Skip a PaySkip Your Monthly SPCO Loan Payment and Form

What is the Skip A PaySkip Your Monthly SPCO Loan Payment And

The Skip A Pay option allows borrowers to temporarily defer their monthly SPCO loan payment. This feature is often designed to provide financial relief during unexpected circumstances, such as job loss or medical emergencies. By opting for this program, borrowers can maintain their financial stability while managing their loan obligations more effectively. It is important to understand the specific terms and conditions associated with this option, as they can vary by lender.

How to use the Skip A PaySkip Your Monthly SPCO Loan Payment And

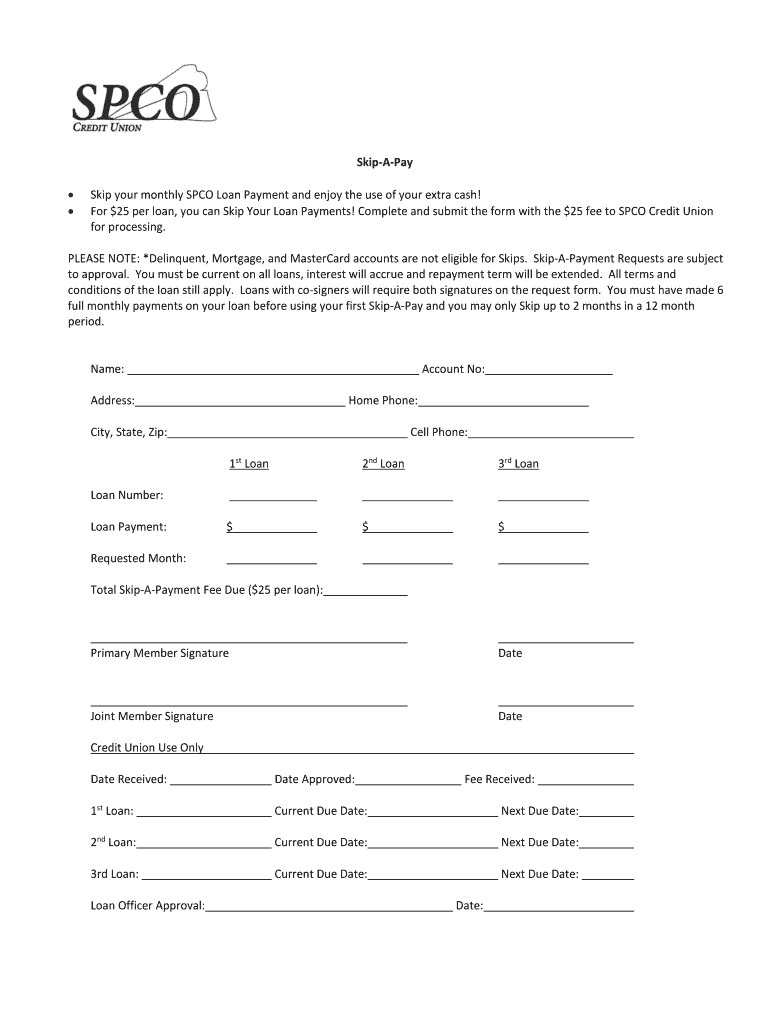

To utilize the Skip A Pay feature, borrowers typically need to submit a request to their lender. This process may involve filling out a specific form that outlines the loan details and the reason for the request. It is advisable to check with the lender regarding any necessary documentation or eligibility criteria. Once the request is approved, the borrower can skip the designated payment month without incurring penalties.

Steps to complete the Skip A PaySkip Your Monthly SPCO Loan Payment And

Completing the Skip A Pay process generally involves several key steps:

- Review the loan agreement to ensure eligibility for the Skip A Pay option.

- Contact the lender to express interest in skipping a payment.

- Fill out the required form, providing necessary information such as loan number and personal details.

- Submit the form to the lender, either online or through other accepted methods.

- Await confirmation from the lender regarding the approval of the request.

Legal use of the Skip A PaySkip Your Monthly SPCO Loan Payment And

The Skip A Pay option is a legal provision available to borrowers under specific conditions set forth by lenders. It is essential for borrowers to fully understand their rights and obligations when opting for this feature. This includes being aware of any potential impacts on the loan term or interest rates. Legal compliance ensures that both the lender and borrower adhere to the agreed-upon terms of the loan.

Eligibility Criteria

Eligibility for the Skip A Pay option typically depends on several factors, including the borrower's payment history and the specific terms of the loan agreement. Lenders may require that payments have been made on time prior to the request. Additionally, some lenders may impose restrictions based on the type of loan or the duration of the loan term. It is advisable for borrowers to consult their lender for detailed eligibility requirements.

Key elements of the Skip A PaySkip Your Monthly SPCO Loan Payment And

Key elements of the Skip A Pay program include:

- Eligibility requirements that must be met by the borrower.

- The specific terms regarding how many payments can be skipped.

- Any fees associated with the program, if applicable.

- The impact on the overall loan balance and payment schedule.

Examples of using the Skip A PaySkip Your Monthly SPCO Loan Payment And

Borrowers may find the Skip A Pay option useful in various scenarios. For instance, a borrower facing unexpected medical expenses may choose to skip a payment to allocate funds towards healthcare. Another example could be a borrower who has experienced a temporary job loss and needs to manage their cash flow more effectively. In both cases, utilizing the Skip A Pay feature can provide necessary financial relief while maintaining loan compliance.

Quick guide on how to complete skip a payskip your monthly spco loan payment and

Complete Skip A PaySkip Your Monthly SPCO Loan Payment And seamlessly on any device

Online document management has become increasingly favored by companies and individuals. It offers an optimal eco-friendly substitute for conventional printed and signed documents, as you can easily find the necessary form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents promptly without any hold-ups. Manage Skip A PaySkip Your Monthly SPCO Loan Payment And on any device using airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to edit and electronically sign Skip A PaySkip Your Monthly SPCO Loan Payment And with ease

- Find Skip A PaySkip Your Monthly SPCO Loan Payment And and click Get Form to initiate the process.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of your documents or redact confidential information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes only a few seconds and carries the same legal authority as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method to share your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from a device of your choice. Edit and electronically sign Skip A PaySkip Your Monthly SPCO Loan Payment And and maintain exceptional communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the skip a payskip your monthly spco loan payment and

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What does 'Skip A PaySkip Your Monthly SPCO Loan Payment And' mean?

'Skip A PaySkip Your Monthly SPCO Loan Payment And' refers to a promotional strategy that allows customers to defer their next monthly payment on their SPCO loan. This feature can be beneficial for those facing temporary financial difficulties, providing them with some breathing room. It’s essential for customers to understand the specifics, such as eligibility and terms, before opting in.

-

How do I use the 'Skip A PaySkip Your Monthly SPCO Loan Payment And' feature?

To utilize the 'Skip A PaySkip Your Monthly SPCO Loan Payment And' feature, simply log into your account and navigate to the payment options. You’ll find the option to skip a payment if you are eligible. Make sure to read through the terms and conditions to understand how skipping a payment might affect your overall loan balance.

-

Are there any fees associated with 'Skip A PaySkip Your Monthly SPCO Loan Payment And'?

Typically, 'Skip A PaySkip Your Monthly SPCO Loan Payment And' options may include a fee, which can vary based on the loan agreement. It’s crucial to review your loan agreement or contact customer service for detailed information about any potential fees before making your decision. Transparency is key to ensuring you understand all implications of skipping a payment.

-

Will skipping a payment affect my credit score?

Generally, using the 'Skip A PaySkip Your Monthly SPCO Loan Payment And' feature does not directly affect your credit score, provided you communicate with your lender. However, it's important to confirm that the skipped payment is reported accurately to credit bureaus. Always maintain open communication with your lender to ensure no misunderstandings arise.

-

Can I still make payments after using 'Skip A PaySkip Your Monthly SPCO Loan Payment And'?

Yes, after using the 'Skip A PaySkip Your Monthly SPCO Loan Payment And' option, you can still make additional payments on your loan. In fact, this could be a smart move to reduce the total interest paid over time. Ensure that you understand how skipped payments will affect upcoming payment schedules.

-

How does 'Skip A PaySkip Your Monthly SPCO Loan Payment And' benefit me?

The primary benefit of utilizing 'Skip A PaySkip Your Monthly SPCO Loan Payment And' is the financial relief it provides during challenging times. By skipping a payment, you can allocate funds to address more urgent expenses, easing your overall financial burden. It's an ideal solution for those seeking flexibility in managing their loan obligations.

-

Is there a limit to how many times I can use 'Skip A PaySkip Your Monthly SPCO Loan Payment And'?

Yes, there may be limits to how often you can use the 'Skip A PaySkip Your Monthly SPCO Loan Payment And' feature per loan agreement. Many lenders allow this option only a limited number of times throughout the loan term. Always check with your lender to understand the specific conditions related to skipping payments.

Get more for Skip A PaySkip Your Monthly SPCO Loan Payment And

Find out other Skip A PaySkip Your Monthly SPCO Loan Payment And

- Sign Maine Construction Business Letter Template Secure

- Can I Sign Louisiana Construction Letter Of Intent

- How Can I Sign Maryland Construction Business Plan Template

- Can I Sign Maryland Construction Quitclaim Deed

- Sign Minnesota Construction Business Plan Template Mobile

- Sign Construction PPT Mississippi Myself

- Sign North Carolina Construction Affidavit Of Heirship Later

- Sign Oregon Construction Emergency Contact Form Easy

- Sign Rhode Island Construction Business Plan Template Myself

- Sign Vermont Construction Rental Lease Agreement Safe

- Sign Utah Construction Cease And Desist Letter Computer

- Help Me With Sign Utah Construction Cease And Desist Letter

- Sign Wisconsin Construction Purchase Order Template Simple

- Sign Arkansas Doctors LLC Operating Agreement Free

- Sign California Doctors Lease Termination Letter Online

- Sign Iowa Doctors LLC Operating Agreement Online

- Sign Illinois Doctors Affidavit Of Heirship Secure

- Sign Maryland Doctors Quitclaim Deed Later

- How Can I Sign Maryland Doctors Quitclaim Deed

- Can I Sign Missouri Doctors Last Will And Testament