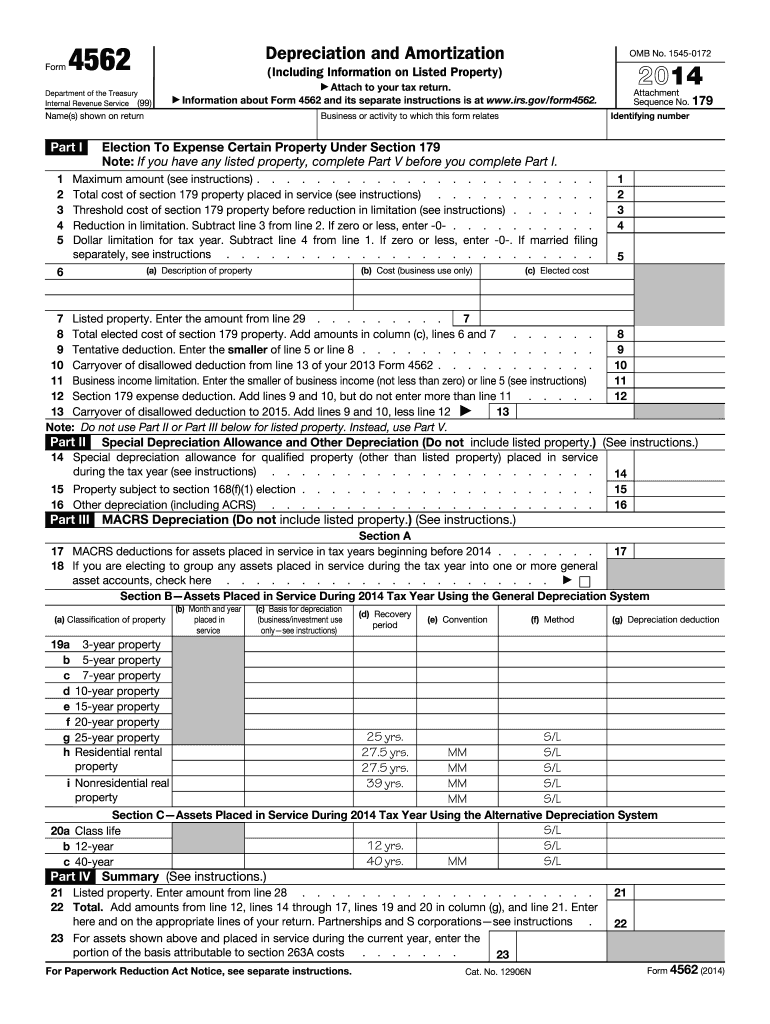

The Irs 4562 Form, officially known as the Depreciation and Amortization form, is a crucial document used by taxpayers to report depreciation and amortization of property. This form is essential for individuals and businesses to calculate the depreciation of assets over time, allowing them to reduce taxable income. It includes various sections to detail the types of property being depreciated, the method of depreciation, and the applicable depreciation rates. Understanding this form is vital for accurate tax reporting and compliance with IRS regulations.

How to use the Irs 4562 Form

Using the Irs 4562 Form involves several steps to ensure accurate reporting of depreciation. First, identify the assets that qualify for depreciation. Next, select the appropriate method for calculating depreciation, such as the Modified Accelerated Cost Recovery System (MACRS) or straight-line method. Fill out the form by providing details such as the date the asset was placed in service, the cost of the asset, and the depreciation claimed in previous years. Finally, ensure that the completed form is included with your tax return to avoid any issues with the IRS.

Steps to complete the Irs 4562 Form

Completing the Irs 4562 Form requires careful attention to detail. Follow these steps:

- Gather information about the assets you are depreciating, including purchase dates and costs.

- Choose the appropriate depreciation method based on the asset type.

- Fill out Part I for the current year’s depreciation, indicating the assets and their respective costs.

- Complete Part II if you are claiming amortization for intangible assets.

- Review the form for accuracy before submission.

Key elements of the Irs 4562 Form

The Irs 4562 Form comprises several key elements that taxpayers must understand. These include:

- Part I: This section is dedicated to claiming depreciation on assets.

- Part II: Used for amortization of intangible assets.

- Part III: Details the election to expense certain assets under Section 179.

- Part IV: Provides information on listed property, which has special rules regarding depreciation.

Filing Deadlines / Important Dates

Filing the Irs 4562 Form is typically aligned with the tax return deadlines. For most taxpayers, the deadline to file is April 15. However, if you file for an extension, you have until October 15 to submit your return, including the Irs 4562 Form. It is important to adhere to these deadlines to avoid penalties and ensure compliance with IRS regulations.

Penalties for Non-Compliance

Failing to file the Irs 4562 Form or inaccuracies in reporting can lead to significant penalties. The IRS may impose fines for late filing, which can accumulate over time. Additionally, underreporting income due to incorrect depreciation calculations can result in back taxes owed, interest, and further penalties. It is essential to ensure accuracy and timeliness when submitting this form to mitigate potential financial consequences.

Quick guide on how to complete 2014 irs 4562 form

Complete Irs 4562 Form effortlessly on any gadget

Online document management has gained traction among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can access the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Irs 4562 Form on any device using airSlate SignNow's Android or iOS applications and streamline any document-related processes today.

How to modify and eSign Irs 4562 Form with ease

- Obtain Irs 4562 Form and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow specifically offers for this purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your updates.

- Select how you want to share your form, via email, SMS, or invitation link, or download it to your computer.

Put aside concerns about lost or misplaced documents, tedious form searches, or mistakes that require reprinting new document copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device you prefer. Modify and eSign Irs 4562 Form and ensure outstanding communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2014 irs 4562 form

Create this form in 5 minutes!

How to create an eSignature for the 2014 irs 4562 form

The way to generate an electronic signature for your PDF online

The way to generate an electronic signature for your PDF in Google Chrome

The way to generate an electronic signature for signing PDFs in Gmail

The best way to create an electronic signature from your smartphone

The best way to make an electronic signature for a PDF on iOS

The best way to create an electronic signature for a PDF file on Android

People also ask

-

What is the Irs 4562 Form and why do I need it?

The Irs 4562 Form is used to report depreciation and amortization for assets. You need this form if you want to claim deductions for your business's property expenses, which can signNowly reduce your tax liability. airSlate SignNow simplifies the process of completing and submitting the Irs 4562 Form.

-

How can airSlate SignNow help with the completion of the Irs 4562 Form?

airSlate SignNow provides a user-friendly platform that enables you to fill out and eSign the Irs 4562 Form digitally. With built-in templates and guidance, our solution makes it easier to ensure that your form is completed accurately and submitted on time. This streamlines your workflow and reduces the chances of errors.

-

Are there any costs associated with using airSlate SignNow for the Irs 4562 Form?

Yes, there are various pricing plans available for using airSlate SignNow, catering to different business needs. Each plan provides access to features that facilitate not just the Irs 4562 Form, but all your document signing and management needs. You can assess your options and choose a plan that suits your budget.

-

Is airSlate SignNow compliant with IRS regulations when handling the Irs 4562 Form?

Absolutely! airSlate SignNow ensures that all electronic signatures and submitted documents comply with IRS regulations, making it a reliable choice for your Irs 4562 Form. Our platform adheres to the highest security and compliance standards, giving you peace of mind regarding confidentiality and legal validity.

-

Can I integrate airSlate SignNow with other accounting software when filling out the Irs 4562 Form?

Yes, airSlate SignNow offers robust integrations with popular accounting and tax software, enhancing your ability to manage documents associated with the Irs 4562 Form. This seamless connectivity allows you to import and export data effortlessly, streamlining your entire filing process.

-

What are the benefits of using airSlate SignNow for the Irs 4562 Form over traditional methods?

Using airSlate SignNow for the Irs 4562 Form provides signNow benefits such as time savings, reduced paper usage, and enhanced accuracy. Digital signing eliminates the need for physical documents, while our templates minimize the risk of common errors. Overall, our service is a cost-effective solution for managing all your form-related needs.

-

Is there customer support available when using airSlate SignNow for the Irs 4562 Form?

Yes, airSlate SignNow offers comprehensive customer support to assist you with any questions regarding the Irs 4562 Form or any other features. Our knowledgeable team is available through multiple channels, ensuring you receive timely assistance to help navigate the platform with ease.

Get more for Irs 4562 Form

Find out other Irs 4562 Form

- Electronic signature California Sublease Agreement Template Myself

- Can I Electronic signature Florida Sublease Agreement Template

- How Can I Electronic signature Tennessee Sublease Agreement Template

- Electronic signature Maryland Roommate Rental Agreement Template Later

- Electronic signature Utah Storage Rental Agreement Easy

- Electronic signature Washington Home office rental agreement Simple

- Electronic signature Michigan Email Cover Letter Template Free

- Electronic signature Delaware Termination Letter Template Now

- How Can I Electronic signature Washington Employee Performance Review Template

- Electronic signature Florida Independent Contractor Agreement Template Now

- Electronic signature Michigan Independent Contractor Agreement Template Now

- Electronic signature Oregon Independent Contractor Agreement Template Computer

- Electronic signature Texas Independent Contractor Agreement Template Later

- Electronic signature Florida Employee Referral Form Secure

- How To Electronic signature Florida CV Form Template

- Electronic signature Mississippi CV Form Template Easy

- Electronic signature Ohio CV Form Template Safe

- Electronic signature Nevada Employee Reference Request Mobile

- How To Electronic signature Washington Employee Reference Request

- Electronic signature New York Working Time Control Form Easy