IRS Announces Tax Relief for Victims of Flooding in Alaska 2019

Understanding the IRS Tax Relief for Flood Victims in Alaska

The IRS has announced tax relief measures for individuals and businesses affected by flooding in Alaska. This relief is designed to assist those who have suffered losses due to natural disasters, allowing them to manage their tax obligations more effectively. The relief may include extended deadlines for filing tax returns and making payments, as well as the possibility of claiming certain deductions related to disaster losses.

Steps to Utilize IRS Tax Relief for Flood Victims in Alaska

To take advantage of the IRS tax relief, affected individuals should follow these steps:

- Determine eligibility based on the disaster declaration and personal circumstances.

- Gather necessary documentation, including proof of losses and any relevant tax forms.

- Complete the required forms, ensuring all information is accurate and complete.

- Submit the forms either online or via mail, depending on the preferred method.

Filing Deadlines and Important Dates

It is crucial to be aware of the filing deadlines associated with the IRS tax relief for flood victims. Typically, the IRS will announce specific dates for filing tax returns and making payments, which may be extended for those impacted by the flooding. Keeping track of these dates ensures compliance and helps avoid penalties.

Required Documents for Tax Relief Application

When applying for tax relief, individuals must prepare specific documents, including:

- Proof of identity, such as a driver's license or Social Security card.

- Records of any losses incurred due to flooding, including photographs and receipts.

- Completed tax forms, including the Alaska 6100 oil gas return form if applicable.

Eligibility Criteria for Tax Relief

To qualify for the IRS tax relief, individuals must meet certain eligibility criteria. This typically includes being a resident of the affected area and having suffered direct losses due to the flooding. Additionally, businesses must demonstrate how the disaster has impacted their operations to qualify for relief.

Penalties for Non-Compliance

Failing to comply with the IRS guidelines when applying for tax relief can result in penalties. These may include fines or interest on unpaid taxes. It is essential for individuals and businesses to adhere to the established processes and deadlines to avoid these consequences.

Quick guide on how to complete irs announces tax relief for victims of flooding in alaska

Accomplish IRS Announces Tax Relief For Victims Of Flooding In Alaska effortlessly on any gadget

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an ideal eco-friendly substitute for conventional printed and signed papers, allowing you to obtain the necessary form and securely archive it online. airSlate SignNow equips you with all the tools required to create, edit, and eSign your documents swiftly without delays. Manage IRS Announces Tax Relief For Victims Of Flooding In Alaska across any platform with airSlate SignNow apps for Android or iOS and streamline any document-related task today.

How to modify and eSign IRS Announces Tax Relief For Victims Of Flooding In Alaska effortlessly

- Locate IRS Announces Tax Relief For Victims Of Flooding In Alaska and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize relevant sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which only takes seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to deliver your form, via email, text message (SMS), or invite link, or download it to your computer.

Put an end to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign IRS Announces Tax Relief For Victims Of Flooding In Alaska and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct irs announces tax relief for victims of flooding in alaska

Create this form in 5 minutes!

How to create an eSignature for the irs announces tax relief for victims of flooding in alaska

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

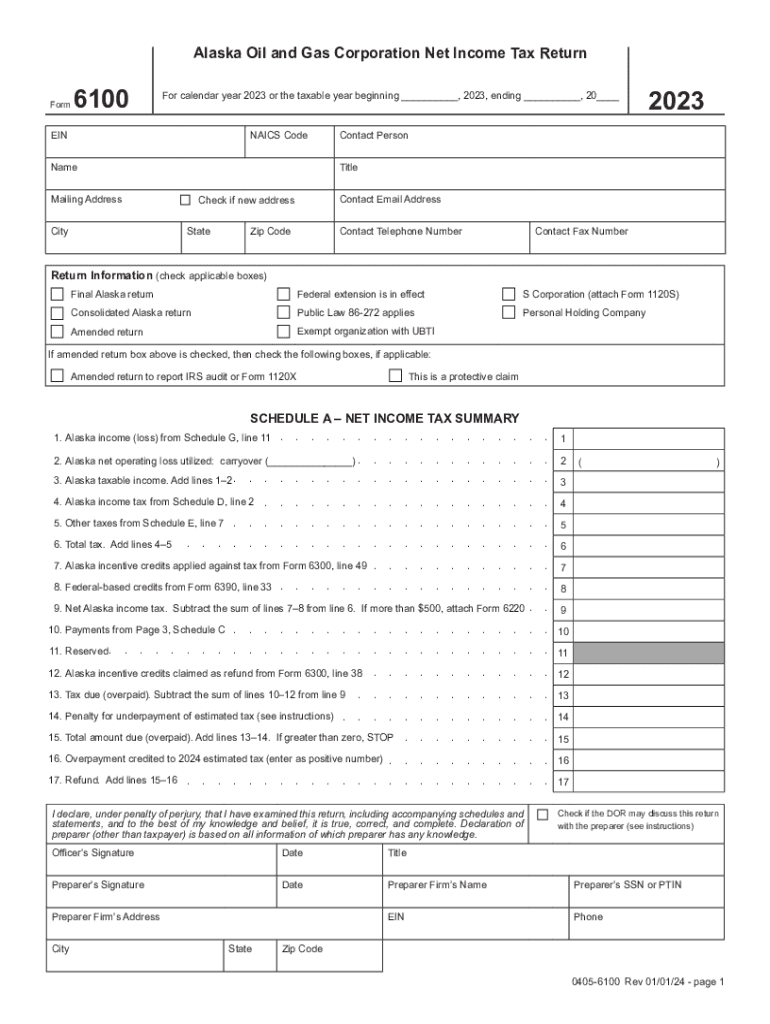

What is the alaska 6100 oil gas return form?

The alaska 6100 oil gas return form is a standard document required for reporting oil and gas production in Alaska. This form ensures that producers comply with the state's regulations regarding resource extraction. Proper submission of the alaska 6100 oil gas return form is crucial for avoiding penalties and ensuring compliance.

-

How can airSlate SignNow help with the alaska 6100 oil gas return form?

airSlate SignNow offers a user-friendly platform that simplifies the process of completing and submitting the alaska 6100 oil gas return form. With our eSignature capabilities, you can easily sign and send the form electronically, saving time and reducing paper waste. Our solution ensures that your submissions are secure and compliant.

-

Is there a cost associated with using airSlate SignNow for the alaska 6100 oil gas return form?

Yes, airSlate SignNow provides a variety of pricing plans tailored to different business needs. You can choose a plan that fits your budget while effectively managing your alaska 6100 oil gas return form submissions. The pricing is designed to be cost-effective, providing value for businesses of all sizes.

-

What features does airSlate SignNow offer for the alaska 6100 oil gas return form?

airSlate SignNow includes features like customizable templates, eSignature integration, and document tracking specifically for the alaska 6100 oil gas return form. These tools help streamline your submission process, ensuring accuracy and efficiency. Additionally, the platform offers secure storage for all your forms.

-

Can I integrate airSlate SignNow with other software for the alaska 6100 oil gas return form?

Absolutely! airSlate SignNow supports integrations with popular business tools, allowing for seamless management of the alaska 6100 oil gas return form within your existing workflows. This ensures you can fill out, sign, and track your forms without switching between applications. Check our integration list for more details.

-

What are the benefits of using airSlate SignNow for the alaska 6100 oil gas return form?

Using airSlate SignNow for the alaska 6100 oil gas return form streamlines the filing process, reduces errors, and enhances compliance. Our platform enables quick eSigning and document sharing, making it easy to keep track of submissions. The convenience of digital forms also saves time and resources for your business.

-

Do I need tech skills to use airSlate SignNow for the alaska 6100 oil gas return form?

No, airSlate SignNow is designed to be user-friendly, so you do not need advanced tech skills to manage the alaska 6100 oil gas return form. The intuitive interface guides you through the process, making it accessible for users of all skill levels. You can start using it effectively in minutes.

Get more for IRS Announces Tax Relief For Victims Of Flooding In Alaska

- Maryland release form

- Quitclaim deed by two individuals to llc maryland form

- Warranty deed from two individuals to llc maryland form

- Unconditional waiver and release upon progress payment corporation or llc maryland form

- Maryland intestate form

- Conditional waiver and release upon final payment individual maryland form

- Quitclaim deed by two individuals to corporation maryland form

- Warranty deed from two individuals to corporation maryland form

Find out other IRS Announces Tax Relief For Victims Of Flooding In Alaska

- How Can I eSign Illinois Healthcare / Medical Presentation

- Can I eSign Hawaii High Tech Document

- How Can I eSign Hawaii High Tech Document

- How Do I eSign Hawaii High Tech Document

- Can I eSign Hawaii High Tech Word

- How Can I eSign Hawaii High Tech Form

- How Do I eSign New Mexico Healthcare / Medical Word

- How To eSign Washington High Tech Presentation

- Help Me With eSign Vermont Healthcare / Medical PPT

- How To eSign Arizona Lawers PDF

- How To eSign Utah Government Word

- How Can I eSign Connecticut Lawers Presentation

- Help Me With eSign Hawaii Lawers Word

- How Can I eSign Hawaii Lawers Document

- How To eSign Hawaii Lawers PPT

- Help Me With eSign Hawaii Insurance PPT

- Help Me With eSign Idaho Insurance Presentation

- Can I eSign Indiana Insurance Form

- How To eSign Maryland Insurance PPT

- Can I eSign Arkansas Life Sciences PDF