Instructions for Form 709 Instructions for Form 709, United States Gift and Generation Skipping Transfer Tax Return 2018

Understanding Form 709: United States Gift and Generation-Skipping Transfer Tax Return

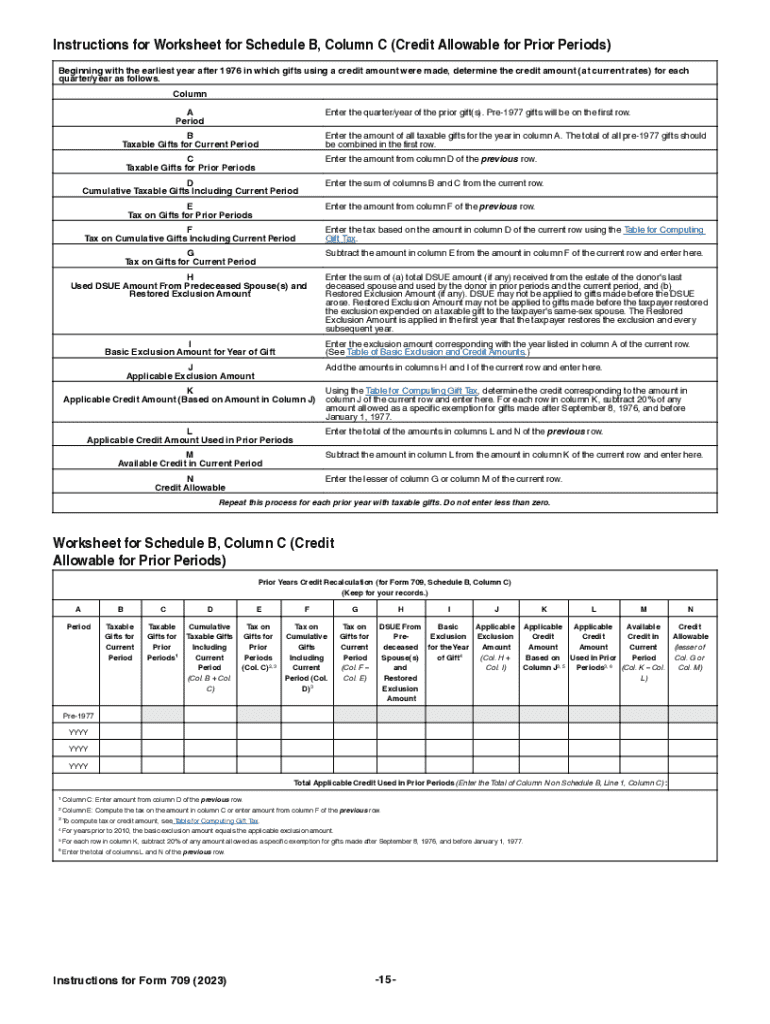

Form 709 is a crucial document for individuals who make gifts that exceed the annual exclusion limit or who engage in generation-skipping transfers. It is primarily used to report such gifts to the Internal Revenue Service (IRS) and to calculate any gift tax owed. The form ensures compliance with federal tax laws regarding gifts and transfers that may impact the estate tax. Understanding the nuances of this form is essential for proper tax planning and compliance.

Steps to Complete Form 709

Completing Form 709 involves several key steps:

- Gather necessary information about the gifts made, including the recipient's details and the value of each gift.

- Determine if any gifts qualify for exclusions or deductions, such as the annual exclusion amount.

- Fill out the form accurately, ensuring all required sections are completed, including Part 1 for the donor's information and Part 2 for the gifts made.

- Calculate any gift tax owed, if applicable, and ensure to include any prior gifts that may affect the current tax liability.

- Review the completed form for accuracy before submission.

Filing Deadlines for Form 709

Form 709 must be filed by April fifteenth of the year following the year in which the gifts were made. If the due date falls on a weekend or holiday, the deadline is extended to the next business day. It is important to adhere to this timeline to avoid penalties and interest on any taxes owed.

Required Documents for Form 709

To complete Form 709, you will need the following documents:

- Records of all gifts made during the tax year, including their values and recipients.

- Documentation of any prior gifts that may affect the current year's gift tax calculations.

- Information on any applicable exclusions or deductions, such as educational or medical expenses paid on behalf of others.

Legal Use of Form 709

Form 709 is legally required for individuals who exceed the annual gift tax exclusion limit. Failure to file this form when necessary can result in penalties and interest on unpaid taxes. It is essential for taxpayers to understand their obligations under federal tax law to avoid any legal complications.

IRS Guidelines for Form 709

The IRS provides detailed guidelines on how to complete Form 709, including instructions on reporting gifts and calculating any associated taxes. Taxpayers should refer to these guidelines to ensure compliance and accuracy in their filings. The IRS also updates these guidelines periodically, so it is important to use the most current version when preparing the form.

Quick guide on how to complete instructions for form 709 instructions for form 709 united states gift and generation skipping transfer tax return

Complete Instructions For Form 709 Instructions For Form 709, United States Gift and Generation Skipping Transfer Tax Return effortlessly on any device

Online document administration has gained popularity among businesses and individuals. It offers a great eco-friendly substitute to conventional printed and signed documents, as you can locate the appropriate form and safely store it online. airSlate SignNow equips you with all the resources you need to create, alter, and eSign your documents quickly without delays. Manage Instructions For Form 709 Instructions For Form 709, United States Gift and Generation Skipping Transfer Tax Return on any device with airSlate SignNow's Android or iOS applications and streamline any document-centric process today.

The best way to alter and eSign Instructions For Form 709 Instructions For Form 709, United States Gift and Generation Skipping Transfer Tax Return without any hassle

- Locate Instructions For Form 709 Instructions For Form 709, United States Gift and Generation Skipping Transfer Tax Return and click Obtain Form to begin.

- Utilize the tools we offer to submit your document.

- Emphasize important sections of your documents or conceal sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click the Finish button to save your modifications.

- Choose how you want to share your form, via email, text message (SMS), or invite link, or download it to your computer.

Put an end to misplaced or missing files, tedious form searches, or errors that necessitate printing new copies of documents. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Alter and eSign Instructions For Form 709 Instructions For Form 709, United States Gift and Generation Skipping Transfer Tax Return and guarantee outstanding communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct instructions for form 709 instructions for form 709 united states gift and generation skipping transfer tax return

Create this form in 5 minutes!

How to create an eSignature for the instructions for form 709 instructions for form 709 united states gift and generation skipping transfer tax return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the Instructions For Form 709, Instructions For Form 709, United States Gift and Generation Skipping Transfer Tax Return?

The Instructions For Form 709, Instructions For Form 709, United States Gift and Generation Skipping Transfer Tax Return, provide essential guidelines for taxpayers who need to report gifts and generation-skipping transfers. These instructions detail how to complete the form accurately to comply with federal tax regulations.

-

How can airSlate SignNow assist me with the Instructions For Form 709?

AirSlate SignNow can streamline your document management when dealing with the Instructions For Form 709, Instructions For Form 709, United States Gift and Generation Skipping Transfer Tax Return. Our platform allows you to create, edit, and eSign forms with ease, ensuring your submissions are handled quickly and securely.

-

What features does airSlate SignNow offer for handling tax documents?

AirSlate SignNow provides features such as customizable templates, legal electronic signatures, and real-time collaboration, making it ideal for managing tax documents. These tools facilitate the efficient completion of forms like the Instructions For Form 709, Instructions For Form 709, United States Gift and Generation Skipping Transfer Tax Return.

-

Is airSlate SignNow cost-effective for individuals filing the Instructions For Form 709?

Yes, airSlate SignNow offers competitive pricing plans designed to be cost-effective for both individuals and businesses. Utilizing our service to manage the Instructions For Form 709, Instructions For Form 709, United States Gift and Generation Skipping Transfer Tax Return can ultimately save you time and money.

-

Can I integrate airSlate SignNow with other applications for tax management?

Absolutely! AirSlate SignNow allows for seamless integration with various applications such as cloud storage and accounting software, enhancing your workflow efficiency. This facilitates the handling of the Instructions For Form 709, Instructions For Form 709, United States Gift and Generation Skipping Transfer Tax Return in conjunction with your existing tax management tools.

-

What are the benefits of using airSlate SignNow for tax filing?

Using airSlate SignNow for tax filing simplifies the process by enabling secure document handling, easier collaboration with tax advisors, and faster turnaround times. These advantages are particularly helpful for efficiently managing the Instructions For Form 709, Instructions For Form 709, United States Gift and Generation Skipping Transfer Tax Return.

-

How secure is airSlate SignNow when filing sensitive tax documents?

AirSlate SignNow prioritizes security by employing advanced encryption technologies to protect sensitive information during transactions. You can confidently file your Instructions For Form 709, Instructions For Form 709, United States Gift and Generation Skipping Transfer Tax Return, knowing your data is safeguarded.

Get more for Instructions For Form 709 Instructions For Form 709, United States Gift and Generation Skipping Transfer Tax Return

Find out other Instructions For Form 709 Instructions For Form 709, United States Gift and Generation Skipping Transfer Tax Return

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors