Instructions for Form 8804 W WORKSHEET 2023

Understanding Form 8804 and Its Purpose

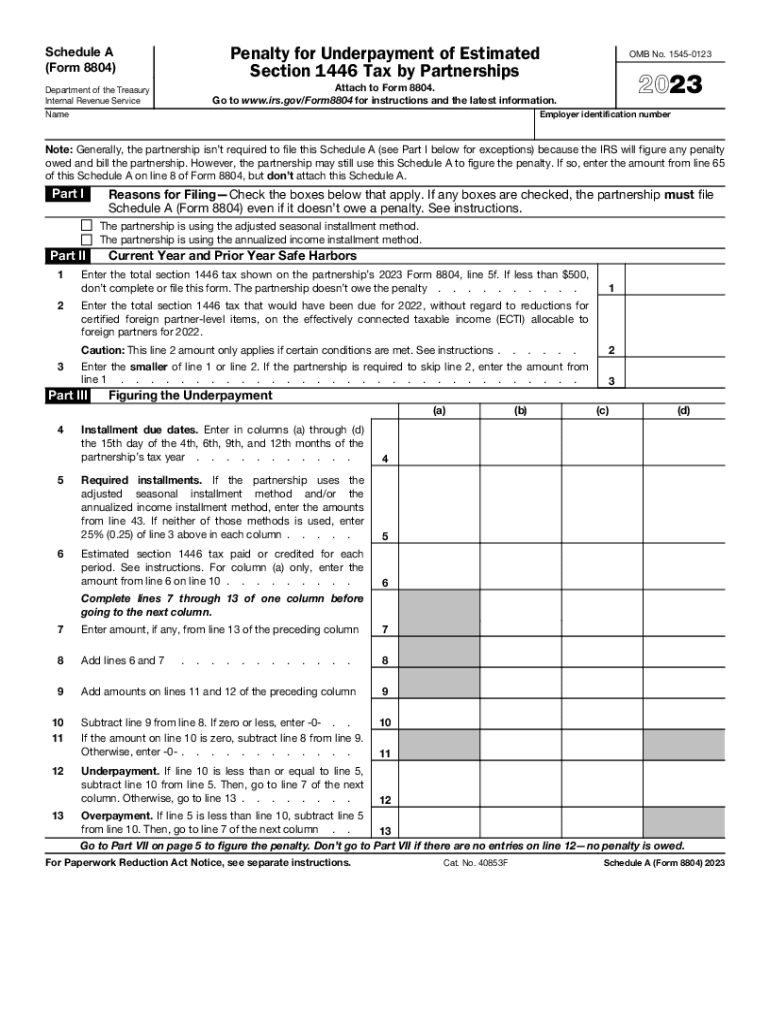

Form 8804 is a tax form used by partnerships to report and pay the withholding tax on effectively connected income allocable to foreign partners. This form is essential for ensuring compliance with U.S. tax laws and helps partnerships fulfill their obligations regarding tax withholding. The form is specifically designed for partnerships that have foreign partners and must report tax liabilities on their behalf. Understanding the purpose of Form 8804 is crucial for any partnership operating with international stakeholders.

Steps to Complete Form 8804

Completing Form 8804 involves several key steps to ensure accuracy and compliance. First, gather all necessary information about the partnership and its foreign partners, including their names, addresses, and taxpayer identification numbers. Next, calculate the total effectively connected income and determine the withholding tax amount that applies to each foreign partner. Fill out the form carefully, ensuring that all figures are accurate and that the appropriate sections are completed. Finally, review the form for any errors before submission.

Filing Deadlines for Form 8804

Timely filing of Form 8804 is critical to avoid penalties. Generally, Form 8804 must be filed by the 15th day of the fourth month following the end of the partnership's tax year. For partnerships operating on a calendar year, this means the deadline is April 15. It is important to stay informed about any changes to filing deadlines, especially if they fall on a weekend or holiday, which may affect the due date.

IRS Guidelines for Form 8804

The IRS provides detailed guidelines for completing and submitting Form 8804. These guidelines outline the requirements for partnerships, the information needed to fill out the form, and the procedures for remitting payment for any taxes due. Partnerships should carefully review the IRS instructions to ensure compliance with all regulations and to avoid potential issues during the filing process. Adhering to these guidelines is essential for maintaining good standing with the IRS.

Required Documents for Form 8804

To successfully complete Form 8804, several documents are typically required. Partnerships should have access to their financial statements, records of income earned, and details regarding each foreign partner's share of income. Additionally, any prior tax filings related to foreign partners may be necessary to ensure accurate reporting. Having these documents organized and readily available can streamline the filing process.

Penalties for Non-Compliance with Form 8804

Failure to file Form 8804 accurately and on time can result in significant penalties. The IRS imposes fines for late filings, inaccuracies, and failure to pay the required withholding tax. Partnerships may face both monetary penalties and interest on unpaid taxes. Understanding the implications of non-compliance underscores the importance of timely and accurate submissions.

Examples of Using Form 8804

Form 8804 is utilized in various scenarios involving partnerships with foreign partners. For instance, if a partnership earns income from U.S. sources and allocates a portion of that income to a foreign partner, it must use Form 8804 to report the withholding tax on that income. Another example includes partnerships that have multiple foreign partners, each with different income allocations, necessitating careful calculations and reporting on the form. These examples highlight the practical applications of Form 8804 in real-world partnership scenarios.

Quick guide on how to complete instructions for form 8804 w worksheet

Effortlessly prepare Instructions For Form 8804 W WORKSHEET on any device

Digital document management has gained popularity among businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can easily locate the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly and without interruptions. Manage Instructions For Form 8804 W WORKSHEET on any device using the airSlate SignNow Android or iOS applications and streamline any document-related process today.

The easiest way to modify and electronically sign Instructions For Form 8804 W WORKSHEET with ease

- Obtain Instructions For Form 8804 W WORKSHEET and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize pertinent parts of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review the information and click on the Done button to save your updates.

- Select how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, time-consuming form searches, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from your preferred device. Edit and electronically sign Instructions For Form 8804 W WORKSHEET to ensure effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct instructions for form 8804 w worksheet

Create this form in 5 minutes!

How to create an eSignature for the instructions for form 8804 w worksheet

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 8804 and why is it important?

Form 8804 is a tax form used by partnerships to report their U.S. income tax liability. It is essential for ensuring compliance with tax regulations and properly reporting taxes withheld on behalf of foreign partners. Understanding form 8804 helps businesses avoid penalties related to tax reporting.

-

How can airSlate SignNow assist with form 8804?

AirSlate SignNow streamlines the process of preparing and signing form 8804, making tax submissions more efficient. With its user-friendly interface, you can easily create and eSign form 8804, helping ensure accuracy and compliance. This solution reduces the hassle associated with tax documentation.

-

Are there any costs associated with using airSlate SignNow for form 8804?

Yes, airSlate SignNow offers several pricing plans that cater to different businesses' needs, including those who need to handle form 8804. These plans are structured to be cost-effective, ensuring you get value for your investment while accessing features that support tax compliance. Explore our pricing page for more detailed information.

-

What integrations does airSlate SignNow offer for form 8804?

AirSlate SignNow integrates with various applications, enhancing your workflow when dealing with form 8804. Whether you are using accounting software or cloud storage solutions, these integrations facilitate a seamless experience, allowing easy access to necessary documents and data. This streamlines the eSigning process for tax forms like 8804.

-

Can I customize my form 8804 templates with airSlate SignNow?

Absolutely! AirSlate SignNow allows you to create customizable templates for form 8804. This feature ensures that you can tailor the document to meet specific requirements while maintaining compliance with tax regulations. Custom templates help save time and eliminate errors during the eSigning process.

-

Is airSlate SignNow secure for filing sensitive forms like 8804?

Yes, airSlate SignNow prioritizes security, making it a safe choice for filing sensitive documents such as form 8804. The platform employs advanced encryption protocols and compliance measures to protect your data. You can confidently eSign and manage your tax documents without worrying about security bsignNowes.

-

What features does airSlate SignNow offer for managing form 8804 submissions?

AirSlate SignNow provides an array of features designed to simplify the management of form 8804 submissions. These include eSignature capabilities, real-time tracking, reminders, and notifications, ensuring that you stay organized and on top of your tax filing obligations. Such features enhance overall efficiency and accuracy.

Get more for Instructions For Form 8804 W WORKSHEET

Find out other Instructions For Form 8804 W WORKSHEET

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document

- How Can I Electronic signature Delaware Banking PDF

- Can I Electronic signature Hawaii Banking Document

- Can I eSignature North Carolina Courts Presentation

- Can I eSignature Oklahoma Courts Word

- How To Electronic signature Alabama Business Operations Form

- Help Me With Electronic signature Alabama Car Dealer Presentation

- How Can I Electronic signature California Car Dealer PDF

- How Can I Electronic signature California Car Dealer Document

- How Can I Electronic signature Colorado Car Dealer Form

- How To Electronic signature Florida Car Dealer Word

- How Do I Electronic signature Florida Car Dealer Document

- Help Me With Electronic signature Florida Car Dealer Presentation

- Can I Electronic signature Georgia Car Dealer PDF

- How Do I Electronic signature Georgia Car Dealer Document

- Can I Electronic signature Georgia Car Dealer Form