Alaska Form 6100 Oil and Gas Corporation Net Income Tax 2020

What is the Alaska Form 6100 Oil And Gas Corporation Net Income Tax

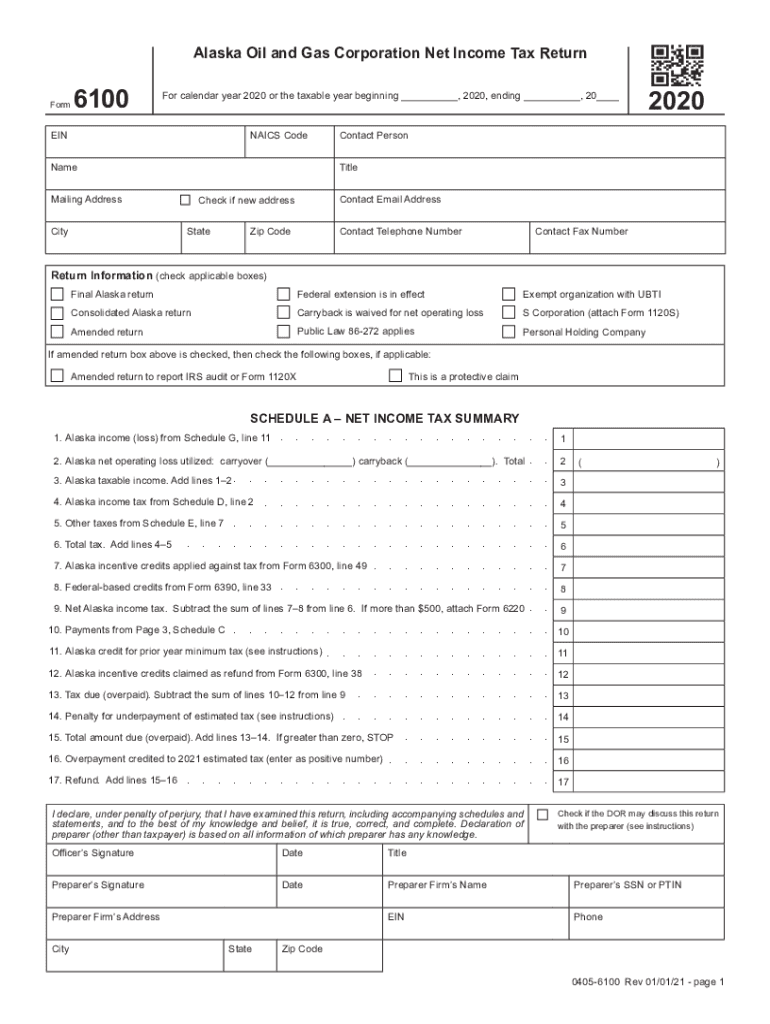

The Alaska Form 6100 is a tax document specifically designed for oil and gas corporations operating within the state of Alaska. This form is used to calculate the net income tax owed by these corporations based on their revenue and expenses related to oil and gas production. It is essential for ensuring compliance with state tax regulations and for accurately reporting financial performance to the Alaska Department of Revenue.

Steps to complete the Alaska Form 6100 Oil And Gas Corporation Net Income Tax

Completing the Alaska Form 6100 involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents, including income statements and expense reports related to oil and gas operations. Next, fill out the form by providing detailed information about gross income, allowable deductions, and any applicable credits. Ensure that all calculations are accurate, as errors can lead to penalties. Finally, review the completed form for completeness before submission.

Legal use of the Alaska Form 6100 Oil And Gas Corporation Net Income Tax

The legal use of the Alaska Form 6100 is governed by state tax laws and regulations. To be considered valid, the form must be completed accurately and submitted by the designated deadlines. Additionally, the signatures of authorized representatives must be included to affirm the accuracy of the information provided. Compliance with these legal requirements ensures that the form is recognized by the state as a legitimate tax document.

Filing Deadlines / Important Dates

Filing deadlines for the Alaska Form 6100 are crucial for compliance. Typically, the form must be submitted by the 15th day of the fourth month following the end of the corporation's tax year. For corporations operating on a calendar year, this means the deadline is April 15. It is important to keep track of these dates to avoid late penalties and interest on unpaid taxes.

Required Documents

To complete the Alaska Form 6100, several documents are required. These include:

- Income statements detailing gross revenue from oil and gas operations.

- Expense reports outlining allowable deductions.

- Prior year tax returns for reference.

- Any applicable tax credits documentation.

Having these documents ready will facilitate a smoother filing process.

Form Submission Methods (Online / Mail / In-Person)

The Alaska Form 6100 can be submitted through various methods to accommodate different preferences. Corporations may choose to file online through the Alaska Department of Revenue's website, which often allows for quicker processing. Alternatively, the form can be mailed to the appropriate tax office or submitted in person at designated locations. Each method has specific guidelines that should be followed to ensure successful submission.

Quick guide on how to complete alaska form 6100 oil and gas corporation net income tax

Effortlessly Prepare Alaska Form 6100 Oil And Gas Corporation Net Income Tax on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly solution to conventional printed and signed documents, as you can obtain the correct form and securely save it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents quickly without any delays. Manage Alaska Form 6100 Oil And Gas Corporation Net Income Tax on any device using the airSlate SignNow Android or iOS applications and streamline any document-related process today.

The Easiest Way to Modify and eSign Alaska Form 6100 Oil And Gas Corporation Net Income Tax with Ease

- Locate Alaska Form 6100 Oil And Gas Corporation Net Income Tax and click on Get Form to begin.

- Use the tools we provide to fill out your form.

- Select important sections of your documents or redact sensitive information with tools exclusively available from airSlate SignNow for this purpose.

- Create your eSignature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional handwritten signature.

- Review all details and click on the Done button to save your changes.

- Select your preferred method for sending your form: via email, text message (SMS), invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Modify and eSign Alaska Form 6100 Oil And Gas Corporation Net Income Tax while ensuring effective communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct alaska form 6100 oil and gas corporation net income tax

Create this form in 5 minutes!

How to create an eSignature for the alaska form 6100 oil and gas corporation net income tax

How to generate an eSignature for your PDF file online

How to generate an eSignature for your PDF file in Google Chrome

How to make an eSignature for signing PDFs in Gmail

The best way to make an eSignature straight from your mobile device

The best way to create an electronic signature for a PDF file on iOS

The best way to make an eSignature for a PDF document on Android devices

People also ask

-

What is the Alaska oil gas return and how can airSlate SignNow help?

The Alaska oil gas return is a critical document that businesses in the oil and gas industry must file for tax purposes. airSlate SignNow provides an efficient platform to eSign and send these documents securely, ensuring compliance and reducing the risk of errors.

-

How does airSlate SignNow ensure compliance with Alaska oil gas return regulations?

airSlate SignNow offers features that allow users to customize templates that comply with Alaska oil gas return regulations. Document tracking and audit trails ensure that all actions are recorded, which can help businesses demonstrate compliance during audits.

-

What are the pricing options for airSlate SignNow for businesses handling Alaska oil gas returns?

airSlate SignNow offers flexible pricing plans to accommodate various business sizes needing assistance with Alaska oil gas returns. Users can choose from monthly or annual subscriptions, ensuring a cost-effective solution for managing their documents.

-

Can I integrate airSlate SignNow with other software for Alaska oil gas return processing?

Yes, airSlate SignNow seamlessly integrates with various software applications that businesses typically use for managing Alaska oil gas returns. This allows for a streamlined workflow, making it easier to manage documents without switching between platforms.

-

What features does airSlate SignNow offer for eSigning Alaska oil gas return documents?

airSlate SignNow provides features such as customizable templates, secure eSignatures, and automated workflows specifically designed for Alaska oil gas returns. These capabilities enhance efficiency and simplify document management for businesses in this sector.

-

How secure is airSlate SignNow for handling sensitive Alaska oil gas return information?

airSlate SignNow prioritizes security with multiple levels of encryption and data protection, ensuring the safety of your Alaska oil gas return data. Compliance with industry standards, including GDPR, guarantees that sensitive information remains confidential.

-

What benefits can businesses expect when using airSlate SignNow for Alaska oil gas returns?

By using airSlate SignNow for Alaska oil gas returns, businesses can expect improved efficiency, reduced processing times, and minimized errors. The user-friendly interface makes it easy to manage documents, leading to quick turnaround times and enhanced productivity.

Get more for Alaska Form 6100 Oil And Gas Corporation Net Income Tax

- Cal fire 200 form

- Appendix 1 professional consultantamp39s certificate council of form

- Sts challan form

- Europees aanrijdingsformulier digitaal

- Havale formu remttance form ziraat bank london

- Printable hipaa privacy policy template form

- Pheaahardship form

- Turkey visa application form fast passports ampamp visas

Find out other Alaska Form 6100 Oil And Gas Corporation Net Income Tax

- How To eSignature Iowa Doctors Business Letter Template

- Help Me With eSignature Indiana Doctors Notice To Quit

- eSignature Ohio Education Purchase Order Template Easy

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast

- eSignature Washington Education Lease Agreement Form Later

- eSignature Missouri Doctors Residential Lease Agreement Fast

- eSignature Wyoming Education Quitclaim Deed Easy

- eSignature Alaska Government Agreement Fast

- How Can I eSignature Arizona Government POA

- How Do I eSignature Nevada Doctors Lease Agreement Template

- Help Me With eSignature Nevada Doctors Lease Agreement Template

- How Can I eSignature Nevada Doctors Lease Agreement Template

- eSignature Finance & Tax Accounting Presentation Arkansas Secure

- eSignature Arkansas Government Affidavit Of Heirship Online