November Combined Excise Tax Return November Combined Excise Tax Return 2022

What is the November Combined Excise Tax Return?

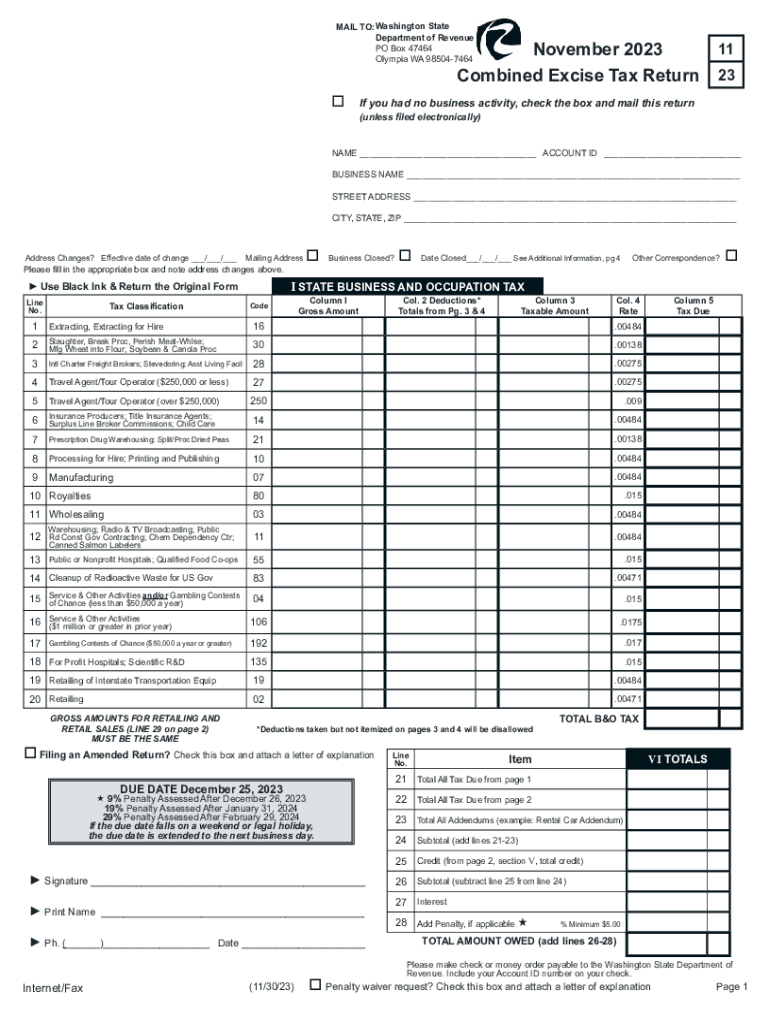

The November Combined Excise Tax Return is a crucial tax document used by businesses in the United States to report and pay various excise taxes. This return consolidates multiple excise taxes into a single filing, simplifying the process for taxpayers. Excise taxes may apply to specific goods, services, or activities, including fuel, tobacco, and certain types of manufacturing. Understanding this form is essential for compliance and accurate tax reporting.

Steps to complete the November Combined Excise Tax Return

Completing the November Combined Excise Tax Return involves several key steps:

- Gather necessary information: Collect all relevant financial data, including sales figures and tax rates for the applicable excise taxes.

- Fill out the form: Carefully enter the required information on the form, ensuring accuracy to avoid penalties.

- Review your entries: Double-check all calculations and entries for errors or omissions.

- Submit the return: File the completed return by the deadline, either electronically or via mail, depending on your preference.

Filing Deadlines / Important Dates

It is essential to be aware of the filing deadlines associated with the November Combined Excise Tax Return. Generally, the return is due on the last day of the month following the reporting period. For November, this means the return must be filed by December 31. Missing this deadline can result in penalties and interest on unpaid taxes.

Key elements of the November Combined Excise Tax Return

The November Combined Excise Tax Return includes several critical elements that must be accurately reported:

- Taxpayer information: This section requires the business name, address, and identification number.

- Excise tax types: Specify the types of excise taxes being reported, such as fuel or environmental taxes.

- Tax calculations: Provide detailed calculations for each type of excise tax, including rates and total amounts owed.

- Signature: The form must be signed by an authorized representative of the business, certifying the accuracy of the information provided.

Legal use of the November Combined Excise Tax Return

The November Combined Excise Tax Return serves a legal purpose by ensuring compliance with federal tax laws. Businesses are required to file this return to report their excise tax liabilities accurately. Failing to submit the return or providing false information can lead to legal repercussions, including fines and audits by tax authorities.

Who Issues the Form

The November Combined Excise Tax Return is issued by the Internal Revenue Service (IRS). The IRS provides guidelines and resources to assist businesses in understanding their obligations regarding excise taxes. It is important for taxpayers to refer to the IRS website or consult with tax professionals for the most current information regarding the form and its requirements.

Quick guide on how to complete november combined excise tax return november combined excise tax return

Manage November Combined Excise Tax Return November Combined Excise Tax Return effortlessly on any device

Online document management has gained popularity among businesses and individuals alike. It offers an ideal eco-friendly substitute to traditional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow provides all the tools you require to create, modify, and electronically sign your documents swiftly and without interruptions. Handle November Combined Excise Tax Return November Combined Excise Tax Return on any device using the airSlate SignNow Android or iOS applications and streamline your document-centric processes today.

How to modify and electronically sign November Combined Excise Tax Return November Combined Excise Tax Return with ease

- Locate November Combined Excise Tax Return November Combined Excise Tax Return and click Get Form to begin.

- Use the tools we provide to complete your form.

- Highlight key sections of the documents or redact sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes seconds and carries the same legal weight as a traditional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you want to send your form, via email, text message (SMS), invite link, or download it to your computer.

Eliminate the worries of lost or mislaid documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and electronically sign November Combined Excise Tax Return November Combined Excise Tax Return and ensure outstanding communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct november combined excise tax return november combined excise tax return

Create this form in 5 minutes!

How to create an eSignature for the november combined excise tax return november combined excise tax return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the November Combined Excise Tax Return?

The November Combined Excise Tax Return is a comprehensive tax form that combines various excise taxes due for the month of November. This return simplifies the filing process for businesses, allowing them to report and remit multiple excise taxes in one submission. Understanding this process is essential for ensuring compliance and avoiding penalties.

-

How does airSlate SignNow help with the November Combined Excise Tax Return?

airSlate SignNow streamlines the preparation and submission of the November Combined Excise Tax Return by providing a user-friendly platform for eSigning and sending required documents. Our solution offers templates and secure integration options that make it easy for businesses to manage their tax documents effectively. This efficiency can save time and reduce the risk of errors.

-

Is airSlate SignNow a cost-effective solution for managing the November Combined Excise Tax Return?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses looking to manage their November Combined Excise Tax Return. Our pricing plans are tailored to fit various business sizes and needs, allowing more organizations to benefit from our eSigning and document management features without breaking the bank.

-

What features does airSlate SignNow offer for the November Combined Excise Tax Return?

airSlate SignNow provides a range of features specifically useful for the November Combined Excise Tax Return, including customizable templates, automated reminders, and secure cloud storage. Our platform ensures that all documents related to the excise tax return process are organized and accessible at all times, simplifying your workflow.

-

Can I integrate airSlate SignNow with other accounting software for the November Combined Excise Tax Return?

Absolutely! airSlate SignNow offers integrations with various popular accounting software, enhancing your ability to manage the November Combined Excise Tax Return. This means you can seamlessly connect your eSigning process with your accounting tools, ensuring all tax documents are synchronized with your financial records.

-

What are the benefits of using airSlate SignNow for the November Combined Excise Tax Return?

Using airSlate SignNow for the November Combined Excise Tax Return provides multiple benefits, including enhanced compliance, reduced processing time, and improved organization of important tax documents. Our solution helps businesses avoid costly mistakes and ensures that all submissions are completed accurately and on time.

-

How secure is airSlate SignNow for handling the November Combined Excise Tax Return?

Security is a top priority for airSlate SignNow. We employ advanced encryption and secure authentication processes to protect your sensitive information related to the November Combined Excise Tax Return. Our solution complies with industry standards to give you peace of mind while managing your tax documents.

Get more for November Combined Excise Tax Return November Combined Excise Tax Return

- Privilege form

- Affidavit for colleciton of personal property in arizona form

- Information necessary to complete this petition is contained on the notice of valuation

- Navajo nation forms

- California resale certificate sales form

- California sales tax exemption certificate form

- Ftb 3561 bklt sp fillable c2 rev 11 2014 folleto plan de pagos a plazo ftb ca form

- Ftb 2924 form

Find out other November Combined Excise Tax Return November Combined Excise Tax Return

- Sign Michigan Charity Rental Application Later

- How To Sign Minnesota Charity Purchase Order Template

- Sign Mississippi Charity Affidavit Of Heirship Now

- Can I Sign Nevada Charity Bill Of Lading

- How Do I Sign Nebraska Charity Limited Power Of Attorney

- Sign New Hampshire Charity Residential Lease Agreement Online

- Sign New Jersey Charity Promissory Note Template Secure

- How Do I Sign North Carolina Charity Lease Agreement Form

- How To Sign Oregon Charity Living Will

- Sign South Dakota Charity Residential Lease Agreement Simple

- Sign Vermont Charity Business Plan Template Later

- Sign Arkansas Construction Executive Summary Template Secure

- How To Sign Arkansas Construction Work Order

- Sign Colorado Construction Rental Lease Agreement Mobile

- Sign Maine Construction Business Letter Template Secure

- Can I Sign Louisiana Construction Letter Of Intent

- How Can I Sign Maryland Construction Business Plan Template

- Can I Sign Maryland Construction Quitclaim Deed

- Sign Minnesota Construction Business Plan Template Mobile

- Sign Construction PPT Mississippi Myself