What is Form 8960 Net Investment Income Tax TurboTax 2022

Understanding Form 8960: Net Investment Income Tax

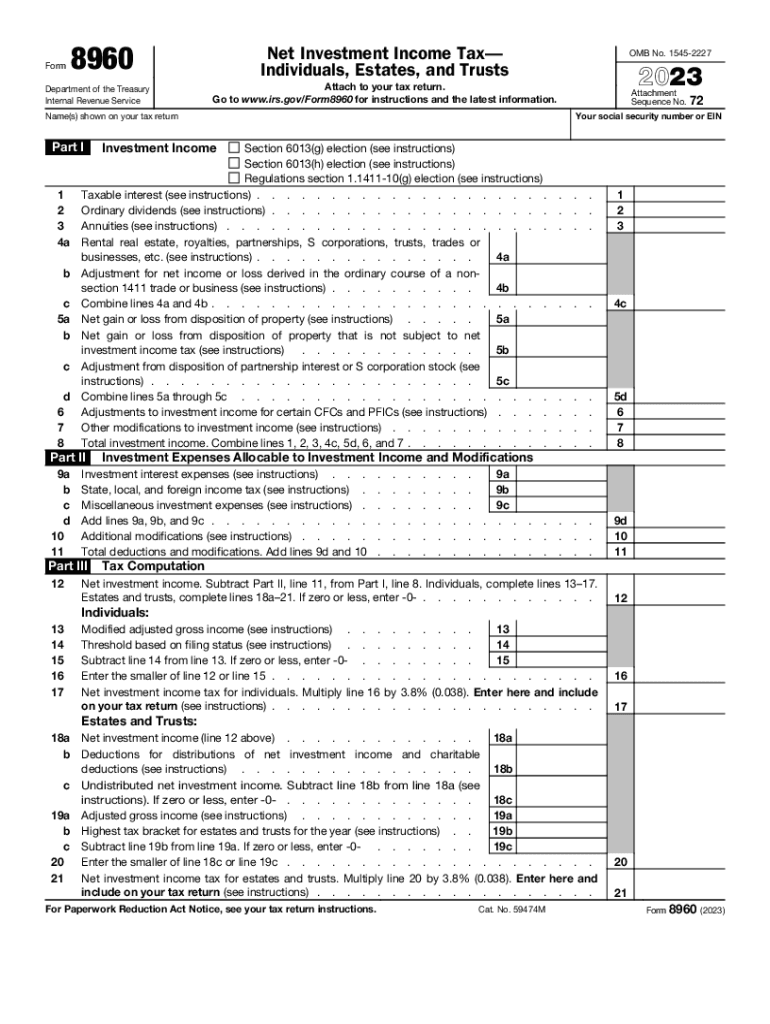

Form 8960 is used to calculate the Net Investment Income Tax (NIIT), which applies to individuals, estates, and trusts that have net investment income and modified adjusted gross income above certain thresholds. This tax is part of the Affordable Care Act and is aimed at high-income earners. The thresholds for individuals are $200,000 for single filers and $250,000 for married couples filing jointly. Understanding this form is crucial for accurately reporting and paying the associated tax.

Steps to Complete Form 8960

Completing Form 8960 involves several steps:

- Determine if you are subject to the NIIT based on your income level.

- Gather necessary financial documents, including investment income statements.

- Calculate your total net investment income, which includes interest, dividends, capital gains, rental income, and other passive income.

- Subtract any allowable deductions related to your investment income.

- Complete the form by entering your total net investment income and modified adjusted gross income.

- Follow the instructions for filing the form with your tax return.

Required Documents for Form 8960

To accurately complete Form 8960, you will need several documents:

- Form 1040 or 1040-SR, which is your individual income tax return.

- Statements of your investment income, including Form 1099 for dividends and interest.

- Records of any capital gains or losses from the sale of investments.

- Documentation of any deductions related to your investment income.

Filing Deadlines for Form 8960

Form 8960 must be filed along with your annual income tax return. The standard deadline for filing your federal tax return is April 15. If you require additional time, you can file for an extension, which typically extends the deadline to October 15. However, any taxes owed must still be paid by the original deadline to avoid penalties and interest.

IRS Guidelines for Form 8960

The IRS provides specific guidelines for completing Form 8960. It is important to follow these instructions carefully to ensure compliance. The guidelines include detailed information on calculating net investment income, determining eligibility for the tax, and understanding how to report the income correctly. The IRS also offers resources and publications that can assist in understanding the nuances of the NIIT.

Digital Submission Methods for Form 8960

Form 8960 can be submitted electronically when you file your federal income tax return using tax software, such as TurboTax. Electronic filing is encouraged as it can expedite processing and reduce errors. Alternatively, you can print the form and submit it by mail. Ensure that you keep copies of your completed forms and any supporting documents for your records.

Quick guide on how to complete what is form 8960 net investment income tax turbotax

Effortlessly Prepare What Is Form 8960 Net Investment Income Tax TurboTax on All Devices

The management of online documents has gained popularity among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary forms and securely save them online. airSlate SignNow provides all the tools required to swiftly create, modify, and electronically sign your documents without any delays. Handle What Is Form 8960 Net Investment Income Tax TurboTax on any device using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

The Simplest Way to Modify and Electronically Sign What Is Form 8960 Net Investment Income Tax TurboTax with Ease

- Find What Is Form 8960 Net Investment Income Tax TurboTax and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Highlight important sections of the documents or redact confidential information with tools specifically provided by airSlate SignNow.

- Create your signature using the Sign tool, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow fulfills your document management needs with just a few clicks from any device you prefer. Modify and electronically sign What Is Form 8960 Net Investment Income Tax TurboTax to guarantee effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct what is form 8960 net investment income tax turbotax

Create this form in 5 minutes!

How to create an eSignature for the what is form 8960 net investment income tax turbotax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What Is Form 8960 Net Investment Income Tax TurboTax?

Form 8960 is used to calculate the Net Investment Income Tax (NIIT) for individuals and estates. This tax applies to investment income above certain thresholds and can affect your overall tax liability. Understanding this form is essential for accurate tax filings, especially when using TurboTax software.

-

How does TurboTax simplify the process of filling Form 8960?

TurboTax simplifies the completion of Form 8960 by providing step-by-step guidance through the tax filing process. It helps users identify applicable income sources and automatically calculates the NIIT. This ensures a stress-free way to comply with tax obligations related to investments.

-

Can airSlate SignNow help with signing documents related to tax filings?

Yes, airSlate SignNow allows users to easily create, send, and eSign documents related to tax filings, including Form 8960. With an intuitive interface, you can ensure that all necessary tax documentation is securely signed and stored. This makes managing tax responsibilities seamless and efficient.

-

What are the benefits of using TurboTax for taxes involving Form 8960?

Using TurboTax for taxes involving Form 8960 offers several benefits, including intuitive interfaces and real-time calculations. Users receive personalized assistance based on their financial situations. This ensures that all aspects of the Net Investment Income Tax are addressed accurately, maximizing refunds or minimizing taxes owed.

-

Are there any additional fees when using TurboTax for Form 8960?

While TurboTax has various pricing tiers, additional fees may apply depending on the complexity of your tax situation. Filing Form 8960 typically requires at least the Plus version for full functionality. Reviewing the pricing plans will help you select the best option for your needs.

-

How can I integrate TurboTax with other financial tools for tax calculations?

TurboTax offers integrations with multiple financial tools that can help streamline tax calculations, including investment software and accounting platforms. This allows for easy importation of relevant financial data. By linking TurboTax with these tools, you can effectively manage and report your Net Investment Income Tax.

-

What features are included in TurboTax that assist with Form 8960?

TurboTax includes features like income categorization, deduction identification, and detailed guidance on filling Form 8960. The software also provides error-checking to minimize mistakes and maximizes tax benefits. These features combine to ensure a thorough understanding of your net investment taxes.

Get more for What Is Form 8960 Net Investment Income Tax TurboTax

Find out other What Is Form 8960 Net Investment Income Tax TurboTax

- eSign Hawaii Police Permission Slip Online

- eSign New Hampshire Sports IOU Safe

- eSign Delaware Courts Operating Agreement Easy

- eSign Georgia Courts Bill Of Lading Online

- eSign Hawaii Courts Contract Mobile

- eSign Hawaii Courts RFP Online

- How To eSign Hawaii Courts RFP

- eSign Hawaii Courts Letter Of Intent Later

- eSign Hawaii Courts IOU Myself

- eSign Hawaii Courts IOU Safe

- Help Me With eSign Hawaii Courts Cease And Desist Letter

- How To eSign Massachusetts Police Letter Of Intent

- eSign Police Document Michigan Secure

- eSign Iowa Courts Emergency Contact Form Online

- eSign Kentucky Courts Quitclaim Deed Easy

- How To eSign Maryland Courts Medical History

- eSign Michigan Courts Lease Agreement Template Online

- eSign Minnesota Courts Cease And Desist Letter Free

- Can I eSign Montana Courts NDA

- eSign Montana Courts LLC Operating Agreement Mobile