Schedule K 1 Form 8865, Partner's Share of Income IUCAT 2022

What is the Schedule K-1 Form 8865, Partner's Share of Income?

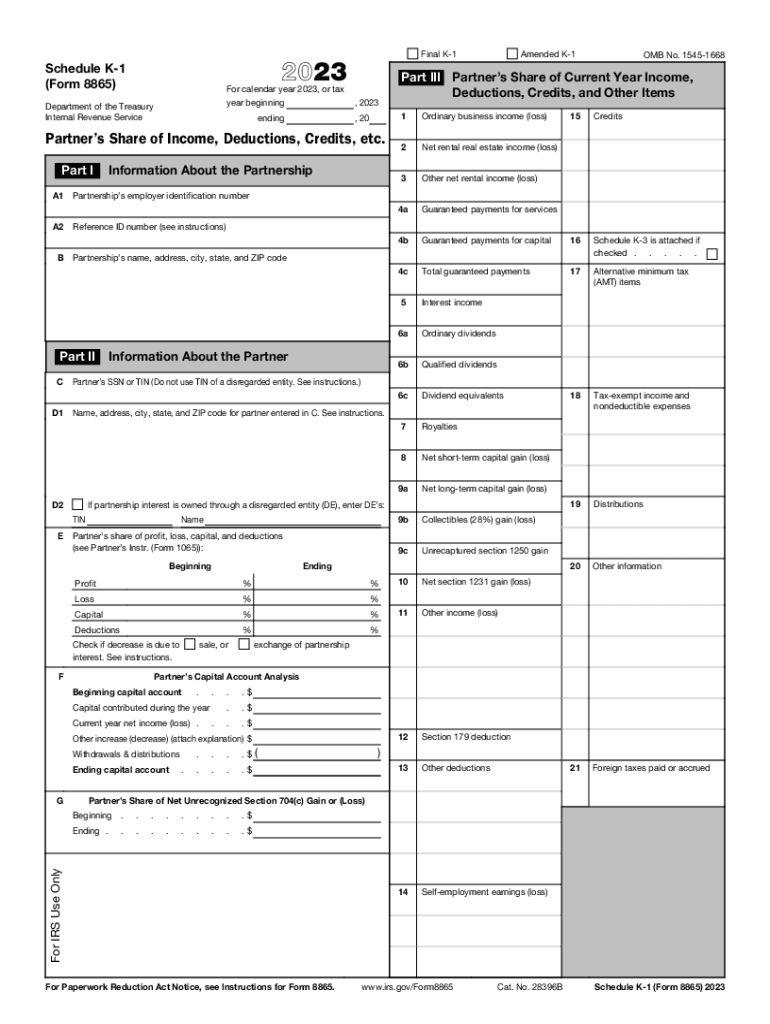

The Schedule K-1 Form 8865 is a tax document used in the United States to report income, deductions, and credits from partnerships. Specifically, it is designed for partners in foreign partnerships, allowing them to report their share of the partnership's income to the IRS. This form is essential for ensuring compliance with U.S. tax laws, particularly for individuals who have invested in or are involved with foreign entities. Understanding this form is crucial for accurate tax reporting and avoiding potential penalties.

How to Use the Schedule K-1 Form 8865

Using the Schedule K-1 Form 8865 involves several steps to ensure that all relevant information is accurately reported. First, partners must receive their K-1 from the partnership, which details their share of income, deductions, and credits. Next, this information needs to be entered into the partner's individual tax return, typically on Form 1040. It is important to keep a copy of the K-1 for personal records, as it may be needed for future reference or audits. Additionally, partners should consult with a tax professional if they have questions about how to report the information correctly.

Steps to Complete the Schedule K-1 Form 8865

Completing the Schedule K-1 Form 8865 requires careful attention to detail. Here are the steps involved:

- Obtain the form from the partnership or download it from the IRS website.

- Fill in the partner's identifying information, including name, address, and taxpayer identification number.

- Enter the partnership's identifying information, including its name and Employer Identification Number (EIN).

- Report the partner's share of income, deductions, and credits as provided by the partnership.

- Review the completed form for accuracy before submission.

Key Elements of the Schedule K-1 Form 8865

The Schedule K-1 Form 8865 contains several key elements that are important for accurate reporting. These include:

- Partner's identifying information: This section captures essential details about the partner.

- Partnership's information: This includes the name and EIN of the partnership.

- Income, deductions, and credits: This section details the partner's share of the partnership's financial results.

- Other information: Additional details may be required based on the partnership’s activities.

Filing Deadlines / Important Dates

Filing deadlines for the Schedule K-1 Form 8865 are crucial for compliance. Generally, partnerships must provide the K-1 to partners by March 15 of the following tax year. Partners are required to include the information from the K-1 on their tax returns, which are typically due on April 15. If additional time is needed, partners can file for an extension, but they must still report any income from the K-1 by the original deadline to avoid penalties.

Who Issues the Form

The Schedule K-1 Form 8865 is issued by partnerships that have foreign partners. It is the responsibility of the partnership to prepare and distribute the K-1 to each partner. This ensures that each partner receives accurate information regarding their share of the partnership’s income, deductions, and credits, which is necessary for their individual tax filings. Partners should ensure they receive this form in a timely manner to meet their own filing obligations.

Quick guide on how to complete schedule k 1 form 8865 partners share of income iucat

Effortlessly Prepare Schedule K 1 Form 8865, Partner's Share Of Income IUCAT on Any Device

Managing documents online has gained popularity among businesses and individuals alike. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to find the correct form and securely store it on the internet. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents promptly without delays. Manage Schedule K 1 Form 8865, Partner's Share Of Income IUCAT on any platform using airSlate SignNow's Android or iOS applications and streamline your document-related tasks today.

How to Edit and Electronically Sign Schedule K 1 Form 8865, Partner's Share Of Income IUCAT with Ease

- Locate Schedule K 1 Form 8865, Partner's Share Of Income IUCAT and select Get Form to begin.

- Take advantage of the tools we provide to complete your document.

- Emphasize pertinent sections of the documents or obscure sensitive information using the tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign feature, which takes just seconds and carries the same legal validity as a conventional handwritten signature.

- Review the details and click the Done button to save your changes.

- Decide how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns over lost or misplaced documents, tedious searching for forms, or mistakes that require printing new document copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device of your choice. Edit and electronically sign Schedule K 1 Form 8865, Partner's Share Of Income IUCAT and ensure outstanding communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct schedule k 1 form 8865 partners share of income iucat

Create this form in 5 minutes!

How to create an eSignature for the schedule k 1 form 8865 partners share of income iucat

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Schedule K 1 Form 8865, Partner's Share Of Income IUCAT?

The Schedule K 1 Form 8865, Partner's Share Of Income IUCAT is used to report a partner's share of income, deductions, and credits from a partnership. This form is essential for partners in multi-member entities to accurately report their taxable income. Using airSlate SignNow, you can easily eSign and manage these documents efficiently.

-

How does airSlate SignNow facilitate filling out the Schedule K 1 Form 8865?

airSlate SignNow provides a user-friendly platform for completing the Schedule K 1 Form 8865, Partner's Share Of Income IUCAT. The software simplifies the process with templates that guide users through filling out the necessary fields and ensures compliance with IRS requirements. This makes tax season less stressful for partners.

-

What features does airSlate SignNow offer for the Schedule K 1 Form 8865?

With airSlate SignNow, you can take advantage of features like secure eSigning, document sharing, and automated workflows specifically tailored for the Schedule K 1 Form 8865, Partner's Share Of Income IUCAT. These features enhance efficiency and ensure your documents are processed swiftly and securely.

-

Is there a cost associated with using airSlate SignNow for the Schedule K 1 Form 8865?

Yes, there is a cost associated with using airSlate SignNow, but it is competitively priced to provide a cost-effective solution for managing the Schedule K 1 Form 8865, Partner's Share Of Income IUCAT. Various pricing plans are available to accommodate different business sizes and needs, allowing you to find the right fit.

-

Can airSlate SignNow integrate with other accounting software for the Schedule K 1 Form 8865?

Absolutely! airSlate SignNow seamlessly integrates with several accounting software options, making it easy to manage the Schedule K 1 Form 8865, Partner's Share Of Income IUCAT alongside your financial data. This ensures a smooth workflow and minimizes the risk of errors during data entry.

-

What benefits does using airSlate SignNow provide for the Schedule K 1 Form 8865?

Using airSlate SignNow for the Schedule K 1 Form 8865, Partner's Share Of Income IUCAT allows you to save time, reduce paperwork, and enhance security. The platform ensures that your documents are signed quickly and stored safely, providing peace of mind during tax preparation and filing.

-

How secure is airSlate SignNow for managing the Schedule K 1 Form 8865?

Security is a top priority for airSlate SignNow. The platform utilizes encryption and complies with industry standards to protect your data when managing the Schedule K 1 Form 8865, Partner's Share Of Income IUCAT. You can confidently eSign and share your documents while ensuring their confidentiality.

Get more for Schedule K 1 Form 8865, Partner's Share Of Income IUCAT

Find out other Schedule K 1 Form 8865, Partner's Share Of Income IUCAT

- Help Me With eSignature Tennessee Banking PDF

- How Can I eSignature Virginia Banking PPT

- How Can I eSignature Virginia Banking PPT

- Can I eSignature Washington Banking Word

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT

- How Can I eSignature Montana Car Dealer Document

- Help Me With eSignature Kentucky Charity Form

- How Do I eSignature Michigan Charity Presentation

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document