California Tax Form 541 K 1 2018

What is the California Tax Form 541 K-1

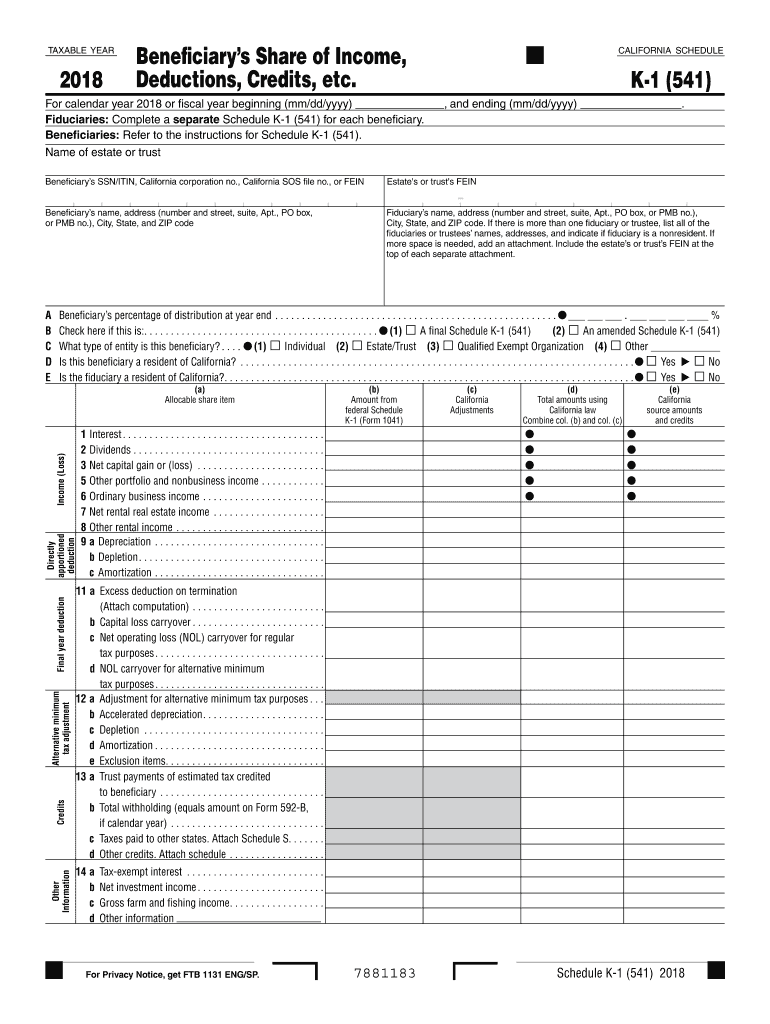

The California Tax Form 541 K-1 is a crucial document used for reporting income, deductions, and credits for beneficiaries of estates and trusts. This form is specifically designed for California tax purposes and is part of the California Form 541, which is the California fiduciary income tax return. Beneficiaries receive a K-1 to report their share of the income generated by the estate or trust on their personal tax returns.

How to use the California Tax Form 541 K-1

To effectively use the California Tax Form 541 K-1, beneficiaries must first receive the form from the estate or trust. The K-1 details the beneficiary's share of income, deductions, and credits. Beneficiaries should carefully review the information provided on the K-1, as it must be reported accurately on their individual tax returns. It is essential to ensure that the amounts align with the beneficiary's records to avoid discrepancies during tax filing.

Steps to complete the California Tax Form 541 K-1

Completing the California Tax Form 541 K-1 involves several key steps:

- Receive the form: Obtain the K-1 from the estate or trust administrator.

- Review the information: Check that all amounts reported match your expectations based on the trust or estate's financial activities.

- Fill in your tax return: Use the information from the K-1 to complete your individual California tax return, ensuring you report all income and deductions accurately.

- File your return: Submit your completed tax return by the appropriate deadline, including the K-1 information.

Key elements of the California Tax Form 541 K-1

The California Tax Form 541 K-1 includes several key elements that beneficiaries must understand:

- Beneficiary Information: This section contains the name, address, and taxpayer identification number of the beneficiary.

- Income Details: The form lists various types of income, including ordinary income, capital gains, and other distributions from the trust or estate.

- Deductions and Credits: Beneficiaries may also see deductions and credits that can be claimed on their individual tax returns.

- Signature of the fiduciary: The form must be signed by the fiduciary managing the estate or trust, validating the information provided.

Filing Deadlines / Important Dates

Filing deadlines for the California Tax Form 541 K-1 are typically aligned with the due dates for the California fiduciary income tax return (Form 541). The return is generally due on the fifteenth day of the fourth month after the end of the estate or trust's taxable year. For estates or trusts operating on a calendar year, this means the due date is April 15. However, if the deadline falls on a weekend or holiday, it may be extended to the next business day.

Penalties for Non-Compliance

Failure to comply with the requirements associated with the California Tax Form 541 K-1 can result in penalties. If a beneficiary does not report the income listed on the K-1, they may face underpayment penalties and interest on any unpaid taxes. Additionally, the estate or trust may incur penalties for failing to provide accurate K-1s to beneficiaries or for late filings. It is essential for both fiduciaries and beneficiaries to ensure compliance to avoid these financial repercussions.

Quick guide on how to complete form 541 k 1 2018 2019

Your assistance manual on how to prepare your California Tax Form 541 K 1

If you wish to learn how to complete and submit your California Tax Form 541 K 1, here are a few quick guidelines to simplify your tax submission process.

Initially, you just need to set up your airSlate SignNow account to alter the way you manage documents online. airSlate SignNow is an extremely user-friendly and powerful document solution that enables you to edit, create, and finalize your tax documents effortlessly. With its editor, you can toggle between text, check boxes, and eSignatures, and return to modify information as necessary. Enhance your tax administration with advanced PDF editing, eSigning, and user-friendly sharing.

Follow these steps to finalize your California Tax Form 541 K 1 in a matter of minutes:

- Establish your account and begin working on PDFs in no time.

- Utilize our directory to locate any IRS tax form; browse through different versions and schedules.

- Click Obtain form to open your California Tax Form 541 K 1 in our editor.

- Complete the necessary fillable fields with your information (text, numbers, check marks).

- Employ the Sign Tool to include your legally-binding eSignature (if necessary).

- Examine your document and rectify any errors.

- Save changes, print your copy, send it to your recipient, and download it to your device.

Utilize this manual to file your taxes electronically with airSlate SignNow. Be aware that filing on paper can increase mistakes on returns and delay refunds. Naturally, before e-filing your taxes, verify the IRS website for submission regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct form 541 k 1 2018 2019

FAQs

-

Which ITR form should an NRI fill out for AY 2018–2019 to claim the TDS deducted by banks only?

ITR form required to be submitted depends upon nature of income. As a NRI shall generally have income from other sources like interest, rental income therefore s/he should file ITR 2.

-

Which ITR form should an NRI fill out for AY 2018–2019 for salary income?

File ITR 2 and for taking credit of foreign taxes fill form 67 before filling ITR.For specific clarifications / legal advice feel free to write to dsssvtax[at]gmail or call/WhatsApp: 9052535440.

-

Can I fill out the JEE Mains 2018 form after 1 Jan?

No students cannot fill the JEE Main 2018 application or admission form after 1 January. If they want to updated with details, so can visit at

-

Can I fill the form for the SSC CGL 2018 which will be held in June 2019 and when will the form for 2019 come out?

No, you can’t fill the form for SSC CGL 2018 as application process has been long over.SSC CGL 2019 : No concrete information at this time. Some update should come by August-September 2019.Like Exambay on facebook for all latest updates on SSC CGL 2018 , SSC CGL 2019 and other upcoming exams

-

How do I fill out the CBSE class 12th compartment 2018 online form?

Here is the details:Step 1: Visit the official website www.cbse.nic.in.Step 2: Check out the “Recent Announcements” section.Step 3: Click on “Online Application for Class XII Compartment”Step 4: Now look for “Online Submission of LOC for Compartment/IOP Exam 2018” or “Online Application for Private Candidate for Comptt/IOP Examination 2018”.Step 5: Select a suitable link as per your class. Enter Roll Number, School Code, Centre Number and click on “Proceed” Button.Step 6: Now a form will be displayed on the screen. Fill the form carefully and submit. Pay attention and fill all your details correctly. If your details are incorrect, your form may get rejected.Step 7: After filling all your details correctly, upload the scanned copy of your photo and signature.Step 8: After uploading all your documents, go to the fee payment option. You can pay the fee via demand draft or e-challan.Step 9: After making the payment click on “Submit” button and take printout of confirmation page.Step 10: Now you have to send your documents to the address of regional office within 7 days. Documents including the photocopy of the confirmation page, photocopy of marksheet and e-challan or if you have paid via demand draft, then the original DD must be sent.Students who have successfully registered themselves for the exam may download their CBSE Compartment Admit Card once it is available on the official website.I hope you got your answer.

Create this form in 5 minutes!

How to create an eSignature for the form 541 k 1 2018 2019

How to make an eSignature for the Form 541 K 1 2018 2019 in the online mode

How to make an electronic signature for the Form 541 K 1 2018 2019 in Google Chrome

How to make an eSignature for signing the Form 541 K 1 2018 2019 in Gmail

How to generate an eSignature for the Form 541 K 1 2018 2019 right from your smartphone

How to create an eSignature for the Form 541 K 1 2018 2019 on iOS devices

How to make an eSignature for the Form 541 K 1 2018 2019 on Android devices

People also ask

-

What is the ftb 2018 form 541?

The ftb 2018 form 541 is the California tax return form specifically designed for fiduciaries of estates and trusts. This form is essential for reporting taxable income and calculating tax liabilities for these entities. Using airSlate SignNow can simplify the eSigning and submission process for this form.

-

How can airSlate SignNow help with the ftb 2018 form 541?

airSlate SignNow streamlines the process of completing and eSigning the ftb 2018 form 541. With its user-friendly interface, you can easily upload the document, add your signatures, and send it out for signing. This saves time and reduces the risk of errors in tax submissions.

-

Is there a cost associated with using airSlate SignNow for the ftb 2018 form 541?

Yes, airSlate SignNow offers various pricing plans tailored to different needs, including those looking to digitally sign the ftb 2018 form 541. You can choose from monthly or annual subscriptions based on your volume of use and specific requirements. It's designed to be a cost-effective solution for any business.

-

Can I integrate airSlate SignNow with other applications for filing the ftb 2018 form 541?

Absolutely! airSlate SignNow supports integration with numerous applications, enabling seamless workflows when filing the ftb 2018 form 541. This integration allows you to connect with accounting software or document management tools, enhancing your efficiency and organization.

-

What security features does airSlate SignNow provide for the ftb 2018 form 541?

airSlate SignNow prioritizes security with features like encrypted eSignatures and secure document storage. These measures ensure your sensitive information related to the ftb 2018 form 541 remains protected throughout the signing process. You can have peace of mind knowing your documents are safe.

-

Is it easy to use airSlate SignNow for signing the ftb 2018 form 541?

Yes, airSlate SignNow is designed to be user-friendly, making it easy for anyone to eSign the ftb 2018 form 541. The straightforward interface guides you through the entire process, which is perfect even for those unfamiliar with digital signing. Start signing in just a few clicks!

-

What benefits does airSlate SignNow offer for managing the ftb 2018 form 541?

Using airSlate SignNow for the ftb 2018 form 541 provides numerous benefits, including faster processing times, reduced paperwork, and less manual work. The automated workflow allows you to send documents for signature instantly, improving efficiency and accuracy in your tax filings.

Get more for California Tax Form 541 K 1

Find out other California Tax Form 541 K 1

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document

- Can I Sign Nevada Legal Form

- How Do I Sign New Jersey Legal Word

- Help Me With Sign New York Legal Document