Individual Income SC Department of Revenue 2022

Steps to complete the SC-1041 tax form

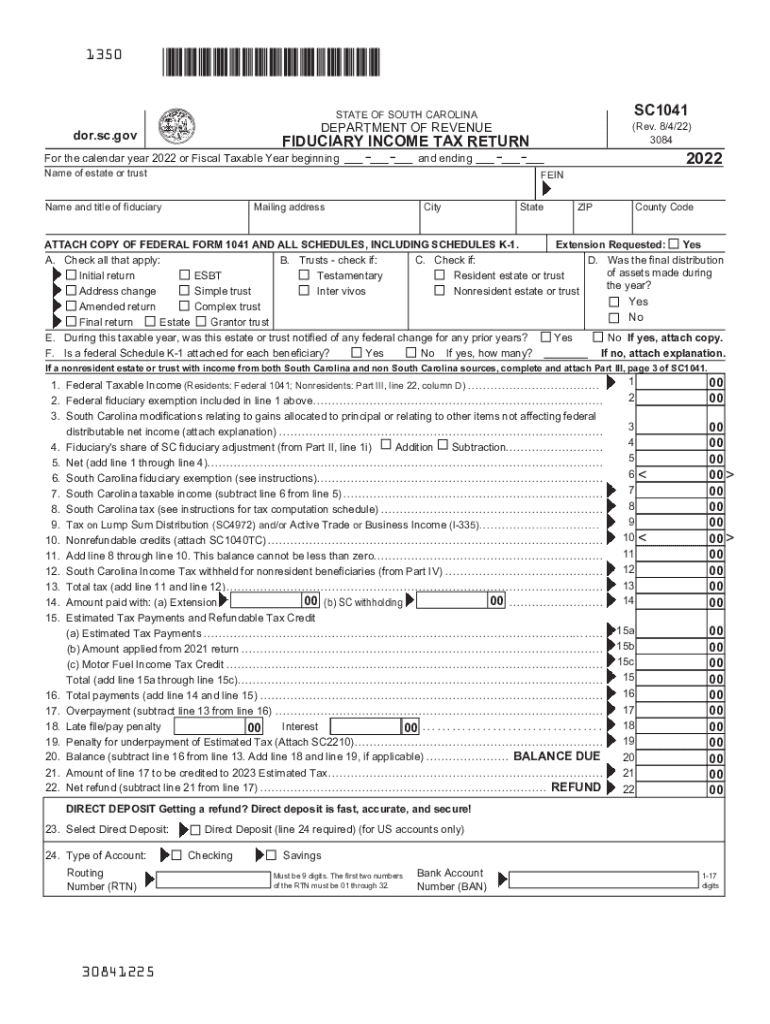

Completing the SC-1041 tax form requires careful attention to detail to ensure accuracy. Follow these steps for a smooth filing process:

- Gather necessary documents, including income statements, expense records, and any relevant tax documents.

- Begin by entering the fiduciary's name, address, and federal identification number at the top of the form.

- Report all income received by the estate or trust, including interest, dividends, and capital gains, on the appropriate lines.

- Deduct allowable expenses related to the estate's or trust's operations, such as management fees and legal expenses, in the designated sections.

- Calculate the taxable income by subtracting total deductions from total income.

- Complete the signature section, ensuring that the fiduciary or authorized representative signs and dates the form.

- Review the completed form for accuracy before submission.

Required documents for the SC-1041 tax form

To successfully complete the SC-1041 tax form, you will need several key documents:

- Federal tax return for the estate or trust (Form 1041).

- Income statements, including Forms 1099 and K-1.

- Records of all expenses incurred during the tax year.

- Any relevant legal documents that establish the fiduciary's authority.

- Documentation for any property deductions claimed.

Filing deadlines for the SC-1041 tax form

Understanding the filing deadlines is crucial to avoid penalties. The SC-1041 tax form is typically due:

- On the fifteenth day of the fourth month following the close of the tax year for estates and trusts.

- If the due date falls on a weekend or holiday, the deadline is extended to the next business day.

Legal use of the SC-1041 tax form

The SC-1041 tax form is legally required for estates and trusts that have generated income during the tax year. Proper completion ensures compliance with South Carolina tax laws and allows the fiduciary to report income accurately. Failure to file can result in penalties and interest on unpaid taxes.

Who issues the SC-1041 tax form

The SC-1041 tax form is issued by the South Carolina Department of Revenue. This state agency oversees tax collection and compliance, providing the necessary forms and instructions for fiduciaries managing estates and trusts.

Examples of using the SC-1041 tax form

The SC-1041 tax form is used in various scenarios, including:

- When an estate generates income from investments, rental properties, or business operations.

- When a trust receives income from its assets, such as dividends or interest.

- In situations where the fiduciary must report distributions to beneficiaries.

Quick guide on how to complete individual income sc department of revenue

Prepare Individual Income SC Department Of Revenue effortlessly on any device

Web-based document management has become increasingly favored by enterprises and individuals alike. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, as you can obtain the necessary form and securely keep it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents quickly without any delays. Handle Individual Income SC Department Of Revenue on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric workflow today.

The easiest way to edit and eSign Individual Income SC Department Of Revenue seamlessly

- Locate Individual Income SC Department Of Revenue and then click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize relevant sections of your documents or obscure sensitive information using tools that airSlate SignNow provides specifically for this function.

- Create your signature with the Sign feature, which takes just seconds and carries the same legal validity as a traditional written signature.

- Review the details and then click on the Done button to save your changes.

- Choose how you would like to send your form, whether by email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in a few clicks from any device of your choice. Modify and eSign Individual Income SC Department Of Revenue and guarantee outstanding communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct individual income sc department of revenue

Create this form in 5 minutes!

How to create an eSignature for the individual income sc department of revenue

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is sc1041 and how does airSlate SignNow help with it?

The sc1041 form is essential for reporting certain types of income. airSlate SignNow provides a seamless platform to eSign and send documents, including the sc1041, ensuring compliance and efficiency in your business transactions.

-

How much does airSlate SignNow cost for using sc1041 forms?

AirSlate SignNow offers flexible pricing plans designed to accommodate various business needs. With our competitive pricing, you can easily eSign and manage your sc1041 forms without breaking the bank.

-

Are there any special features for handling sc1041 documents with airSlate SignNow?

Yes, airSlate SignNow includes advanced features like template creation, status tracking, and customizable workflows specifically for sc1041 documents. These tools streamline the signing process, making it quick and efficient.

-

Can I integrate airSlate SignNow with other tools to manage sc1041 workflows?

Absolutely! airSlate SignNow integrates seamlessly with numerous third-party applications, making it easy to incorporate your sc1041 processes into your existing workflow. This integration helps enhance productivity and coordination.

-

What are the benefits of using airSlate SignNow for sc1041 eSigning?

Using airSlate SignNow for sc1041 eSigning provides several advantages, including time savings, enhanced security, and the ability to track document status. This allows businesses to ensure accuracy and maintain compliance efficiently.

-

Is there a mobile app for signing sc1041 documents with airSlate SignNow?

Yes, airSlate SignNow offers a mobile app that allows users to sign sc1041 documents on-the-go. This mobile functionality ensures that you can manage important paperwork anytime, anywhere, without any hassle.

-

How secure is the signing process for sc1041 documents in airSlate SignNow?

Security is a top priority for airSlate SignNow. Our platform ensures that your sc1041 documents are encrypted, and we comply with essential industry standards to protect your sensitive data during the eSigning process.

Get more for Individual Income SC Department Of Revenue

- Discount divas return form

- Dorchester county scrap metal permit form

- Amu degree certificate form

- 1420 biodata form

- Kia rondo repair manual pdf form

- Terex 760b parts manual pdf form

- Enteral therapy precertification worksheet unicarestateplan com form

- Fillable online suffolkcountyny suffolk county department of form

Find out other Individual Income SC Department Of Revenue

- Sign Washington Sports Last Will And Testament Free

- How Can I Sign Ohio Real Estate LLC Operating Agreement

- Sign Ohio Real Estate Quitclaim Deed Later

- How Do I Sign Wisconsin Sports Forbearance Agreement

- How To Sign Oregon Real Estate Resignation Letter

- Can I Sign Oregon Real Estate Forbearance Agreement

- Sign Pennsylvania Real Estate Quitclaim Deed Computer

- How Do I Sign Pennsylvania Real Estate Quitclaim Deed

- How Can I Sign South Dakota Orthodontists Agreement

- Sign Police PPT Alaska Online

- How To Sign Rhode Island Real Estate LLC Operating Agreement

- How Do I Sign Arizona Police Resignation Letter

- Sign Texas Orthodontists Business Plan Template Later

- How Do I Sign Tennessee Real Estate Warranty Deed

- Sign Tennessee Real Estate Last Will And Testament Free

- Sign Colorado Police Memorandum Of Understanding Online

- How To Sign Connecticut Police Arbitration Agreement

- Sign Utah Real Estate Quitclaim Deed Safe

- Sign Utah Real Estate Notice To Quit Now

- Sign Hawaii Police LLC Operating Agreement Online