State Income Tax Return Extension Information OLT Com 2022

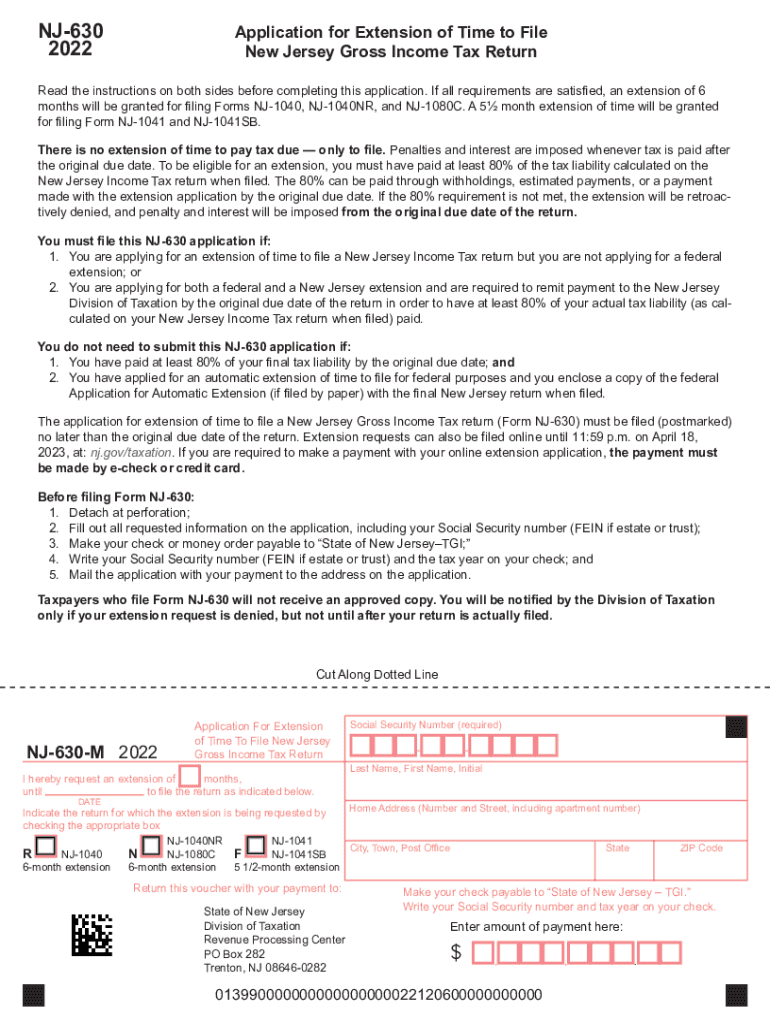

Key elements of the 2016 New Jersey form

The 2016 New Jersey form is primarily used for state income tax returns. Understanding its key elements is essential for accurate completion. This form includes personal information such as name, address, and Social Security number. Additionally, it requires details about income sources, deductions, and credits. Taxpayers must also report any additional taxes owed and provide information on payments made throughout the year. Ensuring that each section is filled out correctly can help avoid delays in processing and potential penalties.

Steps to complete the 2016 New Jersey form

Completing the 2016 New Jersey form involves several important steps. First, gather all necessary documents, including W-2s, 1099s, and records of any deductions. Next, carefully fill out the form, starting with personal information, followed by income details. Be sure to include any eligible deductions and credits, as these can significantly affect your tax liability. After completing the form, review it for accuracy, ensuring all calculations are correct. Finally, submit the form either electronically or by mail, depending on your preference.

Filing deadlines / Important dates for the 2016 New Jersey form

Filing deadlines are crucial for ensuring compliance with state tax laws. For the 2016 New Jersey form, the standard filing deadline is typically April 15 of the following year. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should also be aware of any extensions available, which can provide additional time to file. Keeping track of these important dates helps avoid penalties and ensures timely processing of your tax return.

Penalties for non-compliance with the 2016 New Jersey form

Failure to comply with the requirements of the 2016 New Jersey form can result in various penalties. These may include late filing fees, interest on unpaid taxes, and potential legal action for severe non-compliance. It is important to file the form accurately and on time to avoid these consequences. Understanding the specific penalties associated with different types of non-compliance can help taxpayers take proactive steps to meet their obligations.

Eligibility criteria for the 2016 New Jersey form

Eligibility for filing the 2016 New Jersey form generally depends on residency status and income level. Residents of New Jersey who earn income during the tax year are typically required to file. Additionally, non-residents who earn income from New Jersey sources must also complete this form. Specific income thresholds may apply, determining whether an individual is required to file or may qualify for exemptions. Understanding these criteria is essential for ensuring compliance and avoiding unnecessary filings.

Form submission methods for the 2016 New Jersey form

Taxpayers have several options for submitting the 2016 New Jersey form. The form can be filed electronically through approved software or the state’s online portal, which often provides faster processing times. Alternatively, taxpayers may choose to mail a paper version of the form to the appropriate state tax office. In-person submissions may also be available at designated tax offices. Each method has its own advantages, and taxpayers should select the one that best fits their needs.

Quick guide on how to complete state income tax return extension information oltcom

Effortlessly Complete State Income Tax Return Extension Information OLT com on Any Device

Managing documents online has gained traction among businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed paperwork, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to swiftly create, alter, and electronically sign your documents without delays. Handle State Income Tax Return Extension Information OLT com on any device with airSlate SignNow's Android or iOS applications and enhance any document-based task today.

How to Modify and eSign State Income Tax Return Extension Information OLT com with Ease

- Locate State Income Tax Return Extension Information OLT com and select Get Form to begin.

- Make use of the tools available to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive information using tools that airSlate SignNow specifically offers for that purpose.

- Create your signature with the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select your preferred method for sending your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns over lost or misplaced documents, tedious form searching, or mistakes that require printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from your chosen device. Alter and eSign State Income Tax Return Extension Information OLT com to ensure optimal communication at any point in the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct state income tax return extension information oltcom

Create this form in 5 minutes!

How to create an eSignature for the state income tax return extension information oltcom

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2016 New Jersey form used for?

The 2016 New Jersey form is commonly used for various tax and legal purposes within the state. This form is integral for ensuring compliance with New Jersey's state laws. Businesses can utilize airSlate SignNow to electronically sign and submit these forms easily and securely.

-

How can I complete the 2016 New Jersey form using airSlate SignNow?

To complete the 2016 New Jersey form with airSlate SignNow, users can upload the document, fill in necessary fields, and then eSign it. The platform provides a user-friendly interface that simplifies the form-filling process. Additionally, users can collaborate with team members to ensure accuracy and completeness.

-

Is there a cost associated with using airSlate SignNow for the 2016 New Jersey form?

Yes, there is a cost associated with using airSlate SignNow for the 2016 New Jersey form, but it remains competitively priced. Plans are designed to cater to various business sizes and include essential features like eSigning and document management. Investing in airSlate SignNow will streamline your workflow and save time on document handling.

-

What features does airSlate SignNow offer for the 2016 New Jersey form?

airSlate SignNow offers several features to enhance the submission process for the 2016 New Jersey form, including eSignature capability, document templates, and real-time collaboration tools. These features help users manage their paperwork efficiently. Additionally, the platform is secure and compliant with legal standards to protect sensitive information.

-

Can I track the status of my 2016 New Jersey form once sent through airSlate SignNow?

Yes, airSlate SignNow provides tracking capabilities for the 2016 New Jersey form once it has been sent out for signing. Users can receive notifications on the status of the document, ensuring they are always updated. This feature enhances accountability and helps users follow up on forms efficiently.

-

What benefits does airSlate SignNow offer for managing the 2016 New Jersey form?

Using airSlate SignNow for the 2016 New Jersey form delivers signNow benefits, such as reducing paperwork errors and expediting the signing process. The platform's automation features minimize manual tasks, allowing teams to focus on more critical aspects of their business. Furthermore, users appreciate the convenience of accessing documents from anywhere.

-

Does airSlate SignNow integrate with other software for handling the 2016 New Jersey form?

Yes, airSlate SignNow seamlessly integrates with various software applications to handle the 2016 New Jersey form efficiently. Integration options include popular CRM systems, cloud storage solutions, and productivity tools. These connections enhance operational workflow by allowing data to be shared among systems effortlessly.

Get more for State Income Tax Return Extension Information OLT com

- Notice to terminate lease form

- 7 day notice to terminate week to week tenancy residential from tenant to landlord mississippi form

- Mississippi 30 form

- Assignment of deed of trust by individual mortgage holder mississippi form

- Mississippi assignment form

- Month to month form

- Ms terminate form

- Mississippi month to month form

Find out other State Income Tax Return Extension Information OLT com

- How To eSign Delaware Business partnership agreement

- How Do I eSign Massachusetts Business partnership agreement

- Can I eSign Georgia Business purchase agreement

- How Can I eSign Idaho Business purchase agreement

- How To eSign Hawaii Employee confidentiality agreement

- eSign Idaho Generic lease agreement Online

- eSign Pennsylvania Generic lease agreement Free

- eSign Kentucky Home rental agreement Free

- How Can I eSign Iowa House rental lease agreement

- eSign Florida Land lease agreement Fast

- eSign Louisiana Land lease agreement Secure

- How Do I eSign Mississippi Land lease agreement

- eSign Connecticut Landlord tenant lease agreement Now

- eSign Georgia Landlord tenant lease agreement Safe

- Can I eSign Utah Landlord lease agreement

- How Do I eSign Kansas Landlord tenant lease agreement

- How Can I eSign Massachusetts Landlord tenant lease agreement

- eSign Missouri Landlord tenant lease agreement Secure

- eSign Rhode Island Landlord tenant lease agreement Later

- How Can I eSign North Carolina lease agreement