Application for Extension of Time to File, Form NJ 630 2024-2026

What is the Application For Extension Of Time To File, Form NJ 630

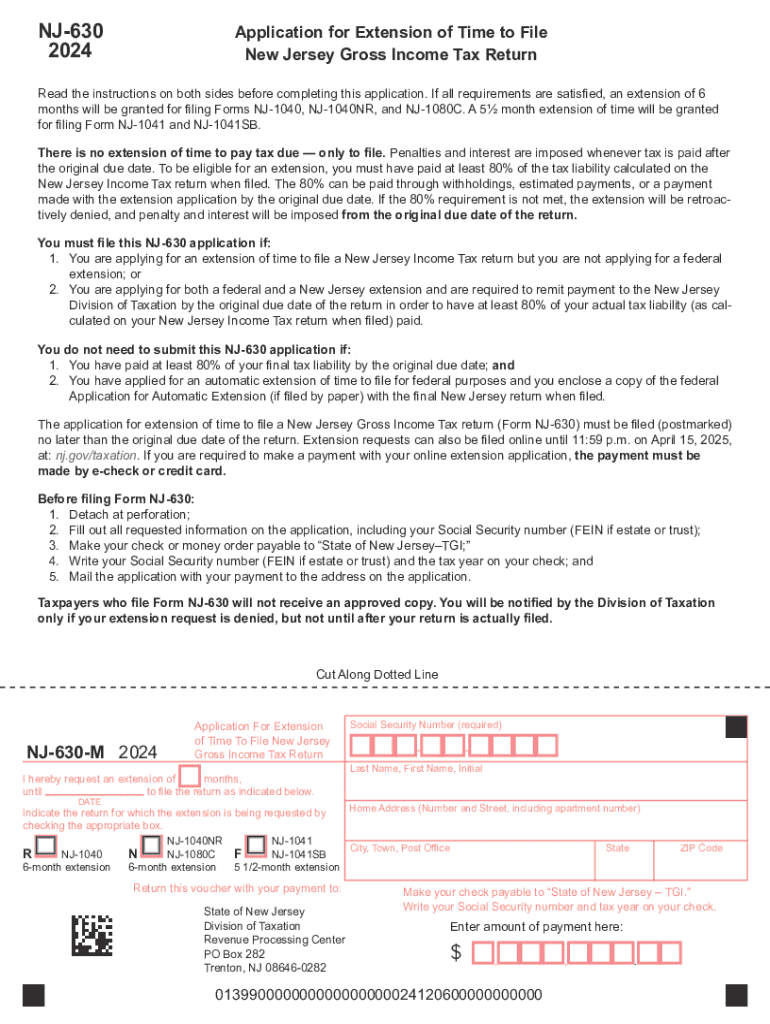

The Application For Extension Of Time To File, Form NJ 630, is a crucial document for New Jersey taxpayers who need additional time to file their state income tax returns. This form allows individuals and businesses to request an extension, typically granting an additional six months to submit their tax filings. It is important to note that while this extension provides more time to file, it does not extend the deadline for payment of any taxes owed. Taxpayers must still estimate and pay any due taxes by the original filing deadline to avoid penalties and interest.

Steps to Complete the Application For Extension Of Time To File, Form NJ 630

Completing Form NJ 630 involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents, including income statements and previous tax returns. Then, fill out the form with your personal information, including name, address, and Social Security number. Next, calculate your estimated tax liability and any payments made. Finally, submit the completed form to the New Jersey Division of Taxation by the deadline. It is advisable to keep a copy for your records.

Filing Deadlines / Important Dates

Understanding the filing deadlines for Form NJ 630 is essential for compliance. Typically, the application must be submitted by the original due date of your tax return, which is usually April fifteenth for most individuals. If the deadline falls on a weekend or holiday, it is extended to the next business day. The extended filing period granted by this form allows taxpayers until October fifteenth to file their returns. However, any taxes owed must be paid by the original due date to avoid penalties.

Eligibility Criteria

Eligibility for using Form NJ 630 is generally straightforward. Any individual or business taxpayer who requires more time to file their New Jersey state income tax return can apply for an extension. This includes self-employed individuals, partnerships, and corporations. However, taxpayers should be aware that this form is not applicable for those who have already filed their returns or for certain specific tax situations that may require different forms or procedures.

Key Elements of the Application For Extension Of Time To File, Form NJ 630

Form NJ 630 includes several key elements that taxpayers must complete accurately. These elements include the taxpayer's name, address, Social Security number or Employer Identification Number, and the estimated amount of tax due. Additionally, the form requires a signature and date to certify the information provided. It is important to ensure that all information is correct to avoid delays in processing the extension.

Form Submission Methods (Online / Mail / In-Person)

Taxpayers have multiple options for submitting Form NJ 630. The form can be filed online through the New Jersey Division of Taxation's website, which is often the fastest method. Alternatively, taxpayers may choose to mail the completed form to the appropriate address listed on the form instructions. For those who prefer in-person submissions, visiting a local Division of Taxation office is also an option. Regardless of the method chosen, it is crucial to ensure that the form is submitted by the deadline to avoid penalties.

Create this form in 5 minutes or less

Find and fill out the correct application for extension of time to file form nj 630

Create this form in 5 minutes!

How to create an eSignature for the application for extension of time to file form nj 630

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are New Jersey state income tax forms?

New Jersey state income tax forms are official documents required by the state for individuals and businesses to report their income and calculate their tax obligations. These forms include various schedules and instructions to ensure accurate filing. Understanding these forms is crucial for compliance with state tax laws.

-

How can airSlate SignNow help with New Jersey state income tax forms?

airSlate SignNow provides a streamlined solution for sending and eSigning New Jersey state income tax forms. Our platform allows users to easily manage and store their tax documents securely, ensuring that all necessary forms are completed and submitted on time. This simplifies the tax filing process for both individuals and businesses.

-

Are there any costs associated with using airSlate SignNow for New Jersey state income tax forms?

Yes, airSlate SignNow offers various pricing plans that cater to different needs, including options for individuals and businesses. The cost is competitive and reflects the value of our easy-to-use platform for managing New Jersey state income tax forms. You can choose a plan that best fits your budget and requirements.

-

What features does airSlate SignNow offer for managing New Jersey state income tax forms?

airSlate SignNow includes features such as document templates, eSignature capabilities, and secure cloud storage specifically designed for New Jersey state income tax forms. These features enhance efficiency and ensure that your tax documents are handled professionally. Additionally, our platform allows for easy collaboration with tax professionals.

-

Can I integrate airSlate SignNow with other software for New Jersey state income tax forms?

Absolutely! airSlate SignNow offers integrations with various accounting and tax software, making it easier to manage your New Jersey state income tax forms. This seamless integration allows for automatic data transfer and reduces the risk of errors, ensuring a smooth filing process.

-

Is airSlate SignNow secure for handling New Jersey state income tax forms?

Yes, security is a top priority at airSlate SignNow. Our platform employs advanced encryption and security protocols to protect your New Jersey state income tax forms and sensitive information. You can trust that your documents are safe and compliant with industry standards.

-

How does airSlate SignNow improve the efficiency of filing New Jersey state income tax forms?

By using airSlate SignNow, you can signNowly improve the efficiency of filing New Jersey state income tax forms. Our platform allows for quick document preparation, easy eSigning, and secure sharing, which reduces the time spent on tax filing. This efficiency helps you meet deadlines and avoid penalties.

Get more for Application For Extension Of Time To File, Form NJ 630

- Trade policy review world trade organization slidelegendcom form

- 32 form online subscription agreement

- Software distribution agreement secgov form

- 34 form agency licensing agreement

- 2011 introduction and penalty relief internal revenue service form

- Microsoft cloud agreementyorb form

- Create an end user license agreement eulalegal templates form

- Means this iphone developer program license agreement form

Find out other Application For Extension Of Time To File, Form NJ 630

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe

- Electronic signature Texas Construction Promissory Note Template Online