What is IRS Form 1041 Schedule K 1? 2024

What is IRS Form 1041 Schedule K-1?

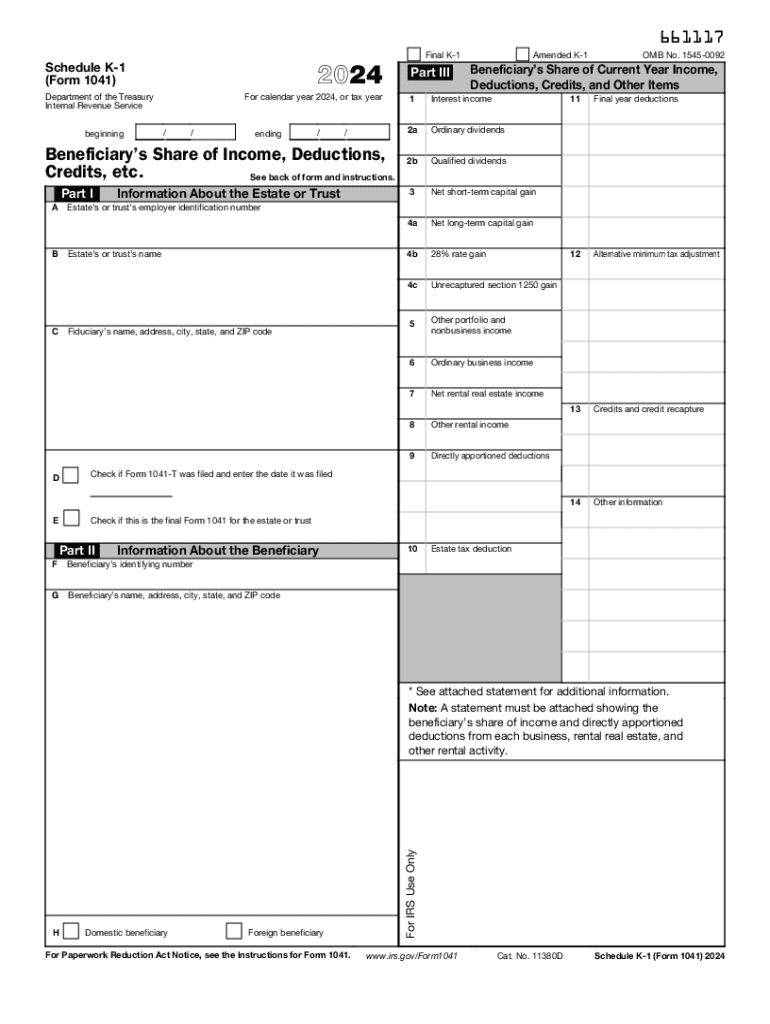

IRS Form 1041 Schedule K-1 is a tax document used to report income, deductions, and credits from estates and trusts. This form is essential for beneficiaries who receive distributions from an estate or trust, as it provides detailed information on their share of the entity’s income. The K-1 form is typically issued by the fiduciary of the estate or trust and is used to help beneficiaries accurately report their income on their individual tax returns.

How to use IRS Form 1041 Schedule K-1?

To use IRS Form 1041 Schedule K-1, beneficiaries should first review the information provided on the form, which includes the type of income received, deductions, and credits. Beneficiaries must then report this information on their personal tax returns, typically on Form 1040. It is important to ensure that the amounts reported on the K-1 match the entries on the tax return to avoid discrepancies that could trigger audits or penalties.

Steps to complete IRS Form 1041 Schedule K-1?

Completing IRS Form 1041 Schedule K-1 involves several key steps:

- Receive the K-1 form from the fiduciary of the estate or trust.

- Review the form for accuracy, ensuring all income types and amounts are correctly reported.

- Transfer the reported amounts to the appropriate sections on your Form 1040.

- Keep a copy of the K-1 for your records, as it may be needed for future reference or audits.

Key elements of IRS Form 1041 Schedule K-1?

The key elements of IRS Form 1041 Schedule K-1 include:

- Beneficiary Information: The name, address, and taxpayer identification number of the beneficiary.

- Entity Information: Details about the estate or trust, including its name and identification number.

- Income Types: Various types of income such as interest, dividends, capital gains, and rental income.

- Deductions and Credits: Any deductions or credits that the beneficiary can claim based on their share of the estate or trust.

Who Issues IRS Form 1041 Schedule K-1?

IRS Form 1041 Schedule K-1 is issued by the fiduciary of the estate or trust, typically the executor or trustee. The fiduciary is responsible for preparing the form accurately and ensuring that it is provided to all beneficiaries who received distributions during the tax year. It is crucial for the fiduciary to comply with IRS guidelines when preparing the K-1 to avoid potential penalties.

Filing Deadlines for IRS Form 1041 Schedule K-1

The filing deadline for IRS Form 1041, which includes the Schedule K-1, is generally April fifteenth for calendar year filers. However, if the estate or trust operates on a fiscal year, the deadline will vary accordingly. It is essential for fiduciaries to ensure that the K-1 forms are distributed to beneficiaries in a timely manner, allowing them to report the income accurately on their tax returns.

Handy tips for filling out What Is IRS Form 1041 Schedule K 1? online

Quick steps to complete and e-sign What Is IRS Form 1041 Schedule K 1? online:

- Use Get Form or simply click on the template preview to open it in the editor.

- Start completing the fillable fields and carefully type in required information.

- Use the Cross or Check marks in the top toolbar to select your answers in the list boxes.

- Utilize the Circle icon for other Yes/No questions.

- Look through the document several times and make sure that all fields are completed with the correct information.

- Insert the current Date with the corresponding icon.

- Add a legally-binding e-signature. Go to Sign -> Add New Signature and select the option you prefer: type, draw, or upload an image of your handwritten signature and place it where you need it.

- Finish filling out the form with the Done button.

- Download your copy, save it to the cloud, print it, or share it right from the editor.

- Check the Help section and contact our Support team if you run into any troubles when using the editor.

We know how stressing filling out documents could be. Obtain access to a HIPAA and GDPR compliant platform for optimum simpleness. Use signNow to electronically sign and send What Is IRS Form 1041 Schedule K 1? for e-signing.

Create this form in 5 minutes or less

Find and fill out the correct what is irs form 1041 schedule k 1

Create this form in 5 minutes!

How to create an eSignature for the what is irs form 1041 schedule k 1

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an IRS Form K-1?

The IRS Form K-1 is a tax document used to report income, deductions, and credits from partnerships, S corporations, estates, and trusts. It provides detailed information to partners or shareholders about their share of the entity's income, which they must report on their personal tax returns.

-

How can airSlate SignNow help with IRS Form K-1?

airSlate SignNow simplifies the process of sending and eSigning IRS Form K-1 by providing a user-friendly platform for document management. You can easily create, send, and track your K-1 forms, ensuring that all parties can sign electronically and securely.

-

Is there a cost associated with using airSlate SignNow for IRS Form K-1?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. The cost is competitive and provides access to features that streamline the management of IRS Form K-1 and other documents, making it a cost-effective solution for businesses.

-

What features does airSlate SignNow offer for IRS Form K-1 management?

airSlate SignNow includes features such as customizable templates, secure eSigning, document tracking, and integration with other software. These features enhance the efficiency of managing IRS Form K-1, ensuring that you can handle your tax documents with ease.

-

Can I integrate airSlate SignNow with other software for IRS Form K-1?

Absolutely! airSlate SignNow offers integrations with various applications, including accounting and tax software, to streamline the process of handling IRS Form K-1. This allows for seamless data transfer and improved workflow efficiency.

-

What are the benefits of using airSlate SignNow for IRS Form K-1?

Using airSlate SignNow for IRS Form K-1 provides numerous benefits, including faster turnaround times, reduced paperwork, and enhanced security. The platform ensures that your documents are signed and returned promptly, helping you meet tax deadlines with ease.

-

Is airSlate SignNow secure for handling IRS Form K-1?

Yes, airSlate SignNow prioritizes security and compliance, ensuring that your IRS Form K-1 and other sensitive documents are protected. The platform uses encryption and secure storage to safeguard your information, giving you peace of mind.

Get more for What Is IRS Form 1041 Schedule K 1?

- Gould assessment form

- Fake bank transfer receipt form fake bank transfer receipt form

- Ihsa wrestling skin form

- Ocfs 4930asfa form

- Bbb customer complaint form

- Itr 4 acknowledgement 20 pdf form

- Letter of intent valley mountain regional center form

- Decree of annulment no children pdf fillable family law self form

Find out other What Is IRS Form 1041 Schedule K 1?

- How To eSign Arizona Course Evaluation Form

- How To eSign California Course Evaluation Form

- How To eSign Florida Course Evaluation Form

- How To eSign Hawaii Course Evaluation Form

- How To eSign Illinois Course Evaluation Form

- eSign Hawaii Application for University Free

- eSign Hawaii Application for University Secure

- eSign Hawaii Medical Power of Attorney Template Free

- eSign Washington Nanny Contract Template Free

- eSignature Ohio Guaranty Agreement Myself

- eSignature California Bank Loan Proposal Template Now

- Can I eSign Indiana Medical History

- eSign Idaho Emergency Contract Form Myself

- eSign Hawaii General Patient Information Fast

- Help Me With eSign Rhode Island Accident Medical Claim Form

- eSignature Colorado Demand for Payment Letter Mobile

- eSignature Colorado Demand for Payment Letter Secure

- eSign Delaware Shareholder Agreement Template Now

- eSign Wyoming Shareholder Agreement Template Safe

- eSign Kentucky Strategic Alliance Agreement Secure