Fiduciary SC Department of Revenue 2017

Understanding the Fiduciary SC Department of Revenue

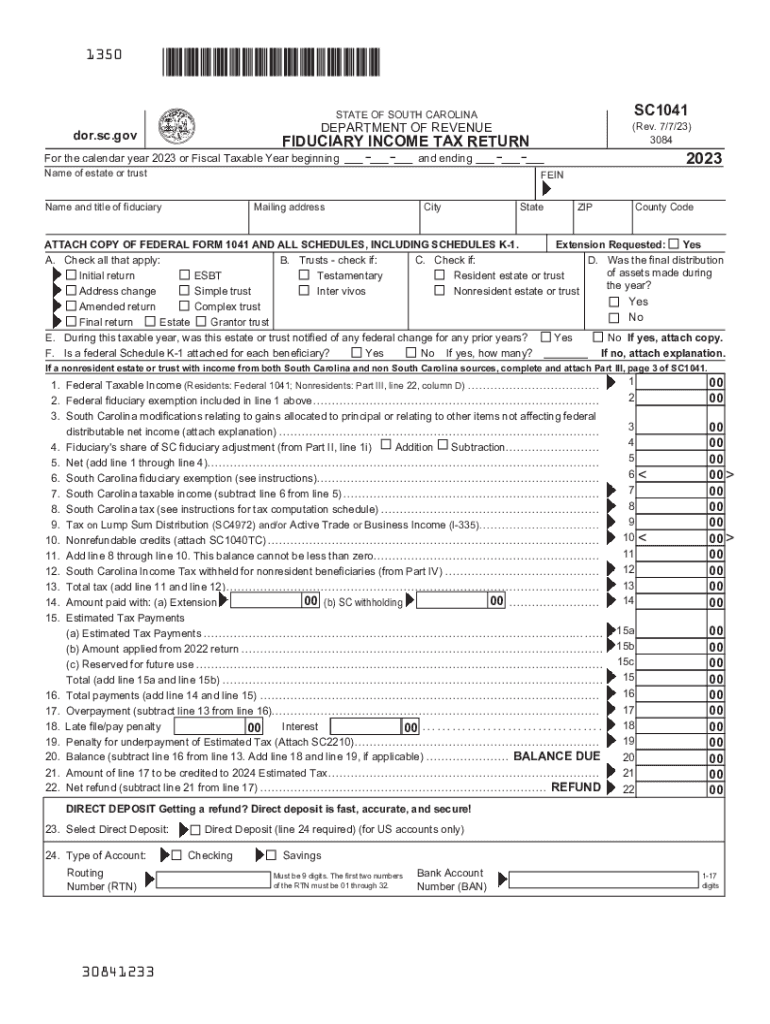

The Fiduciary SC Department of Revenue is responsible for overseeing the taxation of estates and trusts in South Carolina. This department manages the filing and processing of the SC 1041 form, which is essential for reporting income generated by estates or trusts. Understanding its role is crucial for fiduciaries who are managing the financial affairs of deceased individuals or those unable to manage their own finances.

Steps to Complete the Fiduciary SC Department of Revenue Form

Completing the SC 1041 form involves several key steps to ensure accuracy and compliance with state regulations. First, gather all necessary documentation, including income statements and records of deductions. Next, fill out the form with detailed information regarding the estate or trust, including the name, address, and taxpayer identification number. Be sure to report all income accurately, as this will affect the overall tax liability. After completing the form, review it for any errors before submitting it to the SC Department of Revenue.

Legal Use of the Fiduciary SC Department of Revenue

The legal use of the Fiduciary SC Department of Revenue pertains to the proper filing of tax returns for estates and trusts. Fiduciaries must adhere to legal guidelines when reporting income and deductions. This includes understanding the implications of property deductions, which can significantly affect the taxable income of the estate. Compliance with these legal requirements helps avoid penalties and ensures that the estate's financial obligations are met.

Required Documents for Filing

When filing the SC 1041 form, specific documents are required to substantiate the information reported. These documents include income statements, such as K-1 forms, records of property deductions, and any relevant financial statements related to the estate or trust. Maintaining organized records will facilitate a smoother filing process and help ensure all necessary information is included.

Filing Deadlines and Important Dates

Filing deadlines for the SC 1041 form are critical for fiduciaries to observe. Typically, the form must be filed by the fifteenth day of the fourth month following the end of the estate's tax year. It is essential to keep track of these dates to avoid late filing penalties. Additionally, understanding any extensions that may be available can provide further flexibility in meeting these deadlines.

Examples of Using the Fiduciary SC Department of Revenue

Examples of using the Fiduciary SC Department of Revenue include situations where a trustee must report income generated from trust assets or when an executor files on behalf of an estate. Each scenario may involve different considerations regarding property deductions and income reporting. Understanding these examples can help fiduciaries navigate the complexities of tax obligations effectively.

Quick guide on how to complete fiduciary sc department of revenue

Complete Fiduciary SC Department Of Revenue effortlessly on any device

Managing documents online has gained traction with businesses and individuals. It offers an ideal eco-friendly substitute to traditional printed and signed documents, as you can locate the appropriate template and securely keep it online. airSlate SignNow equips you with all the resources required to create, edit, and eSign your documents swiftly without delays. Handle Fiduciary SC Department Of Revenue on any system using airSlate SignNow Android or iOS applications and streamline any document-related process today.

The easiest way to modify and eSign Fiduciary SC Department Of Revenue without hassle

- Find Fiduciary SC Department Of Revenue and click Get Form to initiate.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of your documents or mask sensitive details with tools that airSlate SignNow supplies specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Verify the details and then click the Done button to save your updates.

- Choose how you wish to submit your form, via email, SMS, or an invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors requiring new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Edit and eSign Fiduciary SC Department Of Revenue and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct fiduciary sc department of revenue

Create this form in 5 minutes!

How to create an eSignature for the fiduciary sc department of revenue

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is property deduction in the context of eSigning documents?

Property deduction refers to the ability to reduce taxable income based on property-related expenses, including those incurred during electronic signing processes. By using airSlate SignNow, businesses can ensure that their eSigning activities are documented properly, aiding in accurate property deduction claims. It is important to keep thorough records of electronic signatures for potential tax benefits.

-

How can airSlate SignNow help with property deduction tracking?

airSlate SignNow provides a comprehensive solution to track and document eSigned agreements related to property deductions. With our platform, all signatures and document histories are securely stored, making it easier to retrieve and manage records needed for tax purposes. This streamlined documentation supports effective property deduction management.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers flexible pricing plans tailored to suit various business needs, enhancing your potential for property deduction through organized documentation. Each plan provides robust features that streamline your eSigning process, ensuring cost-effectiveness. By investing in our service, businesses can save time and improve their property deduction documentation efforts.

-

Does airSlate SignNow integrate with accounting software for property deduction purposes?

Yes, airSlate SignNow integrates seamlessly with leading accounting software to enhance your property deduction process. This integration allows for the automatic transfer of eSigned documents into your financial records, simplifying the claim process. Accurate syncing of documentation ensures that all property deduction claims are supported by valid eSignatures.

-

What features does airSlate SignNow offer that assist with property deduction?

airSlate SignNow offers features like customizable templates and audit trails that are essential for managing property deduction. These functionalities ensure that every signed document is traceable, making it easier to validate claims. Additionally, our mobile accessibility allows users to quickly gather signatures on the go, boosting overall productivity in managing property deductions.

-

How can I ensure my documents are secure with airSlate SignNow during property deduction processes?

Security is paramount when handling documents related to property deduction, and airSlate SignNow delivers robust encryption to keep your data safe. Our platform features secure cloud storage and multi-factor authentication, ensuring that your eSigned documents are protected from unauthorized access. This gives you peace of mind when managing sensitive property deduction information.

-

What benefits does using airSlate SignNow provide for property deduction tasks?

Using airSlate SignNow signNowly enhances your ability to manage property deduction tasks by facilitating quick and secure eSigning of documents. This leads to improved efficiency in processing claims and minimizing paperwork errors. Our platform also helps businesses create organized records, making it easier to substantiate property deductions during audits.

Get more for Fiduciary SC Department Of Revenue

- Title vii civil rights act form

- Title vii and sexual harassment claims findlaw form

- Laws enforced by the employment litigation section form

- Business law post test 3 homework flashcardsquizlet form

- No 15 3839 in the united states court of appeals form

- Eleventh circuit pattern jury instructions insider trading by form

- Civil rights without remedies vicarious liability under title form

- Tax considerations when settling employment cases form

Find out other Fiduciary SC Department Of Revenue

- eSignature Arkansas Courts LLC Operating Agreement Now

- How Do I eSignature Arizona Courts Moving Checklist

- eSignature Wyoming Real Estate Quitclaim Deed Myself

- eSignature Wyoming Real Estate Lease Agreement Template Online

- How Can I eSignature Delaware Courts Stock Certificate

- How Can I eSignature Georgia Courts Quitclaim Deed

- Help Me With eSignature Florida Courts Affidavit Of Heirship

- Electronic signature Alabama Banking RFP Online

- eSignature Iowa Courts Quitclaim Deed Now

- eSignature Kentucky Courts Moving Checklist Online

- eSignature Louisiana Courts Cease And Desist Letter Online

- How Can I Electronic signature Arkansas Banking Lease Termination Letter

- eSignature Maryland Courts Rental Application Now

- eSignature Michigan Courts Affidavit Of Heirship Simple

- eSignature Courts Word Mississippi Later

- eSignature Tennessee Sports Last Will And Testament Mobile

- How Can I eSignature Nevada Courts Medical History

- eSignature Nebraska Courts Lease Agreement Online

- eSignature Nebraska Courts LLC Operating Agreement Easy

- Can I eSignature New Mexico Courts Business Letter Template