Form ID K 1, Partner's, Shareholder's, or Tax Idaho Gov 2021-2026

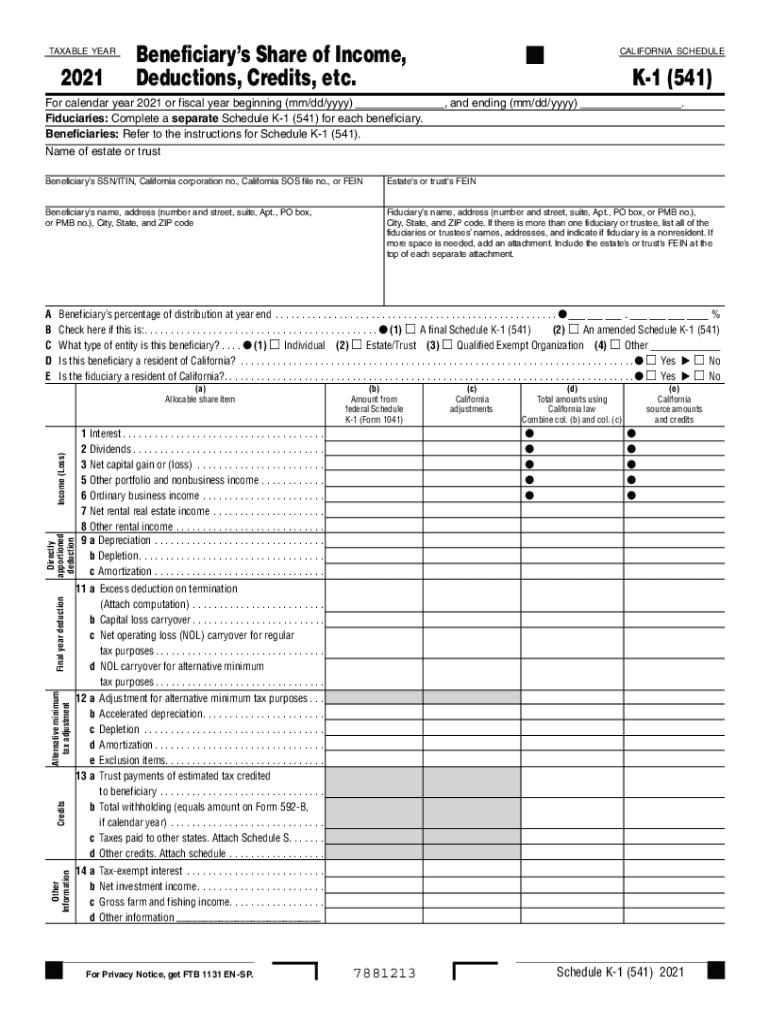

What is the Form 541 K-1?

The Form 541 K-1 is a tax document used in California for reporting income, deductions, and credits from partnerships, S corporations, estates, and trusts. It provides detailed information about each partner's or shareholder's share of the entity's income, which is necessary for individual tax filings. This form is essential for ensuring that all parties accurately report their income to the IRS and the California Franchise Tax Board.

Steps to Complete the Form 541 K-1

Completing the Form 541 K-1 involves several steps to ensure accuracy and compliance with tax regulations:

- Gather necessary financial information from the partnership or entity.

- Fill in the entity's name, address, and tax identification number at the top of the form.

- Report the partner's or shareholder's share of income, deductions, and credits in the appropriate sections.

- Ensure all amounts are accurately calculated and match the entity's records.

- Sign and date the form to certify its accuracy.

Legal Use of the Form 541 K-1

The Form 541 K-1 is legally binding and must be used according to IRS and state guidelines. It serves as a record of income distribution and is crucial for tax compliance. Failure to accurately complete and submit this form can lead to penalties and interest on unpaid taxes. It is advisable to consult with a tax professional to ensure that the form is filled out correctly and submitted on time.

Filing Deadlines for Form 541 K-1

Filing deadlines for the Form 541 K-1 are typically aligned with the tax return deadlines for the entity. Generally, the form must be issued to partners or shareholders by March 15 for calendar year filers. However, if an extension is filed, the deadline may be extended. It is important to stay informed about specific due dates to avoid late filing penalties.

Examples of Using the Form 541 K-1

The Form 541 K-1 can be used in various scenarios:

- Partners in a limited liability company (LLC) reporting their share of profits and losses.

- Shareholders of an S corporation receiving distributions that must be reported on their personal tax returns.

- Beneficiaries of a trust or estate documenting their share of income for individual tax purposes.

Digital vs. Paper Version of the Form 541 K-1

The Form 541 K-1 can be completed and submitted in both digital and paper formats. Digital submission via e-filing can streamline the process and reduce the likelihood of errors. However, some individuals may prefer paper forms for their records. Regardless of the method chosen, it is essential to ensure that the form is filled out completely and accurately.

Quick guide on how to complete form id k 1 partners shareholders or taxidahogov

Prepare Form ID K 1, Partner's, Shareholder's, Or Tax idaho gov effortlessly on any device

Digital document management has gained traction with both companies and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed papers, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, edit, and electronically sign your documents promptly without delays. Manage Form ID K 1, Partner's, Shareholder's, Or Tax idaho gov on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to modify and eSign Form ID K 1, Partner's, Shareholder's, Or Tax idaho gov with ease

- Locate Form ID K 1, Partner's, Shareholder's, Or Tax idaho gov and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important parts of your documents or obscure confidential information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature with the Sign feature, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the details and click on the Done button to save your changes.

- Select how you wish to deliver your form, whether by email, SMS, or invite link, or download it to your computer.

No more worrying about lost or misplaced files, tedious form searching, or mistakes that necessitate the printing of new document copies. airSlate SignNow fulfills all your document management needs in a few clicks from any device of your choice. Alter and eSign Form ID K 1, Partner's, Shareholder's, Or Tax idaho gov and guarantee exceptional communication at every stage of the form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form id k 1 partners shareholders or taxidahogov

Create this form in 5 minutes!

How to create an eSignature for the form id k 1 partners shareholders or taxidahogov

The way to create an e-signature for your PDF file online

The way to create an e-signature for your PDF file in Google Chrome

The best way to make an e-signature for signing PDFs in Gmail

The way to create an e-signature right from your mobile device

The best way to generate an electronic signature for a PDF file on iOS

The way to create an e-signature for a PDF on Android devices

People also ask

-

What is the 2020 California 541 form used for?

The 2020 California 541 form is primarily used by partnerships and LLCs in California to report income, deductions, and credits. It serves as a summary of the entity's financial performance for the tax year and ensures compliance with state tax regulations.

-

How can airSlate SignNow help with filing the 2020 California 541?

AirSlate SignNow streamlines the process of preparing and signing the 2020 California 541 form. With our easy-to-use eSign capabilities, you can securely send the form for signatures, ensuring timely filing and compliance.

-

What features does airSlate SignNow offer for managing the 2020 California 541?

AirSlate SignNow provides an intuitive interface for managing documents, including the 2020 California 541. Features such as document templates, real-time collaboration, and status tracking make it easy to ensure all signatures are collected efficiently.

-

Is there a cost associated with using airSlate SignNow for the 2020 California 541?

Yes, there is a cost associated with using airSlate SignNow, but it's designed to be cost-effective compared to other e-signature solutions. Our pricing plans cater to various business needs, making it affordable to handle documents like the 2020 California 541.

-

Can I integrate airSlate SignNow with other tools to manage the 2020 California 541?

Absolutely! AirSlate SignNow integrates seamlessly with popular software applications such as Google Drive and Microsoft Office. This allows you to easily manage and access your documents, including the 2020 California 541, within your preferred platforms.

-

What are the benefits of using airSlate SignNow for the 2020 California 541?

Using airSlate SignNow for the 2020 California 541 offers several benefits, including time savings and enhanced document security. The platform provides digital signatures that are legally binding, reducing paperwork and ensuring a smooth filing process.

-

How secure is airSlate SignNow when handling the 2020 California 541?

AirSlate SignNow prioritizes security to protect sensitive information, especially when dealing with documents like the 2020 California 541. Our platform utilizes advanced encryption and complies with industry standards to ensure your data is safe.

Get more for Form ID K 1, Partner's, Shareholder's, Or Tax idaho gov

Find out other Form ID K 1, Partner's, Shareholder's, Or Tax idaho gov

- eSign Delaware Insurance Credit Memo Mobile

- eSign Insurance PPT Georgia Computer

- How Do I eSign Hawaii Insurance Operating Agreement

- eSign Hawaii Insurance Stock Certificate Free

- eSign New Hampshire Lawers Promissory Note Template Computer

- Help Me With eSign Iowa Insurance Living Will

- eSign North Dakota Lawers Quitclaim Deed Easy

- eSign Ohio Lawers Agreement Computer

- eSign North Dakota Lawers Separation Agreement Online

- How To eSign North Dakota Lawers Separation Agreement

- eSign Kansas Insurance Moving Checklist Free

- eSign Louisiana Insurance Promissory Note Template Simple

- eSign Texas Lawers Contract Fast

- eSign Texas Lawers Lease Agreement Free

- eSign Maine Insurance Rental Application Free

- How Can I eSign Maryland Insurance IOU

- eSign Washington Lawers Limited Power Of Attorney Computer

- eSign Wisconsin Lawers LLC Operating Agreement Free

- eSign Alabama Legal Quitclaim Deed Online

- eSign Alaska Legal Contract Safe