Form 8606 2014

What is the Form 8606

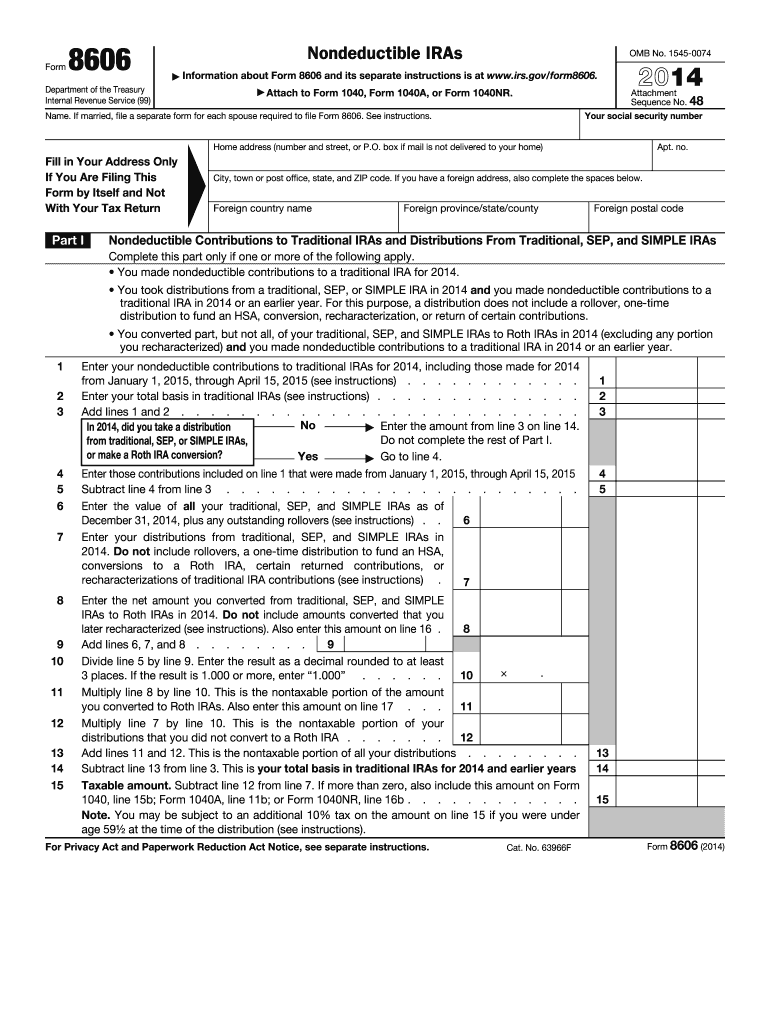

The Form 8606 is a tax form used by U.S. taxpayers to report nondeductible contributions to traditional IRAs and distributions from Roth IRAs. This form is essential for individuals who have made contributions to these retirement accounts that are not tax-deductible, ensuring that they do not pay taxes on these amounts again when they withdraw them. It serves to track the basis in these accounts and helps prevent double taxation.

How to use the Form 8606

To effectively use Form 8606, taxpayers must fill it out when they make nondeductible contributions to a traditional IRA or when they take distributions from a Roth IRA. The form requires detailed information about contributions, conversions, and distributions. Each section must be completed accurately to reflect the taxpayer's financial situation. It is advisable to keep a copy of the form for personal records, as it may be needed for future tax filings.

Steps to complete the Form 8606

Completing Form 8606 involves several key steps:

- Gather necessary information, including the amount of nondeductible contributions and any distributions taken.

- Fill out Part I for nondeductible contributions to traditional IRAs, indicating the total contributions made during the tax year.

- Complete Part II if you have taken distributions from Roth IRAs, providing details on the amounts distributed.

- Ensure all calculations are correct, especially when determining the taxable portion of distributions.

- Review the entire form for accuracy before submission.

Legal use of the Form 8606

The legal use of Form 8606 is crucial for compliance with IRS regulations. It must be filed accurately to avoid penalties and ensure proper reporting of retirement account contributions and distributions. The form is legally binding and must be submitted along with the taxpayer's annual tax return. Failure to file the form when required can result in additional taxes and penalties.

Filing Deadlines / Important Dates

Form 8606 must be filed by the tax return deadline, which is typically April 15 of the following year. If the deadline falls on a weekend or holiday, it is extended to the next business day. Taxpayers who file for an extension must still submit Form 8606 by the original deadline to avoid penalties. Keeping track of these dates is essential for maintaining compliance with IRS requirements.

IRS Guidelines

The IRS provides specific guidelines regarding the use of Form 8606. Taxpayers should refer to the IRS instructions for the form, which outline eligibility criteria, filing requirements, and detailed instructions for each section of the form. Adhering to these guidelines ensures that taxpayers complete the form correctly and understand their obligations regarding nondeductible contributions and distributions.

Quick guide on how to complete 2014 form 8606

Effortlessly Prepare Form 8606 on Any Device

Digital document handling has gained immense popularity among businesses and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and electronically sign your documents swiftly and without complications. Manage Form 8606 on any device using the airSlate SignNow mobile applications for Android or iOS, and enhance any document-based process today.

How to Modify and Electronically Sign Form 8606 with Ease

- Locate Form 8606 and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or obscure sensitive data with tools specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature using the Sign feature, which takes only seconds and is legally equivalent to a traditional handwritten signature.

- Review all the information and click the Done button to finalize your modifications.

- Choose your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the hassles of lost or misplaced documents, tedious form searching, or mistakes that require printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Form 8606 to guarantee excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2014 form 8606

Create this form in 5 minutes!

How to create an eSignature for the 2014 form 8606

The best way to make an electronic signature for your PDF document online

The best way to make an electronic signature for your PDF document in Google Chrome

The best way to make an electronic signature for signing PDFs in Gmail

The best way to generate an eSignature from your smart phone

How to generate an electronic signature for a PDF document on iOS

The best way to generate an eSignature for a PDF file on Android OS

People also ask

-

What is Form 8606 and why is it important for taxpayers?

Form 8606 is a tax form used by taxpayers to report nondeductible contributions to traditional IRAs and distributions from IRAs. It's important for keeping accurate records of your IRA contributions and ensuring you're not taxed twice on the same money. Filing Form 8606 helps prevent unexpected tax liabilities and simplifies your tax preparation process.

-

How can airSlate SignNow help me manage Form 8606 documents?

With airSlate SignNow, you can easily create, send, and eSign Form 8606 documents securely and efficiently. Our platform allows you to track the status of your forms, ensuring that your tax forms are completed and submitted on time. Plus, the easy-to-use interface makes managing all your tax documents, including Form 8606, hassle-free.

-

Is there a cost associated with using airSlate SignNow for Form 8606?

Yes, airSlate SignNow offers several pricing plans, starting with a free trial that allows you to explore our features for managing Form 8606 and other documents. Our pricing is designed to be cost-effective, providing excellent value for businesses looking to streamline their document workflow, including tax-related forms like Form 8606.

-

What features does airSlate SignNow offer for eSigning Form 8606?

airSlate SignNow provides robust features for eSigning Form 8606, including legally binding signatures, customizable templates, and automated workflows. Our platform ensures that your signed documents are securely stored and easily accessible. Additionally, you can invite multiple signers to complete the form quickly and efficiently.

-

Can I integrate airSlate SignNow with other tools for filing Form 8606?

Absolutely! airSlate SignNow seamlessly integrates with various business applications, including CRM systems and accounting software, allowing you to manage Form 8606 within your existing workflow. These integrations help streamline your processes and ensure that your tax documentation is synced with your financial records.

-

How does airSlate SignNow ensure the security of my Form 8606?

Security is a top priority at airSlate SignNow. We utilize advanced encryption methods and comply with industry standards to ensure that your Form 8606 and other sensitive documents are protected. You can trust that your data is safe, allowing you to focus on completing your tax obligations.

-

What benefits does airSlate SignNow provide for businesses dealing with Form 8606?

airSlate SignNow offers numerous benefits for businesses handling Form 8606, including increased efficiency, reduced paperwork, and improved compliance. Our platform simplifies the eSigning process, allowing for quicker turnaround times and reducing the risk of errors. By utilizing airSlate SignNow, businesses can save time and resources, making tax season less stressful.

Get more for Form 8606

- Medical legal intake form

- Lumbar puncture referral form yale medicine

- 0401 occ med intakewmdocx form

- Life span occupational therapy form

- Germline tumor syndromes form

- Bright health prior form

- Him19000 authorization to disclose protected health information

- Strategies to reduce pregnancy related deaths cdc stacks form

Find out other Form 8606

- Help Me With eSignature Tennessee Banking PDF

- How Can I eSignature Virginia Banking PPT

- How Can I eSignature Virginia Banking PPT

- Can I eSignature Washington Banking Word

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT

- How Can I eSignature Montana Car Dealer Document

- Help Me With eSignature Kentucky Charity Form

- How Do I eSignature Michigan Charity Presentation

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document