Irs Farm Rental Form 2018

What is the IRS Farm Rental Form?

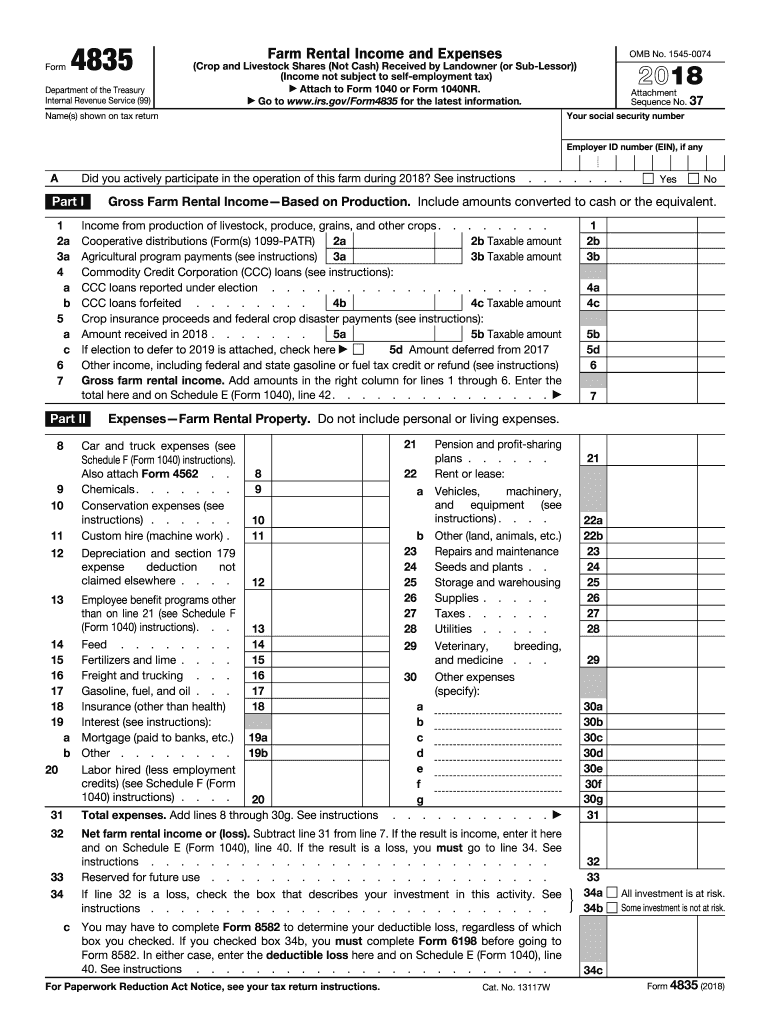

The IRS Farm Rental Form, officially known as Form 4835, is a tax document used by individuals who receive rental income from farm properties. This form allows taxpayers to report income and expenses related to their farming activities, particularly for those who do not materially participate in the farming operation. It is essential for accurately calculating taxable income and ensuring compliance with IRS regulations.

How to Use the IRS Farm Rental Form

To effectively use Form 4835, taxpayers should follow these steps:

- Gather all necessary financial information related to the rental income, including gross receipts and any deductible expenses.

- Complete the form by filling in details such as the type of farm rental, income received, and any applicable expenses.

- Ensure that all calculations are accurate to avoid discrepancies that could lead to audits or penalties.

- Submit the completed form along with your annual tax return to the IRS by the designated deadline.

Steps to Complete the IRS Farm Rental Form

Completing Form 4835 involves several important steps:

- Start by entering your name and taxpayer identification number at the top of the form.

- Report the total rental income received from farm properties in the appropriate section.

- List all deductible expenses, such as repairs, maintenance, and depreciation, in the designated areas.

- Calculate the net profit or loss from your farm rental activities by subtracting total expenses from total income.

- Review the completed form for accuracy before submitting it with your tax return.

Key Elements of the IRS Farm Rental Form

Several key elements are essential when filling out Form 4835:

- Rental Income: This section requires reporting all income generated from farm rentals.

- Expenses: Common deductible expenses include property taxes, insurance, and repairs.

- Net Income Calculation: This is crucial for determining your taxable income from farm rentals.

- Signature: The form must be signed and dated to validate the information provided.

Filing Deadlines / Important Dates

It is important to be aware of the filing deadlines for Form 4835:

- The form is typically due on April fifteenth each year, coinciding with the federal tax return deadline.

- If you are unable to file by this date, consider applying for an extension to avoid penalties.

Form Submission Methods

Form 4835 can be submitted to the IRS through various methods:

- Online Filing: Taxpayers can e-file their returns using approved tax software that supports Form 4835.

- Mail: The completed form can be printed and mailed to the appropriate IRS address based on your location.

- In-Person: Some taxpayers may choose to file in person at their local IRS office, though this is less common.

Quick guide on how to complete irs form 4835 2018 2019

Discover the most efficient method to complete and sign your Irs Farm Rental Form

Are you still investing time in preparing your official documents on paper instead of handling them online? airSlate SignNow offers a superior approach to fill out and sign your Irs Farm Rental Form and comparable forms for public services. Our advanced electronic signature solution equips you with everything necessary to process paperwork swiftly and in compliance with official standards - robust PDF editing, management, protection, signing, and sharing tools all available within a user-friendly interface.

Only a few steps are required to fill out and sign your Irs Farm Rental Form:

- Import the editable template to the editor using the Get Form button.

- Verify what information you need to include in your Irs Farm Rental Form.

- Move through the fields using the Next option to avoid missing anything.

- Utilize Text, Check, and Cross tools to fill in the details.

- Update the content with Text boxes or Images from the toolbar above.

- Emphasize essential information or Erase sections that are no longer relevant.

- Press Sign to generate a legally binding electronic signature with your preferred method.

- Add the Date beside your signature and finalize your process with the Done button.

Store your finished Irs Farm Rental Form in the Documents folder within your profile, download it, or export it to your chosen cloud storage. Our solution also provides versatile form sharing. There’s no need to print your forms when you need to submit them at the appropriate public office - accomplish it via email, fax, or by requesting a USPS “snail mail” delivery from your account. Try it out today!

Create this form in 5 minutes or less

Find and fill out the correct irs form 4835 2018 2019

FAQs

-

Which ITR form should an NRI fill out for AY 2018–2019 to claim the TDS deducted by banks only?

ITR form required to be submitted depends upon nature of income. As a NRI shall generally have income from other sources like interest, rental income therefore s/he should file ITR 2.

-

Which ITR form should an NRI fill out for AY 2018–2019 for salary income?

File ITR 2 and for taking credit of foreign taxes fill form 67 before filling ITR.For specific clarifications / legal advice feel free to write to dsssvtax[at]gmail or call/WhatsApp: 9052535440.

-

How can I fill out an IRS form 8379?

Form 8379, the Injured Spouse declaration, is used to ensure that a spouse’s share of a refund from a joint tax return is not used by the IRS as an offset to pay a tax obligation of the other spouse.Before you file this, make sure that you know the difference between this and the Innocent Spouse declaration, Form 8857. You use Form 8379 when your spouse owes money for a legally enforeceable tax debt (such as a student loan which is in default) for which you are not jointly liable. You use Form 8857 when you want to be released from tax liability for an understatement of tax that resulted from actions taken by your spouse of which you had no knowledge, and had no reason to know.As the other answers have specified, you follow the Instructions for Form 8379 (11/2016) on the IRS Web site to actually fill it out.

-

Can I fill the form for the SSC CGL 2018 which will be held in June 2019 and when will the form for 2019 come out?

No, you can’t fill the form for SSC CGL 2018 as application process has been long over.SSC CGL 2019 : No concrete information at this time. Some update should come by August-September 2019.Like Exambay on facebook for all latest updates on SSC CGL 2018 , SSC CGL 2019 and other upcoming exams

Create this form in 5 minutes!

How to create an eSignature for the irs form 4835 2018 2019

How to create an electronic signature for your Irs Form 4835 2018 2019 online

How to generate an eSignature for your Irs Form 4835 2018 2019 in Chrome

How to make an electronic signature for putting it on the Irs Form 4835 2018 2019 in Gmail

How to create an electronic signature for the Irs Form 4835 2018 2019 from your smartphone

How to make an eSignature for the Irs Form 4835 2018 2019 on iOS

How to make an electronic signature for the Irs Form 4835 2018 2019 on Android devices

People also ask

-

What is a Form 4835?

Form 4835 is used by individuals to report income and expenses from the rental of personal property, typically in the context of farm rental activities. Understanding this form is essential for compliance with IRS regulations. Utilizing airSlate SignNow can simplify the eSigning of documents related to Form 4835.

-

How can airSlate SignNow assist with Form 4835?

airSlate SignNow provides tools that facilitate the easy creation, management, and signing of Form 4835. The platform allows users to input necessary information digitally, making it easy to send and receive completed forms without the hassle of paper. Electronic signatures on Form 4835 are legally binding, ensuring that your documents are valid.

-

Is there a cost associated with using airSlate SignNow for Form 4835?

Yes, airSlate SignNow offers different pricing packages that cater to various business needs, particularly for those handling documents such as Form 4835. The pricing is designed to be cost-effective, allowing you to send and eSign documents efficiently. Various subscription plans are available to fit every budget.

-

What features does airSlate SignNow offer for Form 4835 users?

With airSlate SignNow, users can easily create, edit, and send Form 4835 to clients or partners for signing. Key features include template creation, secure cloud storage, and automated reminders for pending signatures. These features streamline the process, saving time and ensuring compliance.

-

Can I integrate airSlate SignNow with other tools for Form 4835 processing?

Absolutely! airSlate SignNow offers integrations with various apps and services that enhance the efficiency of processing Form 4835. You can connect it with popular platforms like Google Drive, Dropbox, and CRM systems to ensure seamless workflows across your business operations.

-

What are the benefits of using airSlate SignNow for Form 4835?

Using airSlate SignNow for Form 4835 allows businesses to streamline their document workflows, reduce paper usage, and expedite the signing process. The platform is user-friendly and enhances operational efficiency, making it a preferred choice for professionals dealing with various forms including Form 4835.

-

Is eSigning of Form 4835 secure with airSlate SignNow?

Yes, eSigning Form 4835 with airSlate SignNow is secure and compliant with eSignature laws. The platform utilizes advanced encryption and security protocols to protect sensitive information during the entire signing process. This ensures that your completed forms are safe from unauthorized access.

Get more for Irs Farm Rental Form

- Exempt income schedule for entrolled members of a federally recognized american indian tribe 150 101 049 form

- Fdny letterhead form

- Student information release form high school

- Norton youth football and cheer form

- Food allergy emergency plan form

- Property tax rent rebate form pennsylvania online fillable

- Belpointe asset management llc form

- Cit 1 246080200 new mexico corporate income form

Find out other Irs Farm Rental Form

- Electronic signature Texas Shareholder Agreement Template Free

- Electronic signature Mississippi Redemption Agreement Online

- eSignature West Virginia Distribution Agreement Safe

- Electronic signature Nevada Equipment Rental Agreement Template Myself

- Can I Electronic signature Louisiana Construction Contract Template

- Can I eSignature Washington Engineering Proposal Template

- eSignature California Proforma Invoice Template Simple

- eSignature Georgia Proforma Invoice Template Myself

- eSignature Mississippi Proforma Invoice Template Safe

- eSignature Missouri Proforma Invoice Template Free

- Can I eSignature Mississippi Proforma Invoice Template

- eSignature Missouri Proforma Invoice Template Simple

- eSignature Missouri Proforma Invoice Template Safe

- eSignature New Hampshire Proforma Invoice Template Mobile

- eSignature North Carolina Proforma Invoice Template Easy

- Electronic signature Connecticut Award Nomination Form Fast

- eSignature South Dakota Apartment lease agreement template Free

- eSignature Maine Business purchase agreement Simple

- eSignature Arizona Generic lease agreement Free

- eSignature Illinois House rental agreement Free