U S Life Insurance Company Income Tax Return 2024

Understanding the U.S. Corporation Income Tax Return

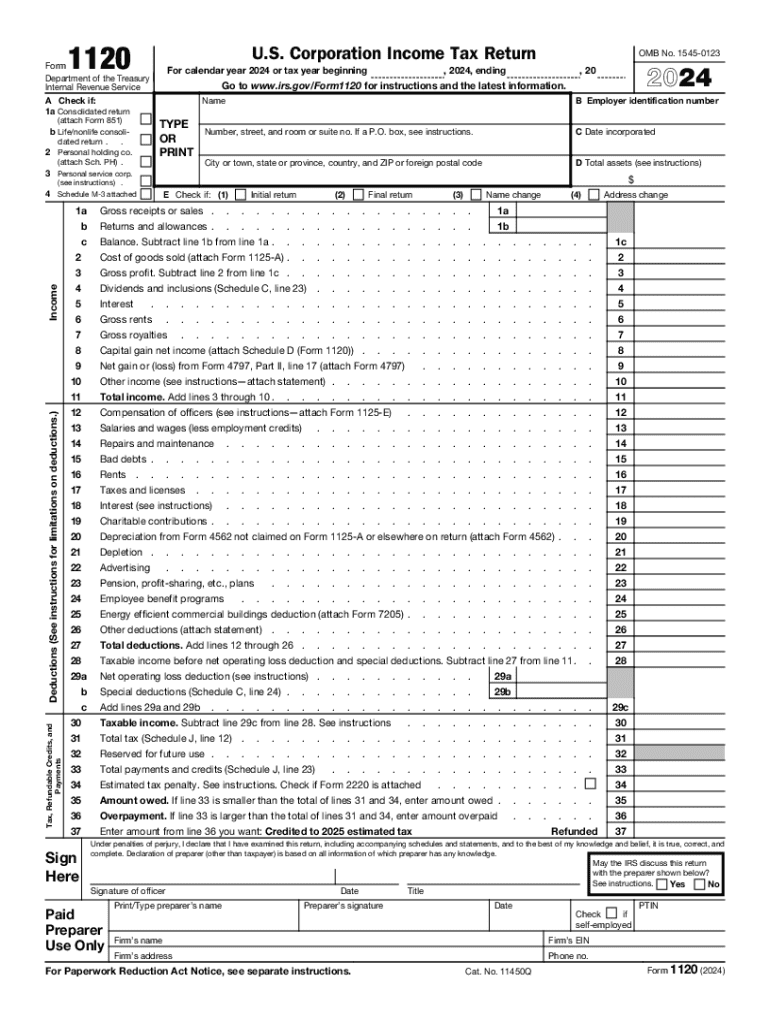

The U.S. Corporation Income Tax Return, commonly referred to as Form 1120, is the official document that corporations in the United States must file annually to report their income, gains, losses, deductions, and credits. This form is essential for determining the corporation's tax liability under the Internal Revenue Code. Corporations must accurately report their financial activities to comply with federal tax laws and avoid penalties.

Steps to Complete Form 1120

Completing Form 1120 involves several key steps:

- Gather financial records: Collect all relevant financial documents, including income statements, balance sheets, and expense reports.

- Fill out the form: Begin by entering identifying information such as the corporation's name, address, and Employer Identification Number (EIN).

- Report income: Detail all sources of income, including sales revenue and investment income.

- Claim deductions: List all allowable deductions that can reduce taxable income, such as operating expenses and depreciation.

- Calculate tax liability: Use the tax rate applicable to your corporation to determine the tax owed based on taxable income.

- Review and sign: Ensure all information is accurate and complete before signing the form.

Filing Deadlines and Important Dates

Corporations must be aware of specific deadlines for filing Form 1120 to avoid penalties:

- The standard due date for Form 1120 is the fifteenth day of the fourth month after the end of the corporation's tax year.

- If the corporation operates on a calendar year, the due date is April 15.

- Extensions can be requested, allowing an additional six months for filing, but any taxes owed must still be paid by the original due date.

Required Documents for Filing

To successfully complete Form 1120, corporations need to gather various documents:

- Financial statements: Income statements and balance sheets for the tax year.

- Expense records: Documentation for all business expenses claimed as deductions.

- Previous tax returns: Copies of prior years' returns may be helpful for reference.

- Supporting schedules: Any additional schedules required to report specific types of income or deductions.

IRS Guidelines for Form 1120

The IRS provides detailed guidelines for completing Form 1120. These guidelines include:

- Instructions on how to report various types of income and deductions.

- Information on tax credits available to corporations.

- Details on record-keeping requirements and how long to retain documents.

Penalties for Non-Compliance

Failing to file Form 1120 on time or inaccurately reporting information can lead to significant penalties:

- Late filing penalties can accrue based on the number of months the return is overdue.

- Accuracy-related penalties may apply if the IRS determines that the corporation has substantially understated its tax liability.

Digital vs. Paper Version of Form 1120

Corporations have the option to file Form 1120 electronically or via paper submission. Each method has its advantages:

- Electronic filing is generally faster and allows for immediate confirmation of receipt by the IRS.

- Paper filing may be preferred by those who are not comfortable with digital processes, but it can take longer for processing.

Handy tips for filling out U S Life Insurance Company Income Tax Return online

Quick steps to complete and e-sign U S Life Insurance Company Income Tax Return online:

- Use Get Form or simply click on the template preview to open it in the editor.

- Start completing the fillable fields and carefully type in required information.

- Use the Cross or Check marks in the top toolbar to select your answers in the list boxes.

- Utilize the Circle icon for other Yes/No questions.

- Look through the document several times and make sure that all fields are completed with the correct information.

- Insert the current Date with the corresponding icon.

- Add a legally-binding e-signature. Go to Sign -> Add New Signature and select the option you prefer: type, draw, or upload an image of your handwritten signature and place it where you need it.

- Finish filling out the form with the Done button.

- Download your copy, save it to the cloud, print it, or share it right from the editor.

- Check the Help section and contact our Support team if you run into any troubles when using the editor.

We know how stressing filling out documents could be. Obtain access to a HIPAA and GDPR compliant platform for optimum simpleness. Use signNow to electronically sign and send out U S Life Insurance Company Income Tax Return for collecting e-signatures.

Create this form in 5 minutes or less

Find and fill out the correct u s life insurance company income tax return

Create this form in 5 minutes!

How to create an eSignature for the u s life insurance company income tax return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it help with tax return processes?

airSlate SignNow is a digital signature solution that streamlines the process of sending and signing documents. For tax return purposes, it allows users to securely eSign forms and contracts, ensuring that all necessary documents are completed efficiently and accurately.

-

How much does airSlate SignNow cost for managing tax return documents?

airSlate SignNow offers various pricing plans to accommodate different business needs. The cost-effective solutions are designed to help businesses manage their tax return documents without breaking the bank, making it an ideal choice for small to medium-sized enterprises.

-

What features does airSlate SignNow offer for tax return management?

airSlate SignNow includes features such as customizable templates, automated workflows, and secure cloud storage. These features simplify the management of tax return documents, allowing users to focus on their core business activities while ensuring compliance and security.

-

Can I integrate airSlate SignNow with other software for tax return preparation?

Yes, airSlate SignNow integrates seamlessly with various accounting and tax preparation software. This integration allows users to streamline their tax return processes by connecting their existing tools with airSlate SignNow for enhanced efficiency.

-

Is airSlate SignNow secure for handling sensitive tax return information?

Absolutely! airSlate SignNow employs advanced security measures, including encryption and secure data storage, to protect sensitive tax return information. Users can confidently manage their documents knowing that their data is safe and compliant with industry standards.

-

How does airSlate SignNow improve the efficiency of tax return filing?

By using airSlate SignNow, businesses can signNowly reduce the time spent on tax return filing. The platform allows for quick eSigning and document sharing, which accelerates the entire process and minimizes delays associated with traditional methods.

-

What benefits does airSlate SignNow provide for tax return-related businesses?

airSlate SignNow offers numerous benefits for businesses dealing with tax returns, including increased productivity, reduced paperwork, and enhanced collaboration. These advantages help businesses operate more efficiently and improve their overall service delivery.

Get more for U S Life Insurance Company Income Tax Return

Find out other U S Life Insurance Company Income Tax Return

- How To Electronic signature New York Legal Lease Agreement

- How Can I Electronic signature New York Legal Stock Certificate

- Electronic signature North Carolina Legal Quitclaim Deed Secure

- How Can I Electronic signature North Carolina Legal Permission Slip

- Electronic signature Legal PDF North Dakota Online

- Electronic signature North Carolina Life Sciences Stock Certificate Fast

- Help Me With Electronic signature North Dakota Legal Warranty Deed

- Electronic signature North Dakota Legal Cease And Desist Letter Online

- Electronic signature North Dakota Legal Cease And Desist Letter Free

- Electronic signature Delaware Orthodontists Permission Slip Free

- How Do I Electronic signature Hawaii Orthodontists Lease Agreement Form

- Electronic signature North Dakota Life Sciences Business Plan Template Now

- Electronic signature Oklahoma Legal Bill Of Lading Fast

- Electronic signature Oklahoma Legal Promissory Note Template Safe

- Electronic signature Oregon Legal Last Will And Testament Online

- Electronic signature Life Sciences Document Pennsylvania Simple

- Electronic signature Legal Document Pennsylvania Online

- How Can I Electronic signature Pennsylvania Legal Last Will And Testament

- Electronic signature Rhode Island Legal Last Will And Testament Simple

- Can I Electronic signature Rhode Island Legal Residential Lease Agreement