About Schedule K 1 Form 1041Internal Revenue Service 2014

What is the About Schedule K-1 Form 1041

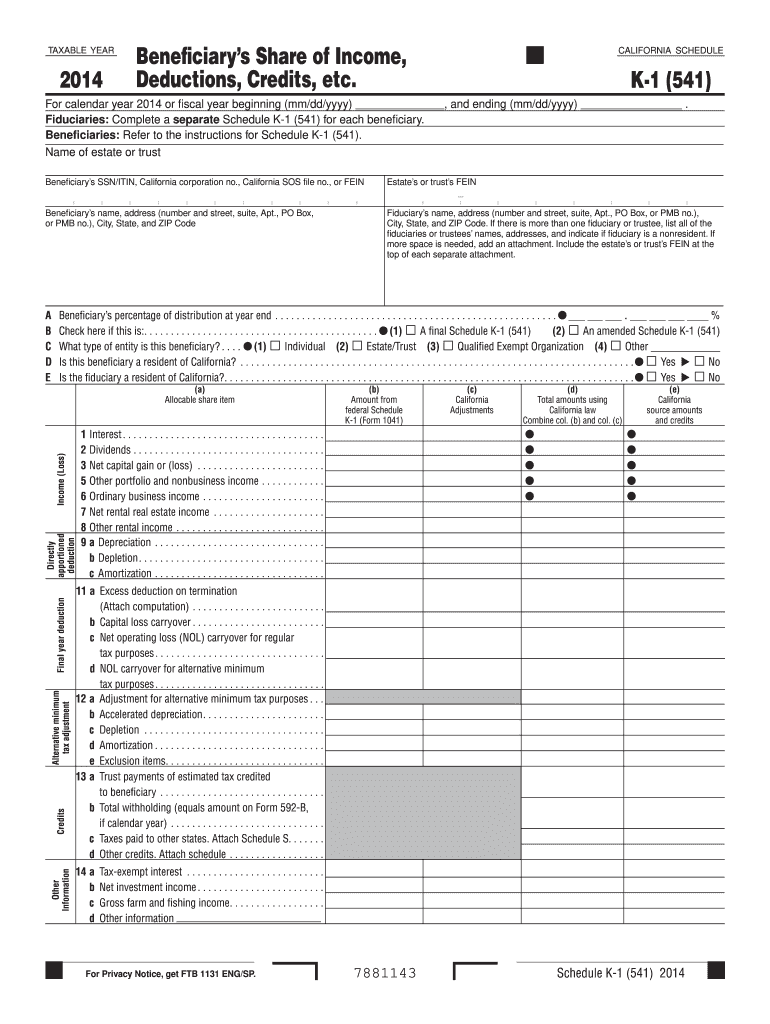

The Schedule K-1 (Form 1041) is a tax document used by estates and trusts to report income, deductions, and credits allocated to beneficiaries. The Internal Revenue Service (IRS) requires this form to ensure that beneficiaries accurately report their share of the estate or trust's income on their personal tax returns. Each beneficiary receives a separate K-1 detailing their portion of the income, which may include interest, dividends, capital gains, and other types of income. Understanding this form is essential for beneficiaries to comply with tax obligations and avoid potential penalties.

How to use the About Schedule K-1 Form 1041

Using the Schedule K-1 (Form 1041) involves several steps to ensure accurate reporting of income. Beneficiaries must first receive their K-1 from the estate or trust, which outlines their share of income and deductions. Once received, beneficiaries should review the information for accuracy, as discrepancies can lead to tax issues. The information on the K-1 must then be reported on the beneficiary's individual tax return, typically on Form 1040. It is crucial to keep a copy of the K-1 for personal records and future reference.

Steps to complete the About Schedule K-1 Form 1041

Completing the Schedule K-1 (Form 1041) requires careful attention to detail. Here are the steps involved:

- Obtain the Schedule K-1 from the estate or trust.

- Review the information provided, including income types and amounts.

- Ensure that your personal information, such as name and Social Security number, is accurate.

- Transfer the relevant amounts from the K-1 to your Form 1040, following IRS instructions.

- Retain a copy of the K-1 for your records.

Key elements of the About Schedule K-1 Form 1041

Several key elements are essential to understand when dealing with the Schedule K-1 (Form 1041). These include:

- Beneficiary Information: The K-1 includes the name, address, and taxpayer identification number of the beneficiary.

- Income Types: Various income types are reported, including ordinary income, capital gains, and tax-exempt income.

- Deductions and Credits: The form may also detail any deductions and credits that the beneficiary can claim.

- Fiduciary Information: The K-1 provides details about the estate or trust, including the fiduciary's name and contact information.

Filing Deadlines / Important Dates

Filing deadlines for the Schedule K-1 (Form 1041) are critical for compliance. The estate or trust must file Form 1041 by the fifteenth day of the fourth month following the end of the tax year. Beneficiaries typically receive their K-1 after the estate or trust files its return, which may be necessary for their personal tax filings. It is advisable for beneficiaries to keep track of these dates to ensure timely reporting of income on their individual tax returns.

Penalties for Non-Compliance

Failure to comply with the reporting requirements associated with the Schedule K-1 (Form 1041) can result in significant penalties. If a beneficiary does not report the income shown on the K-1, they may face penalties for underreporting income, which can include fines and interest on unpaid taxes. Additionally, fiduciaries who fail to provide accurate K-1s to beneficiaries may also incur penalties. It is essential for both beneficiaries and fiduciaries to understand their responsibilities to avoid these consequences.

Quick guide on how to complete 2014 form k 1

Your assistance manual on how to prepare your About Schedule K 1 Form 1041Internal Revenue Service

If you’re curious about how to complete and submit your About Schedule K 1 Form 1041Internal Revenue Service, here are some quick tips on how to make tax filing simpler.

To begin, you just need to create your airSlate SignNow profile to transform how you manage documents online. airSlate SignNow is a highly user-friendly and powerful document solution that enables you to modify, draft, and finalize your tax forms with convenience. With its editor, you can toggle between text, check boxes, and eSignatures and return to adjust information as necessary. Streamline your tax processes with advanced PDF editing, eSigning, and accessible sharing.

Follow the instructions below to complete your About Schedule K 1 Form 1041Internal Revenue Service in no time:

- Set up your account and begin working on PDFs in a matter of minutes.

- Utilize our directory to find any IRS tax form; browse through versions and schedules.

- Click Get form to launch your About Schedule K 1 Form 1041Internal Revenue Service in our editor.

- Enter the necessary fillable fields with your information (text, numbers, check marks).

- Use the Sign Tool to apply your legally-binding eSignature (if needed).

- Review your document and correct any mistakes.

- Save changes, print your copy, send it to your recipient, and download it to your device.

Utilize this guide to submit your taxes electronically with airSlate SignNow. Please remember that filing on paper can increase return errors and delay refunds. Naturally, before e-filing your taxes, consult the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct 2014 form k 1

FAQs

-

How do you know if you need to fill out a 1099 form?

Assuming that you are talking about 1099-MISC. Note that there are other 1099s.check this post - Form 1099 MISC Rules & RegulationsQuick answer - A Form 1099 MISC must be filed for each person to whom payment is made of:$600 or more for services performed for a trade or business by people not treated as employees;Rent or prizes and awards that are not for service ($600 or more) and royalties ($10 or more);any fishing boat proceeds,gross proceeds of $600, or more paid to an attorney during the year, orWithheld any federal income tax under the backup withholding rules regardless of the amount of the payment, etc.

-

How do we know the eligibility to fill out Form 12 BB?

Every year as a salaried employee many of you must have fill Form 12BB, but did you ever bothered to know its purpose. Don’t know ??It is indispensable for both, you and your employer. With the help of Form 12BB, you will be able to figure out how much income tax is to be deducted from your monthly pay. Further, with the help of Form 12BB, you will be in relief at the time of filing returns as at that time you will not have to pay anything due to correct TDS deduction.So, before filing such important form keep the below listed things in your mind so that you may live a tax hassle free life.For More Information:- 7 key points which must be known before filling Form 12BB

-

How many people fill out Form 1099 each year?

There are a few different ways of estimating the numbers and thinking about this question. Data from the most recent years are not available—at least not from a reliable source with rigorous methodology—but here is what I can tell you:The most popular type of 1099 is Form 1099-MISC—the form used to report non-employee income including those for self-employed independent contractors (as well as various other types of “miscellaneous” income)Since 2015, there have been just under 16 million self-employed workers (including incorporated and unincorporated contractor businesses). And the data from the BLS seems to suggest this number has been largely consistent from one year to the next: Table A-9. Selected employment indicatorsNow, the total number of 1099-MISC forms has been inching up each year—along with W-2 form filings—and may have surpassed 100 million filing forms. RE: Evaluating the Growth of the 1099 Workforce But this data only goes to 2014 because, again, it’s hard to find reliable data from recent tax years.In terms of the total number of Form 1099s, you’d have to include Interest and Dividend 1099 forms, real estate and rental income, health and education savings accounts, retirement accounts, etc. I’m sure the total number of all 1099 forms surely ranges in the hundreds of millions.Finally, not everybody who is supposed to get a 1099 form gets one. So if you’re asking about the total number of freelancers, the estimates range from about 7.6 million people who primarily rely on self-employed 1099 income and 53 million people who have some type of supplemental income.If you’re someone who’s responsible for filing Form 1099s to the IRS and payee/recipients, I recommend Advanced Micro Solutions for most small-to-medium accounting service needs. It’s basic but very intuitive and cheap.$79 1099 Software Filer & W2 Software for Small Businesses

-

How can I fill the improvement form for class 12th, CBSE 2014-15?

The forms are available in November or December only. You can't apply for an improvement now!And worse? You can't apply even for next session; it has to be in the year just after you graduated from your high school.

-

How do I fill out Address Line 1 on an Online Form?

(street number) (street name) (street suffix)101 Main StreetYou can query the post office on your address, best as you know it, for the “standard” way of presenting your address. USPS.com® - ZIP Code Lookup or whatever service is offered in your country. That will tell you the standard way to fill out address lines.

Create this form in 5 minutes!

How to create an eSignature for the 2014 form k 1

How to create an eSignature for the 2014 Form K 1 in the online mode

How to make an eSignature for the 2014 Form K 1 in Google Chrome

How to generate an eSignature for signing the 2014 Form K 1 in Gmail

How to create an eSignature for the 2014 Form K 1 right from your smartphone

How to create an electronic signature for the 2014 Form K 1 on iOS devices

How to make an electronic signature for the 2014 Form K 1 on Android devices

People also ask

-

What is the Schedule K-1 Form 1041 and why is it important?

The Schedule K-1 Form 1041 is an essential tax document issued by estates and trusts to report income, deductions, and credits to beneficiaries. Understanding About Schedule K-1 Form 1041 Internal Revenue Service is crucial for beneficiaries to accurately file their personal tax returns. It ensures that all income is reported correctly and helps in avoiding potential tax discrepancies.

-

How can airSlate SignNow facilitate the signing of Schedule K-1 Form 1041?

airSlate SignNow provides a seamless platform for electronically signing the Schedule K-1 Form 1041, making it quick and efficient. With our user-friendly interface, you can easily send, sign, and manage documents securely. This enhances compliance with the requirements set by the About Schedule K-1 Form 1041 Internal Revenue Service, streamlining your tax documentation process.

-

Is there a cost associated with using airSlate SignNow for Schedule K-1 Form 1041?

Yes, airSlate SignNow offers various pricing plans to cater to different business needs, including options for sending and signing the Schedule K-1 Form 1041. Our pricing is competitive and designed to provide value for the features offered. By investing in airSlate SignNow, you ensure a cost-effective solution for managing important tax documents like the Schedule K-1 Form 1041.

-

What features does airSlate SignNow offer for handling tax documents like Schedule K-1 Form 1041?

airSlate SignNow includes features such as document templates, real-time tracking, and secure cloud storage specifically designed for tax documents like the Schedule K-1 Form 1041. These features enable users to easily create, share, and sign documents while maintaining compliance with the About Schedule K-1 Form 1041 Internal Revenue Service guidelines. This ensures a smooth and efficient workflow.

-

Can airSlate SignNow integrate with accounting software for Schedule K-1 Form 1041?

Absolutely! airSlate SignNow seamlessly integrates with popular accounting software to simplify the process of managing Schedule K-1 Form 1041. This integration allows for efficient data transfer and reduces the risk of errors, ensuring compliance with the About Schedule K-1 Form 1041 Internal Revenue Service requirements.

-

How secure is airSlate SignNow when handling sensitive tax documents like Schedule K-1 Form 1041?

Security is a top priority for airSlate SignNow. We employ industry-standard encryption and compliance measures to protect sensitive information, including the Schedule K-1 Form 1041. This commitment to security ensures that your documents are safe while fulfilling the requirements set forth by the About Schedule K-1 Form 1041 Internal Revenue Service.

-

What support does airSlate SignNow offer for users dealing with Schedule K-1 Form 1041?

airSlate SignNow offers comprehensive support to assist users with any questions or concerns related to the Schedule K-1 Form 1041. Our customer service team is available to provide guidance and troubleshoot issues, ensuring you can effectively navigate the requirements of the About Schedule K-1 Form 1041 Internal Revenue Service.

Get more for About Schedule K 1 Form 1041Internal Revenue Service

Find out other About Schedule K 1 Form 1041Internal Revenue Service

- eSign Mississippi Government LLC Operating Agreement Easy

- eSign Ohio High Tech Letter Of Intent Later

- eSign North Dakota High Tech Quitclaim Deed Secure

- eSign Nebraska Healthcare / Medical LLC Operating Agreement Simple

- eSign Nebraska Healthcare / Medical Limited Power Of Attorney Mobile

- eSign Rhode Island High Tech Promissory Note Template Simple

- How Do I eSign South Carolina High Tech Work Order

- eSign Texas High Tech Moving Checklist Myself

- eSign Texas High Tech Moving Checklist Secure

- Help Me With eSign New Hampshire Government Job Offer

- eSign Utah High Tech Warranty Deed Simple

- eSign Wisconsin High Tech Cease And Desist Letter Fast

- eSign New York Government Emergency Contact Form Online

- eSign North Carolina Government Notice To Quit Now

- eSign Oregon Government Business Plan Template Easy

- How Do I eSign Oklahoma Government Separation Agreement

- How Do I eSign Tennessee Healthcare / Medical Living Will

- eSign West Virginia Healthcare / Medical Forbearance Agreement Online

- eSign Alabama Insurance LLC Operating Agreement Easy

- How Can I eSign Alabama Insurance LLC Operating Agreement