About Form 8606, Nondeductible IRAsInternal Revenue Service 2020

Understanding Form 8606: Nondeductible IRAs

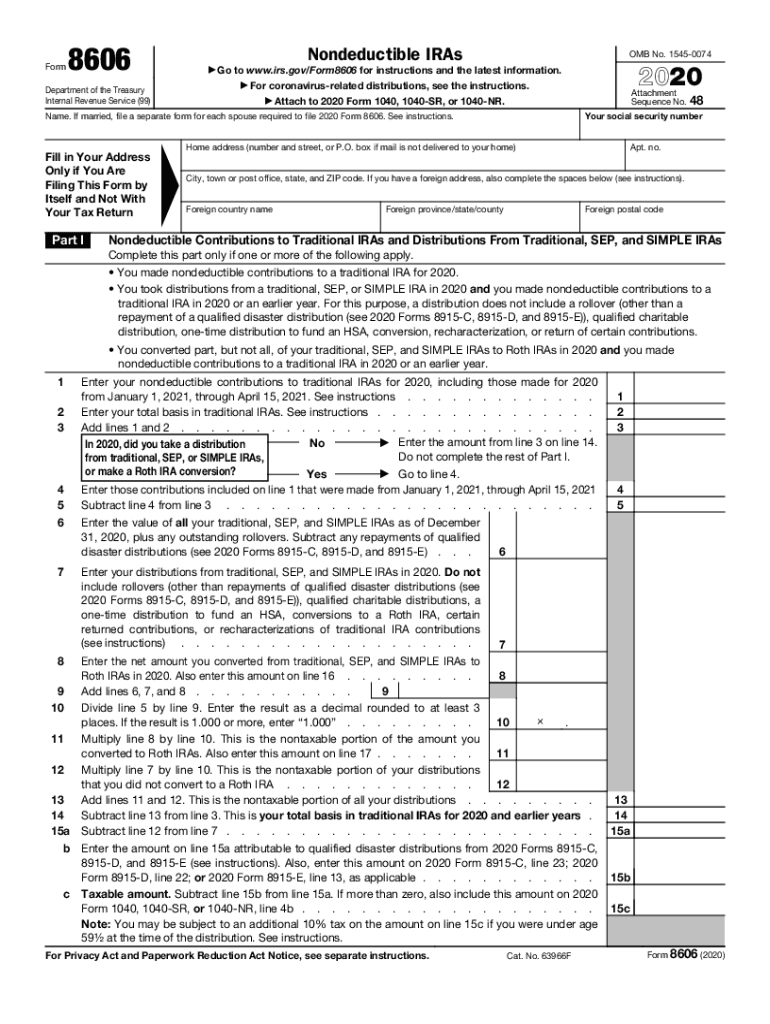

Form 8606 is a crucial document used by taxpayers in the United States to report nondeductible contributions to traditional IRAs and distributions from Roth IRAs. This form is essential for individuals who have made contributions to their IRAs that are not tax-deductible, ensuring that they do not pay taxes on these amounts again when they withdraw them. It also helps track the basis in these accounts, which is vital for accurate tax reporting and compliance.

Steps to Complete Form 8606

Completing Form 8606 involves several steps to ensure accurate reporting. First, gather all relevant information about your IRA contributions and distributions. Next, fill out the form by providing details such as your total nondeductible contributions, any distributions taken, and the basis in your IRAs. It is important to follow the instructions carefully, as errors can lead to penalties or incorrect tax assessments. Once completed, the form should be attached to your tax return.

Filing Deadlines for Form 8606

Form 8606 must be filed along with your annual tax return. The deadline for filing your tax return is typically April 15 of the following year. If you need additional time, you can file for an extension, but ensure that Form 8606 is submitted by the extended deadline to avoid penalties. It is advisable to keep a copy of the form for your records, as you may need it for future tax filings.

Legal Use of Form 8606

Form 8606 is legally binding and must be filled out accurately to comply with IRS regulations. Failure to report nondeductible contributions can result in penalties and additional taxes owed. The form serves as a declaration of your contributions and distributions, ensuring that you are not taxed on the same amounts multiple times. Using a reliable digital signing tool can enhance the security and validity of your submission.

Eligibility Criteria for Filing Form 8606

Eligibility to file Form 8606 typically includes individuals who have made nondeductible contributions to a traditional IRA or who have taken distributions from a Roth IRA. Additionally, if you have a traditional IRA and your modified adjusted gross income exceeds certain limits, you may need to file this form. It is important to review IRS guidelines to determine your specific eligibility and requirements.

Examples of Using Form 8606

Form 8606 is commonly used in various scenarios. For instance, if a taxpayer contributes to a traditional IRA but exceeds the income limits for deductibility, they must file this form to report the nondeductible contribution. Another example includes individuals who convert their traditional IRA to a Roth IRA, requiring them to report the conversion on Form 8606. These examples illustrate the form's importance in maintaining accurate tax records and ensuring compliance with IRS regulations.

Quick guide on how to complete about form 8606 nondeductible irasinternal revenue service

Effortlessly prepare About Form 8606, Nondeductible IRAsInternal Revenue Service on any device

Digital document management has gained popularity among businesses and individuals alike. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents quickly and without hindrance. Manage About Form 8606, Nondeductible IRAsInternal Revenue Service on any platform with airSlate SignNow’s Android or iOS applications and simplify any document-related task today.

How to edit and eSign About Form 8606, Nondeductible IRAsInternal Revenue Service with ease

- Obtain About Form 8606, Nondeductible IRAsInternal Revenue Service and click on Get Form to begin.

- Use the tools we offer to complete your document.

- Highlight important sections of the documents or obscure confidential information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes only seconds and has the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose your preferred method to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Modify and eSign About Form 8606, Nondeductible IRAsInternal Revenue Service to ensure efficient communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct about form 8606 nondeductible irasinternal revenue service

Create this form in 5 minutes!

How to create an eSignature for the about form 8606 nondeductible irasinternal revenue service

The way to make an eSignature for a PDF file online

The way to make an eSignature for a PDF file in Google Chrome

The way to create an electronic signature for signing PDFs in Gmail

The way to make an eSignature straight from your mobile device

The way to make an eSignature for a PDF file on iOS

The way to make an eSignature for a PDF document on Android devices

People also ask

-

What is form 8606 and why is it important?

Form 8606 is crucial for reporting non-deductible contributions to traditional IRAs and distributions from Roth IRAs. Properly managing this form helps you avoid unexpected tax liabilities. Using airSlate SignNow can streamline the process of filling out and eSigning this vital document.

-

How does airSlate SignNow support the completion of form 8606?

airSlate SignNow offers a user-friendly platform that allows you to easily fill out and eSign form 8606. With its intuitive interface, you can quickly gather necessary signatures and ensure compliance. This efficiency is especially beneficial during tax season.

-

What are the pricing options for using airSlate SignNow for form 8606?

airSlate SignNow offers a variety of pricing plans to accommodate individual users and businesses alike. Whether you need a monthly subscription or an annual option, you can find a plan that suits your needs for handling form 8606. Additionally, the service provides cost-effective solutions compared to traditional methods.

-

Can I integrate airSlate SignNow with other software for handling form 8606?

Yes, airSlate SignNow seamlessly integrates with various platforms, allowing you to manage form 8606 alongside your existing tools. This compatibility enhances your workflow and ensures you can maintain an organized approach to document management. Common integrations include CRM systems and project management tools.

-

What are the benefits of using airSlate SignNow for submitting form 8606?

Using airSlate SignNow for submitting form 8606 simplifies the eSigning process and enhances tracking for document submissions. It reduces paperwork and helps ensure that your form signNowes the IRS accurately and on time. Moreover, it offers secure storage for your documents.

-

Is there customer support available for issues related to form 8606?

Absolutely! airSlate SignNow provides dedicated customer support to assist you with any issues regarding form 8606. Whether you have technical questions or need help with your account, friendly representatives are available to guide you through the process.

-

How does airSlate SignNow ensure the security of form 8606 submissions?

airSlate SignNow prioritizes security by employing advanced encryption protocols to protect your data during the submission of form 8606. Compliance with legal regulations ensures that your sensitive information remains confidential and secure. Trust in airSlate SignNow for safe document management.

Get more for About Form 8606, Nondeductible IRAsInternal Revenue Service

- Bicycle accident report not involving a moving motor vehicle form

- Fda form 2301

- Military high value inventory form

- Nailah k byrd form

- Wwwcityofwarrenorgwarrentownecenterwarren towne center building for the future city of warren form

- Sexual history questionnaire form

- City of jersey city office of the city clerk 280 grove street jersey city new jersey 07302 robert byrne r form

- Confirmation sponsor registration form dekalb il stmarydekalb

Find out other About Form 8606, Nondeductible IRAsInternal Revenue Service

- How To eSignature New Mexico Sports Executive Summary Template

- Can I eSignature Utah Real Estate Operating Agreement

- eSignature Vermont Real Estate Warranty Deed Online

- eSignature Vermont Real Estate Operating Agreement Online

- eSignature Utah Real Estate Emergency Contact Form Safe

- eSignature Washington Real Estate Lease Agreement Form Mobile

- How Can I eSignature New York Sports Executive Summary Template

- eSignature Arkansas Courts LLC Operating Agreement Now

- How Do I eSignature Arizona Courts Moving Checklist

- eSignature Wyoming Real Estate Quitclaim Deed Myself

- eSignature Wyoming Real Estate Lease Agreement Template Online

- How Can I eSignature Delaware Courts Stock Certificate

- How Can I eSignature Georgia Courts Quitclaim Deed

- Help Me With eSignature Florida Courts Affidavit Of Heirship

- Electronic signature Alabama Banking RFP Online

- eSignature Iowa Courts Quitclaim Deed Now

- eSignature Kentucky Courts Moving Checklist Online

- eSignature Louisiana Courts Cease And Desist Letter Online

- How Can I Electronic signature Arkansas Banking Lease Termination Letter

- eSignature Maryland Courts Rental Application Now