Form FWV Application for Farm Wineries and Vineyards Tax Credit 2023-2026

Understanding the Form FWV Application for Farm Wineries and Vineyards Tax Credit

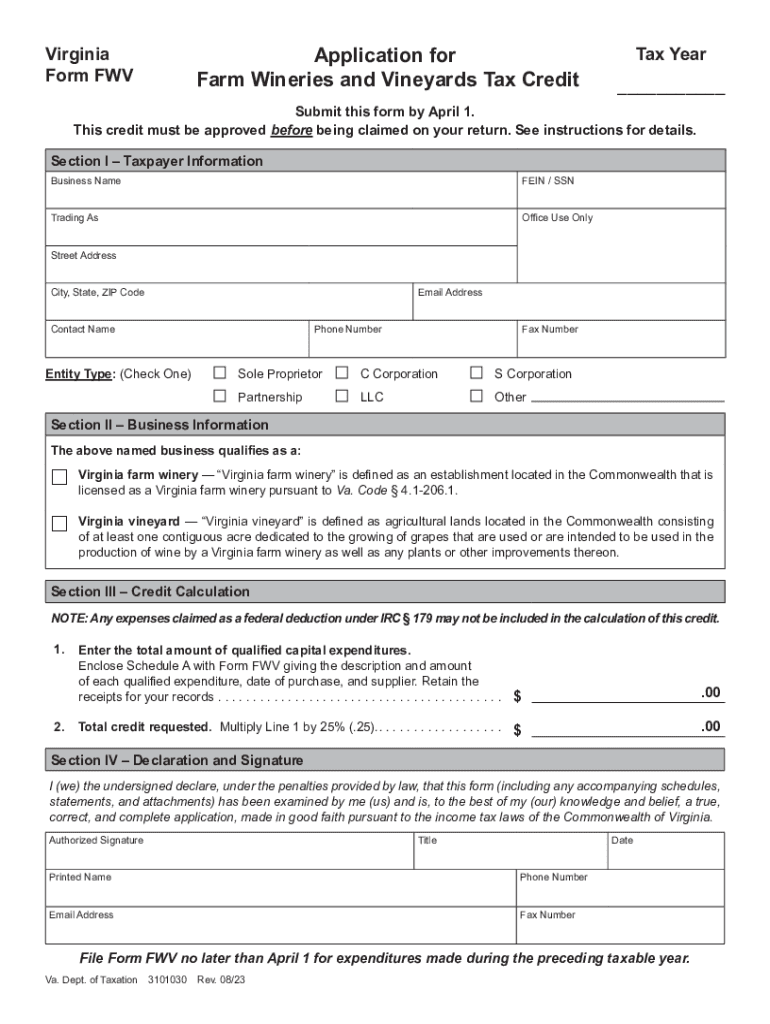

The Form FWV is designed specifically for businesses in the agricultural sector, particularly those involved in farm wineries and vineyards. This tax credit application allows eligible entities to claim credits for certain expenses related to the production and sale of wine. Understanding the nuances of this form is essential for maximizing potential tax benefits.

The credit is available to businesses that meet specific criteria set forth by the Virginia Department of Taxation. This includes requirements related to the production volume of wine and the operational status of the winery or vineyard. Familiarity with these details ensures that applicants can accurately complete the form and avoid potential pitfalls.

Steps to Complete the Form FWV Application for Farm Wineries and Vineyards Tax Credit

Completing the Form FWV requires careful attention to detail. Here are the essential steps to ensure accurate submission:

- Gather necessary documentation, including proof of winery or vineyard operations, production records, and any relevant financial statements.

- Fill out the application form, ensuring all sections are completed. Pay special attention to the eligibility criteria and required fields.

- Calculate the tax credit amount based on the information provided, ensuring compliance with state guidelines.

- Review the completed form for accuracy and completeness before submission.

Following these steps can help streamline the application process and enhance the likelihood of approval.

Eligibility Criteria for the Form FWV Application

To qualify for the tax credit through the Form FWV application, businesses must meet specific eligibility criteria. These criteria typically include:

- Being a licensed winery or vineyard in Virginia.

- Meeting minimum production requirements as defined by state regulations.

- Maintaining compliance with all applicable local, state, and federal laws governing winery operations.

Understanding these criteria is crucial for applicants to ensure they are eligible before submitting the application.

Required Documents for Form FWV Submission

When submitting the Form FWV application, specific documents must accompany the form to support the claims made. Required documents often include:

- Proof of winery or vineyard license.

- Detailed production records, including quantities of wine produced.

- Financial statements that demonstrate operational costs related to wine production.

Having these documents ready can facilitate a smoother review process by the tax authorities.

Form Submission Methods for the FWV Application

Applicants can submit the Form FWV through various methods, ensuring flexibility and convenience. The available submission methods typically include:

- Online submission via the Virginia Department of Taxation’s official website.

- Mailing the completed form to the designated tax office.

- In-person submission at local tax offices, if applicable.

Choosing the appropriate submission method can impact processing times and ensure timely consideration of the application.

Legal Use of the Form FWV Application

The Form FWV application must be used in accordance with state tax laws and regulations. Legal use entails:

- Accurate reporting of all information related to winery operations.

- Compliance with all deadlines and submission guidelines set by the Virginia Department of Taxation.

- Understanding the implications of providing false information, which can lead to penalties or disqualification from receiving credits.

Being aware of these legal requirements helps ensure that businesses can take full advantage of the tax credits available to them without facing legal repercussions.

Quick guide on how to complete form fwv application for farm wineries and vineyards tax credit

Effortlessly Prepare Form FWV Application For Farm Wineries And Vineyards Tax Credit on Any Device

Managing documents online has become popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to access the necessary forms and securely store them online. airSlate SignNow equips you with all the features you need to create, modify, and electronically sign your documents quickly without delays. Handle Form FWV Application For Farm Wineries And Vineyards Tax Credit on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to Alter and eSign Form FWV Application For Farm Wineries And Vineyards Tax Credit with Ease

- Find Form FWV Application For Farm Wineries And Vineyards Tax Credit and click Get Form to commence.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or obscure sensitive information using tools provided by airSlate SignNow specifically for that purpose.

- Create your signature with the Sign feature, which takes mere seconds and holds the same legal validity as a conventional ink signature.

- Verify all details and click the Done button to save your modifications.

- Select how you wish to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate the hassle of lost or mislaid documents, tiresome form searching, and errors that require new copies to be printed. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choosing. Modify and eSign Form FWV Application For Farm Wineries And Vineyards Tax Credit to ensure excellent communication at every step of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form fwv application for farm wineries and vineyards tax credit

Create this form in 5 minutes!

How to create an eSignature for the form fwv application for farm wineries and vineyards tax credit

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the form st 13a?

The form st 13a is a critical document used for sales tax exemptions in specific transactions. By utilizing the form st 13a, businesses can ensure compliance while saving on unnecessary tax expenses. Understanding its purpose is essential for accurate financial management.

-

How can airSlate SignNow help with the form st 13a?

airSlate SignNow streamlines the process of filling out and electronically signing the form st 13a, ensuring that your documents are completed accurately and efficiently. The platform allows users to send the form st 13a securely, making it easy to manage tax exemption documentation. Experience convenience and reliability with our eSigning solution.

-

What are the benefits of using airSlate SignNow for form st 13a?

Using airSlate SignNow for your form st 13a can save time, reduce errors, and enhance collaboration. The ability to digitally sign and send documents means faster approvals and streamlined processes, which are crucial for any business. Our eSigning solution simplifies your workflow while maintaining compliance.

-

Is airSlate SignNow cost-effective when handling the form st 13a?

Yes, airSlate SignNow offers a cost-effective solution for managing the form st 13a compared to traditional methods. By eliminating the need for paper and postage, businesses can signNowly reduce operational costs. Our pricing plans are designed to cater to different needs, providing value to businesses of all sizes.

-

What features does airSlate SignNow offer for the form st 13a?

airSlate SignNow includes features such as customizable templates, real-time tracking, and cloud storage, which are essential for managing the form st 13a. You can easily create, edit, and store your documents in one secure location. These features enhance productivity and ensure that all your eSigning needs are met.

-

Can I integrate airSlate SignNow with other tools for form st 13a management?

Absolutely! airSlate SignNow integrates seamlessly with various business applications, making it easy to manage your form st 13a alongside other processes. Whether you're using CRM software, project management tools, or cloud storage services, our platform ensures that your workflows remain connected and efficient.

-

Is there a mobile app for managing form st 13a with airSlate SignNow?

Yes, airSlate SignNow offers a mobile app that allows you to manage the form st 13a on-the-go. You can easily fill out, sign, and send the form st 13a directly from your smartphone or tablet. Enjoy the flexibility of handling your documents anytime, anywhere.

Get more for Form FWV Application For Farm Wineries And Vineyards Tax Credit

- Affidavit of income butler county ohio form

- Wills and trusts oklahoma state universitystillwater form

- Tulsa county divorce forms

- Appearance bond form

- Form 15 010 1d packet

- Complaint for return of personal property by tenant courts oregon form

- Oregon acknowledgmentsindividualus legal forms

- Free oregon small estate affidavitaffidavit of claiming form

Find out other Form FWV Application For Farm Wineries And Vineyards Tax Credit

- Sign Wisconsin Insurance Living Will Now

- Sign Wyoming Insurance LLC Operating Agreement Simple

- Sign Kentucky Life Sciences Profit And Loss Statement Now

- How To Sign Arizona Non-Profit Cease And Desist Letter

- Can I Sign Arkansas Non-Profit LLC Operating Agreement

- Sign Arkansas Non-Profit LLC Operating Agreement Free

- Sign California Non-Profit Living Will Easy

- Sign California Non-Profit IOU Myself

- Sign California Non-Profit Lease Agreement Template Free

- Sign Maryland Life Sciences Residential Lease Agreement Later

- Sign Delaware Non-Profit Warranty Deed Fast

- Sign Florida Non-Profit LLC Operating Agreement Free

- Sign Florida Non-Profit Cease And Desist Letter Simple

- Sign Florida Non-Profit Affidavit Of Heirship Online

- Sign Hawaii Non-Profit Limited Power Of Attorney Myself

- Sign Hawaii Non-Profit Limited Power Of Attorney Free

- Sign Idaho Non-Profit Lease Agreement Template Safe

- Help Me With Sign Illinois Non-Profit Business Plan Template

- Sign Maryland Non-Profit Business Plan Template Fast

- How To Sign Nevada Life Sciences LLC Operating Agreement