Declaration of Estimated Tax for Fiduciaries 2021

What is the Declaration of Estimated Tax for Fiduciaries

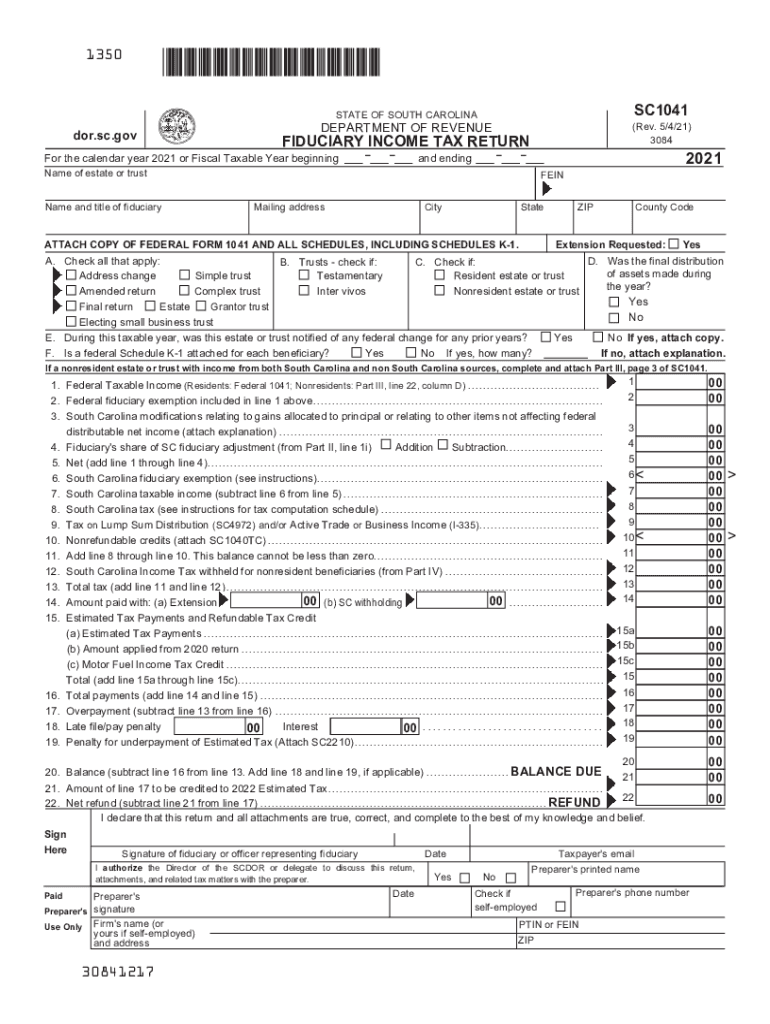

The Declaration of Estimated Tax for Fiduciaries, often referred to as the SC 1041 tax form, is a crucial document for fiduciaries managing estates or trusts in South Carolina. This form is used to report estimated tax payments on income generated by the estate or trust. It ensures that fiduciaries comply with state tax obligations, allowing them to prepay taxes based on anticipated income for the year. Understanding this form is essential for maintaining compliance and avoiding penalties.

How to Use the Declaration of Estimated Tax for Fiduciaries

Using the SC 1041 tax form involves several steps. First, fiduciaries need to estimate the income that the estate or trust will generate throughout the year. This estimation should consider all potential income sources, including dividends, interest, and rental income. Once the estimated income is determined, fiduciaries can calculate the estimated tax liability based on current tax rates. The completed form must then be submitted to the South Carolina Department of Revenue, along with any required payments.

Steps to Complete the Declaration of Estimated Tax for Fiduciaries

Completing the SC 1041 tax form requires careful attention to detail. Here are the steps to follow:

- Gather financial information regarding the estate or trust, including income statements and previous tax returns.

- Estimate the total income for the upcoming tax year.

- Calculate the estimated tax liability using the appropriate tax rates.

- Fill out the SC 1041 tax form, ensuring all sections are completed accurately.

- Submit the form and any estimated tax payments to the South Carolina Department of Revenue by the specified deadline.

Key Elements of the Declaration of Estimated Tax for Fiduciaries

Several key elements must be included when completing the SC 1041 tax form. These include:

- Fiduciary Information: Name, address, and taxpayer identification number of the fiduciary.

- Estate or Trust Information: Name and identification number of the estate or trust.

- Estimated Income: A detailed breakdown of projected income sources.

- Tax Calculation: The estimated tax liability based on the income projections.

- Payment Information: Details regarding any estimated tax payments made or owed.

Filing Deadlines / Important Dates

Fiduciaries must adhere to specific deadlines when submitting the SC 1041 tax form. Typically, the estimated tax payments are due on the 15th day of the fourth, sixth, ninth months, and the following January. It is essential to keep track of these dates to avoid late fees and penalties. Fiduciaries should also be aware of the annual filing deadline for the final tax return for the estate or trust, which is usually due on the 15th day of the fourth month following the end of the tax year.

Penalties for Non-Compliance

Failure to file the SC 1041 tax form or make the required estimated tax payments can result in significant penalties. These may include:

- Late filing penalties, which can accumulate based on the duration of the delay.

- Interest on unpaid taxes, which accrues from the due date until payment is made.

- Potential legal consequences for fiduciaries who do not fulfill their tax obligations.

Quick guide on how to complete declaration of estimated tax for fiduciaries

Prepare Declaration Of Estimated Tax For Fiduciaries effortlessly on any device

Digital document management has gained signNow popularity among businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to locate the appropriate form and securely save it online. airSlate SignNow provides all the resources required to create, modify, and eSign your documents quickly and efficiently. Manage Declaration Of Estimated Tax For Fiduciaries on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to adjust and eSign Declaration Of Estimated Tax For Fiduciaries with ease

- Obtain Declaration Of Estimated Tax For Fiduciaries and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize signNow sections of the documents or redact sensitive information using the tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature with the Sign feature, which takes just seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and then click the Done button to save your modifications.

- Select how you wish to submit your form, either by email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or missing files, tedious document searches, or errors that require printing new copies. airSlate SignNow meets all your document management requirements in just a few clicks from any device you prefer. Edit and eSign Declaration Of Estimated Tax For Fiduciaries and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct declaration of estimated tax for fiduciaries

Create this form in 5 minutes!

How to create an eSignature for the declaration of estimated tax for fiduciaries

The best way to make an electronic signature for a PDF file in the online mode

The best way to make an electronic signature for a PDF file in Chrome

The best way to create an electronic signature for putting it on PDFs in Gmail

The way to create an electronic signature straight from your smartphone

How to generate an e-signature for a PDF file on iOS devices

The way to create an electronic signature for a PDF document on Android

People also ask

-

What is the SC 1041 tax form form?

The SC 1041 tax form form is used by fiduciaries to report income, deductions, and credits of estates or trusts within South Carolina. This form is essential for ensuring compliance with the state's tax regulations and accurately reporting financial information.

-

How can airSlate SignNow assist with the SC 1041 tax form form?

airSlate SignNow offers a streamlined solution for creating and signing the SC 1041 tax form form electronically. Our platform simplifies the document management process, allowing users to eSign and send their tax forms quickly and securely.

-

Is there a cost associated with using airSlate SignNow for the SC 1041 tax form form?

Yes, airSlate SignNow provides various pricing plans that cater to different business needs. Each plan includes features that facilitate the efficient handling of documents like the SC 1041 tax form form, making it a cost-effective solution for your business.

-

What features does airSlate SignNow offer for handling the SC 1041 tax form form?

airSlate SignNow includes features such as customizable templates, team collaboration tools, and secure eSigning capabilities that enhance the process of managing the SC 1041 tax form form. These features ensure that your documents are completed accurately and efficiently.

-

Can I integrate airSlate SignNow with other applications for my SC 1041 tax form form needs?

Absolutely! airSlate SignNow offers integration with a variety of applications, including popular cloud storage services and CRM systems. This allows for a seamless workflow when dealing with the SC 1041 tax form form and other essential documents.

-

What are the benefits of using airSlate SignNow for the SC 1041 tax form form?

Using airSlate SignNow for the SC 1041 tax form form offers numerous benefits, including enhanced efficiency, reduced paper usage, and improved accuracy in document submission. Our platform is designed to save time and help users stay compliant with state tax regulations.

-

Is it secure to use airSlate SignNow for the SC 1041 tax form form?

Yes, airSlate SignNow prioritizes security, employing advanced encryption methods to protect your sensitive information. When handling the SC 1041 tax form form, you can trust that your data is safe and confidential.

Get more for Declaration Of Estimated Tax For Fiduciaries

Find out other Declaration Of Estimated Tax For Fiduciaries

- How Can I Sign Kansas Lawers Promissory Note Template

- Sign Kentucky Lawers Living Will Free

- Sign Kentucky Lawers LLC Operating Agreement Mobile

- Sign Louisiana Lawers Quitclaim Deed Now

- Sign Massachusetts Lawers Quitclaim Deed Later

- Sign Michigan Lawers Rental Application Easy

- Sign Maine Insurance Quitclaim Deed Free

- Sign Montana Lawers LLC Operating Agreement Free

- Sign Montana Lawers LLC Operating Agreement Fast

- Can I Sign Nevada Lawers Letter Of Intent

- Sign Minnesota Insurance Residential Lease Agreement Fast

- How Do I Sign Ohio Lawers LLC Operating Agreement

- Sign Oregon Lawers Limited Power Of Attorney Simple

- Sign Oregon Lawers POA Online

- Sign Mississippi Insurance POA Fast

- How Do I Sign South Carolina Lawers Limited Power Of Attorney

- Sign South Dakota Lawers Quitclaim Deed Fast

- Sign South Dakota Lawers Memorandum Of Understanding Free

- Sign South Dakota Lawers Limited Power Of Attorney Now

- Sign Texas Lawers Limited Power Of Attorney Safe