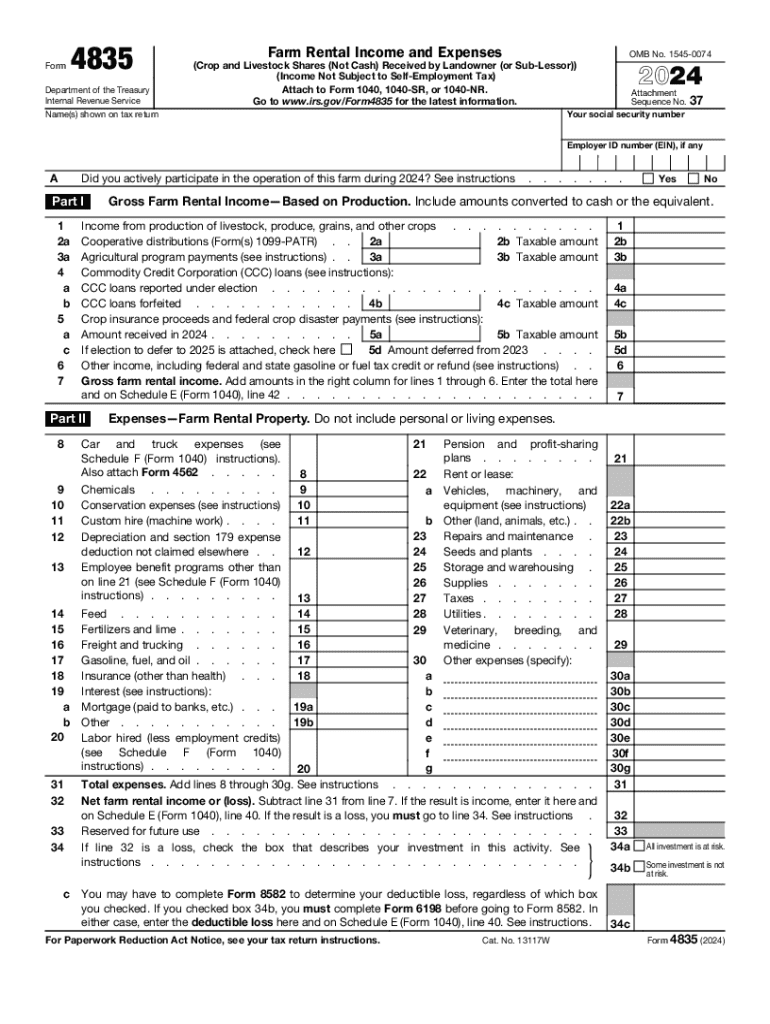

Desktop Form 4835 Farm Rental Income and Expenses 2024-2026

What is the agricultural tax exemption form?

The agricultural tax exemption form is a critical document that allows farmers and agricultural businesses to claim exemptions from certain state sales taxes on purchases related to farming operations. This form is essential for individuals and entities engaged in agriculture, as it helps reduce the overall tax burden associated with farming activities. By completing this form, eligible farmers can ensure they are not paying sales tax on necessary supplies and equipment, thereby enhancing their financial viability.

How to use the agricultural tax exemption form

To use the agricultural tax exemption form effectively, farmers must first determine their eligibility based on state-specific guidelines. Once eligibility is confirmed, the form should be filled out accurately, providing all necessary information about the agricultural operation. This includes details such as the type of farming activities, the items being purchased, and the intended use of these items. After completing the form, it must be submitted to the appropriate state tax authority to obtain the exemption status.

Steps to complete the agricultural tax exemption form

Completing the agricultural tax exemption form involves several key steps:

- Gather necessary information about your agricultural operation, including business name, address, and tax identification number.

- Identify the specific items you plan to purchase that qualify for the exemption.

- Fill out the form with accurate and complete details, ensuring all required sections are addressed.

- Review the form for any errors or omissions before submission.

- Submit the completed form to your state's tax authority, either online or by mail, as specified by local regulations.

Legal use of the agricultural tax exemption form

The legal use of the agricultural tax exemption form is governed by state laws and regulations. It is crucial for farmers to understand that misuse of the form, such as claiming exemptions for non-qualifying purchases, can result in penalties. Each state has its own criteria for what constitutes agricultural purchases, so farmers must ensure compliance with local laws to avoid legal issues.

Required documents for the agricultural tax exemption form

When completing the agricultural tax exemption form, certain documents may be required to support the application. Commonly required documents include:

- Proof of agricultural operation, such as a business license or registration.

- Tax identification number or Social Security number.

- Receipts or invoices for items purchased that are intended for agricultural use.

IRS guidelines for agricultural tax exemptions

The IRS provides specific guidelines regarding agricultural tax exemptions, particularly concerning income reporting and deductions. Farmers should be aware of the relevant IRS forms, such as Form 4835, which pertains to farm rental income and expenses. Understanding these guidelines can help ensure compliance with federal tax laws while maximizing potential deductions related to agricultural activities.

Create this form in 5 minutes or less

Find and fill out the correct desktop form 4835 farm rental income and expenses

Create this form in 5 minutes!

How to create an eSignature for the desktop form 4835 farm rental income and expenses

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an agricultural tax exemption form?

An agricultural tax exemption form is a document that allows qualifying agricultural businesses to apply for tax exemptions on certain purchases. This form helps farmers and agricultural producers save money on essential supplies and equipment. Understanding how to fill out this form correctly can signNowly benefit your agricultural operations.

-

How can airSlate SignNow help with the agricultural tax exemption form?

airSlate SignNow provides a user-friendly platform to create, send, and eSign your agricultural tax exemption form. With our solution, you can streamline the process, ensuring that your documents are completed accurately and efficiently. This saves you time and reduces the risk of errors in your submissions.

-

Is there a cost associated with using airSlate SignNow for the agricultural tax exemption form?

Yes, airSlate SignNow offers various pricing plans to suit different business needs. Our cost-effective solution ensures that you can manage your agricultural tax exemption form and other documents without breaking the bank. You can choose a plan that fits your budget while enjoying all the essential features.

-

What features does airSlate SignNow offer for managing the agricultural tax exemption form?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking, which are essential for managing your agricultural tax exemption form. These tools help you maintain organization and ensure that all necessary steps are completed. Additionally, our platform is designed to enhance collaboration among team members.

-

Can I integrate airSlate SignNow with other software for my agricultural tax exemption form?

Absolutely! airSlate SignNow offers integrations with various software applications, making it easy to manage your agricultural tax exemption form alongside your existing tools. Whether you use CRM systems or accounting software, our platform can seamlessly connect to enhance your workflow.

-

What are the benefits of using airSlate SignNow for the agricultural tax exemption form?

Using airSlate SignNow for your agricultural tax exemption form provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform allows you to complete and sign documents from anywhere, ensuring that you can manage your agricultural needs on the go. This flexibility can lead to faster processing times and improved compliance.

-

How secure is the information submitted through the agricultural tax exemption form on airSlate SignNow?

Security is a top priority at airSlate SignNow. We use advanced encryption and security protocols to protect all information submitted through the agricultural tax exemption form. You can trust that your sensitive data is safe and secure while using our platform.

Get more for Desktop Form 4835 Farm Rental Income And Expenses

Find out other Desktop Form 4835 Farm Rental Income And Expenses

- eSignature South Carolina Charity Confidentiality Agreement Easy

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy

- How Do I eSignature Montana Construction Claim

- eSignature Construction PPT New Jersey Later