Missouri Form E 2018

What is the Missouri Form E

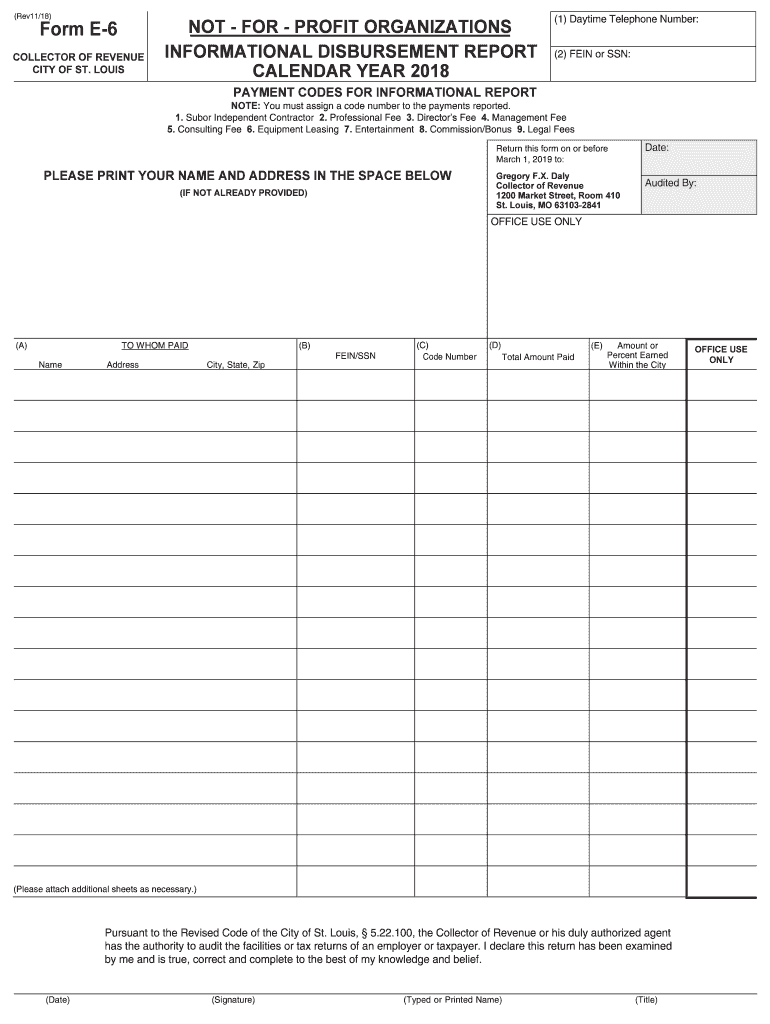

The Missouri Form E, also known as Form E6, is a tax document used primarily for reporting certain tax obligations within the state of Missouri. This form is essential for individuals and businesses that need to declare specific income and deductions for state tax purposes. It is designed to ensure compliance with Missouri tax laws and regulations, providing a structured format for taxpayers to report their financial information accurately.

How to use the Missouri Form E

Using the Missouri Form E involves several steps to ensure proper completion and submission. First, gather all necessary financial documents, including income statements and any relevant deductions. Next, carefully fill out the form, ensuring that all information is accurate and complete. Once the form is filled out, it can be submitted electronically or via mail, depending on your preference. Utilizing an eSignature solution can streamline the signing process, making it easier to submit your form promptly.

Steps to complete the Missouri Form E

Completing the Missouri Form E requires attention to detail. Follow these steps for a successful submission:

- Gather all necessary financial documents, including W-2s, 1099s, and other income statements.

- Access the Missouri Form E, available in a fillable format online.

- Fill in your personal information, including your name, address, and Social Security number.

- Report your total income and any applicable deductions as required by the form.

- Review the completed form for accuracy.

- Sign the form electronically or by hand, if submitting a paper version.

- Submit the form by the designated deadline.

Legal use of the Missouri Form E

The Missouri Form E is legally recognized for tax reporting purposes within the state. It complies with state laws and regulations, ensuring that taxpayers can fulfill their obligations accurately. Using this form correctly helps avoid penalties and ensures that taxpayers remain in good standing with state tax authorities. Additionally, eSignatures are accepted, making the process more efficient while maintaining legal validity.

Filing Deadlines / Important Dates

Filing deadlines for the Missouri Form E are critical to ensure compliance. Typically, the form must be submitted by the state’s tax deadline, which aligns with federal tax deadlines. It is essential to stay informed about any changes to these dates, especially in light of potential extensions or adjustments made by the state. Mark your calendar to avoid late submissions and possible penalties.

Required Documents

When preparing to complete the Missouri Form E, it is important to have the following documents on hand:

- W-2 forms from employers

- 1099 forms for any additional income

- Receipts for deductible expenses

- Previous year’s tax return for reference

Having these documents ready will facilitate a smoother completion process and help ensure accuracy in reporting.

Quick guide on how to complete missouri form e 2018 2019

Your instructional manual on preparing your Missouri Form E

If you’re curious about how to generate and submit your Missouri Form E, here are some brief instructions on how to simplify tax processing.

To begin, you simply need to set up your airSlate SignNow account to revolutionize how you handle documents online. airSlate SignNow is an exceptionally intuitive and robust document solution that enables you to edit, draft, and finalize your tax forms effortlessly. With its editor, you can alternate between text, check boxes, and eSignatures and revisit to modify responses as necessary. Streamline your tax oversight with advanced PDF editing, electronic signing, and easy sharing.

Follow the steps outlined below to complete your Missouri Form E in just a few minutes:

- Establish your account and start working on PDFs within moments.

- Utilize our directory to locate any IRS tax form; sift through versions and schedules.

- Select Get form to access your Missouri Form E in our editor.

- Complete the necessary fillable fields with your information (text, figures, checkmarks).

- Use the Sign Tool to insert your legally-binding eSignature (if needed).

- Examine your document and rectify any mistakes.

- Save changes, print your copy, send it to your recipient, and download it to your device.

Utilize this manual to file your taxes electronically with airSlate SignNow. Keep in mind that submitting in paper form can lead to increased errors and delays in refunds. Of course, before e-filing your taxes, verify the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct missouri form e 2018 2019

FAQs

-

Which ITR form should an NRI fill out for AY 2018–2019 to claim the TDS deducted by banks only?

ITR form required to be submitted depends upon nature of income. As a NRI shall generally have income from other sources like interest, rental income therefore s/he should file ITR 2.

-

Which ITR form should an NRI fill out for AY 2018–2019 for salary income?

File ITR 2 and for taking credit of foreign taxes fill form 67 before filling ITR.For specific clarifications / legal advice feel free to write to dsssvtax[at]gmail or call/WhatsApp: 9052535440.

-

Can I fill the form for the SSC CGL 2018 which will be held in June 2019 and when will the form for 2019 come out?

No, you can’t fill the form for SSC CGL 2018 as application process has been long over.SSC CGL 2019 : No concrete information at this time. Some update should come by August-September 2019.Like Exambay on facebook for all latest updates on SSC CGL 2018 , SSC CGL 2019 and other upcoming exams

-

How do I fill out a CLAT 2019 application form?

Hi thereFirst of all, let me tell you some important points:CLAT 2019 has gone OFFLINE this yearBut the application forms for CLAT 2019 have to be filled ONLINEThe payment of the application fees also should be made onlineNow, kindly note the important dates:Note the details regarding the application fees:Here, if you want the Previous Year Question papers, Rs.500 would be added to the application fees.Apart from this, there would be bank transaction charges added to the application fees.The application fees is non-refundable.Note one important point here that before you fill the application form, check for your eligibility.To know the complete details of filling the application form along with other information like the eligibility - in terms of age, educational qualification, list of NLUs participating and the seats offered under each category, CLAT Reservation policies, CLAT exam pattern, marking scheme, syllabus, important documents required to be kept ready before filling the form, kindly go to the link below:How to fill CLAT 2019 Application form? Registration OPEN | All you need to knowTo know how to prepare for one of the very important section of CLAT exam, GK and Current Affairs, kindly go to the link below:How to prepare GK & Current Affairs for CLAT 2019To practice, daily MCQs on Current Affairs, kindly go to the link below:#CLAT2019 | #AILET2019 | #DULLB2019 | GK and Current Affairs Series: 5 in 10 Series: Day 12For any other queries, kindly write to us at mailateasyway@gmail.comThanks & Regards!

Create this form in 5 minutes!

How to create an eSignature for the missouri form e 2018 2019

How to create an eSignature for the Missouri Form E 2018 2019 in the online mode

How to make an electronic signature for the Missouri Form E 2018 2019 in Chrome

How to create an electronic signature for putting it on the Missouri Form E 2018 2019 in Gmail

How to generate an eSignature for the Missouri Form E 2018 2019 right from your smartphone

How to generate an eSignature for the Missouri Form E 2018 2019 on iOS devices

How to generate an electronic signature for the Missouri Form E 2018 2019 on Android devices

People also ask

-

What is the Missouri Form E?

The Missouri Form E is a document used by employers in Missouri to report employee information for workers' compensation purposes. It is essential for businesses to accurately complete and submit this form to ensure compliance with state laws. Using airSlate SignNow simplifies the process of filling out and signing the Missouri Form E electronically.

-

How can airSlate SignNow help with the Missouri Form E?

airSlate SignNow allows businesses to easily create, send, and eSign the Missouri Form E online. Our user-friendly platform streamlines the completion of this form, ensuring that all required information is accurately captured and securely stored. This helps businesses save time and avoid potential errors in the submission process.

-

What features does airSlate SignNow offer for managing the Missouri Form E?

With airSlate SignNow, users can take advantage of features such as customizable templates, automated workflows, and real-time tracking for the Missouri Form E. These tools enhance efficiency and accuracy, allowing businesses to focus on their core operations while ensuring compliance with state requirements.

-

Is airSlate SignNow cost-effective for handling the Missouri Form E?

Yes, airSlate SignNow offers a cost-effective solution for businesses needing to manage the Missouri Form E. Our pricing plans cater to various business sizes and needs, ensuring that you can find an option that fits your budget without sacrificing functionality or support.

-

Can I integrate airSlate SignNow with other software for the Missouri Form E?

Absolutely! airSlate SignNow seamlessly integrates with a variety of popular software applications, making it easy to manage the Missouri Form E alongside your existing workflows. Whether you use CRM systems, document management tools, or accounting software, our platform enhances interoperability to streamline your processes.

-

What are the benefits of using airSlate SignNow for the Missouri Form E?

Using airSlate SignNow for the Missouri Form E provides numerous benefits, including enhanced speed, security, and accuracy in document handling. Our electronic signature capabilities allow for quicker approvals and submissions, while our compliance features help ensure that your business meets all legal requirements.

-

Is airSlate SignNow secure for submitting the Missouri Form E?

Yes, airSlate SignNow prioritizes security and compliance, making it a safe platform for submitting the Missouri Form E. We use advanced encryption and secure data storage practices to protect sensitive information, giving businesses peace of mind when handling their documents.

Get more for Missouri Form E

- Printable current i 90 form

- Template for document review form

- Summer camp registration form doc

- Gcu application form

- Chattel mortgage security agreement how to fill it out form

- Identifying text structure 1 answer key form

- Timesheet dependable dental staffing form

- Nwcg position task book catalog nwcg form

Find out other Missouri Form E

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document