Form 760ES, Estimated Income Tax Payment Vouchers for 2025-2026

What is the Form 760ES?

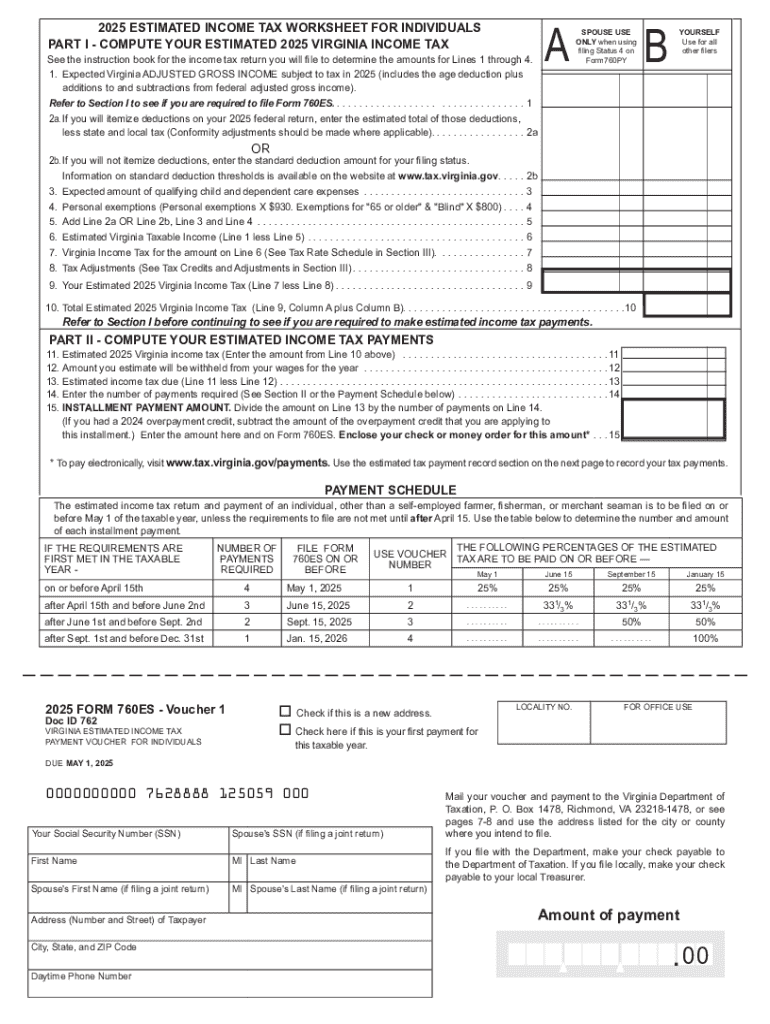

The Form 760ES is an essential document used by Virginia taxpayers to make estimated income tax payments. This form is particularly important for individuals who are self-employed, have significant income not subject to withholding, or expect to owe more than a specific amount in state taxes. By submitting this form, taxpayers can ensure they meet their tax obligations throughout the year, avoiding penalties for underpayment.

How to Use the Form 760ES

To use the Form 760ES effectively, taxpayers need to calculate their estimated tax liability for the year. This involves estimating total income, deductions, and credits. Once the estimated tax is determined, individuals should divide this amount into four equal payments, which are then submitted using the 760ES vouchers. Each voucher corresponds to a specific payment due date, helping taxpayers manage their finances and stay compliant with Virginia tax laws.

Steps to Complete the Form 760ES

Completing the Form 760ES involves several key steps:

- Gather necessary financial documents, including income statements and previous tax returns.

- Calculate your estimated annual income and applicable deductions.

- Determine your estimated tax liability based on Virginia tax rates.

- Divide the total estimated tax by four to find the amount for each quarterly payment.

- Fill out the Form 760ES, ensuring all information is accurate.

- Submit the completed form along with the payment by the due dates specified on the form.

Key Elements of the Form 760ES

The Form 760ES includes several critical components that taxpayers must complete:

- Taxpayer Information: Name, address, and Social Security number.

- Estimated Income: Total expected income for the year.

- Deductions and Credits: Any deductions or credits that may apply.

- Payment Amount: The calculated estimated tax payment for each quarter.

Filing Deadlines for the Form 760ES

Timely submission of the Form 760ES is crucial to avoid penalties. The payment due dates for the 2025 tax year are typically as follows:

- First payment: April 15, 2025

- Second payment: June 15, 2025

- Third payment: September 15, 2025

- Fourth payment: January 15, 2026

How to Obtain the Form 760ES

Taxpayers can obtain the Form 760ES through various means. It is available for download from the Virginia Department of Taxation's website. Additionally, physical copies may be requested by contacting the department directly. Many tax preparation software programs also include the form, allowing users to complete it digitally.

Handy tips for filling out Form 760ES, Estimated Income Tax Payment Vouchers For online

Quick steps to complete and e-sign Form 760ES, Estimated Income Tax Payment Vouchers For online:

- Use Get Form or simply click on the template preview to open it in the editor.

- Start completing the fillable fields and carefully type in required information.

- Use the Cross or Check marks in the top toolbar to select your answers in the list boxes.

- Utilize the Circle icon for other Yes/No questions.

- Look through the document several times and make sure that all fields are completed with the correct information.

- Insert the current Date with the corresponding icon.

- Add a legally-binding e-signature. Go to Sign -> Add New Signature and select the option you prefer: type, draw, or upload an image of your handwritten signature and place it where you need it.

- Finish filling out the form with the Done button.

- Download your copy, save it to the cloud, print it, or share it right from the editor.

- Check the Help section and contact our Support team if you run into any troubles when using the editor.

We understand how straining completing forms can be. Obtain access to a HIPAA and GDPR compliant service for optimum straightforwardness. Use signNow to electronically sign and send Form 760ES, Estimated Income Tax Payment Vouchers For for e-signing.

Create this form in 5 minutes or less

Find and fill out the correct form 760es estimated income tax payment vouchers for

Create this form in 5 minutes!

How to create an eSignature for the form 760es estimated income tax payment vouchers for

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2025 form 760es and why is it important?

The 2025 form 760es is a crucial document for Virginia taxpayers, used for making estimated tax payments. Understanding this form helps ensure compliance with state tax regulations and avoids penalties. Using airSlate SignNow, you can easily eSign and send your 2025 form 760es securely.

-

How can airSlate SignNow help with the 2025 form 760es?

airSlate SignNow streamlines the process of completing and submitting the 2025 form 760es. Our platform allows you to fill out the form electronically, eSign it, and send it directly to the appropriate tax authorities. This saves time and reduces the risk of errors.

-

What are the pricing options for using airSlate SignNow for the 2025 form 760es?

airSlate SignNow offers flexible pricing plans to accommodate various business needs. Whether you are a small business or a large enterprise, you can choose a plan that fits your budget while ensuring you can efficiently manage documents like the 2025 form 760es. Check our website for detailed pricing information.

-

Is airSlate SignNow secure for handling the 2025 form 760es?

Yes, airSlate SignNow prioritizes security and compliance, ensuring that your 2025 form 760es and other sensitive documents are protected. We use advanced encryption and secure storage solutions to keep your information safe. You can trust us to handle your documents with the utmost care.

-

Can I integrate airSlate SignNow with other software for the 2025 form 760es?

Absolutely! airSlate SignNow offers seamless integrations with various software applications, making it easy to manage your 2025 form 760es alongside your other business tools. This integration capability enhances workflow efficiency and ensures that all your documents are in one place.

-

What features does airSlate SignNow offer for managing the 2025 form 760es?

airSlate SignNow provides a range of features designed to simplify the management of the 2025 form 760es. These include customizable templates, automated reminders, and real-time tracking of document status. These features help ensure that your tax documents are completed and submitted on time.

-

How does eSigning the 2025 form 760es work with airSlate SignNow?

eSigning the 2025 form 760es with airSlate SignNow is straightforward. After filling out the form, you can invite signers to eSign electronically, which is legally binding and secure. This process eliminates the need for printing and scanning, making it more efficient.

Get more for Form 760ES, Estimated Income Tax Payment Vouchers For

- The blood red night form

- Schonell spelling test b form

- Pediatric nursing competency checklist 347414062 form

- Physical exam form printable

- Minnesota surety bond dvs form

- Fillable online azdor arizona form request for innocent

- News ampamp multimedia form

- You may qualify to file your federal and arizona form

Find out other Form 760ES, Estimated Income Tax Payment Vouchers For

- eSign Wisconsin High Tech Cease And Desist Letter Fast

- eSign New York Government Emergency Contact Form Online

- eSign North Carolina Government Notice To Quit Now

- eSign Oregon Government Business Plan Template Easy

- How Do I eSign Oklahoma Government Separation Agreement

- How Do I eSign Tennessee Healthcare / Medical Living Will

- eSign West Virginia Healthcare / Medical Forbearance Agreement Online

- eSign Alabama Insurance LLC Operating Agreement Easy

- How Can I eSign Alabama Insurance LLC Operating Agreement

- eSign Virginia Government POA Simple

- eSign Hawaii Lawers Rental Application Fast

- eSign Hawaii Lawers Cease And Desist Letter Later

- How To eSign Hawaii Lawers Cease And Desist Letter

- How Can I eSign Hawaii Lawers Cease And Desist Letter

- eSign Hawaii Lawers Cease And Desist Letter Free

- eSign Maine Lawers Resignation Letter Easy

- eSign Louisiana Lawers Last Will And Testament Mobile

- eSign Louisiana Lawers Limited Power Of Attorney Online

- eSign Delaware Insurance Work Order Later

- eSign Delaware Insurance Credit Memo Mobile