About Form 8804 W, Installment Payments of Section 1446 2024-2026

Understanding Form 8804

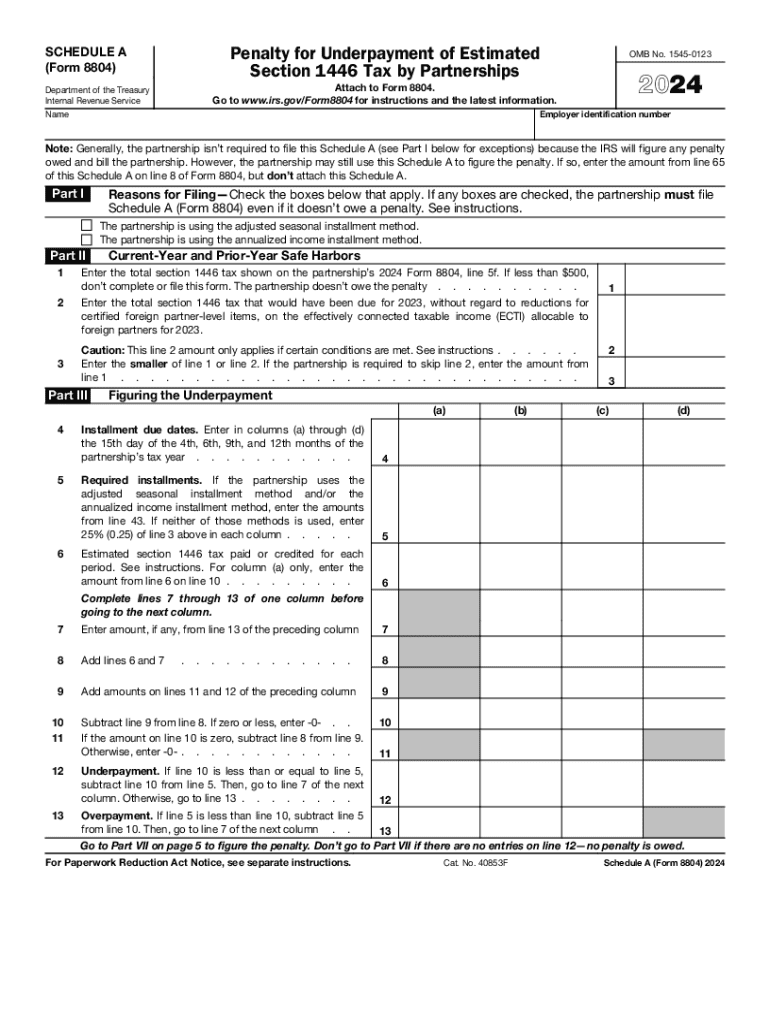

Form 8804 is a tax form used by partnerships to report and pay the installment payments of tax under Section 1446. This form is essential for partnerships that have effectively connected taxable income allocable to foreign partners. It ensures that the IRS receives the appropriate tax payments on behalf of these partners, helping to maintain compliance with U.S. tax regulations.

Steps to Complete Form 8804

Completing Form 8804 involves several key steps:

- Gather necessary information, including the partnership’s name, address, and Employer Identification Number (EIN).

- Calculate the total effectively connected taxable income for the partnership.

- Determine the tax liability for foreign partners based on their share of the income.

- Complete the form by entering the calculated amounts in the appropriate sections.

- Review the form for accuracy before submission.

Filing Deadlines for Form 8804

Partnerships must file Form 8804 by the 15th day of the fourth month following the end of the partnership’s tax year. For partnerships operating on a calendar year, this means the deadline is April 15. It is crucial to adhere to these deadlines to avoid penalties and ensure compliance with IRS regulations.

Required Documents for Form 8804

To complete Form 8804, partnerships need to have the following documents ready:

- Partnership agreement and any amendments.

- Financial statements reflecting the partnership's income.

- Records of distributions to partners.

- Any prior year Form 8804 filings for reference.

IRS Guidelines for Form 8804

The IRS provides specific guidelines for completing and filing Form 8804. These guidelines include instructions on calculating tax liabilities, determining the amounts owed, and filing procedures. It is important to consult the latest IRS instructions to ensure compliance and accuracy in reporting.

Penalties for Non-Compliance

Failing to file Form 8804 or filing it late can result in significant penalties. The IRS may impose fines based on the amount of tax owed and the duration of the delay. Additionally, partnerships may face interest charges on unpaid taxes, making timely filing essential to avoid unnecessary financial burdens.

Create this form in 5 minutes or less

Find and fill out the correct about form 8804 w installment payments of section 1446

Create this form in 5 minutes!

How to create an eSignature for the about form 8804 w installment payments of section 1446

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the form 8804 instructions?

The form 8804 instructions provide detailed guidance on how to complete and file Form 8804, which is used by partnerships to report their tax liabilities. Understanding these instructions is crucial for ensuring compliance with IRS regulations and avoiding penalties.

-

How can airSlate SignNow help with form 8804 instructions?

airSlate SignNow simplifies the process of completing and submitting your form 8804 by allowing you to eSign documents securely and efficiently. Our platform provides templates and tools that can help you follow the form 8804 instructions accurately.

-

Are there any costs associated with using airSlate SignNow for form 8804 instructions?

Yes, airSlate SignNow offers various pricing plans to suit different business needs. Each plan provides access to features that can assist you in following the form 8804 instructions, ensuring you have the tools necessary for compliance.

-

What features does airSlate SignNow offer for managing form 8804 instructions?

airSlate SignNow includes features such as document templates, eSignature capabilities, and real-time collaboration tools. These features make it easier to manage the requirements outlined in the form 8804 instructions and streamline your filing process.

-

Can I integrate airSlate SignNow with other software for form 8804 instructions?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and tax software, enhancing your ability to follow the form 8804 instructions. This integration allows for a more efficient workflow and reduces the chances of errors.

-

What are the benefits of using airSlate SignNow for form 8804 instructions?

Using airSlate SignNow for form 8804 instructions offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform ensures that your documents are handled securely while providing a user-friendly experience.

-

Is there customer support available for questions about form 8804 instructions?

Yes, airSlate SignNow provides dedicated customer support to assist you with any questions regarding form 8804 instructions. Our team is available to help you navigate the process and ensure you have all the information you need.

Get more for About Form 8804 W, Installment Payments Of Section 1446

- Notarized authorization for release of records from the department of economic opportunity form

- N260 excel form

- Veterinary consent form template

- 504 teacher input form 44285377

- Oracle jrockit the definitive guide form

- Rockwood school district physical form

- High mileage appeal greenville sc form

- When completed mail to city of philadelphia department of licenses and inspections department of licenses and inspections form

Find out other About Form 8804 W, Installment Payments Of Section 1446

- How To Electronic signature Tennessee Healthcare / Medical Word

- Can I Electronic signature Hawaii Insurance PDF

- Help Me With Electronic signature Colorado High Tech Form

- How To Electronic signature Indiana Insurance Document

- Can I Electronic signature Virginia Education Word

- How To Electronic signature Louisiana Insurance Document

- Can I Electronic signature Florida High Tech Document

- Can I Electronic signature Minnesota Insurance PDF

- How Do I Electronic signature Minnesota Insurance Document

- How To Electronic signature Missouri Insurance Form

- How Can I Electronic signature New Jersey Insurance Document

- How To Electronic signature Indiana High Tech Document

- How Do I Electronic signature Indiana High Tech Document

- How Can I Electronic signature Ohio Insurance Document

- Can I Electronic signature South Dakota Insurance PPT

- How Can I Electronic signature Maine Lawers PPT

- How To Electronic signature Maine Lawers PPT

- Help Me With Electronic signature Minnesota Lawers PDF

- How To Electronic signature Ohio High Tech Presentation

- How Can I Electronic signature Alabama Legal PDF