Form 8606 2022

What is the Form 8606

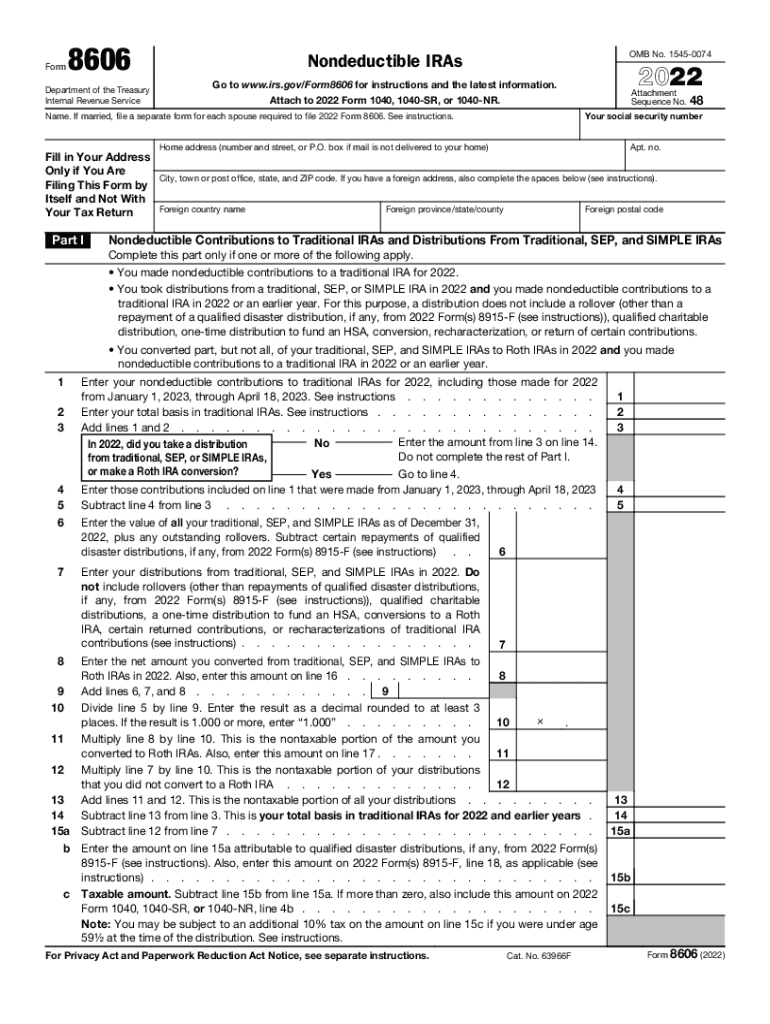

The 2013 Form 8606 is an Internal Revenue Service (IRS) document used to report nondeductible contributions to traditional Individual Retirement Accounts (IRAs) and to track the basis of these contributions. This form is essential for taxpayers who make contributions to a traditional IRA but do not qualify for a tax deduction due to income limits. Additionally, it is used to report distributions from Roth IRAs and to calculate the taxable portion of these distributions. Understanding the purpose of Form 8606 is crucial for accurate tax reporting and compliance.

How to obtain the Form 8606

To obtain the 2013 Form 8606, taxpayers can visit the IRS website, where they can download the form in PDF format. Alternatively, individuals may request a copy by calling the IRS directly or visiting a local IRS office. It is important to ensure that the correct year’s form is used, as tax laws and requirements may change from year to year. Having the correct version of the form is vital for accurate reporting.

Steps to complete the Form 8606

Completing the 2013 Form 8606 involves several steps. First, taxpayers should gather all relevant financial information, including details about their IRA contributions and distributions. The form includes sections for reporting nondeductible contributions, calculating the basis, and determining the taxable amounts for distributions. Each section must be filled out accurately to ensure compliance with IRS regulations. After completing the form, taxpayers should review it for accuracy before submission.

Legal use of the Form 8606

The 2013 Form 8606 is legally binding when filled out correctly and submitted to the IRS. It is essential for taxpayers to understand that failing to file this form when required can lead to penalties and complications with their tax returns. The form serves as a record of nondeductible contributions, which can affect future tax liabilities. Therefore, ensuring the legal use of Form 8606 is crucial for maintaining compliance with tax laws.

IRS Guidelines

The IRS provides specific guidelines for completing the 2013 Form 8606. These guidelines include instructions on eligibility, reporting requirements, and deadlines for submission. Taxpayers should carefully review these instructions to ensure they meet all necessary criteria. The guidelines also outline common mistakes to avoid, which can help prevent issues during the filing process. Adhering to IRS guidelines is essential for accurate and compliant tax reporting.

Filing Deadlines / Important Dates

Filing deadlines for the 2013 Form 8606 align with the general tax filing deadlines set by the IRS. Typically, individual taxpayers must file their tax returns by April 15 of the following year. If additional time is needed, taxpayers can file for an extension, but it is important to note that any taxes owed must still be paid by the original deadline to avoid penalties. Keeping track of these important dates is crucial for timely and compliant tax filing.

Quick guide on how to complete 2022 form 8606

Complete Form 8606 effortlessly on any device

Managing documents online has become increasingly prevalent among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can access the required form and securely store it online. airSlate SignNow provides all the tools you require to create, modify, and electronically sign your documents swiftly without delays. Manage Form 8606 on any platform with airSlate SignNow Android or iOS applications and enhance any document-related process today.

The easiest way to modify and electronically sign Form 8606 smoothly

- Obtain Form 8606 and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight important parts of the documents or obscure sensitive details with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign feature, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select how you wish to send your form, via email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device you choose. Modify and electronically sign Form 8606 and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2022 form 8606

Create this form in 5 minutes!

People also ask

-

What is the 2013 form 8606 used for?

The 2013 form 8606 is used to report non-deductible contributions to traditional IRAs and to calculate the taxable portion of distributions from IRAs. This form is essential for taxpayers who have made such contributions, as it helps in tracking the basis for future distributions and avoiding double taxation.

-

How can I eSign the 2013 form 8606 using airSlate SignNow?

You can easily eSign the 2013 form 8606 using airSlate SignNow by uploading the document to our platform. Once uploaded, you can add your signature fields and send the form for signatures to other parties. This process is quick, secure, and ensures your 2013 form 8606 is signed efficiently.

-

Does airSlate SignNow offer templates for the 2013 form 8606?

Yes, airSlate SignNow provides customizable templates for various tax forms, including the 2013 form 8606. Using our templates can save you time and reduce the risk of human error, making it simpler to complete and eSign your forms accurately.

-

What are the pricing options for using airSlate SignNow to handle forms like the 2013 form 8606?

airSlate SignNow offers flexible pricing plans to cater to different business needs. You can choose from monthly or annual subscriptions that allow you to manage and eSign documents like the 2013 form 8606, providing great value for your investment.

-

Is it safe to store my 2013 form 8606 on airSlate SignNow?

Absolutely! airSlate SignNow employs advanced security measures to protect your documents, including the 2013 form 8606. Your data is encrypted both in transit and at rest, ensuring that only authorized users can access your sensitive information.

-

Can I integrate airSlate SignNow with other software to manage my 2013 form 8606?

Yes, airSlate SignNow easily integrates with various third-party applications to streamline your workflow. You can connect it with tools like Google Drive or Dropbox, making it simple to store and manage your 2013 form 8606 and other documents securely.

-

What are the benefits of using airSlate SignNow for my 2013 form 8606 compared to traditional methods?

Using airSlate SignNow for your 2013 form 8606 offers numerous benefits over traditional methods, including faster turnaround times and improved accuracy in document handling. The digital signing process is more efficient, environmentally friendly, and easier to track.

Get more for Form 8606

- Quitclaim deed by two individuals to husband and wife nebraska form

- Warranty deed from two individuals to husband and wife nebraska form

- Ne llc company form

- Nebraska property 497318020 form

- Subcontractor statement form 497318022

- Quitclaim deed by two individuals to llc nebraska form

- Warranty deed from two individuals to llc nebraska form

- Subcontractors information statement corporation or llc nebraska

Find out other Form 8606

- eSignature Texas Roommate Contract Easy

- eSignature Arizona Sublease Agreement Template Free

- eSignature Georgia Sublease Agreement Template Online

- eSignature Arkansas Roommate Rental Agreement Template Mobile

- eSignature Maryland Roommate Rental Agreement Template Free

- How Do I eSignature California Lodger Agreement Template

- eSignature Kentucky Lodger Agreement Template Online

- eSignature North Carolina Lodger Agreement Template Myself

- eSignature Alabama Storage Rental Agreement Free

- eSignature Oregon Housekeeping Contract Computer

- eSignature Montana Home Loan Application Online

- eSignature New Hampshire Home Loan Application Online

- eSignature Minnesota Mortgage Quote Request Simple

- eSignature New Jersey Mortgage Quote Request Online

- Can I eSignature Kentucky Temporary Employment Contract Template

- eSignature Minnesota Email Cover Letter Template Fast

- How To eSignature New York Job Applicant Rejection Letter

- How Do I eSignature Kentucky Executive Summary Template

- eSignature Hawaii CV Form Template Mobile

- eSignature Nevada CV Form Template Online