Form 4835 2015

What is the Form 4835

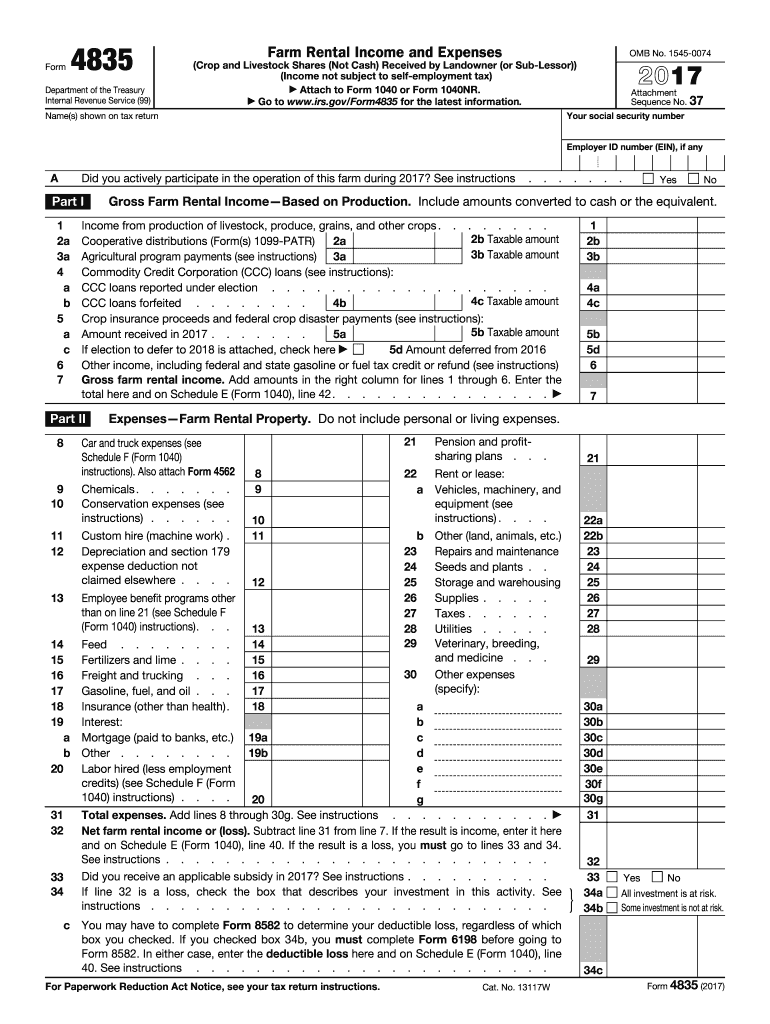

The Form 4835 is a tax form used by individuals who receive income from farming or fishing activities as a self-employed individual. This form is specifically designed for reporting income and expenses related to farming or fishing operations that are not conducted as a business. It is essential for taxpayers who want to accurately report their earnings and deductions to the Internal Revenue Service (IRS).

How to use the Form 4835

To effectively use the Form 4835, individuals must first gather all necessary financial information related to their farming or fishing activities. This includes income from sales, expenses for supplies, and any other relevant financial data. Once the information is collected, taxpayers can fill out the form by entering their income and expenses in the appropriate sections. It is important to ensure that all calculations are accurate to avoid discrepancies with the IRS.

Steps to complete the Form 4835

Completing the Form 4835 involves several key steps:

- Gather all income and expense records related to farming or fishing activities.

- Fill out the top section with personal information, including name and Social Security number.

- Report total income from farming or fishing on the designated lines.

- List all deductible expenses, such as equipment costs, supplies, and labor.

- Calculate the net profit or loss by subtracting total expenses from total income.

- Review the completed form for accuracy before submission.

Legal use of the Form 4835

The Form 4835 is legally recognized by the IRS for reporting income and expenses related to farming or fishing. To ensure legal compliance, it is crucial that taxpayers adhere to IRS guidelines when completing the form. This includes accurately reporting all income and expenses, maintaining proper documentation, and filing the form by the specified deadline. Failure to comply with these regulations may result in penalties or audits.

Filing Deadlines / Important Dates

Taxpayers must be aware of the filing deadlines associated with the Form 4835 to avoid late fees or penalties. The form is typically due on April fifteenth of the tax year. If additional time is needed, taxpayers can file for an extension, which extends the deadline to October fifteenth. It is important to submit the form on time to ensure compliance with IRS regulations.

Examples of using the Form 4835

Individuals may use the Form 4835 in various scenarios, such as:

- A farmer who sells produce at local markets and needs to report income and expenses.

- A fisherman who sells catches directly to consumers and must document earnings.

- Individuals who engage in part-time farming or fishing activities and need to report their earnings accurately.

Who Issues the Form

The Form 4835 is issued by the Internal Revenue Service (IRS), which is the federal agency responsible for tax collection and enforcement in the United States. Taxpayers can obtain the form directly from the IRS website or through authorized tax preparation services. It is essential to use the most current version of the form to ensure compliance with tax laws.

Quick guide on how to complete 2015 form 4835

Complete Form 4835 effortlessly on any device

Online document management has gained traction among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed paperwork, allowing users to find the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, alter, and eSign your documents swiftly without delays. Handle Form 4835 on any platform with airSlate SignNow's Android or iOS applications and streamline any document-related processes today.

How to modify and eSign Form 4835 with ease

- Obtain Form 4835 and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Mark relevant sections of your documents or redact sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet signature.

- Review the details and click on the Done button to save your changes.

- Select how you wish to submit your form, via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or mistakes that necessitate creating new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Form 4835 while guaranteeing effective communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2015 form 4835

Create this form in 5 minutes!

How to create an eSignature for the 2015 form 4835

The way to generate an electronic signature for your PDF file in the online mode

The way to generate an electronic signature for your PDF file in Chrome

The way to make an eSignature for putting it on PDFs in Gmail

The way to create an electronic signature straight from your smartphone

The best way to make an electronic signature for a PDF file on iOS devices

The way to create an electronic signature for a PDF document on Android

People also ask

-

What is Form 4835 and how can airSlate SignNow help?

Form 4835 is used by farmers and fishermen to report farm rental income or losses. airSlate SignNow simplifies the process of completing and submitting Form 4835 by providing a user-friendly platform for eSigning and sending documents securely, making tax season less stressful for farmers.

-

How does airSlate SignNow ensure the security of Form 4835?

When using airSlate SignNow to complete Form 4835, you can trust that your data is secure. We implement advanced encryption protocols and comply with industry standards, ensuring that your sensitive information remains protected throughout the eSigning process.

-

Is there a cost associated with eSigning Form 4835 using airSlate SignNow?

Yes, airSlate SignNow offers affordable pricing plans designed to meet various business needs. Our plans allow you to eSign Form 4835 and other documents without breaking the bank, making it a cost-effective solution for your documentation needs.

-

Can I integrate airSlate SignNow with other software to manage Form 4835?

Absolutely! airSlate SignNow offers seamless integrations with popular software such as Google Drive, Dropbox, and various CRMs. This allows you to easily manage and store your Form 4835 alongside other documents within your existing workflows.

-

What features does airSlate SignNow offer for completing Form 4835?

airSlate SignNow includes features such as customizable templates, in-document commenting, and multi-party signing, which are particularly beneficial for completing Form 4835. These tools help streamline the signing process and ensure all necessary parties can sign quickly and easily.

-

How can airSlate SignNow enhance my experience with Form 4835?

Using airSlate SignNow enhances your experience by providing a fast, efficient, and user-friendly environment for managing Form 4835. The platform is designed to minimize paper usage and reduce errors by allowing you to eSign documents digitally, facilitating a more organized approach to your documentation.

-

What support does airSlate SignNow offer for users completing Form 4835?

We provide comprehensive support for users managing Form 4835 through airSlate SignNow. Our customer support team is available 24/7 to assist with any questions or concerns, ensuring that you have the resources you need to navigate the eSigning process smoothly.

Get more for Form 4835

- Publication 5354 rev 9 2020 internal revenue service form

- 2021 form 1040 es form 1040 es estimated tax for individuals

- Pdf publication 962 rev 12 2020 internal revenue service form

- Irs pub 501 form

- Future developments whats new internal revenue service form

- 2020 form 990 t exempt organization business income tax return and proxy tax under section 6033e

- Irs ct 1 2019 fill out tax template onlineus legal forms

- Reacquisition of amateur status form

Find out other Form 4835

- Electronic signature Oklahoma Education LLC Operating Agreement Fast

- How To Electronic signature Virginia Healthcare / Medical Contract

- How To Electronic signature Virginia Healthcare / Medical Operating Agreement

- Electronic signature Wisconsin Healthcare / Medical Business Letter Template Mobile

- Can I Electronic signature Wisconsin Healthcare / Medical Operating Agreement

- Electronic signature Alabama High Tech Stock Certificate Fast

- Electronic signature Insurance Document California Computer

- Electronic signature Texas Education Separation Agreement Fast

- Electronic signature Idaho Insurance Letter Of Intent Free

- How To Electronic signature Idaho Insurance POA

- Can I Electronic signature Illinois Insurance Last Will And Testament

- Electronic signature High Tech PPT Connecticut Computer

- Electronic signature Indiana Insurance LLC Operating Agreement Computer

- Electronic signature Iowa Insurance LLC Operating Agreement Secure

- Help Me With Electronic signature Kansas Insurance Living Will

- Electronic signature Insurance Document Kentucky Myself

- Electronic signature Delaware High Tech Quitclaim Deed Online

- Electronic signature Maine Insurance Quitclaim Deed Later

- Electronic signature Louisiana Insurance LLC Operating Agreement Easy

- Electronic signature West Virginia Education Contract Safe