Schedule a Form 8804 Penalty for Underpayment of Estimated Section 1446 Tax by Partnerships 2022

Understanding the Penalty for Underpayment of Estimated Section 1446 Tax by Partnerships

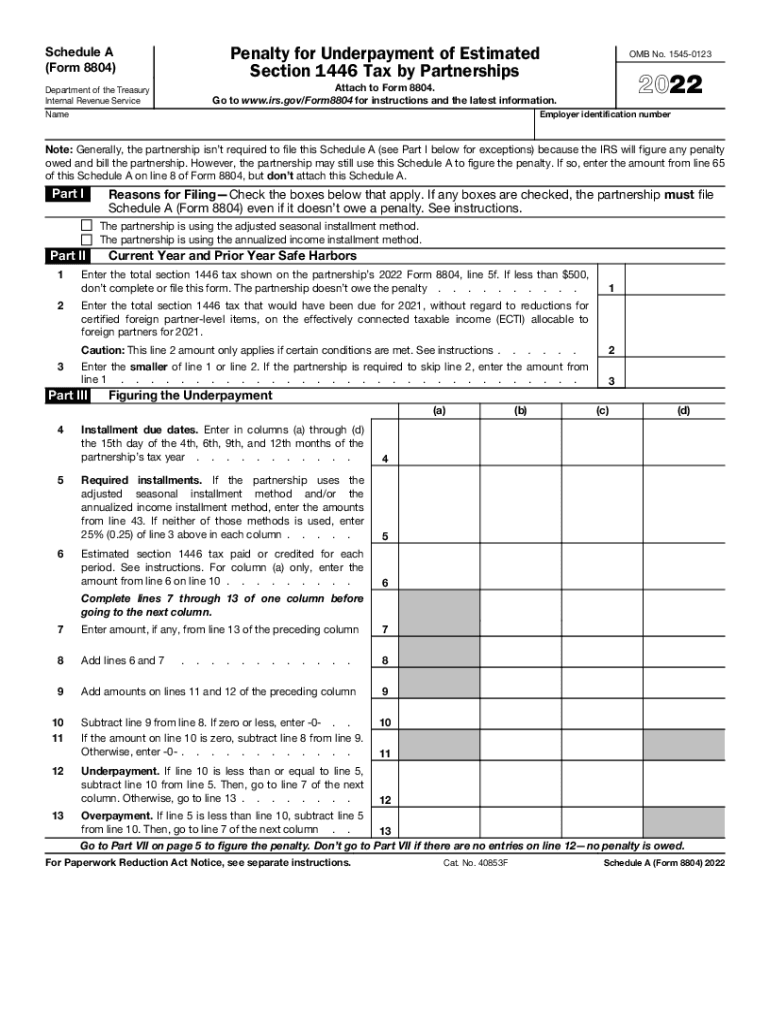

The Schedule A Form 8804 addresses penalties associated with the underpayment of estimated Section 1446 tax by partnerships. This penalty is applicable when a partnership fails to pay the required estimated tax amounts throughout the year. The IRS imposes this penalty to encourage timely payments and compliance with tax obligations. The amount of the penalty is generally calculated based on the underpayment amount and the period of underpayment, which can lead to significant financial consequences if not addressed promptly.

Steps to Complete the Schedule A Form 8804 for Penalty Calculation

Completing the Schedule A Form 8804 involves several key steps to ensure accurate reporting and compliance. First, gather all necessary financial records, including income statements and prior tax filings. Next, calculate the total tax liability for the year, including any adjustments for prior underpayments. Then, determine the estimated tax payments made throughout the year. The difference between the total tax liability and the estimated payments will help identify any potential underpayment. Finally, fill out the Schedule A Form 8804 accurately, ensuring all calculations are correct to avoid further penalties.

IRS Guidelines for Schedule A Form 8804

The IRS provides specific guidelines for the completion and submission of Schedule A Form 8804. These guidelines include instructions on how to calculate the penalty for underpayment and the necessary documentation required for submission. It is crucial to adhere to these guidelines to ensure compliance and avoid additional penalties. The IRS also outlines the deadlines for filing the form, which typically align with the partnership's tax return due dates. Familiarizing oneself with these guidelines can help streamline the filing process and minimize errors.

Filing Deadlines and Important Dates for Schedule A Form 8804

Timely filing of the Schedule A Form 8804 is essential to avoid penalties. The form is generally due on the same date as the partnership's tax return. Partnerships should be aware of the specific deadlines, which may vary based on the entity type and fiscal year. For partnerships following a calendar year, the due date is typically March 15 of the following year. If additional time is needed, partnerships may file for an extension, but it is important to note that this does not extend the time to pay any estimated taxes owed.

Required Documents for Completing Schedule A Form 8804

To complete the Schedule A Form 8804, certain documents are necessary to ensure accurate reporting. These include financial statements, prior year tax returns, and records of estimated tax payments made throughout the year. Additionally, any correspondence from the IRS regarding previous penalties or adjustments should be included. Having these documents readily available will facilitate the completion of the form and help ensure that all required information is accurately reported.

Consequences of Non-Compliance with Schedule A Form 8804

Failure to comply with the requirements of the Schedule A Form 8804 can result in significant penalties. The IRS may impose additional fines for late filing or underpayment of estimated taxes. Furthermore, non-compliance can lead to increased scrutiny from the IRS, potentially resulting in audits or further legal action. It is essential for partnerships to understand these consequences and take proactive measures to ensure compliance with all tax obligations.

Quick guide on how to complete 2022 schedule a form 8804 penalty for underpayment of estimated section 1446 tax by partnerships

Complete Schedule A Form 8804 Penalty For Underpayment Of Estimated Section 1446 Tax By Partnerships effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to access the right form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, modify, and eSign your documents swiftly without hold-ups. Handle Schedule A Form 8804 Penalty For Underpayment Of Estimated Section 1446 Tax By Partnerships on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to alter and eSign Schedule A Form 8804 Penalty For Underpayment Of Estimated Section 1446 Tax By Partnerships with ease

- Locate Schedule A Form 8804 Penalty For Underpayment Of Estimated Section 1446 Tax By Partnerships and click on Get Form to begin.

- Make use of the tools we provide to fill out your document.

- Highlight important sections of your documents or redact sensitive information with the tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which takes seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and then click the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tiresome form searches, or errors that require printing new copies. airSlate SignNow meets your needs in document management in just a few clicks from any device you prefer. Edit and eSign Schedule A Form 8804 Penalty For Underpayment Of Estimated Section 1446 Tax By Partnerships and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2022 schedule a form 8804 penalty for underpayment of estimated section 1446 tax by partnerships

Create this form in 5 minutes!

How to create an eSignature for the 2022 schedule a form 8804 penalty for underpayment of estimated section 1446 tax by partnerships

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 8804 and whom does it concern?

Form 8804 is a tax form filed by partnerships to report taxes on effectively connected income allocable to foreign partners. This form is crucial for partnerships with non-U.S. partners to ensure compliance with U.S. tax regulations.

-

How can airSlate SignNow assist with electronically signing Form 8804?

airSlate SignNow provides a streamlined platform for electronically signing Form 8804, making the process quick and efficient. With our user-friendly interface, partners can easily review and sign the document without any hassles.

-

What features does airSlate SignNow offer for managing Form 8804?

airSlate SignNow includes features such as document templates, in-app signing, and secure cloud storage that are particularly beneficial for managing Form 8804. These tools help ensure that all parties involved can efficiently handle their tax obligations.

-

Is airSlate SignNow affordable for small businesses filing Form 8804?

Yes, airSlate SignNow offers affordable pricing plans tailored for small businesses, making it cost-effective for those who need to file Form 8804. Our pricing structures are designed to provide value while ensuring compliance with tax requirements.

-

Can airSlate SignNow integrate with accounting software for Form 8804 submissions?

Absolutely! airSlate SignNow seamlessly integrates with various accounting software, simplifying the process of filing Form 8804. This integration allows for a smoother workflow, ensuring that documents are prepared and submitted accurately.

-

What are the benefits of using airSlate SignNow for Form 8804?

Using airSlate SignNow for Form 8804 provides numerous benefits, including improved efficiency, secure document handling, and easy collaboration among partners. Our platform helps ensure that your tax filings are not only correct but also timely.

-

How secure is the information shared while signing Form 8804 with airSlate SignNow?

airSlate SignNow prioritizes security, employing advanced encryption and secure servers to protect the information shared while signing Form 8804. You can trust that your sensitive data will remain confidential and safe.

Get more for Schedule A Form 8804 Penalty For Underpayment Of Estimated Section 1446 Tax By Partnerships

Find out other Schedule A Form 8804 Penalty For Underpayment Of Estimated Section 1446 Tax By Partnerships

- eSign Vermont Sports Stock Certificate Secure

- eSign Tennessee Police Cease And Desist Letter Now

- Help Me With eSign Texas Police Promissory Note Template

- eSign Utah Police LLC Operating Agreement Online

- eSign West Virginia Police Lease Agreement Online

- eSign Wyoming Sports Residential Lease Agreement Online

- How Do I eSign West Virginia Police Quitclaim Deed

- eSignature Arizona Banking Moving Checklist Secure

- eSignature California Banking Warranty Deed Later

- eSignature Alabama Business Operations Cease And Desist Letter Now

- How To eSignature Iowa Banking Quitclaim Deed

- How To eSignature Michigan Banking Job Description Template

- eSignature Missouri Banking IOU Simple

- eSignature Banking PDF New Hampshire Secure

- How Do I eSignature Alabama Car Dealer Quitclaim Deed

- eSignature Delaware Business Operations Forbearance Agreement Fast

- How To eSignature Ohio Banking Business Plan Template

- eSignature Georgia Business Operations Limited Power Of Attorney Online

- Help Me With eSignature South Carolina Banking Job Offer

- eSignature Tennessee Banking Affidavit Of Heirship Online