About Schedule D Form 1065Internal Revenue Service IRS Gov 2014

What is the About Schedule D Form 1065Internal Revenue Service IRS gov

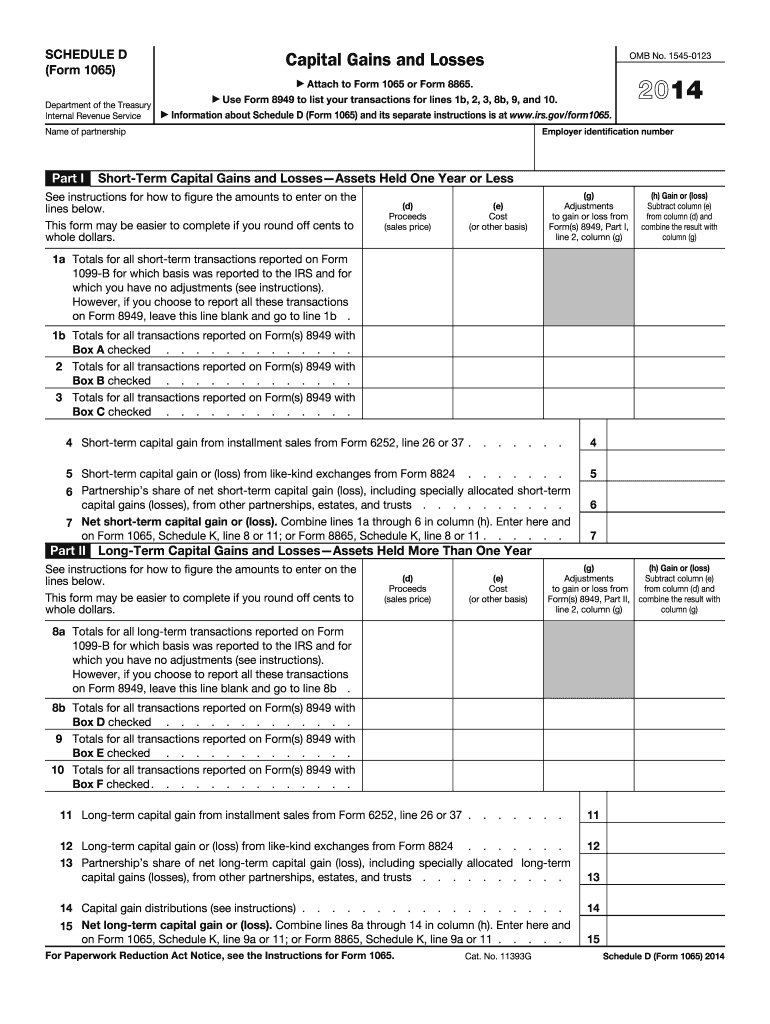

The About Schedule D Form 1065 is a tax form used by partnerships to report capital gains and losses. This form is part of the IRS Form 1065, which is the U.S. Return of Partnership Income. Schedule D specifically focuses on transactions involving capital assets, allowing partnerships to detail their gains and losses from the sale or exchange of these assets. Understanding this form is crucial for accurate tax reporting and compliance with IRS regulations.

How to use the About Schedule D Form 1065Internal Revenue Service IRS gov

Using the About Schedule D Form 1065 involves several steps. First, partnerships must gather all relevant financial information regarding their capital assets. This includes details on the purchase and sale of assets, as well as any adjustments that may affect the gain or loss. Once the necessary information is compiled, the partnership can fill out the form, ensuring that all calculations are accurate. After completing the form, it must be submitted along with Form 1065 to the IRS by the designated deadline.

Steps to complete the About Schedule D Form 1065Internal Revenue Service IRS gov

Completing the About Schedule D Form 1065 requires careful attention to detail. Here are the steps to follow:

- Gather all necessary financial records related to capital assets.

- Determine the basis of each asset, including purchase price and any improvements.

- Calculate the proceeds from the sale of each asset.

- Determine the gain or loss for each transaction by subtracting the basis from the proceeds.

- Fill out Schedule D, providing accurate details of each transaction.

- Review the completed form for accuracy before submission.

Legal use of the About Schedule D Form 1065Internal Revenue Service IRS gov

The legal use of the About Schedule D Form 1065 is essential for partnerships to comply with federal tax laws. This form must be filled out accurately to ensure that all capital gains and losses are reported correctly. Failure to report this information can lead to penalties and interest charges. Partnerships must retain copies of their completed forms and supporting documentation for their records, as the IRS may request this information during audits.

Filing Deadlines / Important Dates

Partnerships must be aware of specific filing deadlines for the About Schedule D Form 1065. The due date for filing Form 1065, including Schedule D, is typically March 15 for calendar year partnerships. If additional time is needed, partnerships can file for an extension, which extends the deadline by six months. However, it is important to note that any tax owed must be paid by the original due date to avoid penalties.

Who Issues the Form

The About Schedule D Form 1065 is issued by the Internal Revenue Service (IRS), the federal agency responsible for tax collection and enforcement in the United States. The IRS provides guidelines and instructions for completing the form, ensuring that partnerships understand their obligations and the information required for accurate reporting.

Quick guide on how to complete about schedule d form 1065internal revenue service irsgov

Complete About Schedule D Form 1065Internal Revenue Service IRS gov effortlessly on any gadget

Virtual document management has become increasingly popular among enterprises and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to locate the necessary form and securely archive it online. airSlate SignNow equips you with all the tools needed to create, modify, and eSign your documents promptly without holdups. Handle About Schedule D Form 1065Internal Revenue Service IRS gov on any gadget with airSlate SignNow Android or iOS applications and enhance any document-centered workflow today.

The easiest method to alter and eSign About Schedule D Form 1065Internal Revenue Service IRS gov seamlessly

- Obtain About Schedule D Form 1065Internal Revenue Service IRS gov and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight pertinent sections of the documents or redact sensitive data with tools that airSlate SignNow supplies specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to save your edits.

- Decide how you want to send your form, via email, text message (SMS), or an invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Edit and eSign About Schedule D Form 1065Internal Revenue Service IRS gov and guarantee outstanding communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct about schedule d form 1065internal revenue service irsgov

Create this form in 5 minutes!

How to create an eSignature for the about schedule d form 1065internal revenue service irsgov

The way to generate an electronic signature for a PDF document in the online mode

The way to generate an electronic signature for a PDF document in Chrome

The way to generate an eSignature for putting it on PDFs in Gmail

The best way to create an electronic signature right from your mobile device

The best way to make an eSignature for a PDF document on iOS devices

The best way to create an electronic signature for a PDF on Android devices

People also ask

-

What is the Schedule D Form 1065 and why is it important?

The Schedule D Form 1065 is a tax form used by partnerships to report capital gains and losses. Understanding 'About Schedule D Form 1065Internal Revenue Service IRS gov.' is crucial for ensuring accurate tax reporting and compliance with IRS regulations.

-

How can airSlate SignNow assist with the Schedule D Form 1065?

airSlate SignNow offers a seamless way to eSign and send documents related to the Schedule D Form 1065. Our platform simplifies the process, ensuring that all your tax documents are securely signed and delivered in compliance with 'About Schedule D Form 1065Internal Revenue Service IRS gov.' guidelines.

-

What are the pricing plans for using airSlate SignNow for tax forms?

airSlate SignNow provides flexible pricing plans to cater to different business needs, making it an affordable option for handling tax documents like the Schedule D Form 1065. By choosing our service, you will save time and reduce costs while ensuring compliance with 'About Schedule D Form 1065Internal Revenue Service IRS gov.' requirements.

-

Are there any integrations available with airSlate SignNow for tax preparation software?

Yes, airSlate SignNow integrates with various tax preparation software, enhancing your ability to manage documents like the Schedule D Form 1065. These integrations streamline your workflow and support compliance with 'About Schedule D Form 1065Internal Revenue Service IRS gov.' processes.

-

What features does airSlate SignNow offer to enhance document security?

airSlate SignNow prioritizes document security with features like encryption, audit trails, and secure cloud storage. These features instill confidence that your documents related to the Schedule D Form 1065 are protected, adhering to 'About Schedule D Form 1065Internal Revenue Service IRS gov.' standards.

-

Can I access airSlate SignNow on mobile devices?

Yes, airSlate SignNow is accessible on mobile devices, allowing you to manage and eSign your Schedule D Form 1065 on the go. This flexibility supports efficient handling of your tax documents, aligning with the information in 'About Schedule D Form 1065Internal Revenue Service IRS gov.'

-

What benefits does eSigning my Schedule D Form 1065 with airSlate SignNow provide?

eSigning your Schedule D Form 1065 with airSlate SignNow speeds up the process, allowing for immediate completion and submission. This efficiency helps you stay compliant with 'About Schedule D Form 1065Internal Revenue Service IRS gov.' while reducing the hassle of paperwork.

Get more for About Schedule D Form 1065Internal Revenue Service IRS gov

- Ac2131 on site application for minor variation to approved plans form

- Form 8 employment pass sponsorship application form

- Msf4371 rev 0519 form

- Httpsapi2ilovepdfcomv1download pinterest form

- Request check the box to indicate if you are requesting a letter of certification or a transcript of hours earned form

- You can complete and submit this form online at www

- Sf500 budgeting loan claim form you can fill in on screen print and sign with a pen

- Building permit application form ministry of works transport

Find out other About Schedule D Form 1065Internal Revenue Service IRS gov

- How Can I eSignature Idaho Non-Profit Business Plan Template

- eSignature Mississippi Life Sciences Lease Agreement Myself

- How Can I eSignature Mississippi Life Sciences Last Will And Testament

- How To eSignature Illinois Non-Profit Contract

- eSignature Louisiana Non-Profit Business Plan Template Now

- How Do I eSignature North Dakota Life Sciences Operating Agreement

- eSignature Oregon Life Sciences Job Offer Myself

- eSignature Oregon Life Sciences Job Offer Fast

- eSignature Oregon Life Sciences Warranty Deed Myself

- eSignature Maryland Non-Profit Cease And Desist Letter Fast

- eSignature Pennsylvania Life Sciences Rental Lease Agreement Easy

- eSignature Washington Life Sciences Permission Slip Now

- eSignature West Virginia Life Sciences Quitclaim Deed Free

- Can I eSignature West Virginia Life Sciences Residential Lease Agreement

- eSignature New York Non-Profit LLC Operating Agreement Mobile

- How Can I eSignature Colorado Orthodontists LLC Operating Agreement

- eSignature North Carolina Non-Profit RFP Secure

- eSignature North Carolina Non-Profit Credit Memo Secure

- eSignature North Dakota Non-Profit Quitclaim Deed Later

- eSignature Florida Orthodontists Business Plan Template Easy