California Form K 1 2015

What is the California Form K-1

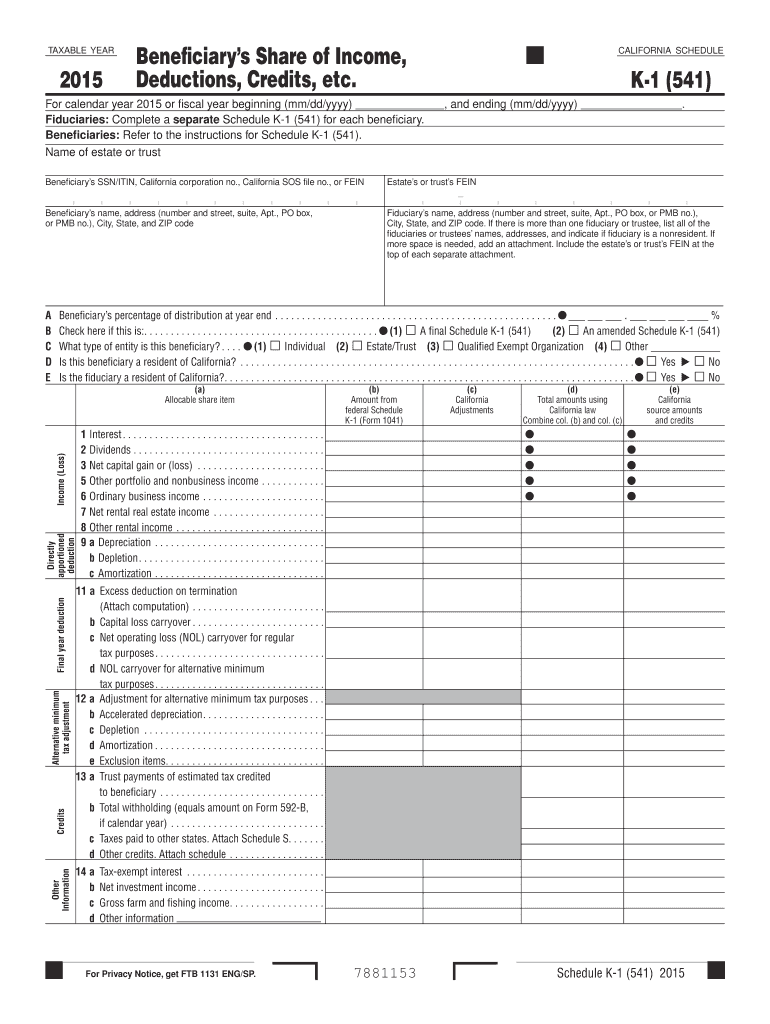

The California Form K-1 is a tax document used to report income, deductions, and credits from partnerships, S corporations, estates, and trusts. This form is essential for individuals who receive income from these entities, as it provides detailed information that must be included in their personal tax returns. The California Form K-1 helps ensure that income is accurately reported to the California Franchise Tax Board (FTB), allowing for proper taxation and compliance with state tax laws.

How to use the California Form K-1

Using the California Form K-1 involves several steps. First, recipients must obtain the form from the entity that issued it, such as a partnership or S corporation. Once received, the form should be reviewed carefully to ensure that all reported amounts are accurate. The information on the K-1 must then be transferred to the individual's California tax return, specifically on the appropriate lines for income, deductions, and credits. It is crucial to retain a copy of the K-1 for personal records and to support any claims made on the tax return.

Steps to complete the California Form K-1

Completing the California Form K-1 requires attention to detail. Follow these steps:

- Gather necessary information, including the entity's name, address, and federal identification number.

- Fill in the recipient's information, including name, address, and Social Security number.

- Report the income, deductions, and credits as specified in the form, ensuring accuracy in each section.

- Double-check all entries for errors or omissions before finalizing the form.

- Sign and date the form to certify its accuracy.

Legal use of the California Form K-1

The legal use of the California Form K-1 is governed by state tax laws. This form must be accurately completed and filed to comply with the California Revenue and Taxation Code. Failure to report income from a K-1 can result in penalties, interest, and potential audits by the California Franchise Tax Board. It is important for recipients to understand their obligations and ensure that the information reported aligns with their overall tax situation.

Filing Deadlines / Important Dates

Filing deadlines for the California Form K-1 are typically aligned with the tax return deadlines for the entities that issue them. Generally, partnerships and S corporations must provide K-1 forms to their partners or shareholders by March 15. Individual taxpayers must then include the information from the K-1 on their California tax returns, which are due by April 15. It is essential to be aware of these dates to avoid late filing penalties.

Who Issues the Form

The California Form K-1 is issued by partnerships, S corporations, estates, and trusts. These entities are responsible for preparing and distributing the form to their partners or shareholders. Each entity must ensure that the K-1 is accurate and reflects the correct amounts of income, deductions, and credits allocated to each recipient. This process is crucial for maintaining compliance with state tax regulations.

Quick guide on how to complete california form k 1 2015

Your assistance manual on how to prepare your California Form K 1

If you’re interested in understanding how to finalize and present your California Form K 1, here are some concise guidelines on how to simplify tax processing.

Initially, you merely need to create your airSlate SignNow profile to alter how you manage documents online. airSlate SignNow is an extremely user-friendly and powerful document solution that enables you to modify, draft, and complete your tax forms effortlessly. Utilizing its editor, you can toggle between text, check boxes, and eSignatures and return to adjust responses as necessary. Enhance your tax management with advanced PDF editing, eSigning, and user-friendly sharing.

Follow the instructions below to complete your California Form K 1 in just a few minutes:

- Create your account and start working on PDFs in moments.

- Utilize our directory to find any IRS tax form; browse through versions and schedules.

- Click Get form to access your California Form K 1 in our editor.

- Complete the mandatory fillable fields with your information (text, numbers, check marks).

- Employ the Sign Tool to apply your legally-binding eSignature (if required).

- Review your document and fix any errors.

- Save modifications, print your copy, submit it to your recipient, and download it to your device.

Utilize this manual to submit your taxes electronically with airSlate SignNow. Please be aware that submitting on paper may lead to errors in returns and delay refunds. Naturally, before electronically filing your taxes, verify the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct california form k 1 2015

FAQs

-

How do you know if you need to fill out a 1099 form?

Assuming that you are talking about 1099-MISC. Note that there are other 1099s.check this post - Form 1099 MISC Rules & RegulationsQuick answer - A Form 1099 MISC must be filed for each person to whom payment is made of:$600 or more for services performed for a trade or business by people not treated as employees;Rent or prizes and awards that are not for service ($600 or more) and royalties ($10 or more);any fishing boat proceeds,gross proceeds of $600, or more paid to an attorney during the year, orWithheld any federal income tax under the backup withholding rules regardless of the amount of the payment, etc.

-

How can I fill out the FY 2015-16 and 2016-17 ITR forms after the 31st of March 2018?

As you know the last date of filling income tax retruns has been gone for the financial year 2015–16 and 2016–17. and if you haven’t done it before 31–03–2018. then i don’t think it is possible according to the current guidlines of IT Department. it may possible that they can send you the notice to answer for not filling the retrun and they may charge penalty alsoif your income was less than taxable limit then its ok it is a valid reson but you don’t need file ITR for those years but if your income was more than the limit then, i think you have to write the lette to your assessing officer with a genuine reason that why didn’t you file the ITR.This was only suggestion not adviceyou can also go through the professional chartered accountant

-

Which forms do I fill out for taxes in California? I have a DBA/sole proprietorship company with less than $1000 in profit. How many forms do I fill out? This is really overwhelming. Do I need to fill the Form 1040-ES? Did the deadline pass?

You need to file two tax returns- one Federal Tax Form and another California State income law.My answer to your questions are for Tax Year 2018The limitation date for tax year 15.04.2018Federal Tax return for Individual is Form 1040 . Since you are carrying on proprietorship business, you will need to fill the Schedule C in Form 1040Form 1040 -ES , as the name suggests is for paying estimated tax for the current year. This is not the actual tax return form. Please note that while Form 1040, which is the return form for individuals, relates to the previous year, the estimated tax form (Form 1040-EZ ) calculates taxes for the current year.As far as , the tax return under tax laws of Californa State is concerned, the Schedule CA (540) Form is to be used for filing state income tax return . You use your federal information (forms 1040) to fill out your 540 FormPrashanthttp://irstaxapp.com

-

How do we know the eligibility to fill out Form 12 BB?

Every year as a salaried employee many of you must have fill Form 12BB, but did you ever bothered to know its purpose. Don’t know ??It is indispensable for both, you and your employer. With the help of Form 12BB, you will be able to figure out how much income tax is to be deducted from your monthly pay. Further, with the help of Form 12BB, you will be in relief at the time of filing returns as at that time you will not have to pay anything due to correct TDS deduction.So, before filing such important form keep the below listed things in your mind so that you may live a tax hassle free life.For More Information:- 7 key points which must be known before filling Form 12BB

-

How many people fill out Form 1099 each year?

There are a few different ways of estimating the numbers and thinking about this question. Data from the most recent years are not available—at least not from a reliable source with rigorous methodology—but here is what I can tell you:The most popular type of 1099 is Form 1099-MISC—the form used to report non-employee income including those for self-employed independent contractors (as well as various other types of “miscellaneous” income)Since 2015, there have been just under 16 million self-employed workers (including incorporated and unincorporated contractor businesses). And the data from the BLS seems to suggest this number has been largely consistent from one year to the next: Table A-9. Selected employment indicatorsNow, the total number of 1099-MISC forms has been inching up each year—along with W-2 form filings—and may have surpassed 100 million filing forms. RE: Evaluating the Growth of the 1099 Workforce But this data only goes to 2014 because, again, it’s hard to find reliable data from recent tax years.In terms of the total number of Form 1099s, you’d have to include Interest and Dividend 1099 forms, real estate and rental income, health and education savings accounts, retirement accounts, etc. I’m sure the total number of all 1099 forms surely ranges in the hundreds of millions.Finally, not everybody who is supposed to get a 1099 form gets one. So if you’re asking about the total number of freelancers, the estimates range from about 7.6 million people who primarily rely on self-employed 1099 income and 53 million people who have some type of supplemental income.If you’re someone who’s responsible for filing Form 1099s to the IRS and payee/recipients, I recommend Advanced Micro Solutions for most small-to-medium accounting service needs. It’s basic but very intuitive and cheap.$79 1099 Software Filer & W2 Software for Small Businesses

Create this form in 5 minutes!

How to create an eSignature for the california form k 1 2015

How to make an eSignature for the California Form K 1 2015 online

How to generate an electronic signature for the California Form K 1 2015 in Google Chrome

How to generate an electronic signature for putting it on the California Form K 1 2015 in Gmail

How to generate an eSignature for the California Form K 1 2015 straight from your smartphone

How to generate an electronic signature for the California Form K 1 2015 on iOS devices

How to make an eSignature for the California Form K 1 2015 on Android devices

People also ask

-

What is California Form K 1 and why is it important?

California Form K 1 is a tax document used to report income, deductions, and credits from partnerships and S corporations. It's essential for California taxpayers who are partners in a partnership or shareholders in an S corporation to accurately report their share of income on their individual tax returns.

-

How can airSlate SignNow help with California Form K 1?

airSlate SignNow simplifies the process of sending and eSigning California Form K 1 documents. With its user-friendly platform, businesses can quickly prepare, send, and receive signed forms, ensuring compliance and streamlined operations.

-

What features does airSlate SignNow offer for managing California Form K 1?

airSlate SignNow offers features such as customizable templates, real-time tracking, and secure cloud storage specifically for California Form K 1. These tools enhance efficiency and ensure that all signed documents are easily accessible and organized.

-

Is there a trial available for airSlate SignNow to handle California Form K 1?

Yes, airSlate SignNow offers a free trial that allows users to explore its features for handling California Form K 1. This trial enables businesses to experience the platform's capabilities without any upfront commitment.

-

What is the pricing structure for airSlate SignNow services related to California Form K 1?

airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes, making it cost-effective for managing California Form K 1. Each plan includes essential features for document signing and management, ensuring that users get value for their investment.

-

Can I integrate airSlate SignNow with other software for California Form K 1?

Absolutely! airSlate SignNow seamlessly integrates with various accounting and business applications, making it easy to manage California Form K 1 alongside your existing workflows. This integration helps streamline the document signing process and improves overall efficiency.

-

What are the benefits of using airSlate SignNow for California Form K 1?

Using airSlate SignNow for California Form K 1 offers numerous benefits, including faster turnaround times for document signing, improved security, and reduced paperwork. Additionally, it enhances collaboration among teams and clients, ensuring that all parties are on the same page.

Get more for California Form K 1

- Application for employment memory lane assisted living form

- Sbi general insurance arogya top up proposal form

- Sf 16 form

- Db 212 3 workersamp39 compensation board new york state wcb ny form

- Barrel racing pas score sheet ohio 4 h form

- Piecing me together pdf form

- Request for hardship determination form

- Enrollment agreement template form

Find out other California Form K 1

- eSign North Dakota Real Estate Business Letter Template Computer

- eSign North Dakota Real Estate Quitclaim Deed Myself

- eSign Maine Sports Quitclaim Deed Easy

- eSign Ohio Real Estate LLC Operating Agreement Now

- eSign Ohio Real Estate Promissory Note Template Online

- How To eSign Ohio Real Estate Residential Lease Agreement

- Help Me With eSign Arkansas Police Cease And Desist Letter

- How Can I eSign Rhode Island Real Estate Rental Lease Agreement

- How Do I eSign California Police Living Will

- Can I eSign South Dakota Real Estate Quitclaim Deed

- How To eSign Tennessee Real Estate Business Associate Agreement

- eSign Michigan Sports Cease And Desist Letter Free

- How To eSign Wisconsin Real Estate Contract

- How To eSign West Virginia Real Estate Quitclaim Deed

- eSign Hawaii Police Permission Slip Online

- eSign New Hampshire Sports IOU Safe

- eSign Delaware Courts Operating Agreement Easy

- eSign Georgia Courts Bill Of Lading Online

- eSign Hawaii Courts Contract Mobile

- eSign Hawaii Courts RFP Online