Instructions for Schedule K 1 Form 1041 for a 2019

Key elements of the ftb 2018 form 541

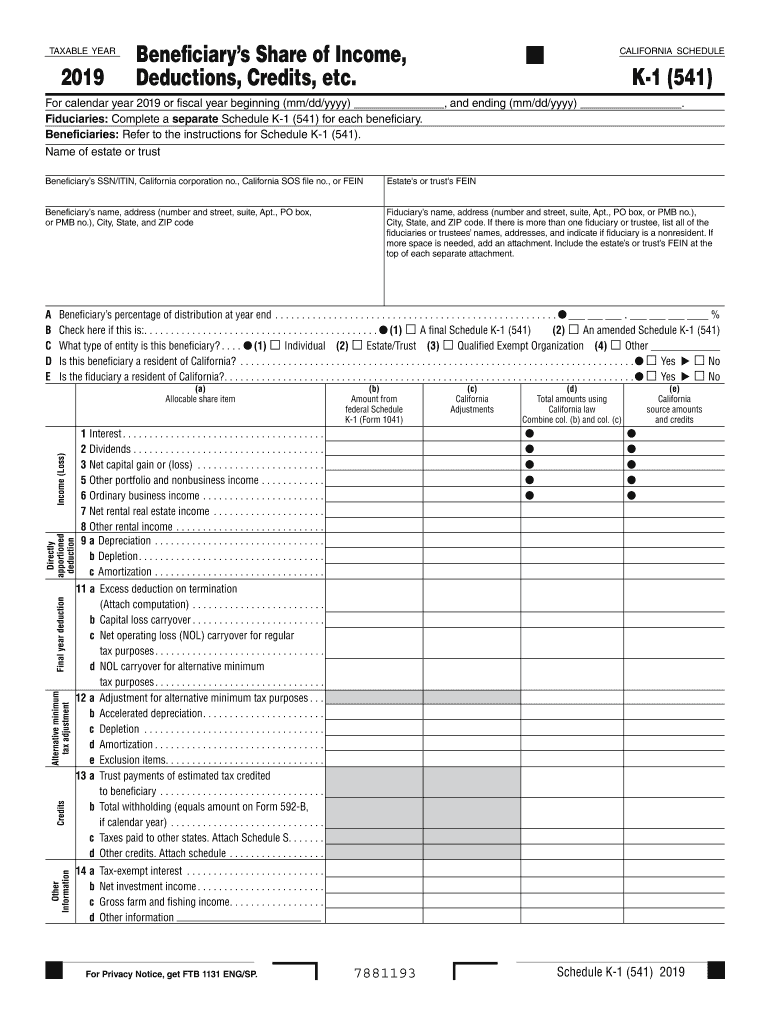

The ftb 2018 form 541 is essential for California taxpayers who need to report income from estates and trusts. This form is specifically designed for fiduciaries to report the income, deductions, and credits of the estate or trust. Key elements include:

- Identification Information: This section requires the name, address, and taxpayer identification number of the estate or trust.

- Income Reporting: Taxpayers must report various types of income, including interest, dividends, and capital gains.

- Deductions: The form allows for specific deductions related to the estate or trust, which can help reduce taxable income.

- Tax Calculation: The form includes a section for calculating the tax owed based on the reported income and applicable tax rates.

- Signature Section: A fiduciary must sign the form, affirming that the information provided is accurate and complete.

Steps to complete the ftb 2018 form 541

Completing the ftb 2018 form 541 involves several steps to ensure accuracy and compliance with California tax laws. Follow these steps for a smooth filing process:

- Gather Necessary Documents: Collect all relevant financial documents, including income statements, expense records, and previous tax returns.

- Fill Out Identification Information: Enter the name, address, and taxpayer identification number for the estate or trust in the designated section.

- Report Income: Accurately report all sources of income, ensuring to include interest, dividends, and any other relevant earnings.

- Claim Deductions: Identify and enter any deductions that apply to the estate or trust, which can lower the overall taxable income.

- Calculate Tax Liability: Use the provided tax tables to determine the tax owed based on the reported income and deductions.

- Review and Sign: Carefully review all entries for accuracy before signing the form to certify its correctness.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the ftb 2018 form 541 is crucial to avoid penalties. The key dates include:

- Original Filing Deadline: The form is typically due on the fifteenth day of the fourth month following the close of the tax year.

- Extension Requests: If additional time is needed, taxpayers can request an extension, which generally allows for an extra six months to file.

- Payment Deadlines: Any taxes owed must also be paid by the original filing deadline to avoid interest and penalties.

Form Submission Methods

Taxpayers can submit the ftb 2018 form 541 through various methods, ensuring flexibility and convenience. The available submission methods include:

- Online Submission: Taxpayers can e-file the form through the California Franchise Tax Board's online portal.

- Mail Submission: The form can be printed and mailed to the appropriate address specified by the Franchise Tax Board.

- In-Person Submission: Taxpayers may also choose to deliver the form in person at designated Franchise Tax Board offices.

Penalties for Non-Compliance

Failure to file the ftb 2018 form 541 on time or inaccuracies can result in penalties. Understanding these penalties helps taxpayers remain compliant:

- Late Filing Penalty: A penalty may be assessed for failing to file by the deadline, typically calculated as a percentage of the unpaid tax.

- Accuracy-Related Penalty: If the form contains significant errors, additional penalties may apply based on the amount of tax underreported.

- Interest Charges: Interest may accrue on any unpaid taxes from the original due date until payment is made in full.

IRS Guidelines

While the ftb 2018 form 541 is specific to California, it is essential to be aware of relevant IRS guidelines that may impact the filing process. These include:

- Federal Tax Treatment: Understanding how income reported on the form is treated at the federal level can help ensure accurate reporting.

- IRS Publication References: Taxpayers should refer to IRS publications that provide guidance on reporting income from estates and trusts.

- Coordination with Federal Forms: Ensure that information reported on the ftb 2018 form 541 aligns with any related federal tax forms, such as Form 1041.

Quick guide on how to complete 2019 instructions for schedule k 1 form 1041 for a

Effortlessly Prepare Instructions For Schedule K 1 Form 1041 For A on Any Device

The management of online documents has gained popularity among businesses and individuals alike. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly and without obstacles. Manage Instructions For Schedule K 1 Form 1041 For A across any platform using airSlate SignNow's Android or iOS applications and simplify any document-based process today.

How to Modify and Electronically Sign Instructions For Schedule K 1 Form 1041 For A with Ease

- Locate Instructions For Schedule K 1 Form 1041 For A and click on Get Form to begin.

- Utilize the tools we provide to finalize your document.

- Emphasize important sections of your documents or redact sensitive information with tools designed specifically for this purpose by airSlate SignNow.

- Generate your electronic signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional ink signature.

- Review all information and click on the Done button to save your changes.

- Select your preferred method to send your form via email, SMS, invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tiresome form navigation, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management requirements in just a few clicks from any device you choose. Edit and electronically sign Instructions For Schedule K 1 Form 1041 For A while ensuring outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2019 instructions for schedule k 1 form 1041 for a

Create this form in 5 minutes!

How to create an eSignature for the 2019 instructions for schedule k 1 form 1041 for a

The way to generate an electronic signature for a PDF in the online mode

The way to generate an electronic signature for a PDF in Chrome

The way to create an eSignature for putting it on PDFs in Gmail

The way to create an eSignature straight from your smart phone

The best way to make an eSignature for a PDF on iOS devices

The way to create an eSignature for a PDF document on Android OS

People also ask

-

What is ftb 2018 form 541?

The ftb 2018 form 541 is the California fiduciary income tax return used by estates or trusts. It is essential for reporting income earned by the estate or trust during the tax year. Filing this form accurately ensures compliance with state tax regulations.

-

How can airSlate SignNow help with ftb 2018 form 541?

With airSlate SignNow, you can easily create, send, and eSign the ftb 2018 form 541. This streamlined process enhances convenience by allowing you to handle your tax documentation electronically, thus saving time and reducing paperwork.

-

What are the pricing options for using airSlate SignNow?

airSlate SignNow offers various pricing plans to suit different business needs, making it affordable to access features to manage documents like the ftb 2018 form 541. You'll find options ranging from basic to advanced features that enhance collaboration and efficiency.

-

Is it possible to integrate airSlate SignNow with other software?

Yes, airSlate SignNow seamlessly integrates with numerous applications, allowing for easy management of documents including the ftb 2018 form 541. This integration ensures that you can connect your existing workflow and enhance productivity across platforms.

-

What are the key features of airSlate SignNow?

airSlate SignNow provides a range of features, including document templates, eSignature capabilities, and status tracking. These features make it simpler to prepare and manage documents such as the ftb 2018 form 541, regardless of your business size.

-

Can I store my ftb 2018 form 541 documents securely with airSlate SignNow?

Absolutely! airSlate SignNow prioritizes security and compliance, ensuring that all your documents, including the ftb 2018 form 541, are stored safely. With encryption and strict access controls, your sensitive information remains protected.

-

What benefits does eSigning provide for the ftb 2018 form 541?

eSigning the ftb 2018 form 541 with airSlate SignNow allows for faster contract execution and enhances convenience for all parties involved. No more printing or mailing physical documents, which saves time and reduces paper waste.

Get more for Instructions For Schedule K 1 Form 1041 For A

Find out other Instructions For Schedule K 1 Form 1041 For A

- eSignature Maine Business Operations Living Will Online

- eSignature Louisiana Car Dealer Profit And Loss Statement Easy

- How To eSignature Maryland Business Operations Business Letter Template

- How Do I eSignature Arizona Charity Rental Application

- How To eSignature Minnesota Car Dealer Bill Of Lading

- eSignature Delaware Charity Quitclaim Deed Computer

- eSignature Colorado Charity LLC Operating Agreement Now

- eSignature Missouri Car Dealer Purchase Order Template Easy

- eSignature Indiana Charity Residential Lease Agreement Simple

- How Can I eSignature Maine Charity Quitclaim Deed

- How Do I eSignature Michigan Charity LLC Operating Agreement

- eSignature North Carolina Car Dealer NDA Now

- eSignature Missouri Charity Living Will Mobile

- eSignature New Jersey Business Operations Memorandum Of Understanding Computer

- eSignature North Dakota Car Dealer Lease Agreement Safe

- eSignature Oklahoma Car Dealer Warranty Deed Easy

- eSignature Oregon Car Dealer Rental Lease Agreement Safe

- eSignature South Carolina Charity Confidentiality Agreement Easy

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure