Annual 1042 S 2022

What is the Annual 1042 S

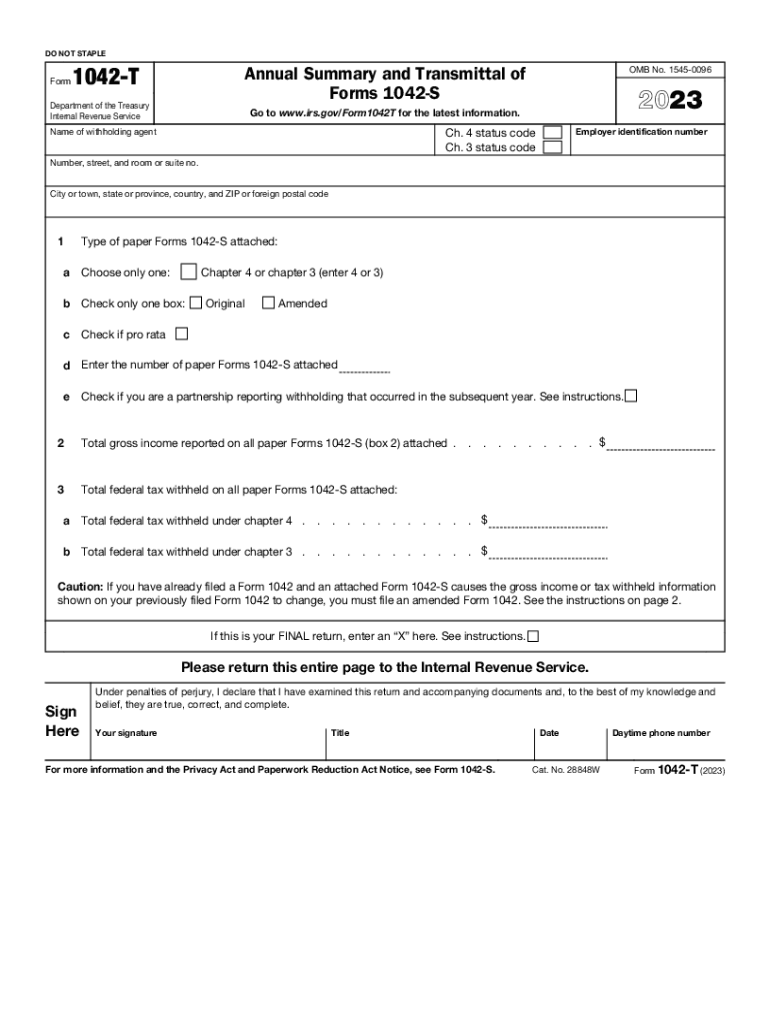

The Annual 1042 S is a tax form used by withholding agents to report amounts paid to foreign persons, including non-resident aliens and foreign entities. This form is essential for reporting income subject to withholding under U.S. tax law. It provides details about the income paid, the amount withheld, and the recipient's information. The Annual 1042 S is crucial for ensuring compliance with the Internal Revenue Service (IRS) regulations regarding foreign payments.

Key elements of the Annual 1042 S

Understanding the key elements of the Annual 1042 S is vital for accurate reporting. This form includes the following critical components:

- Recipient's Information: Name, address, and taxpayer identification number (TIN) of the foreign recipient.

- Income Types: Various types of income, such as dividends, interest, and royalties, must be specified.

- Withholding Amount: The total amount withheld from the payment made to the foreign recipient.

- Withholding Agent Details: Information about the entity responsible for withholding the taxes.

Steps to complete the Annual 1042 S

Completing the Annual 1042 S involves several important steps to ensure accuracy and compliance:

- Gather Information: Collect all necessary information about the foreign recipients and the payments made.

- Fill Out the Form: Complete the form by entering the required details, including income types and withholding amounts.

- Review for Accuracy: Double-check all entries to ensure that the information is correct and complete.

- Submit the Form: File the Annual 1042 S with the IRS by the specified deadline.

Filing Deadlines / Important Dates

Timely filing of the Annual 1042 S is crucial to avoid penalties. The IRS typically sets specific deadlines for submission. Generally, the form must be filed by March 15 of the year following the calendar year in which the payments were made. If the due date falls on a weekend or holiday, the deadline is extended to the next business day. It is essential to keep track of these dates to ensure compliance.

Required Documents

To accurately complete the Annual 1042 S, certain documents are necessary. These may include:

- Payment Records: Documentation of all payments made to foreign recipients.

- Withholding Certificates: Any relevant IRS forms that establish the withholding rate.

- Recipient Information: Identification details of the foreign persons receiving payments.

Penalties for Non-Compliance

Failure to file the Annual 1042 S accurately or on time can result in significant penalties. The IRS imposes fines for late filings, incorrect information, or failure to withhold the appropriate taxes. These penalties can accumulate quickly, making it essential for withholding agents to understand their obligations and ensure compliance with IRS regulations.

Quick guide on how to complete annual 1042 s

Complete Annual 1042 S easily on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Annual 1042 S across any platform with the airSlate SignNow Android or iOS applications and enhance any document-driven process today.

The simplest way to alter and eSign Annual 1042 S effortlessly

- Obtain Annual 1042 S and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Mark signNow portions of the documents or obscure sensitive data with tools specifically offered by airSlate SignNow for that purpose.

- Create your electronic signature using the Sign feature, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you wish to share your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow manages all your document management needs in just a few clicks from your preferred device. Edit and eSign Annual 1042 S and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct annual 1042 s

Create this form in 5 minutes!

How to create an eSignature for the annual 1042 s

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the form 1042 t instructions?

The form 1042 t instructions detail how to generate and file Form 1042-S, which is used to report income subject to withholding for non-resident aliens. Understanding these instructions is crucial for compliance with tax laws. It's important to follow the guidance closely to avoid any penalties or errors.

-

How can airSlate SignNow assist with form 1042 t instructions?

AirSlate SignNow offers tools that simplify the process of preparing and signing Form 1042-S, following the form 1042 t instructions. Our platform ensures that you can easily collect electronic signatures and streamline document management. This makes adhering to tax regulations easier for businesses.

-

Are there any costs associated with using airSlate SignNow for form 1042 t instructions?

Yes, airSlate SignNow offers various pricing plans to suit different business needs, providing value while helping you follow the form 1042 t instructions. We offer a free trial, allowing you to explore our features before committing to a plan. This way, you can ensure it meets your document signing needs effectively.

-

What features does airSlate SignNow provide for managing form 1042 t instructions?

AirSlate SignNow provides features like templates, integration options, and automated reminders to help you follow form 1042 t instructions efficiently. Our user-friendly interface helps streamline document workflow, enabling quick turnaround on signatures and document submissions. This enhances productivity in managing tax-related forms.

-

Can I integrate airSlate SignNow with my existing software for form 1042 t instructions?

Absolutely! AirSlate SignNow easily integrates with many popular software applications. This allows you to automate processes related to form 1042 t instructions without disrupting your existing workflows, ensuring a seamless experience across your business operations.

-

What are the benefits of using airSlate SignNow for form 1042 t instructions?

Utilizing airSlate SignNow for your form 1042 t instructions simplifies the document signing process and enhances compliance. The platform is cost-effective, user-friendly, and enables you to keep track of your submissions effectively. This not only saves time but also reduces the stress associated with tax forms.

-

Is airSlate SignNow secure for handling form 1042 t instructions?

Yes, security is a top priority at airSlate SignNow. We implement advanced encryption standards to ensure that your documents and any related form 1042 t instructions are protected. You can trust that your sensitive information is handled securely while using our platform.

Get more for Annual 1042 S

- Rf 9 decedent refund claim rev 9 19 form

- K 40svr property tax relief claim for seniors and disabled form

- Kansas department of revenueagricultural exemptio form

- Tourist tax return form brevard tax collector

- Optod lettersandscience netreportpolktaxespolktaxes com home polk county tax collector form

- Tax return drop off sheet mark cross tax services form

- Uftnj comindexincome and expense forms click here assessor upper

- Ct ifta 2 application for international fuel tax form

Find out other Annual 1042 S

- How To Electronic signature Massachusetts Finance & Tax Accounting Quitclaim Deed

- Electronic signature Michigan Finance & Tax Accounting RFP Now

- Electronic signature Oklahoma Government RFP Later

- Electronic signature Nebraska Finance & Tax Accounting Business Plan Template Online

- Electronic signature Utah Government Resignation Letter Online

- Electronic signature Nebraska Finance & Tax Accounting Promissory Note Template Online

- Electronic signature Utah Government Quitclaim Deed Online

- Electronic signature Utah Government POA Online

- How To Electronic signature New Jersey Education Permission Slip

- Can I Electronic signature New York Education Medical History

- Electronic signature Oklahoma Finance & Tax Accounting Quitclaim Deed Later

- How To Electronic signature Oklahoma Finance & Tax Accounting Operating Agreement

- Electronic signature Arizona Healthcare / Medical NDA Mobile

- How To Electronic signature Arizona Healthcare / Medical Warranty Deed

- Electronic signature Oregon Finance & Tax Accounting Lease Agreement Online

- Electronic signature Delaware Healthcare / Medical Limited Power Of Attorney Free

- Electronic signature Finance & Tax Accounting Word South Carolina Later

- How Do I Electronic signature Illinois Healthcare / Medical Purchase Order Template

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Online

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Computer