Buyer's Retail Sales Tax Exemption Certificate Form 2021-2026

Understanding the Buyer's Retail Sales Tax Exemption Certificate Form

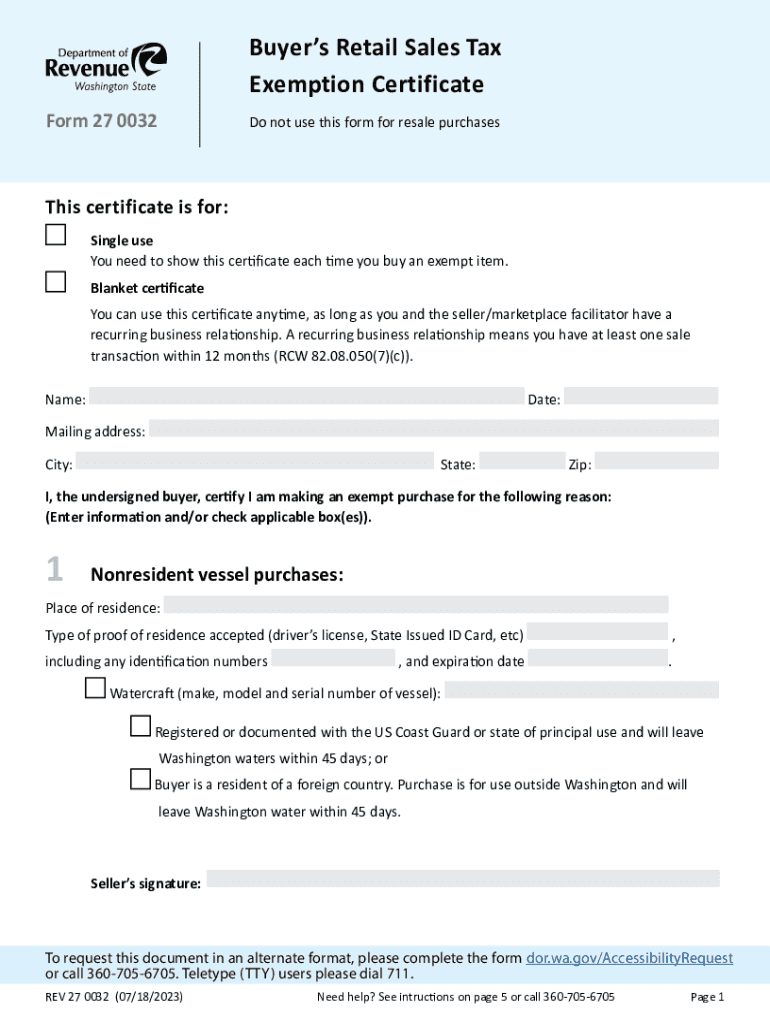

The Buyer's Retail Sales Tax Exemption Certificate Form is a crucial document used in Washington State for businesses and individuals seeking to make tax-exempt purchases. This form allows eligible buyers to purchase goods without paying sales tax, provided the items are intended for resale or other exempt purposes. Understanding the specific uses and requirements of this form is essential for compliance and effective tax management.

How to Use the Buyer's Retail Sales Tax Exemption Certificate Form

To use the Buyer's Retail Sales Tax Exemption Certificate Form, a buyer must present it to the seller at the time of purchase. The seller retains this certificate for their records to validate the tax-exempt status of the transaction. It is important for buyers to ensure that the form is filled out accurately, including the buyer's name, address, and the reason for the exemption. This helps prevent any potential misunderstandings or disputes regarding tax obligations.

Steps to Complete the Buyer's Retail Sales Tax Exemption Certificate Form

Completing the Buyer's Retail Sales Tax Exemption Certificate Form involves several key steps:

- Provide your legal business name and address.

- Indicate the type of exemption you are claiming, such as resale or other specific exemptions.

- Include your Washington State Unified Business Identifier (UBI) number if applicable.

- Sign and date the form to certify the accuracy of the information provided.

Ensuring that all information is accurate and complete is essential to avoid issues during audits or tax assessments.

Eligibility Criteria for the Buyer's Retail Sales Tax Exemption Certificate Form

Eligibility for using the Buyer's Retail Sales Tax Exemption Certificate Form generally includes businesses that are registered to collect sales tax in Washington State. Additionally, individuals or organizations making purchases for resale, or those qualifying under specific exemptions, such as non-profit organizations, may also be eligible. It is important to review the specific criteria outlined by the Washington Department of Revenue to ensure compliance.

Legal Use of the Buyer's Retail Sales Tax Exemption Certificate Form

The legal use of the Buyer's Retail Sales Tax Exemption Certificate Form is governed by Washington State tax laws. Buyers must ensure that they are using the form for legitimate tax-exempt purposes. Misuse of the form, such as claiming exemptions for personal use or without proper justification, can lead to penalties and interest on unpaid taxes. Sellers are also responsible for verifying the validity of the exemption claimed to protect themselves from potential tax liabilities.

Who Issues the Buyer's Retail Sales Tax Exemption Certificate Form

The Washington State Department of Revenue is the authority that issues and regulates the Buyer's Retail Sales Tax Exemption Certificate Form. This agency provides guidelines on how to properly complete and use the form, as well as updates on any changes to tax laws or exemption criteria. Buyers and sellers should refer to the Department of Revenue for the most current information and resources related to tax exemptions.

Quick guide on how to complete buyers retail sales tax exemption certificate form

Complete Buyer's Retail Sales Tax Exemption Certificate Form effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers a perfect environmentally friendly substitute for traditional printed and signed papers, as you can easily locate the right form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, modify, and electronically sign your documents swiftly without delays. Manage Buyer's Retail Sales Tax Exemption Certificate Form on any device with airSlate SignNow’s Android or iOS applications and simplify any document-related process today.

How to edit and electronically sign Buyer's Retail Sales Tax Exemption Certificate Form with ease

- Obtain Buyer's Retail Sales Tax Exemption Certificate Form and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive details with tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal standing as a traditional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from your chosen device. Edit and electronically sign Buyer's Retail Sales Tax Exemption Certificate Form and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct buyers retail sales tax exemption certificate form

Create this form in 5 minutes!

How to create an eSignature for the buyers retail sales tax exemption certificate form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Washington tax exemption form?

The Washington tax exemption form is a document used by businesses to claim exemptions from certain taxes within the state. By submitting this form, eligible entities can reduce their tax burden and ensure compliance with Washington state tax regulations. It's crucial for businesses to understand their eligibility to maximize tax savings.

-

How can airSlate SignNow help with the Washington tax exemption form?

airSlate SignNow simplifies the process of completing and submitting the Washington tax exemption form by allowing users to eSign and send documents securely. Our platform provides an intuitive interface that makes managing tax exemption forms quick and efficient. You can easily store and retrieve your completed documents when needed.

-

Is there a cost associated with using airSlate SignNow for the Washington tax exemption form?

Yes, airSlate SignNow offers various pricing plans that are cost-effective for businesses of all sizes. Depending on your needs, you can choose a plan that allows you to eSign the Washington tax exemption form and manage other documents efficiently. Investing in our service helps streamline your paperwork and save time.

-

What features does airSlate SignNow offer for managing the Washington tax exemption form?

airSlate SignNow provides features such as customizable templates, advanced signing options, and cloud storage to streamline the management of your Washington tax exemption form. Our user-friendly platform allows you to track document status and collaborate with others, ensuring a smooth workflow. Take advantage of these features to enhance your document management process.

-

Can I integrate airSlate SignNow with other software for the Washington tax exemption form?

Absolutely! airSlate SignNow offers integrations with various software applications, making it easier to manage your Washington tax exemption form alongside your existing systems. You can streamline your workflow by connecting our platform with tools you already use, improving efficiency and data accuracy.

-

What are the benefits of using airSlate SignNow for the Washington tax exemption form?

Using airSlate SignNow for the Washington tax exemption form provides benefits such as enhanced security, increased turnaround times, and reduced paperwork. Our platform allows you to eSign documents from anywhere, ensuring flexibility and ease of access. Plus, with automated reminders, you can stay on top of your filing deadlines.

-

How does airSlate SignNow ensure the security of my Washington tax exemption form?

airSlate SignNow prioritizes security by employing advanced encryption protocols and secure cloud storage for your Washington tax exemption form. Our platform complies with regulatory standards to protect your sensitive information during transmission and storage. You can confidently manage your documents knowing they are safeguarded against unauthorized access.

Get more for Buyer's Retail Sales Tax Exemption Certificate Form

Find out other Buyer's Retail Sales Tax Exemption Certificate Form

- How Can I Electronic signature Texas Electronic Contract

- How Do I Electronic signature Michigan General contract template

- Electronic signature Maine Email Contracts Later

- Electronic signature New Mexico General contract template Free

- Can I Electronic signature Rhode Island Email Contracts

- How Do I Electronic signature California Personal loan contract template

- Electronic signature Hawaii Personal loan contract template Free

- How To Electronic signature Hawaii Personal loan contract template

- Electronic signature New Hampshire Managed services contract template Computer

- Electronic signature Alabama Real estate sales contract template Easy

- Electronic signature Georgia Real estate purchase contract template Secure

- Electronic signature South Carolina Real estate sales contract template Mobile

- Can I Electronic signature Kentucky Residential lease contract

- Can I Electronic signature Nebraska Residential lease contract

- Electronic signature Utah New hire forms Now

- Electronic signature Texas Tenant contract Now

- How Do I Electronic signature Florida Home rental application

- Electronic signature Illinois Rental application Myself

- How Can I Electronic signature Georgia Rental lease form

- Electronic signature New York Rental lease form Safe