Irs 4835 Form 2011

What is the Irs 4835 Form

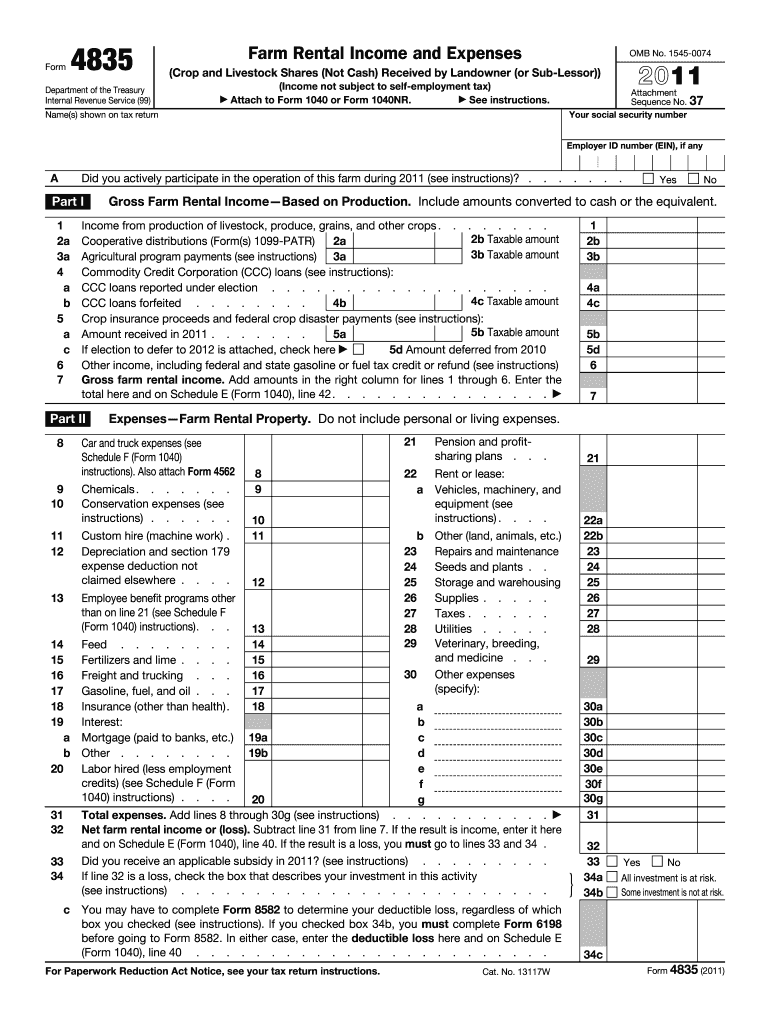

The Irs 4835 Form, also known as the "Farm Rental Income and Expenses," is used by individuals who receive income from renting out farmland. This form allows taxpayers to report their rental income and associated expenses related to the operation of a farm. It is particularly relevant for those who are not directly involved in farming but earn income through leasing their agricultural property. The information provided on this form helps the IRS determine the taxable income derived from these rental activities.

How to use the Irs 4835 Form

Using the Irs 4835 Form involves several steps to ensure accurate reporting of rental income and expenses. Taxpayers should begin by gathering all relevant financial documents, including rental agreements, receipts for expenses, and any other supporting documentation related to the rental activity. Once the necessary information is compiled, fill out the form by entering the total rental income received and detailing the expenses incurred, such as repairs, maintenance, and property management costs. It is crucial to maintain accurate records to substantiate the entries made on the form.

Steps to complete the Irs 4835 Form

Completing the Irs 4835 Form requires careful attention to detail. Follow these steps for a smooth process:

- Gather all financial documents related to rental income and expenses.

- Enter your personal information at the top of the form, including your name and Social Security number.

- Report the total rental income received in the designated section.

- List all allowable expenses, such as repairs, maintenance, and utilities, in the appropriate fields.

- Calculate the net rental income by subtracting total expenses from total income.

- Review the completed form for accuracy before submission.

Legal use of the Irs 4835 Form

The Irs 4835 Form is legally binding when completed accurately and submitted on time. It is essential for taxpayers to ensure that all information provided is truthful and substantiated by appropriate documentation. Failure to comply with IRS regulations regarding this form may result in penalties or audits. The form must be submitted as part of the taxpayer's annual income tax return, and it plays a critical role in determining the tax liability associated with rental income.

Filing Deadlines / Important Dates

Filing deadlines for the Irs 4835 Form align with the general tax filing deadlines for individual taxpayers. Typically, the deadline for submitting your tax return, including the Irs 4835 Form, is April 15 of each year. If April 15 falls on a weekend or holiday, the deadline may be extended to the next business day. It is advisable to file early to avoid any last-minute issues. Additionally, if you require more time, you can file for an extension, but you must still pay any taxes owed by the original deadline to avoid penalties.

Examples of using the Irs 4835 Form

There are various scenarios in which the Irs 4835 Form is applicable. For instance, if a taxpayer owns farmland and leases it to a farmer, they would report the rental income received on this form. Another example is when an individual rents out a portion of their property for agricultural purposes, such as growing crops or raising livestock. In both cases, the Irs 4835 Form allows the taxpayer to accurately report income and claim related expenses, ensuring compliance with IRS regulations.

Quick guide on how to complete irs 4835 2011 form

Effortlessly Prepare Irs 4835 Form on Any Device

Online document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to swiftly create, modify, and electronically sign your documents without delays. Manage Irs 4835 Form on any device with airSlate SignNow apps for Android or iOS and enhance any document-related process today.

The simplest way to edit and eSign Irs 4835 Form effortlessly

- Obtain Irs 4835 Form and click on Get Form to begin.

- Make use of the tools we provide to complete your form.

- Accent pertinent sections of the documents or redact sensitive information using tools specifically offered by airSlate SignNow for this purpose.

- Generate your eSignature with the Sign tool, which only takes seconds and carries the same legal validity as a conventional wet ink signature.

- Verify all the information and click on the Done button to finalize your changes.

- Select your preferred method of sending your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from your preferred device. Modify and eSign Irs 4835 Form and ensure excellent communication throughout the form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct irs 4835 2011 form

Create this form in 5 minutes!

How to create an eSignature for the irs 4835 2011 form

The way to generate an eSignature for your PDF document in the online mode

The way to generate an eSignature for your PDF document in Chrome

How to make an electronic signature for putting it on PDFs in Gmail

How to generate an electronic signature right from your mobile device

The way to create an electronic signature for a PDF document on iOS devices

How to generate an electronic signature for a PDF on Android devices

People also ask

-

What is the Irs 4835 Form?

The Irs 4835 Form is used by taxpayers to report income and expenses for farming or fishing activities. This form is essential for reporting profit or loss from these activities and ensures compliance with IRS regulations. Understanding the Irs 4835 Form is crucial for managing your tax obligations accurately.

-

How can airSlate SignNow help with the Irs 4835 Form?

airSlate SignNow streamlines the process of filling out and submitting your Irs 4835 Form by allowing users to eSign documents quickly and easily. With our platform, you can ensure that your form is completed accurately and securely. This makes managing your tax documentation much more efficient.

-

Is airSlate SignNow affordable for small businesses needing the Irs 4835 Form?

Yes, airSlate SignNow offers competitive pricing plans that cater to small businesses needing to handle the Irs 4835 Form and other documents. We provide flexible packages, including a free trial, enabling you to assess the value of our services without any long-term commitment. Our cost-effective solutions are designed to fit various budgets.

-

Can I save time using airSlate SignNow for the Irs 4835 Form?

Absolutely! Using airSlate SignNow allows you to complete the Irs 4835 Form in a fraction of the time compared to traditional methods. Our user-friendly interface and template options help streamline the entire document process, reducing the time spent on administrative tasks while ensuring compliance.

-

What features does airSlate SignNow offer for the Irs 4835 Form?

airSlate SignNow includes several features tailored to help with the Irs 4835 Form, like customizable templates, in-app document sharing, and secure eSigning options. These features make it easy to create, edit, and send your form quickly while maintaining security and accuracy. Our platform also allows for collaboration with multiple users.

-

Does airSlate SignNow integrate with other applications for managing the Irs 4835 Form?

Yes, airSlate SignNow seamlessly integrates with a number of popular applications, enhancing your workflow for the Irs 4835 Form. Whether you use accounting software or document management systems, our integrations allow for a smooth transition of your data. This interoperability helps streamline your tax processes.

-

What are the benefits of eSigning the Irs 4835 Form with airSlate SignNow?

eSigning the Irs 4835 Form with airSlate SignNow offers several benefits, including enhanced security, reduced paperwork, and faster processing times. By leveraging our eSigning capabilities, you can eliminate delays associated with traditional signatures and improve the overall efficiency of your tax documentation process. Additionally, all signed documents are stored securely within our platform.

Get more for Irs 4835 Form

Find out other Irs 4835 Form

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors