600S Corporation Tax Return Department of Revenue 2015

Understanding the Georgia DOR 1003 Income Return Form

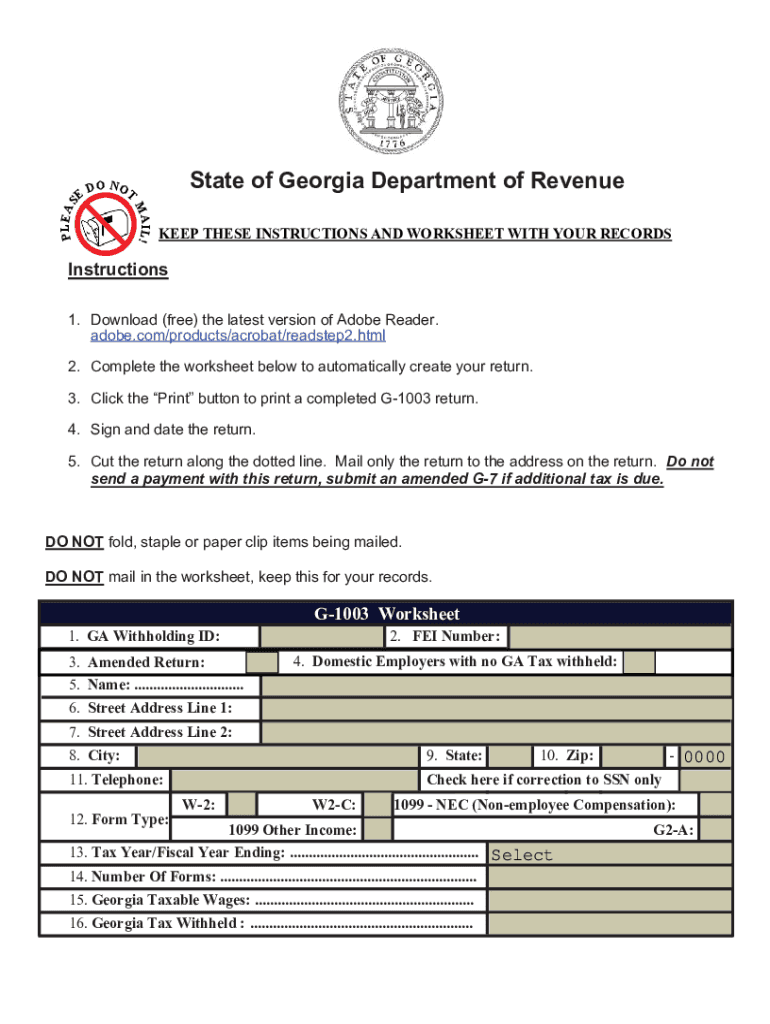

The Georgia DOR 1003 Income Return Form, commonly referred to as the G-1003, is essential for reporting income for various entities, including corporations and partnerships. This form is specifically designed for Georgia taxpayers to ensure compliance with state tax regulations. It captures critical information regarding income, deductions, and credits, allowing the Georgia Department of Revenue to assess tax liabilities accurately.

Steps to Complete the Georgia DOR 1003 Income Return Form

Completing the Georgia DOR 1003 Income Return Form involves several key steps:

- Gather all necessary financial documents, including income statements and deduction records.

- Fill out the identification section with your business name, address, and taxpayer identification number.

- Report total income on the designated lines, ensuring accuracy to avoid discrepancies.

- Detail any deductions or credits applicable to your situation, following the instructions provided with the form.

- Review the completed form for any errors or omissions before submission.

Required Documents for Filing the Georgia DOR 1003 Income Return Form

To successfully file the Georgia DOR 1003 Income Return Form, you will need several documents:

- Financial statements, including profit and loss statements.

- Records of any deductions or credits you plan to claim.

- Previous year’s tax return for reference.

- Any additional forms or schedules that support your income claims.

Filing Deadlines for the Georgia DOR 1003 Income Return Form

It is crucial to be aware of the filing deadlines for the Georgia DOR 1003 Income Return Form. Generally, the form must be submitted by the fifteenth day of the fourth month following the end of your tax year. For most businesses operating on a calendar year, this means the due date is April 15. Late submissions may incur penalties, so timely filing is essential.

Form Submission Methods for the Georgia DOR 1003 Income Return Form

The Georgia DOR 1003 Income Return Form can be submitted through various methods:

- Online: Use the Georgia Department of Revenue’s e-filing system for a quick and efficient submission.

- Mail: Send the completed form to the appropriate address provided in the filing instructions.

- In-Person: Deliver the form directly to your local Georgia Department of Revenue office.

Penalties for Non-Compliance with the Georgia DOR 1003 Income Return Form

Failure to file the Georgia DOR 1003 Income Return Form by the deadline can result in penalties. These penalties may include:

- Late filing fees, which can accumulate over time.

- Interest on any unpaid taxes, compounding the total amount owed.

- Potential audits or increased scrutiny from the Georgia Department of Revenue.

Quick guide on how to complete 600s corporation tax return department of revenue

Prepare 600S Corporation Tax Return Department Of Revenue effortlessly on any device

Online document management has gained traction among organizations and individuals. It presents an ideal eco-conscious substitute for traditional printed and signed documents, enabling you to locate the appropriate form and securely store it online. airSlate SignNow provides all the tools necessary to create, edit, and eSign your documents swiftly without delays. Manage 600S Corporation Tax Return Department Of Revenue on any device with airSlate SignNow Android or iOS applications and simplify any document-related task today.

The easiest way to edit and eSign 600S Corporation Tax Return Department Of Revenue without exertion

- Locate 600S Corporation Tax Return Department Of Revenue and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important parts of your documents or obscure sensitive details with tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and has the same legal legitimacy as a conventional wet ink signature.

- Verify all the information and click the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or errors that require new document copies to be printed. airSlate SignNow meets all your document management needs in a few clicks from any device you prefer. Modify and eSign 600S Corporation Tax Return Department Of Revenue and ensure outstanding communication at every stage of the form preparation procedure with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 600s corporation tax return department of revenue

Create this form in 5 minutes!

How to create an eSignature for the 600s corporation tax return department of revenue

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the georgia dor 1003 income return form make?

The georgia dor 1003 income return form make is a specific document used in Georgia for reporting income and tax purposes. It allows individuals and businesses to accurately declare their income to the Department of Revenue (DOR). Understanding how to correctly fill out this form can ensure compliance and avoid penalties.

-

How can airSlate SignNow help me with the georgia dor 1003 income return form make?

airSlate SignNow provides an efficient platform to eSign and send your georgia dor 1003 income return form make seamlessly. Its user-friendly interface allows you to complete the document easily, ensuring that you can focus on what matters most—your business. Additionally, you can access your signed forms anytime, anywhere.

-

What features does airSlate SignNow offer for handling the georgia dor 1003 income return form make?

airSlate SignNow offers robust features such as document templates, convenience of eSigning, and secure cloud storage, all tailored for the georgia dor 1003 income return form make. You can create, edit, and send documents, making the entire process fast and efficient. These features empower you to manage your income documentation with confidence.

-

Is there a cost associated with using airSlate SignNow for the georgia dor 1003 income return form make?

Yes, using airSlate SignNow involves a subscription fee, which varies based on the plan you select. However, the cost is often justified by the time saved and the enhanced accuracy you achieve when handling the georgia dor 1003 income return form make. Free trials may also be available to assess the platform's suitability for your needs.

-

Can I integrate airSlate SignNow with other tools for my georgia dor 1003 income return form make?

Absolutely! airSlate SignNow offers integrations with various applications, allowing you to streamline workflows associated with the georgia dor 1003 income return form make. This integration capability helps users connect their favorite tools and enhance productivity.

-

What are the benefits of using airSlate SignNow for the georgia dor 1003 income return form make?

Using airSlate SignNow for the georgia dor 1003 income return form make offers several benefits, including increased efficiency, improved accuracy, and enhanced security. It simplifies the signing process, allowing for quicker submissions to the Georgia DOR. These advantages can save you both time and money.

-

Is airSlate SignNow secure for handling the georgia dor 1003 income return form make?

Yes, airSlate SignNow prioritizes security and employs advanced encryption protocols to safeguard your documents, including the georgia dor 1003 income return form make. You can trust that your sensitive information is protected throughout the signing process, ensuring peace of mind.

Get more for 600S Corporation Tax Return Department Of Revenue

- Defective drywall disclosure statement dpor virginiagov form

- Septic waiver disclosure form dpor virginiagov

- Residential property disclosure statement dulles area form

- Virginia building code or zoning ordinance violations disclosure form

- Defective drywall disclosure statement dpor form

- Non employment affidavit form

- West virginia real estate power of attorney form

- Monterey residential escrow report form

Find out other 600S Corporation Tax Return Department Of Revenue

- eSign Car Dealer Form Georgia Simple

- eSign Florida Car Dealer Profit And Loss Statement Myself

- eSign Georgia Car Dealer POA Mobile

- Sign Nebraska Courts Warranty Deed Online

- Sign Nebraska Courts Limited Power Of Attorney Now

- eSign Car Dealer Form Idaho Online

- How To eSign Hawaii Car Dealer Contract

- How To eSign Hawaii Car Dealer Living Will

- How Do I eSign Hawaii Car Dealer Living Will

- eSign Hawaii Business Operations Contract Online

- eSign Hawaii Business Operations LLC Operating Agreement Mobile

- How Do I eSign Idaho Car Dealer Lease Termination Letter

- eSign Indiana Car Dealer Separation Agreement Simple

- eSign Iowa Car Dealer Agreement Free

- eSign Iowa Car Dealer Limited Power Of Attorney Free

- eSign Iowa Car Dealer Limited Power Of Attorney Fast

- eSign Iowa Car Dealer Limited Power Of Attorney Safe

- How Can I eSign Iowa Car Dealer Limited Power Of Attorney

- How To eSign Illinois Business Operations Stock Certificate

- Can I eSign Louisiana Car Dealer Quitclaim Deed