Form 541 K 1 2016

What is the Form 541 K-1

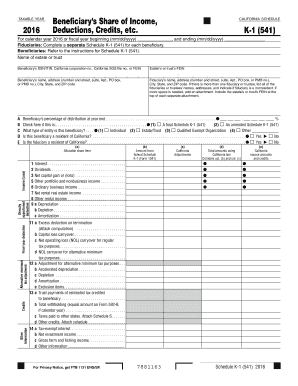

The Form 541 K-1 is a tax document used in the United States for reporting income, deductions, and credits from partnerships, S corporations, estates, and trusts. It serves as a detailed statement provided to each partner or shareholder, outlining their share of the entity's income, losses, and other tax-related information. This form is essential for individuals who are part of such entities, as it allows them to accurately report their earnings on their personal tax returns.

How to use the Form 541 K-1

To use the Form 541 K-1 effectively, recipients must first receive the completed form from the partnership, S corporation, estate, or trust. Once in possession of the form, individuals should review the information provided, including their share of income, deductions, and credits. This information is then transferred to the individual's personal tax return, typically on Form 1040. It is important to ensure that all details are accurate and correspond with the entity's tax filings to avoid discrepancies.

Steps to complete the Form 541 K-1

Completing the Form 541 K-1 involves several key steps:

- Gather necessary information about the partnership, S corporation, estate, or trust.

- Fill in the entity's name, address, and Employer Identification Number (EIN).

- Provide details about the partner or shareholder, including their name, address, and tax identification number.

- Report the partner's or shareholder's share of income, deductions, and credits in the appropriate sections.

- Review the completed form for accuracy before submitting it to the relevant tax authorities.

Legal use of the Form 541 K-1

The Form 541 K-1 is legally recognized by the Internal Revenue Service (IRS) as a valid document for reporting income from partnerships and other entities. It is crucial for all partners or shareholders to receive this form to ensure compliance with tax regulations. Accurate completion and timely submission of the Form 541 K-1 help avoid potential legal issues and penalties associated with underreporting income or misreporting deductions.

Filing Deadlines / Important Dates

Filing deadlines for the Form 541 K-1 typically align with the tax return deadlines for the entity issuing the form. For partnerships and S corporations, the deadline is generally March 15 for calendar year filers. However, if an extension is filed, this deadline may be extended to September 15. It is important for recipients of the Form 541 K-1 to be aware of these dates to ensure they report their income accurately and on time.

Form Submission Methods (Online / Mail / In-Person)

The Form 541 K-1 can be submitted through various methods, depending on the recipient's preference and the requirements of the IRS. Individuals can file their tax returns online using tax preparation software, which often includes options for entering K-1 information. Alternatively, the form can be mailed directly to the IRS along with the individual's tax return. In-person submissions are generally not applicable for K-1 forms, as they are typically filed as part of the overall tax return process.

Quick guide on how to complete form 541 k 1 2016

Your assistance manual on how to prepare your Form 541 K 1

If you’re looking to discover how to complete and submit your Form 541 K 1, below are a few concise guidelines on how to simplify the tax submission process.

To begin, you simply need to set up your airSlate SignNow account to revolutionize the way you manage documents online. airSlate SignNow is an exceptionally user-friendly and robust document solution that enables you to modify, create, and finalize your tax documents effortlessly. With its editor, you can toggle between text, checkboxes, and eSignatures, and revisit to modify responses as needed. Enhance your tax handling with advanced PDF editing, eSigning, and easy sharing.

Follow the instructions below to complete your Form 541 K 1 in just a few minutes:

- Create an account and start working on PDFs in no time.

- Utilize our directory to locate any IRS tax form; browse through versions and schedules.

- Select Get form to open your Form 541 K 1 in our editor.

- Complete the necessary fillable fields with your information (text, numbers, checkmarks).

- Employ the Sign Tool to add your legally-binding eSignature (if necessary).

- Examine your document and correct any errors.

- Save changes, print your copy, send it to your recipient, and download it to your device.

Use this manual to file your taxes electronically with airSlate SignNow. Keep in mind that submitting on paper can lead to return errors and delay refunds. Certainly, before e-filing your taxes, check the IRS website for submission guidelines in your state.

Create this form in 5 minutes or less

Find and fill out the correct form 541 k 1 2016

FAQs

-

How do I fill out 2016 ITR form?

First of all you must know about all of your sources of income. In Indian Income Tax Act there are multiple forms for different types of sources of Income. If you have only salary & other source of income you can fill ITR-1 by registering your PAN on e-Filing Home Page, Income Tax Department, Government of India after registration you have to login & select option fill ITR online in this case you have to select ITR-1 for salary, house property & other source income.if you have income from business & profession and not maintaining books & also not mandatory to prepare books & total turnover in business less than 1 Crores & want to show profit more than 8% & if you are a professional and not required to make books want to show profit more than 50% of receipts than you can use online quick e-filling form ITR-4S i.s. for presumptive business income.for other source of income there are several forms according to source of income download Excel utility or JAVA utility form e-Filing Home Page, Income Tax Department, Government of India fill & upload after login to your account.Prerequisite before E-filling.Last year return copy (if available)Bank Account number with IFSC Code.Form 16/16A (if Available)Saving Details / Deduction Slips LIC,PPF, etc.Interest Statement from Banks or OthersProfit & Loss Account, Balance Sheet, Tax Audit Report only if filling ITR-4, ITR-5, ITR-6, ITR-7.hope this will help you in case any query please let me know.

-

How do you know if you need to fill out a 1099 form?

Assuming that you are talking about 1099-MISC. Note that there are other 1099s.check this post - Form 1099 MISC Rules & RegulationsQuick answer - A Form 1099 MISC must be filed for each person to whom payment is made of:$600 or more for services performed for a trade or business by people not treated as employees;Rent or prizes and awards that are not for service ($600 or more) and royalties ($10 or more);any fishing boat proceeds,gross proceeds of $600, or more paid to an attorney during the year, orWithheld any federal income tax under the backup withholding rules regardless of the amount of the payment, etc.

-

How can I fill out the FY 2015-16 and 2016-17 ITR forms after the 31st of March 2018?

As you know the last date of filling income tax retruns has been gone for the financial year 2015–16 and 2016–17. and if you haven’t done it before 31–03–2018. then i don’t think it is possible according to the current guidlines of IT Department. it may possible that they can send you the notice to answer for not filling the retrun and they may charge penalty alsoif your income was less than taxable limit then its ok it is a valid reson but you don’t need file ITR for those years but if your income was more than the limit then, i think you have to write the lette to your assessing officer with a genuine reason that why didn’t you file the ITR.This was only suggestion not adviceyou can also go through the professional chartered accountant

-

How do we know the eligibility to fill out Form 12 BB?

Every year as a salaried employee many of you must have fill Form 12BB, but did you ever bothered to know its purpose. Don’t know ??It is indispensable for both, you and your employer. With the help of Form 12BB, you will be able to figure out how much income tax is to be deducted from your monthly pay. Further, with the help of Form 12BB, you will be in relief at the time of filing returns as at that time you will not have to pay anything due to correct TDS deduction.So, before filing such important form keep the below listed things in your mind so that you may live a tax hassle free life.For More Information:- 7 key points which must be known before filling Form 12BB

-

How many people fill out Form 1099 each year?

There are a few different ways of estimating the numbers and thinking about this question. Data from the most recent years are not available—at least not from a reliable source with rigorous methodology—but here is what I can tell you:The most popular type of 1099 is Form 1099-MISC—the form used to report non-employee income including those for self-employed independent contractors (as well as various other types of “miscellaneous” income)Since 2015, there have been just under 16 million self-employed workers (including incorporated and unincorporated contractor businesses). And the data from the BLS seems to suggest this number has been largely consistent from one year to the next: Table A-9. Selected employment indicatorsNow, the total number of 1099-MISC forms has been inching up each year—along with W-2 form filings—and may have surpassed 100 million filing forms. RE: Evaluating the Growth of the 1099 Workforce But this data only goes to 2014 because, again, it’s hard to find reliable data from recent tax years.In terms of the total number of Form 1099s, you’d have to include Interest and Dividend 1099 forms, real estate and rental income, health and education savings accounts, retirement accounts, etc. I’m sure the total number of all 1099 forms surely ranges in the hundreds of millions.Finally, not everybody who is supposed to get a 1099 form gets one. So if you’re asking about the total number of freelancers, the estimates range from about 7.6 million people who primarily rely on self-employed 1099 income and 53 million people who have some type of supplemental income.If you’re someone who’s responsible for filing Form 1099s to the IRS and payee/recipients, I recommend Advanced Micro Solutions for most small-to-medium accounting service needs. It’s basic but very intuitive and cheap.$79 1099 Software Filer & W2 Software for Small Businesses

Create this form in 5 minutes!

How to create an eSignature for the form 541 k 1 2016

How to make an eSignature for your Form 541 K 1 2016 online

How to generate an eSignature for your Form 541 K 1 2016 in Google Chrome

How to make an electronic signature for signing the Form 541 K 1 2016 in Gmail

How to create an electronic signature for the Form 541 K 1 2016 straight from your smart phone

How to generate an electronic signature for the Form 541 K 1 2016 on iOS

How to generate an eSignature for the Form 541 K 1 2016 on Android OS

People also ask

-

What is Form 541 K 1 and why is it important?

Form 541 K 1 is a tax document used to report income received by partners in partnerships or beneficiaries of certain trusts. Understanding Form 541 K 1 is crucial for accurate tax reporting and compliance. With airSlate SignNow, you can easily manage and eSign Form 541 K 1, ensuring that you stay organized and compliant with tax regulations.

-

How does airSlate SignNow simplify the process of signing Form 541 K 1?

airSlate SignNow streamlines the signing process for Form 541 K 1 by allowing users to send and receive documents electronically. With just a few clicks, you can eSign Form 541 K 1 from any device, saving time and reducing paperwork. This efficiency helps businesses focus on what matters most, instead of getting bogged down by manual processes.

-

What features does airSlate SignNow offer for handling Form 541 K 1?

airSlate SignNow offers features such as customizable templates, real-time tracking, and secure cloud storage specifically for documents like Form 541 K 1. These features enhance collaboration and ensure that all parties have access to the latest version of the form. Additionally, airSlate SignNow provides an intuitive interface that simplifies document management, making it easier to handle Form 541 K 1.

-

Is airSlate SignNow cost-effective for businesses needing to send Form 541 K 1?

Yes, airSlate SignNow is a cost-effective solution for businesses needing to send Form 541 K 1. Our competitive pricing plans are designed to accommodate businesses of all sizes, ensuring that you can manage your document signing needs without breaking the bank. By using airSlate SignNow, you can save money on printing and mailing costs associated with traditional document handling.

-

Can I integrate airSlate SignNow with other software for Form 541 K 1 management?

Absolutely! airSlate SignNow offers seamless integration with popular business applications, making it easy to manage Form 541 K 1 alongside your existing workflows. Whether you use accounting software or customer relationship management tools, our platform allows for smooth data transfer and enhances overall productivity.

-

How secure is airSlate SignNow when handling sensitive documents like Form 541 K 1?

Security is a top priority at airSlate SignNow. We utilize industry-leading encryption protocols to protect your sensitive documents, including Form 541 K 1, during transmission and storage. Additionally, our platform complies with legal standards to ensure that your data remains safe and confidential.

-

Can I track the status of my Form 541 K 1 documents with airSlate SignNow?

Yes, with airSlate SignNow, you can easily track the status of your Form 541 K 1 documents in real-time. Our platform provides notifications and updates on when your document is sent, viewed, and signed, giving you peace of mind and control over your document workflows.

Get more for Form 541 K 1

- Sbi mobile number change application form pdf 256824651

- Idaho rental application doc form

- Youth sports registration form doc

- What is the criteria for a msha approved bathhouse waiver form

- Donation request form city of overland park opkansas

- Service connected sc a va determination that an illness or injury was incurred or aggravated in the line of duty in the form

- Enterprise agreement template form

- Guidelines contract template form

Find out other Form 541 K 1

- How Do I eSign Hawaii Insurance Operating Agreement

- eSign Hawaii Insurance Stock Certificate Free

- eSign New Hampshire Lawers Promissory Note Template Computer

- Help Me With eSign Iowa Insurance Living Will

- eSign North Dakota Lawers Quitclaim Deed Easy

- eSign Ohio Lawers Agreement Computer

- eSign North Dakota Lawers Separation Agreement Online

- How To eSign North Dakota Lawers Separation Agreement

- eSign Kansas Insurance Moving Checklist Free

- eSign Louisiana Insurance Promissory Note Template Simple

- eSign Texas Lawers Contract Fast

- eSign Texas Lawers Lease Agreement Free

- eSign Maine Insurance Rental Application Free

- How Can I eSign Maryland Insurance IOU

- eSign Washington Lawers Limited Power Of Attorney Computer

- eSign Wisconsin Lawers LLC Operating Agreement Free

- eSign Alabama Legal Quitclaim Deed Online

- eSign Alaska Legal Contract Safe

- How To eSign Alaska Legal Warranty Deed

- eSign Alaska Legal Cease And Desist Letter Simple