What is Form 4835 Farm Rental Income and Expenses 2022

What is Form 4835 Farm Rental Income and Expenses

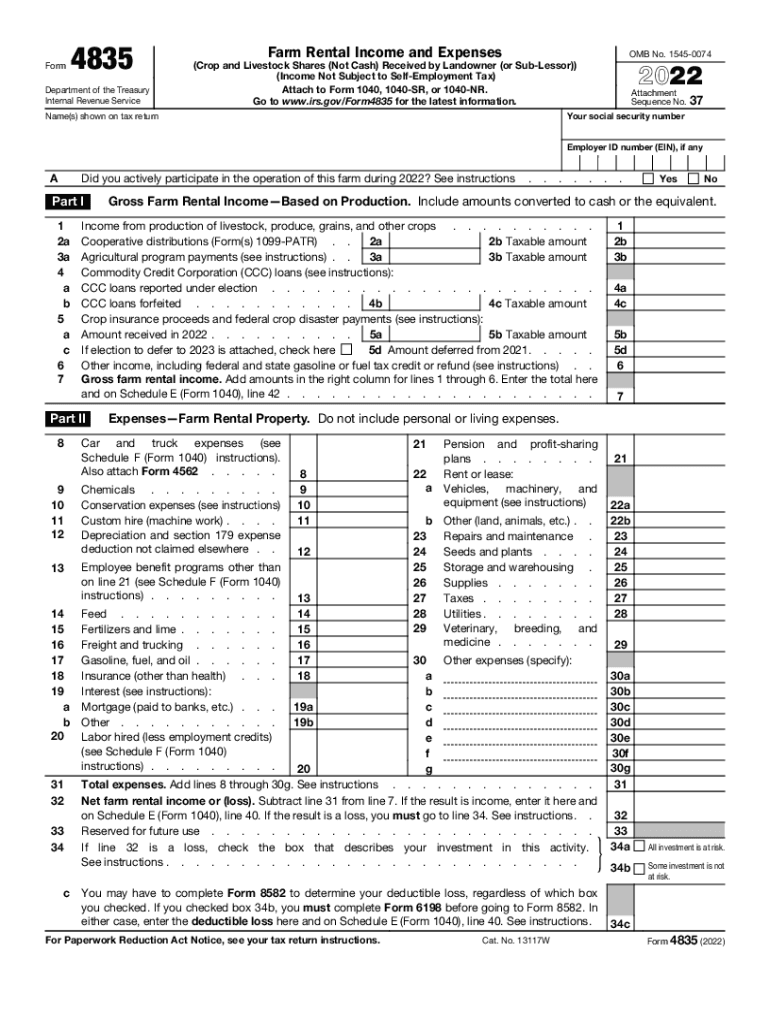

Form 4835 is a tax document used by individuals who receive rental income from farming activities. This form allows taxpayers to report income and expenses related to farm rental activities. It is particularly relevant for landlords who rent out land for agricultural purposes, enabling them to detail their earnings and costs associated with managing the rental property. The information reported on Form 4835 is essential for accurately calculating taxable income and ensuring compliance with IRS regulations.

How to Use Form 4835 Farm Rental Income and Expenses

To effectively use Form 4835, taxpayers should first gather all necessary financial information related to their farm rental activities. This includes rental income received, expenses incurred, and any related deductions. After collecting this data, individuals can complete the form by entering income in the appropriate sections, detailing expenses such as repairs, maintenance, and other costs associated with the rental property. Accurate record-keeping is crucial to ensure that all reported figures are correct and substantiated by receipts or documentation.

Steps to Complete Form 4835 Farm Rental Income and Expenses

Completing Form 4835 involves several key steps:

- Gather all relevant financial documents, including records of rental income and expenses.

- Fill out the form by entering your name, address, and taxpayer identification number.

- Report total rental income received from the farm rental activities.

- Detail all allowable expenses related to the rental property, ensuring to categorize them correctly.

- Calculate the net profit or loss by subtracting total expenses from total income.

- Review the completed form for accuracy before submission.

Legal Use of Form 4835 Farm Rental Income and Expenses

Form 4835 is legally recognized by the IRS as a valid method for reporting farm rental income and expenses. To ensure that the form is legally binding, taxpayers must follow IRS guidelines for completion and submission. This includes providing accurate information and maintaining supporting documentation for all reported figures. Compliance with tax laws is essential, as failure to accurately report income or expenses can result in penalties or audits.

IRS Guidelines for Form 4835

The IRS provides specific guidelines for completing Form 4835, which include instructions on what constitutes eligible income and allowable expenses. Taxpayers should refer to the IRS instructions for Form 4835 to understand the requirements for reporting rental income from farming activities. Key points include the necessity of documenting all income and expenses, as well as understanding the implications of net profit or loss on overall tax liability.

Filing Deadlines for Form 4835

Form 4835 must be filed by the tax return deadline, which is typically April 15 for individual taxpayers. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is important for taxpayers to be aware of these deadlines to avoid late filing penalties. Additionally, if an extension is needed, taxpayers should file Form 4868 to obtain additional time to submit their tax returns, including Form 4835.

Quick guide on how to complete what is form 4835 farm rental income and expenses

Complete What Is Form 4835 Farm Rental Income And Expenses effortlessly on any device

Digital document management has gained traction among organizations and individuals. It offers a perfect eco-friendly substitute for traditional printed and signed papers, allowing you to locate the appropriate form and securely keep it online. airSlate SignNow equips you with all the tools necessary to create, alter, and eSign your documents swiftly without delays. Manage What Is Form 4835 Farm Rental Income And Expenses on any device using airSlate SignNow’s Android or iOS applications and enhance any document-related task today.

The most effective way to modify and eSign What Is Form 4835 Farm Rental Income And Expenses without difficulty

- Locate What Is Form 4835 Farm Rental Income And Expenses and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes just seconds and holds the same legal validity as a standard wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method to share your form: by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Alter and eSign What Is Form 4835 Farm Rental Income And Expenses and ensure outstanding communication at every phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct what is form 4835 farm rental income and expenses

Create this form in 5 minutes!

People also ask

-

What is the 2018 4835 farm form and its purpose?

The 2018 4835 farm form is a tax document used by farmers to report income and expenses related to their farming operations. This form helps agricultural businesses detail their earnings and deductions, ensuring compliance with IRS regulations while optimizing tax liabilities.

-

How can airSlate SignNow help with the 2018 4835 farm documentation?

airSlate SignNow streamlines the process of preparing and signing your 2018 4835 farm forms. With its user-friendly interface, you can easily upload, fill, and eSign documents, ensuring that all necessary paperwork is completed efficiently and accurately.

-

What are the pricing options for using airSlate SignNow for the 2018 4835 farm?

airSlate SignNow offers various pricing plans to cater to different business needs. Whether you're a small farm or a large agricultural enterprise, you can choose a plan that efficiently supports your 2018 4835 farm documentation requirements at a competitive price.

-

What features does airSlate SignNow provide for the 2018 4835 farm?

AirSlate SignNow provides numerous features for the 2018 4835 farm, including customizable templates, real-time tracking of document statuses, and in-app communication for seamless collaboration. These features simplify document management, ensuring that your farming operations remain efficient.

-

Are there any integrations available with airSlate SignNow for agricultural businesses?

Yes, airSlate SignNow offers integrations with various tools commonly used in the agricultural sector. This ensures that you can easily connect your existing software with the platform to facilitate the completion of the 2018 4835 farm documentation efficiently.

-

What benefits does airSlate SignNow offer for signing the 2018 4835 farm?

Using airSlate SignNow to manage your 2018 4835 farm forms offers numerous benefits, such as increased efficiency, reduced turnaround times, and enhanced security for your sensitive information. By digitizing your documents, you can focus more on your farming activities than on paperwork.

-

Is airSlate SignNow compliant with regulations for the 2018 4835 farm?

Absolutely! airSlate SignNow adheres to industry standards and regulations for handling sensitive information, making it a compliant solution for your 2018 4835 farm forms. You can trust that your documents will be secure and meet legal requirements throughout the signing process.

Get more for What Is Form 4835 Farm Rental Income And Expenses

- Assignment of mortgage by individual mortgage holder new mexico form

- Assignment of mortgage by corporate mortgage holder new mexico form

- Nm month form

- New mexico tenant form

- 7 day notice to cure material breach or lease terminates residential new mexico form

- 30 day notice to terminate month to month lease for residential from tenant to landlord new mexico form

- New mexico 7 form

- Nm 7 day form

Find out other What Is Form 4835 Farm Rental Income And Expenses

- eSign West Virginia Healthcare / Medical Forbearance Agreement Online

- eSign Alabama Insurance LLC Operating Agreement Easy

- How Can I eSign Alabama Insurance LLC Operating Agreement

- eSign Virginia Government POA Simple

- eSign Hawaii Lawers Rental Application Fast

- eSign Hawaii Lawers Cease And Desist Letter Later

- How To eSign Hawaii Lawers Cease And Desist Letter

- How Can I eSign Hawaii Lawers Cease And Desist Letter

- eSign Hawaii Lawers Cease And Desist Letter Free

- eSign Maine Lawers Resignation Letter Easy

- eSign Louisiana Lawers Last Will And Testament Mobile

- eSign Louisiana Lawers Limited Power Of Attorney Online

- eSign Delaware Insurance Work Order Later

- eSign Delaware Insurance Credit Memo Mobile

- eSign Insurance PPT Georgia Computer

- How Do I eSign Hawaii Insurance Operating Agreement

- eSign Hawaii Insurance Stock Certificate Free

- eSign New Hampshire Lawers Promissory Note Template Computer

- Help Me With eSign Iowa Insurance Living Will

- eSign North Dakota Lawers Quitclaim Deed Easy