Amended Quarterly Withholding Form Boone County, KY 2020

What is the Amended Quarterly Withholding Form for Boone County, KY?

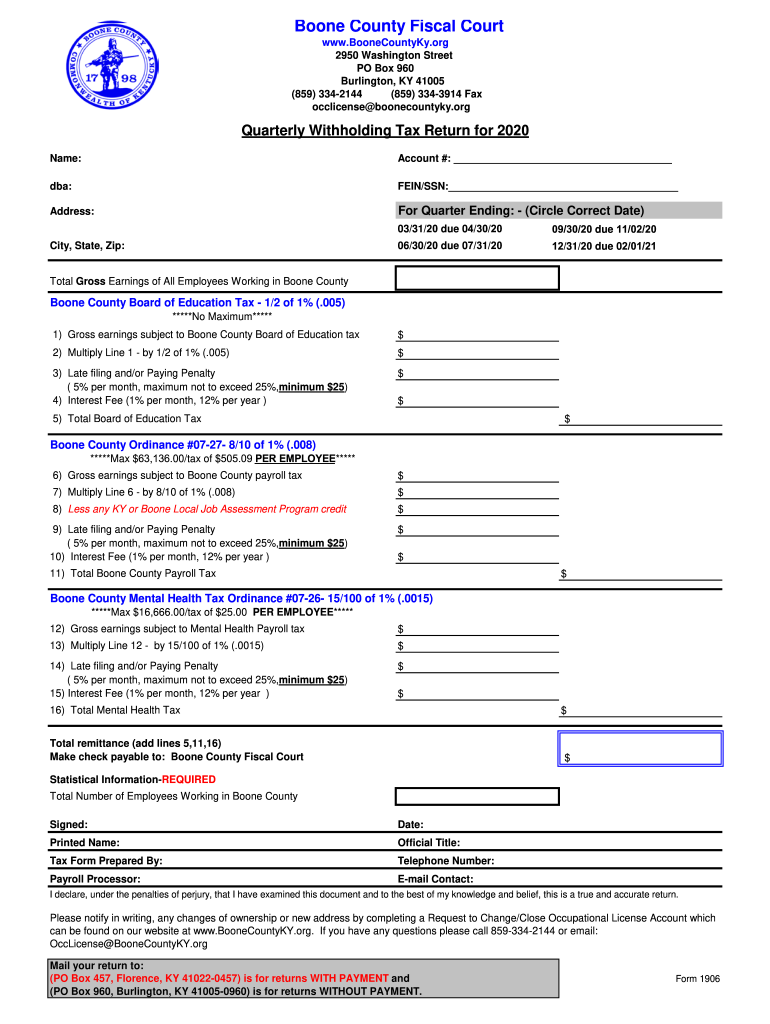

The Amended Quarterly Withholding Form for Boone County, KY, is a crucial document for employers who need to correct previously submitted withholding tax returns. This form allows businesses to amend their reported income tax withholdings, ensuring compliance with local tax regulations. It is essential for maintaining accurate tax records and avoiding potential penalties associated with incorrect filings.

Steps to Complete the Amended Quarterly Withholding Form for Boone County, KY

Completing the Amended Quarterly Withholding Form involves several key steps:

- Gather all relevant financial documents, including previous withholding tax returns and any supporting documentation.

- Clearly indicate the amendments being made, specifying the original amounts and the corrected figures.

- Ensure that all required fields are filled out accurately, including employer information and tax identification numbers.

- Review the form for any errors or omissions before submission.

How to Obtain the Amended Quarterly Withholding Form for Boone County, KY

The Amended Quarterly Withholding Form can be obtained through the Boone County fiscal court's website or directly from their office. It is advisable to ensure you have the most current version of the form, as updates may occur. Additionally, forms may be available at local tax offices or through state tax resources.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the Amended Quarterly Withholding Form is essential for compliance. Typically, amendments should be filed within a specific timeframe after the original return was submitted. Employers should check local regulations for exact dates to avoid late penalties.

Penalties for Non-Compliance

Failure to file the Amended Quarterly Withholding Form accurately and on time can result in significant penalties. These may include fines, interest on unpaid taxes, and potential legal consequences. It is crucial for employers to adhere to submission guidelines to mitigate these risks.

Digital vs. Paper Version

Employers have the option to submit the Amended Quarterly Withholding Form either digitally or via paper. Digital submissions can streamline the process, allowing for quicker processing times and easier tracking. However, some may prefer paper submissions for record-keeping purposes. Understanding the benefits and requirements of each method can help businesses choose the best option for their needs.

Quick guide on how to complete 2020 amended quarterly withholding form boone county ky

Complete Amended Quarterly Withholding Form Boone County, KY effortlessly on any device

Online document management has become widely embraced by businesses and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to obtain the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without any holdups. Handle Amended Quarterly Withholding Form Boone County, KY on any device via airSlate SignNow's Android or iOS applications and enhance any document-based task today.

The easiest method to alter and eSign Amended Quarterly Withholding Form Boone County, KY with ease

- Obtain Amended Quarterly Withholding Form Boone County, KY and then click Get Form to begin.

- Make use of the tools we offer to complete your form.

- Emphasize important sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Generate your eSignature with the Sign feature, which takes only seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and then click on the Done button to store your modifications.

- Decide how you wish to send your form, whether by email, text message (SMS), or an invitation link, or download it to your computer.

Eliminate the hassle of lost or misfiled documents, tedious searches for forms, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you select. Edit and eSign Amended Quarterly Withholding Form Boone County, KY to ensure effective communication at every phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2020 amended quarterly withholding form boone county ky

Create this form in 5 minutes!

How to create an eSignature for the 2020 amended quarterly withholding form boone county ky

How to create an electronic signature for a PDF file online

How to create an electronic signature for a PDF file in Google Chrome

How to create an electronic signature for signing PDFs in Gmail

The way to create an eSignature right from your mobile device

How to create an eSignature for a PDF file on iOS

The way to create an eSignature for a PDF on Android devices

People also ask

-

What is a highway quarterly tax return in Kentucky?

A highway quarterly tax return in Kentucky is a tax form that trucking companies and fleet operators must submit to report their fuel usage and mileage. This return helps ensure compliance with state tax regulations. It is essential for maintaining accurate records and can affect fuel tax refunds and assessments.

-

How can airSlate SignNow streamline the highway quarterly tax return process in Kentucky?

airSlate SignNow provides a user-friendly platform for submitting highway quarterly tax returns in Kentucky electronically. This solution enhances efficiency by allowing users to prepare, sign, and send documents quickly. Additionally, it reduces paperwork and accelerates workflow, making tax season smoother.

-

What features does airSlate SignNow offer for managing highway quarterly tax returns?

airSlate SignNow includes features such as customizable templates, electronic signatures, and document tracking designed specifically for managing highway quarterly tax returns in Kentucky. These features allow users to ensure that all documents are completed accurately and submitted on time. Additionally, the platform supports secure storage and easy sharing of important tax documents.

-

Is there a cost associated with using airSlate SignNow for highway quarterly tax returns?

Yes, airSlate SignNow offers various pricing plans that cater to businesses of all sizes needing to manage highway quarterly tax returns in Kentucky. The subscription includes access to essential features and customer support. Pricing is flexible, allowing businesses to choose a plan that fits their budget and needs.

-

Can airSlate SignNow integrate with accounting software for highway quarterly tax returns?

Absolutely! airSlate SignNow seamlessly integrates with popular accounting software, facilitating the management of highway quarterly tax returns in Kentucky. This integration enables users to sync financial data directly, ensuring accurate reporting and helping to streamline tax preparation processes. It saves time by reducing manual data entry.

-

How does electronic signature help in filing highway quarterly tax returns in Kentucky?

Using electronic signatures simplifies the filing of highway quarterly tax returns in Kentucky by enabling quick approvals and confirmations from all parties involved. This method is legally binding and helps eliminate the need for printing and scanning documents. Consequently, it speeds up the tax filing process and enhances overall efficiency.

-

What are the benefits of using airSlate SignNow for Kentucky highway quarterly tax returns?

The primary benefits of using airSlate SignNow for Kentucky highway quarterly tax returns include increased efficiency, compliance assurance, and enhanced security. The platform provides an easy-to-use interface that allows for swift document management and submission. Moreover, it helps reduce errors and delays, resulting in a more streamlined tax process.

Get more for Amended Quarterly Withholding Form Boone County, KY

- West virginia landlord 497431664 form

- Letter from landlord to tenant for failure to use electrical plumbing sanitary heating ventilating air conditioning and other 497431665 form

- Letter from landlord to tenant as notice to tenant of tenants disturbance of neighbors peaceful enjoyment to remedy or lease 497431666 form

- Tenant notice premises form

- Wv illegal law form

- Landlord rent increase 497431669 form

- West virginia tenant form

- Letter from landlord to tenant about intent to increase rent and effective date of rental increase west virginia form

Find out other Amended Quarterly Withholding Form Boone County, KY

- How To eSign South Dakota Construction Promissory Note Template

- eSign Education Word Oregon Secure

- How Do I eSign Hawaii Finance & Tax Accounting NDA

- eSign Georgia Finance & Tax Accounting POA Fast

- eSign Georgia Finance & Tax Accounting POA Simple

- How To eSign Oregon Education LLC Operating Agreement

- eSign Illinois Finance & Tax Accounting Resignation Letter Now

- eSign Texas Construction POA Mobile

- eSign Kansas Finance & Tax Accounting Stock Certificate Now

- eSign Tennessee Education Warranty Deed Online

- eSign Tennessee Education Warranty Deed Now

- eSign Texas Education LLC Operating Agreement Fast

- eSign Utah Education Warranty Deed Online

- eSign Utah Education Warranty Deed Later

- eSign West Virginia Construction Lease Agreement Online

- How To eSign West Virginia Construction Job Offer

- eSign West Virginia Construction Letter Of Intent Online

- eSign West Virginia Construction Arbitration Agreement Myself

- eSign West Virginia Education Resignation Letter Secure

- eSign Education PDF Wyoming Mobile