Form 8606 2019

What is the Form 8606

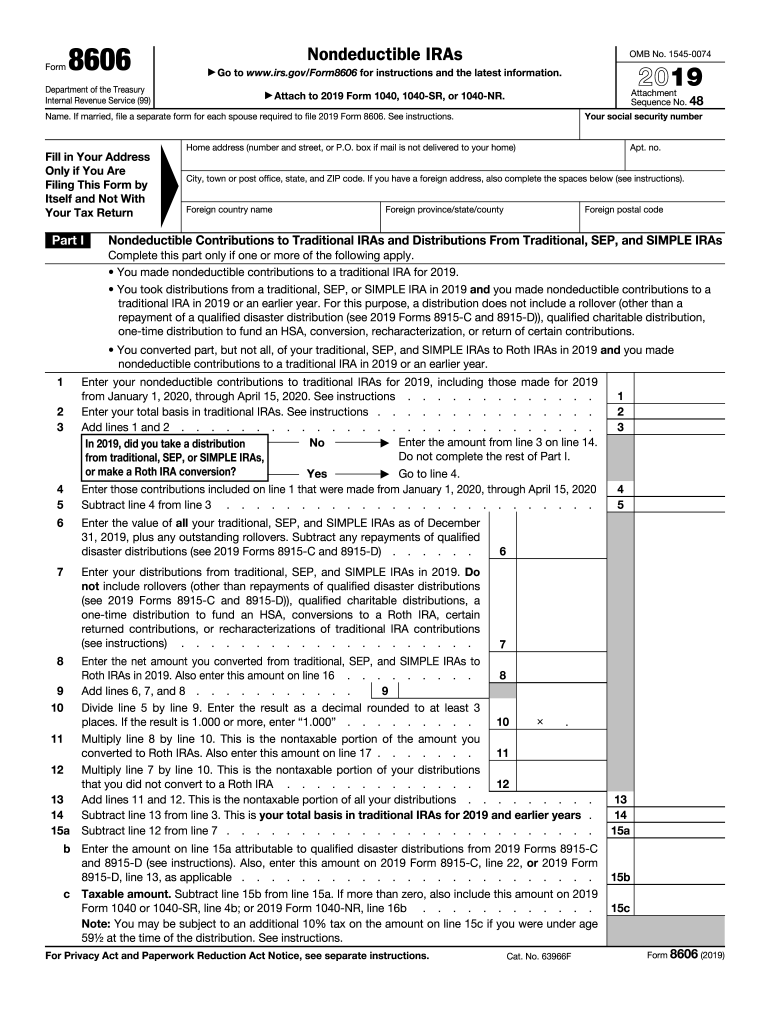

The Form 8606 is a tax document used by U.S. taxpayers to report their nondeductible contributions to traditional Individual Retirement Accounts (IRAs) and to track distributions from Roth IRAs. This form is essential for individuals who have made nondeductible contributions to their IRAs, as it helps to ensure that they do not pay taxes on those contributions again when they withdraw them. The IRS requires this form to maintain accurate records of these contributions and distributions, which can affect future tax liabilities.

How to use the Form 8606

Using the Form 8606 involves several steps. First, determine if you need to file it based on your IRA contributions and withdrawals. If you made nondeductible contributions or took distributions from a Roth IRA, you will need to complete the form. Fill out the relevant sections, which include reporting your contributions, calculating the taxable portion of distributions, and providing necessary information about your IRAs. After completing the form, attach it to your tax return to ensure proper reporting and compliance with IRS regulations.

Steps to complete the Form 8606

Completing the Form 8606 requires careful attention to detail. Follow these steps:

- Gather all relevant financial documents, including records of your IRA contributions and distributions.

- Fill out Part I to report nondeductible contributions to traditional IRAs.

- Complete Part II if you took distributions from a Roth IRA, detailing the amounts and dates.

- Calculate the taxable portion of any distributions, if applicable, using the provided instructions.

- Review the form for accuracy before submitting it with your tax return.

IRS Guidelines

The IRS provides specific guidelines for completing and filing the Form 8606. It is crucial to follow these guidelines to avoid errors that could lead to penalties or additional taxes. The IRS outlines eligibility criteria for who must file the form, the information required, and the deadlines for submission. Familiarizing yourself with these guidelines can help ensure compliance and accurate reporting of your IRA activities.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the Form 8606 is essential for timely compliance. Generally, the form must be submitted along with your federal tax return by the tax filing deadline, which is typically April 15 for most taxpayers. If you need additional time, consider filing for an extension, but remember that this does not extend the deadline for any taxes owed. Keeping track of these important dates can help you avoid late fees and penalties.

Penalties for Non-Compliance

Failing to file the Form 8606 when required can lead to significant penalties. The IRS may impose a fine for each year the form is not filed, which can accumulate over time. Additionally, if you do not report your nondeductible contributions accurately, you may face double taxation on those amounts when you withdraw them. Ensuring compliance with IRS requirements is crucial to avoid these financial repercussions.

Quick guide on how to complete 2019 form 8606 nondeductible iras

Effortlessly Prepare Form 8606 on Any Device

Digital document management has become increasingly favored by companies and individuals. It serves as an ideal eco-friendly substitute for conventional printed and signed papers, allowing you to find the appropriate form and securely keep it online. airSlate SignNow equips you with all the necessary tools to quickly create, modify, and eSign your documents without delays. Manage Form 8606 on any device using airSlate SignNow's Android or iOS applications and simplify your document-related tasks today.

How to Modify and eSign Form 8606 with Ease

- Find Form 8606 and click on Get Form to begin.

- Utilize the features we offer to complete your document.

- Mark important sections of your documents or obscure sensitive information with the tools airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign tool, which takes seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your changes.

- Choose your preferred method to send your form: via email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Form 8606 and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2019 form 8606 nondeductible iras

Create this form in 5 minutes!

How to create an eSignature for the 2019 form 8606 nondeductible iras

How to generate an electronic signature for the 2019 Form 8606 Nondeductible Iras online

How to create an electronic signature for the 2019 Form 8606 Nondeductible Iras in Google Chrome

How to create an eSignature for putting it on the 2019 Form 8606 Nondeductible Iras in Gmail

How to create an eSignature for the 2019 Form 8606 Nondeductible Iras from your smartphone

How to generate an eSignature for the 2019 Form 8606 Nondeductible Iras on iOS devices

How to make an eSignature for the 2019 Form 8606 Nondeductible Iras on Android OS

People also ask

-

What is the tax form 2015 form 8606 used for?

The tax form 2015 form 8606 is used to report your non-deductible contributions to a traditional IRA and to calculate the taxable portion of your distributions. This form is essential for taxpayers who made contributions to a traditional IRA but did not deduct them from their taxable income.

-

How can airSlate SignNow help me with the tax form 2015 form 8606?

airSlate SignNow provides an easy-to-use platform to eSign and manage documents, including your tax form 2015 form 8606. You can quickly send this form to your tax preparer or clients for electronic signing, ensuring a smooth and efficient process.

-

Is it secure to eSign the tax form 2015 form 8606 with airSlate SignNow?

Yes, airSlate SignNow employs the highest security standards to ensure that your eSigned documents, including the tax form 2015 form 8606, are safe. With encryption and secure storage, you can confidently manage your sensitive tax documents.

-

What features does airSlate SignNow offer for managing my tax documents?

airSlate SignNow offers a range of features for managing your tax documents, including templates, reminders, and workflow automation, specifically designed to simplify tasks like filling out the tax form 2015 form 8606. These features enhance productivity and reduce administrative burdens.

-

Are there any additional costs for sending the tax form 2015 form 8606 with airSlate SignNow?

With airSlate SignNow, there are no hidden fees for sending the tax form 2015 form 8606. The platform's pricing is straightforward and cost-effective, allowing you to manage all your signing needs without worrying about additional costs.

-

Can I integrate airSlate SignNow with other software for handling my tax documents?

Absolutely! airSlate SignNow offers integrations with various software solutions that can help you handle your tax documents seamlessly, including your financial management tools. This integration simplifies the process of managing forms like the tax form 2015 form 8606.

-

How does eSigning the tax form 2015 form 8606 expedite my tax filing process?

eSigning the tax form 2015 form 8606 using airSlate SignNow can signNowly expedite your tax filing process. With real-time signing and easy document sharing features, you can ensure faster review and submission of your tax forms.

Get more for Form 8606

Find out other Form 8606

- eSign Missouri Work Order Computer

- eSign Hawaii Electrical Services Contract Safe

- eSign Texas Profit Sharing Agreement Template Safe

- eSign Iowa Amendment to an LLC Operating Agreement Myself

- eSign Kentucky Amendment to an LLC Operating Agreement Safe

- eSign Minnesota Affidavit of Identity Now

- eSign North Dakota Affidavit of Identity Free

- Help Me With eSign Illinois Affidavit of Service

- eSign North Dakota Affidavit of Identity Simple

- eSign Maryland Affidavit of Service Now

- How To eSign Hawaii Affidavit of Title

- How Do I eSign New Mexico Affidavit of Service

- How To eSign Texas Affidavit of Title

- How Do I eSign Texas Affidavit of Service

- eSign California Cease and Desist Letter Online

- eSign Colorado Cease and Desist Letter Free

- How Do I eSign Alabama Hold Harmless (Indemnity) Agreement

- eSign Connecticut Hold Harmless (Indemnity) Agreement Mobile

- eSign Hawaii Hold Harmless (Indemnity) Agreement Mobile

- Help Me With eSign Hawaii Hold Harmless (Indemnity) Agreement