05 166 Texas Franchise Tax Affiliate Schedule for Annual Report 2022

What is the 05 166 Texas Franchise Tax Affiliate Schedule for Annual Report

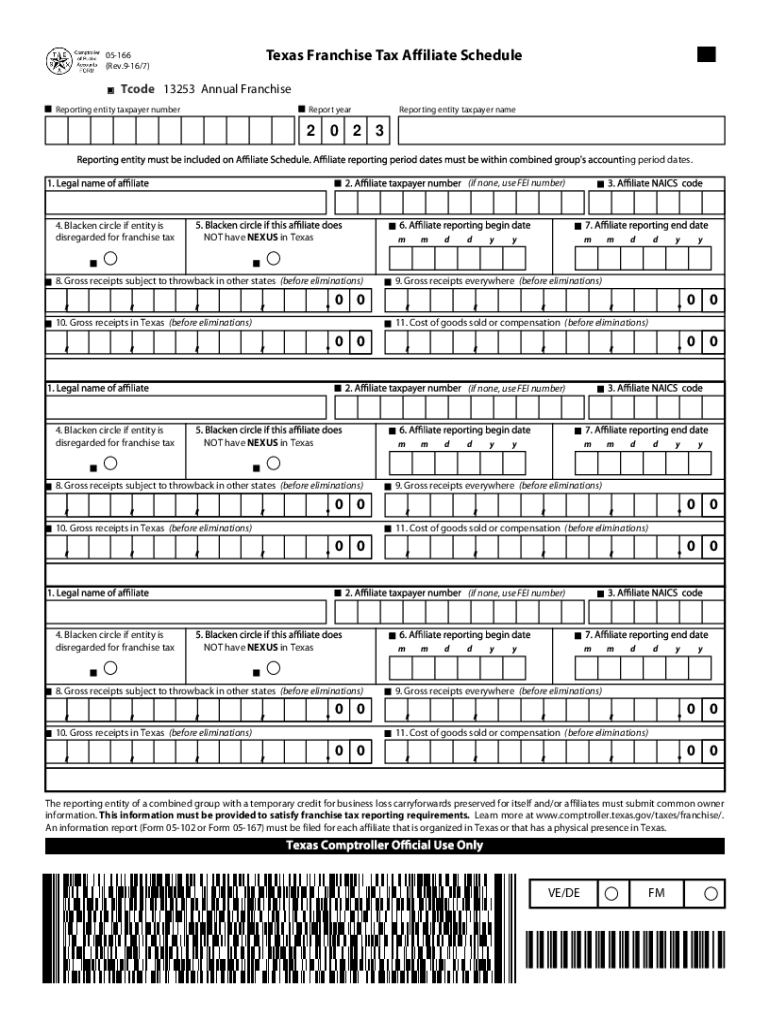

The 05 166 Texas Franchise Tax Affiliate Schedule is a crucial document for businesses operating in Texas. This form is specifically designed for entities that are part of an affiliated group. It allows these businesses to report their franchise tax liability accurately. The schedule helps in determining the total revenue and the tax obligations of each affiliate within the group, ensuring compliance with Texas tax laws.

Steps to Complete the 05 166 Texas Franchise Tax Affiliate Schedule for Annual Report

Completing the 05 166 Texas Franchise Tax Affiliate Schedule involves several important steps:

- Gather necessary financial documents, including revenue statements and previous tax filings.

- Identify all affiliates within the group and their respective revenues.

- Fill out the form by entering the required information for each affiliate, including their total revenue and any applicable deductions.

- Review the completed schedule for accuracy before submission.

- Submit the form along with the annual franchise tax report by the specified deadline.

Key Elements of the 05 166 Texas Franchise Tax Affiliate Schedule for Annual Report

Understanding the key elements of the 05 166 Texas Franchise Tax Affiliate Schedule is essential for accurate reporting. Important components include:

- Affiliate Information: Details about each affiliate, including name, address, and taxpayer identification number.

- Total Revenue: The gross revenue generated by each affiliate during the reporting period.

- Deductions: Any allowable deductions that can reduce the taxable revenue.

- Signature Section: A declaration that the information provided is accurate and complete, signed by an authorized representative.

Filing Deadlines / Important Dates

Timely submission of the 05 166 Texas Franchise Tax Affiliate Schedule is critical to avoid penalties. The filing deadline typically aligns with the annual franchise tax report, which is due on May 15th for most entities. If this date falls on a weekend or holiday, the deadline is extended to the next business day. It is advisable to check for any updates or changes to these dates each year.

Legal Use of the 05 166 Texas Franchise Tax Affiliate Schedule for Annual Report

The 05 166 Texas Franchise Tax Affiliate Schedule must be used in accordance with Texas tax laws. It is legally required for businesses that are part of an affiliated group to report their franchise tax liabilities accurately. Failure to submit this schedule or providing false information can result in penalties, fines, or other legal repercussions. Ensuring compliance with all relevant regulations is essential for maintaining good standing with the state.

Examples of Using the 05 166 Texas Franchise Tax Affiliate Schedule for Annual Report

Practical examples can clarify how to utilize the 05 166 Texas Franchise Tax Affiliate Schedule. For instance, consider a corporation with three subsidiaries. Each subsidiary must report its revenue, and the parent company consolidates this information on the 05 166 form. Another example is a limited liability company (LLC) with multiple business lines, where each line must be reported separately to accurately reflect the overall tax liability. These examples illustrate the importance of detailed reporting for compliance and tax calculation.

Quick guide on how to complete 05 166 texas franchise tax affiliate schedule for annual report

Effortlessly Prepare 05 166 Texas Franchise Tax Affiliate Schedule For Annual Report on Any Device

Managing documents online has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents quickly without delays. Manage 05 166 Texas Franchise Tax Affiliate Schedule For Annual Report on any device with the airSlate SignNow apps for Android or iOS and enhance any document-related process today.

How to Edit and eSign 05 166 Texas Franchise Tax Affiliate Schedule For Annual Report with Ease

- Find 05 166 Texas Franchise Tax Affiliate Schedule For Annual Report and click on Get Form to begin.

- Make use of the tools we provide to fill out your form.

- Emphasize relevant sections of your documents or redact sensitive information using the tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature with the Sign feature, which only takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Wave goodbye to lost or misplaced documents, cumbersome form searching, and errors that require reprinting new document copies. airSlate SignNow meets your document management requirements in just a few clicks from any device. Modify and eSign 05 166 Texas Franchise Tax Affiliate Schedule For Annual Report to ensure effective communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 05 166 texas franchise tax affiliate schedule for annual report

Create this form in 5 minutes!

How to create an eSignature for the 05 166 texas franchise tax affiliate schedule for annual report

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the pricing structure for the Texas affiliate program at airSlate SignNow?

The pricing for the Texas affiliate program at airSlate SignNow is designed to be flexible and competitive. Affiliates can earn commissions based on the volume of sales generated through their referrals. For full details regarding the specific commission rates and any potential bonuses, visit our pricing page.

-

How does the airSlate SignNow Texas affiliate program benefit my business?

Joining the airSlate SignNow Texas affiliate program can provide signNow benefits, including a steady revenue stream from commissions. Additionally, affiliates gain access to specialized resources and training that can enhance their marketing efforts. This program also allows you to offer a trusted eSigning solution to your network, boosting your credibility.

-

Are there any specific features that the airSlate SignNow Texas affiliate program highlights?

Yes, the airSlate SignNow Texas affiliate program highlights several key features, such as its intuitive interface, robust security measures, and mobile accessibility. These features not only enhance user experience but also make it easier for affiliates to promote an effective eSigning solution. Additionally, our platform integrates seamlessly with various applications to streamline document workflows.

-

What types of integrations does airSlate SignNow offer for Texas affiliates?

airSlate SignNow offers a wide range of integrations with popular tools and platforms, including CRM systems, document management software, and cloud storage services. These integrations allow Texas affiliates to provide a comprehensive solution tailored to their clients’ needs. This flexibility can be a powerful selling point when promoting the service.

-

How can I effectively promote airSlate SignNow as a Texas affiliate?

As a Texas affiliate, you can effectively promote airSlate SignNow by leveraging various marketing strategies such as content marketing, social media promotion, and targeted email campaigns. Using your unique affiliate links, you can share valuable content that highlights the benefits of the eSigning solution. Engaging potential clients with informative materials will enhance your conversion rates.

-

What support is available for Texas affiliates in the program?

Texas affiliates in the airSlate SignNow program have access to dedicated support resources, including account managers and extensive training materials. Our affiliate portal provides access to marketing assets, tracking tools, and best practices to optimize your promotional efforts. We are committed to helping our affiliates succeed in generating revenue.

-

Is there a limit on how many referrals I can have as a Texas affiliate?

No, there is no limit on the number of referrals you can generate as a Texas affiliate for airSlate SignNow. The more referrals you bring in, the higher your potential commissions. We encourage affiliates to expand their networks and promote the benefits of our user-friendly eSigning solution to maximize their success.

Get more for 05 166 Texas Franchise Tax Affiliate Schedule For Annual Report

- La cc art 103 1 divorce form packet

- Summary sheet mr civ p 5h maine form

- County united states form

- Multistate fixed rate note installment payments unsecured form

- Multistate biweekly fixed rate note form 3264 pdf

- Page 1 of 21 lease for oil gas and other liquid 1 form

- How do you notarize if a signer cant be presentnna form

- Clerk of civil district court for the parish of orleans civil form

Find out other 05 166 Texas Franchise Tax Affiliate Schedule For Annual Report

- Sign Oklahoma Insurance Limited Power Of Attorney Now

- Sign Idaho Legal Separation Agreement Online

- Sign Illinois Legal IOU Later

- Sign Illinois Legal Cease And Desist Letter Fast

- Sign Indiana Legal Cease And Desist Letter Easy

- Can I Sign Kansas Legal LLC Operating Agreement

- Sign Kansas Legal Cease And Desist Letter Now

- Sign Pennsylvania Insurance Business Plan Template Safe

- Sign Pennsylvania Insurance Contract Safe

- How Do I Sign Louisiana Legal Cease And Desist Letter

- How Can I Sign Kentucky Legal Quitclaim Deed

- Sign Kentucky Legal Cease And Desist Letter Fast

- Sign Maryland Legal Quitclaim Deed Now

- Can I Sign Maine Legal NDA

- How To Sign Maine Legal Warranty Deed

- Sign Maine Legal Last Will And Testament Fast

- How To Sign Maine Legal Quitclaim Deed

- Sign Mississippi Legal Business Plan Template Easy

- How Do I Sign Minnesota Legal Residential Lease Agreement

- Sign South Carolina Insurance Lease Agreement Template Computer