Establishing secure connection…Loading editor…Preparing document…

We are not affiliated with any brand or entity on this form.

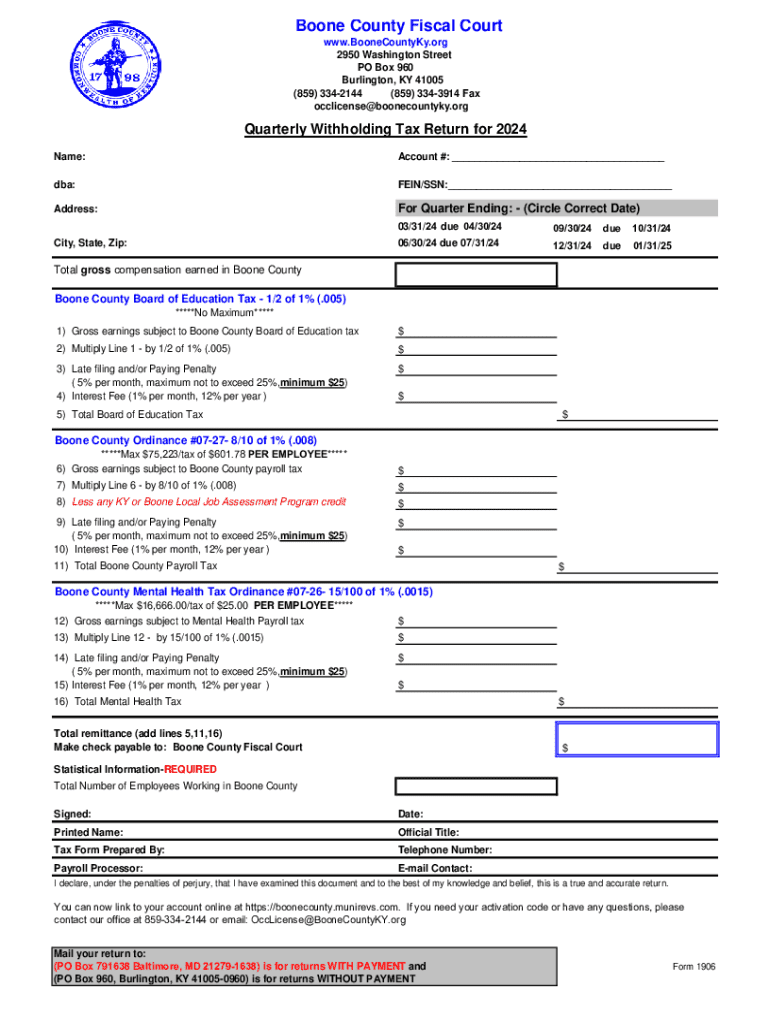

Payroll Tax Forms 2024-2026

be ready to get more

Create this form in 5 minutes or less

Find and fill out the correct payroll tax forms 735177095

Versions

Form popularity

Fillable & printable

4.6 Satisfied (121 Votes)

4.8 Satisfied (408 Votes)

4.8 Satisfied (1566 Votes)

4.8 Satisfied (1728 Votes)

4.8 Satisfied (1110 Votes)

4.8 Satisfied (3990 Votes)

4.7 Satisfied (565 Votes)

4.8 Satisfied (3043 Votes)

Create this form in 5 minutes!

How to create an eSignature for the payroll tax forms 735177095

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the significance of the year 1906 in relation to airSlate SignNow?

The year 1906 marks a pivotal moment in the evolution of document management and signing processes. airSlate SignNow builds on over a century of advancements to provide a modern, efficient eSigning solution. By leveraging historical insights, we ensure our platform meets contemporary business needs.

-

How does airSlate SignNow's pricing compare to other eSignature solutions?

airSlate SignNow offers competitive pricing that caters to businesses of all sizes. With plans starting at an affordable rate, you can access powerful features without breaking the bank. Our pricing model reflects the value of our services, especially when considering the efficiency gained since 1906.

-

What features does airSlate SignNow offer to enhance document signing?

airSlate SignNow provides a range of features designed to streamline the signing process. From customizable templates to real-time tracking, our platform ensures that your documents are handled efficiently. These features have evolved signNowly since 1906, making document management easier than ever.

-

What are the benefits of using airSlate SignNow for my business?

Using airSlate SignNow can greatly enhance your business operations by reducing turnaround times for document signing. Our user-friendly interface and robust features allow for seamless integration into your existing workflows. The benefits of adopting our solution are clear, especially when considering the advancements since 1906.

-

Can airSlate SignNow integrate with other software tools?

Yes, airSlate SignNow offers integrations with various software tools to enhance your workflow. Whether you use CRM systems, project management tools, or cloud storage services, our platform can connect seamlessly. This capability has been refined over the years, building on the legacy of innovation since 1906.

-

Is airSlate SignNow secure for handling sensitive documents?

Absolutely, airSlate SignNow prioritizes the security of your documents. We implement industry-standard encryption and compliance measures to protect sensitive information. Our commitment to security has been a cornerstone of our service since our inception, reflecting best practices established since 1906.

-

How can I get started with airSlate SignNow?

Getting started with airSlate SignNow is simple and straightforward. You can sign up for a free trial to explore our features and see how they can benefit your business. Join us in revolutionizing document management, a journey that has evolved since 1906.

Get more for Payroll Tax Forms

Find out other Payroll Tax Forms

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe

- eSignature Florida Real Estate Quitclaim Deed Online

- eSignature Arizona Sports Moving Checklist Now

- eSignature South Dakota Plumbing Emergency Contact Form Mobile

- eSignature South Dakota Plumbing Emergency Contact Form Safe

- Can I eSignature South Dakota Plumbing Emergency Contact Form

- eSignature Georgia Real Estate Affidavit Of Heirship Later

- eSignature Hawaii Real Estate Operating Agreement Online

- eSignature Idaho Real Estate Cease And Desist Letter Online

- eSignature Idaho Real Estate Cease And Desist Letter Simple

- eSignature Wyoming Plumbing Quitclaim Deed Myself

- eSignature Colorado Sports Living Will Mobile

be ready to get more

Get this form now!

If you believe that this page should be taken down, please follow our DMCA take down process here.