Jersey Form 2019

What is the New Jersey Income Tax Form?

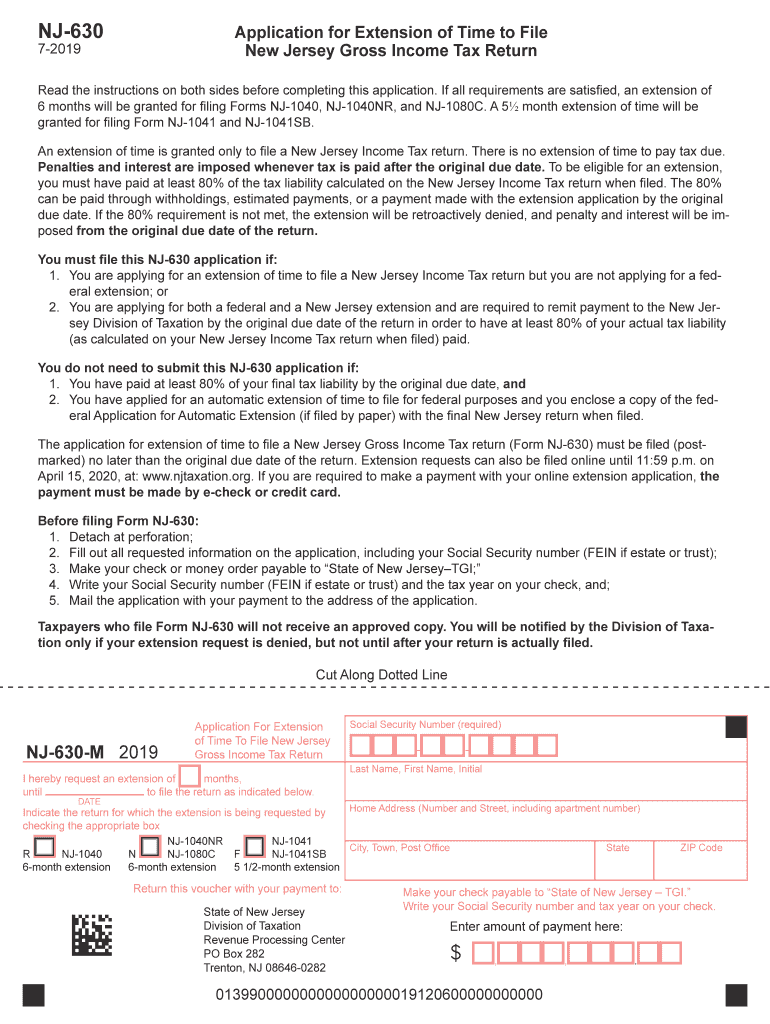

The New Jersey income tax form is a document that residents of New Jersey use to report their income and calculate their state tax liability. This form is essential for individuals and businesses alike, as it ensures compliance with state tax laws. The primary form used for individual income tax is the NJ-1040, while businesses may need to use different forms depending on their structure. Understanding the specific requirements and types of forms available is crucial for accurate tax filing.

How to Obtain the New Jersey Income Tax Form

Obtaining the New Jersey income tax form is straightforward. Taxpayers can access the forms directly from the New Jersey Division of Taxation's website. Additionally, forms are available at public libraries, post offices, and tax preparation offices throughout the state. For those who prefer a digital approach, the forms can be downloaded and printed, allowing for easy completion at home.

Steps to Complete the New Jersey Income Tax Form

Completing the New Jersey income tax form involves several key steps:

- Gather all necessary documents, including W-2s, 1099s, and any other income statements.

- Determine your filing status, which affects your tax rates and deductions.

- Fill out the form accurately, ensuring all income is reported and deductions are claimed.

- Review the completed form for any errors or omissions.

- Sign and date the form before submitting it.

Legal Use of the New Jersey Income Tax Form

The New Jersey income tax form is legally binding once completed and submitted. It is important to ensure that all information provided is accurate and truthful, as submitting false information can lead to penalties. The form must be signed by the taxpayer, and electronic submissions should comply with eSignature laws to ensure their validity.

Filing Deadlines / Important Dates

Filing deadlines for the New Jersey income tax form typically align with federal tax deadlines. Generally, individual taxpayers must file their returns by April fifteenth each year. However, if April fifteenth falls on a weekend or holiday, the deadline may be extended to the next business day. It is crucial for taxpayers to stay informed about any changes to these deadlines to avoid late filing penalties.

Required Documents for the New Jersey Income Tax Form

To complete the New Jersey income tax form, taxpayers must have several documents ready:

- W-2 forms from employers showing annual income.

- 1099 forms for other income sources, such as freelance work or interest.

- Records of any deductions or credits being claimed, such as property taxes or charitable contributions.

- Identification information, including Social Security numbers for all dependents.

Quick guide on how to complete new jersey state tax informationsupport

Complete Jersey Form effortlessly on any device

Online document management has become widespread among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow provides all the resources you need to create, modify, and electronically sign your documents swiftly without delays. Manage Jersey Form on any platform with the airSlate SignNow Android or iOS applications and enhance any document-based operation today.

How to modify and electronically sign Jersey Form effortlessly

- Locate Jersey Form and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize relevant sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes moments and carries the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow manages all your document management needs in just a few clicks from any device of your choice. Modify and electronically sign Jersey Form and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct new jersey state tax informationsupport

Create this form in 5 minutes!

How to create an eSignature for the new jersey state tax informationsupport

How to make an eSignature for the New Jersey State Tax Informationsupport in the online mode

How to create an electronic signature for your New Jersey State Tax Informationsupport in Google Chrome

How to generate an eSignature for putting it on the New Jersey State Tax Informationsupport in Gmail

How to generate an electronic signature for the New Jersey State Tax Informationsupport straight from your smartphone

How to make an electronic signature for the New Jersey State Tax Informationsupport on iOS

How to make an eSignature for the New Jersey State Tax Informationsupport on Android OS

People also ask

-

What are the state of New Jersey income tax forms required for filing?

To file your state income tax in New Jersey, you typically need to complete forms such as the NJ-1040, NJ-1040NR, and NJ-8879. These forms are essential for reporting your income and applicable deductions. Ensuring you have the correct state of New Jersey income tax forms can streamline your filing process and help you avoid penalties.

-

How can airSlate SignNow help with the state of New Jersey income tax forms?

airSlate SignNow offers a user-friendly platform that allows you to easily send and eSign your state of New Jersey income tax forms. The solution provides templates and secure storage, making it convenient to manage your tax documents. Using airSlate SignNow can save time and enhance compliance for your tax filings.

-

What is the cost associated with using airSlate SignNow for state of New Jersey income tax forms?

airSlate SignNow offers several pricing plans based on your needs, starting with cost-effective options for individuals and small businesses. The pricing includes features tailored for effortless management of state of New Jersey income tax forms. You can choose a plan that fits your requirements and budget, ensuring you get value for your investment.

-

What features does airSlate SignNow offer for handling tax forms?

airSlate SignNow provides features like document templates, customizable workflows, and secure eSignature capabilities, specifically designed for managing state of New Jersey income tax forms. The platform also allows real-time tracking and notifications, ensuring you never miss important deadlines or updates on your forms. These features enhance efficiency and accuracy in your tax filing process.

-

Are there integrations available to assist with New Jersey income tax forms?

Yes, airSlate SignNow offers integrations with various accounting and tax software, which can simplify the process of filling out state of New Jersey income tax forms. By connecting with tools like QuickBooks or Xero, you can automatically import data and reduce manual entry errors. These integrations save time and help streamline your tax submission process.

-

Is airSlate SignNow secure for storing tax documents like New Jersey income tax forms?

Absolutely, airSlate SignNow prioritizes security with features like encryption, secure storage, and compliance with various regulations. Your state of New Jersey income tax forms and sensitive information are protected to ensure confidentiality. You can trust that your documents are safe while facilitating easy access when you need them.

-

Can I use airSlate SignNow for multiple state income tax forms?

Yes, airSlate SignNow is versatile and supports a wide range of state income tax forms, including those for New Jersey and other states. This capability allows you to manage different tax requirements from a single platform. Utilizing airSlate SignNow simplifies the process of handling various state of New Jersey income tax forms efficiently.

Get more for Jersey Form

- Hsbc banking instruction via telex or facsimile form

- Nehs candidate form examples

- Invitation homes rental application form

- Residence verification form

- Prescriptionnon prescription medication authorization form elcbigbend

- History and physical template form

- Opt out form for group pension scheme scottish widows

- Notice of petition holdover proceeding nycourts 47971606 form

Find out other Jersey Form

- eSign North Dakota Prenuptial Agreement Template Safe

- eSign Ohio Prenuptial Agreement Template Fast

- eSign Utah Prenuptial Agreement Template Easy

- eSign Utah Divorce Settlement Agreement Template Online

- eSign Vermont Child Custody Agreement Template Secure

- eSign North Dakota Affidavit of Heirship Free

- How Do I eSign Pennsylvania Affidavit of Heirship

- eSign New Jersey Affidavit of Residence Free

- eSign Hawaii Child Support Modification Fast

- Can I eSign Wisconsin Last Will and Testament

- eSign Wisconsin Cohabitation Agreement Free

- How To eSign Colorado Living Will

- eSign Maine Living Will Now

- eSign Utah Living Will Now

- eSign Iowa Affidavit of Domicile Now

- eSign Wisconsin Codicil to Will Online

- eSign Hawaii Guaranty Agreement Mobile

- eSign Hawaii Guaranty Agreement Now

- How Can I eSign Kentucky Collateral Agreement

- eSign Louisiana Demand for Payment Letter Simple