Orm1040Department of the TreasuryInternal Revenue 2024-2026

Understanding Roth IRAs

A Roth IRA is a type of individual retirement account that allows individuals to invest after-tax income, meaning contributions are made with money that has already been taxed. The primary benefit of a Roth IRA is that qualified withdrawals, including earnings, are tax-free in retirement. This account is particularly advantageous for younger investors who expect to be in a higher tax bracket in the future.

Eligibility Criteria for Roth IRAs

To contribute to a Roth IRA, individuals must meet certain income limits set by the IRS. For the tax year 2022, the ability to contribute phases out for single filers with modified adjusted gross incomes (MAGI) above $129,000 and for married couples filing jointly above $204,000. Additionally, individuals must have earned income, such as wages or self-employment income, to be eligible for contributions.

Steps to Open a Roth IRA

Opening a Roth IRA involves several straightforward steps:

- Choose a financial institution that offers Roth IRA accounts, such as banks, credit unions, or investment firms.

- Complete the application process, providing personal information and selecting your investment options.

- Fund your account with contributions, ensuring you stay within the annual contribution limits.

- Monitor your investments and adjust your portfolio as needed to align with your retirement goals.

Backdoor Roth IRA Steps

For high-income earners who exceed the income limits for direct contributions, a backdoor Roth IRA is a strategy to circumvent these restrictions. The process typically involves:

- Contributing to a traditional IRA, which has no income limits for contributions.

- Converting the traditional IRA to a Roth IRA, ideally shortly after the contribution to minimize tax implications.

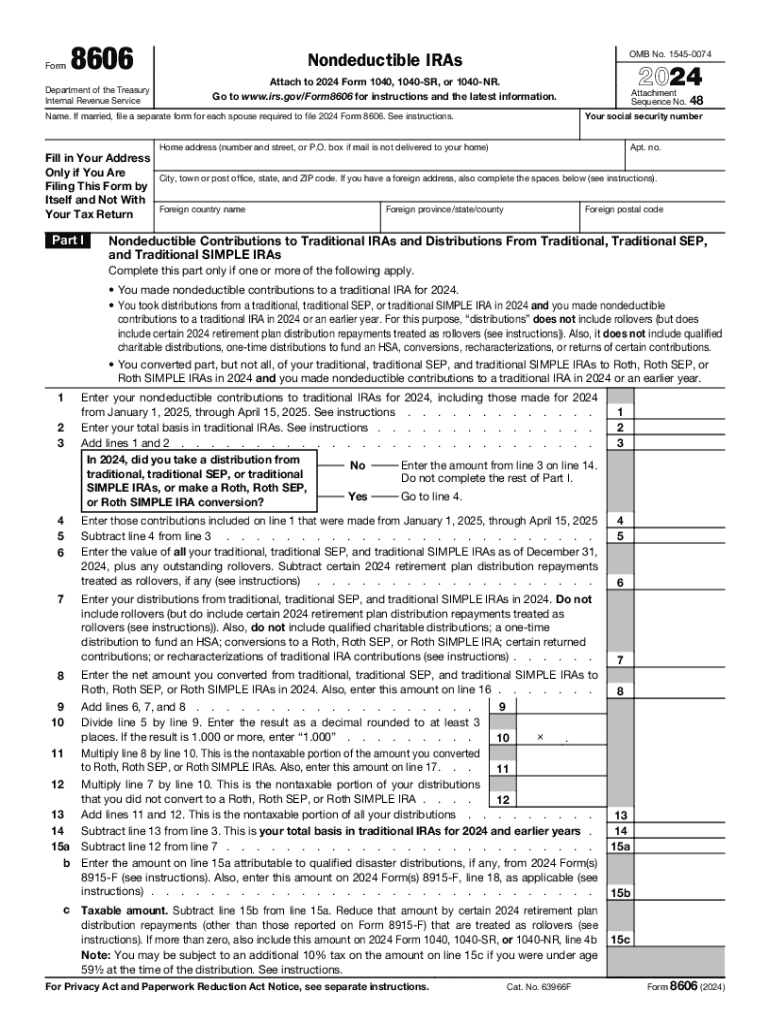

- Filing Form 8606 to report the conversion and ensure that the tax on any earnings is appropriately handled.

IRS Guidelines for Roth IRAs

The IRS provides specific guidelines regarding contributions, withdrawals, and conversions related to Roth IRAs. Key points include:

- Contributions must be made with after-tax dollars.

- Qualified withdrawals are tax-free if the account has been open for at least five years and the account holder is at least 59½ years old.

- Form 8606 is required to report any non-deductible contributions to traditional IRAs and conversions to Roth IRAs.

Filing Deadlines for Roth IRAs

Contributions to a Roth IRA for a given tax year can be made until the tax filing deadline, which is typically April 15 of the following year. For example, contributions for the 2022 tax year can be made until April 15, 2023. It is essential to keep track of these deadlines to maximize retirement savings.

Create this form in 5 minutes or less

Find and fill out the correct orm1040department of the treasuryinternal revenue

Create this form in 5 minutes!

How to create an eSignature for the orm1040department of the treasuryinternal revenue

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an IRAs Roth and how does it work?

An IRAs Roth is a type of individual retirement account that allows your investments to grow tax-free. Contributions are made with after-tax dollars, meaning you won't pay taxes on withdrawals during retirement. This makes IRAs Roth an attractive option for those looking to maximize their retirement savings.

-

What are the benefits of using an IRAs Roth?

The primary benefits of an IRAs Roth include tax-free growth and tax-free withdrawals in retirement. Additionally, there are no required minimum distributions during the account holder's lifetime, allowing for greater flexibility in retirement planning. This makes IRAs Roth a powerful tool for long-term financial growth.

-

How does airSlate SignNow integrate with IRAs Roth management?

airSlate SignNow can streamline the documentation process for IRAs Roth management by allowing users to easily send and eSign necessary forms. This integration simplifies the workflow, ensuring that all paperwork is completed efficiently and securely. With airSlate SignNow, managing your IRAs Roth becomes hassle-free.

-

What are the costs associated with setting up an IRAs Roth?

Setting up an IRAs Roth typically involves minimal fees, which can vary depending on the financial institution. Many providers offer low or no account maintenance fees, making it a cost-effective option for retirement savings. It's essential to compare different providers to find the best deal for your IRAs Roth.

-

Can I contribute to an IRAs Roth if I have a traditional IRA?

Yes, you can contribute to both an IRAs Roth and a traditional IRA, but there are income limits that may affect your ability to contribute to an IRAs Roth. It's important to understand these limits and how they apply to your financial situation. Consulting with a financial advisor can help clarify your options.

-

What types of investments can I hold in an IRAs Roth?

An IRAs Roth can hold a variety of investments, including stocks, bonds, mutual funds, and ETFs. This flexibility allows you to create a diversified portfolio tailored to your retirement goals. Always check with your provider to ensure your chosen investments are eligible within your IRAs Roth.

-

How can I withdraw funds from my IRAs Roth?

Withdrawing funds from your IRAs Roth is straightforward, as contributions can be withdrawn tax-free at any time. However, to withdraw earnings without penalties, you must meet certain conditions, such as being at least 59½ years old and having the account for at least five years. Understanding these rules is crucial for effective retirement planning.

Get more for Orm1040Department Of The TreasuryInternal Revenue

Find out other Orm1040Department Of The TreasuryInternal Revenue

- How To Sign Wyoming Plumbing Form

- Help Me With Sign Idaho Real Estate PDF

- Help Me With Sign Idaho Real Estate PDF

- Can I Sign Idaho Real Estate PDF

- How To Sign Idaho Real Estate PDF

- How Do I Sign Hawaii Sports Presentation

- How Do I Sign Kentucky Sports Presentation

- Can I Sign North Carolina Orthodontists Presentation

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document