Federal Tax Tables 2017

Understanding the Federal Tax Tables

The Federal Tax Tables are essential tools used by taxpayers to determine their federal income tax liability. These tables provide the tax rates applicable to various income levels and filing statuses, such as single, married filing jointly, or head of household. By referencing these tables, individuals can accurately calculate their tax obligations based on their taxable income.

How to Use the Federal Tax Tables

To use the Federal Tax Tables effectively, taxpayers should first identify their filing status and the corresponding income range. The tables list tax rates for each income bracket, allowing users to locate their specific income level. By following the table, taxpayers can determine the exact amount of tax owed. It's important to ensure that all income sources are considered when calculating total taxable income.

Filing Deadlines / Important Dates

Taxpayers should be aware of the key deadlines associated with filing their federal income tax returns. Typically, the deadline for filing is April 15 of each year. However, if this date falls on a weekend or holiday, the deadline may be extended. Additionally, taxpayers should note that extensions for filing do not extend the time to pay any taxes owed. Being mindful of these dates helps avoid penalties and interest charges.

Required Documents

To complete IRS Form 6251, taxpayers need several documents to ensure accurate reporting. Key documents include W-2 forms from employers, 1099 forms for other income sources, and any relevant deduction or credit documentation. Gathering these documents beforehand streamlines the process of filling out the form and helps prevent errors that could lead to delays or audits.

IRS Guidelines

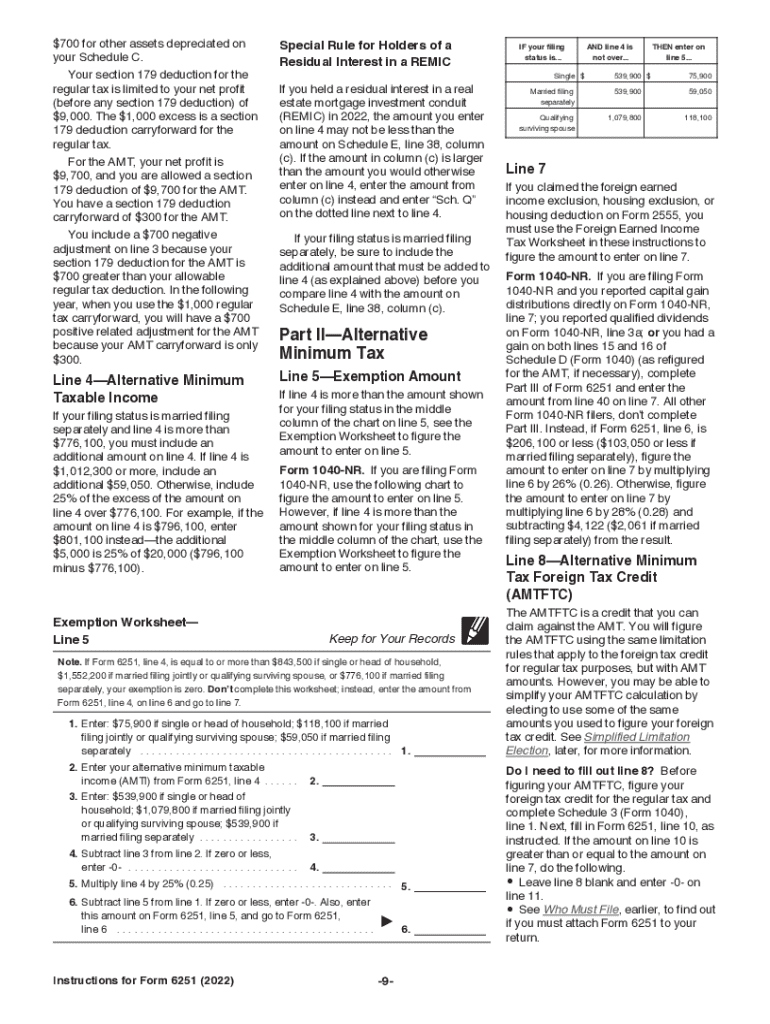

The IRS provides comprehensive guidelines for completing Form 6251, which addresses the Alternative Minimum Tax (AMT). These guidelines outline eligibility criteria, calculation methods, and necessary disclosures. Taxpayers should review these instructions carefully to ensure compliance and to understand how AMT may impact their overall tax liability.

Penalties for Non-Compliance

Failing to comply with tax regulations can result in significant penalties. For instance, if a taxpayer does not file Form 6251 when required, they may face fines or additional taxes owed. Understanding the consequences of non-compliance emphasizes the importance of accurate and timely filing. Taxpayers are encouraged to seek assistance if they are unsure about their obligations.

Quick guide on how to complete federal tax tables

Complete Federal Tax Tables with ease on any device

Digital document management has gained traction among businesses and individuals. It serves as an ideal environmentally friendly alternative to traditional printed and signed papers, allowing you to access the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents quickly and efficiently. Handle Federal Tax Tables on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The simplest way to modify and eSign Federal Tax Tables effortlessly

- Obtain Federal Tax Tables and click on Get Form to begin.

- Utilize the features we provide to complete your document.

- Emphasize important parts of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional moist ink signature.

- Review all the information and click on the Done button to save your adjustments.

- Choose how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns over lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any chosen device. Edit and eSign Federal Tax Tables and maintain effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct federal tax tables

Create this form in 5 minutes!

How to create an eSignature for the federal tax tables

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the IRS Form 6251 instructions?

The IRS Form 6251 instructions provide guidance on how to calculate the Alternative Minimum Tax (AMT). This form is required for taxpayers whose income exceeds certain thresholds. Understanding these instructions is crucial for accurate tax reporting and avoiding potential penalties.

-

How can airSlate SignNow help with IRS Form 6251 instructions?

AirSlate SignNow streamlines the document signing process, allowing you to easily send and eSign tax forms, including those related to IRS Form 6251 instructions. This feature ensures that all necessary signatures are collected efficiently and securely, making tax preparation simpler.

-

Is there a cost associated with using airSlate SignNow for tax forms like IRS Form 6251?

AirSlate SignNow offers cost-effective pricing plans designed to accommodate businesses of all sizes. By investing in this solution, you gain access to features that facilitate the electronic signing of critical documents, including IRS Form 6251 instructions, which can save you time and resources.

-

What features does airSlate SignNow offer for managing IRS Form 6251 instructions?

AirSlate SignNow provides a user-friendly interface for managing documents, including templates for IRS Form 6251 instructions. Key features include real-time tracking, reminders, and the ability to customize workflows, all aimed at enhancing your document management experience.

-

Can airSlate SignNow be integrated with other accounting software for IRS Form 6251 instructions?

Yes, airSlate SignNow easily integrates with various accounting and tax preparation software to streamline your processes related to IRS Form 6251 instructions. This integration allows for seamless data transfer, reducing manual entry and improving overall efficiency.

-

What are the benefits of using airSlate SignNow for IRS Form 6251 instructions?

Using airSlate SignNow for IRS Form 6251 instructions enhances efficiency, reduces the chances of errors, and ensures compliance with tax regulations. Its digital signature capabilities make it simple to collect necessary approvals without the hassle of paper forms.

-

How does airSlate SignNow ensure the security of IRS Form 6251 instructions?

AirSlate SignNow prioritizes security with advanced encryption and compliance with regulations like GDPR and HIPAA. This commitment ensures that your IRS Form 6251 instructions and other sensitive documents are protected throughout the entire signing and storage process.

Get more for Federal Tax Tables

- Subp 020 editable and saveable california judicial council forms

- 1120s s corporation tax return checklist mini form

- And regulatory services form

- Unreasonable to live at home form

- Client history questionnaire dermatologyallergy university of uwveterinarycare wisc form

- 90 day chronological bible reading plan form

- Tff application santa barbara form

- Enterprise software license agreement template form

Find out other Federal Tax Tables

- eSignature Massachusetts Redemption Agreement Simple

- eSignature North Carolina Redemption Agreement Mobile

- eSignature Utah Equipment Rental Agreement Template Now

- Help Me With eSignature Texas Construction Contract Template

- eSignature Illinois Architectural Proposal Template Simple

- Can I eSignature Indiana Home Improvement Contract

- How Do I eSignature Maryland Home Improvement Contract

- eSignature Missouri Business Insurance Quotation Form Mobile

- eSignature Iowa Car Insurance Quotation Form Online

- eSignature Missouri Car Insurance Quotation Form Online

- eSignature New Jersey Car Insurance Quotation Form Now

- eSignature Hawaii Life-Insurance Quote Form Easy

- How To eSignature Delaware Certeficate of Insurance Request

- eSignature New York Fundraising Registration Form Simple

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking